If a stock price falls to zero, you lose all of your investment in the company. However, stock prices don't usually fall to zero even if the company goes bankrupt. The company still has some value.

What happens when a company's stock reaches zero value?

A company's stock reaching zero value does not mean that the company must file for bankruptcy. It simply means that the equity value of the company has been wiped out, and if the company wants to raise new equity capital, it must re-issue common shares to new shareholders. It can't happen since without money changing hands there is no contract.

Can a stock go to zero if the company goes bankrupt?

However, stock prices don't usually fall to zero even if the company goes bankrupt. The company still has some value. One example of a stock that has fallen to almost zero is Helios and Matheson Analytics. The parent company of MoviePass trades at $0.00050 in OTC markets.

Can I sell shares if the price goes to zero?

You can sell shares off market should you want to crystallize a tax loss in a suspended company in the current tax year. Such a sale, for a penny or a “peppercorn” will be legally valid but not recorded by the stock exchange. Originally Answered: What happens once a stock's price goes to zero?

What happens if a stock has zero value?

Zero value is always a common cause of delisting.

What happens when a stock's value falls to zero?

When a stock's value falls to zero, many of the major exchanges will delist the particular security in question.

Why are stocks worthless?

Stocks that fall to a selling price of zero dollars are probably disasters for investors and companies alike. These securities will immediately – or quickly – be delisted by their stock exchange and can quickly become worthless to investors. The reasons for this precipitous "fall from grace" can be many. The result, unfortunately, is most often the same – worthless stocks. Common reasons include operating problems, product availability, delivery or quality issues and, of course, mismanagement.

What happens if a company files for bankruptcy?

Even a company that files a Chapter 11 bankruptcy, hoping to reorganize its finances, instead of a Chapter 7 liquidation bankruptcy, typically must cancel and eliminate its original stock, making these shares worthless. Should the company successfully reorganize and become financially sound, it will usually issue new stock, leaving former shareholders with worthless stock certificates.

Can you get bids on stock when it's zero?

Zero Stock Bids. When your stock initially is delisted and falls to zero, sometimes you can still get bids through the over-the-counter market. There are times that speculators, because of rumors or belief that a company will recover and have value, will make a bid to purchase your stock.

Is Appvion worthless after Chapter 11?

A recent example of this involves Appvion, whose Employee Stock Ownership Plan may be worthless after the company filled Chapter 11. If former shareholders believe the company will now succeed, they must buy some of the new post-bankruptcy stock should they want to continue their investment.

Is OTC stock market volatile?

The OTC market tends to be extremely volatile and a haven for speculators hoping to make fast profits. While it seldom happens, OTC stocks can be popular, even after losing their stock exchange listing privileges. The company could still be experiencing growth, and could be relisted on a major exchange in the future.

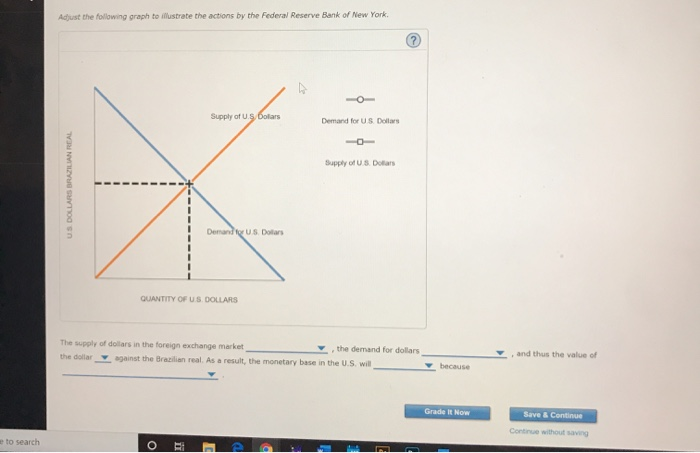

What happens to the price of a stock if demand is high?

Investopedia describes supply and demand as such: If more people want to buy a stock (demand is high), then the price will rise. If more people don’t want a stock (demand is low), then the price will fall.

Can you buy stock after a company is delisted?

You don’t lose your shares when a company is delisted, but you cannot buy anymore from that exchange. The asset becomes an over-the-counter stock, meaning that you won’t be able to buy it from most brokerages, decreasing its value even further.

Is MoviePass going bankrupt?

MoviePass’s parent company Helios and Matheson Analytics — who made the terrible decision to drop the price of the subscription — filed for Chapter 7 bankruptcy in January 2020 after being delisted from the Nasdaq. The company had suffered multi-million dollar deficits monthly because of MoviePass.

Will a stock hit $0.01?

As long as someone owns a share, a stock will never hit $0. However, what is far more likely to happen for a company is to be delisted by the stock exchange (i.e. Nasdaq or S&P 500).

Conclusion

There you have it, the article on what happens when a stock’s price falls to zero. It’s actually a pretty common sight in the stock market among the penny stocks. If a company can’t raise their stock price above a certain threshold then chances are they will become delisted from an exchange.

5 Reasons Why You Should Never Use Phone Apps To Trade

Using a phone trading app will result in you earning less per year. Don’t fall victim to some of the most common traps of phone investing.

5 Reasons Why The Tech Sector Grows Faster Than Other Sectors

The tech sector has exploded in value over the past 30 years. Here is why that is. This knowledge could help you profit from this trend.

Why Checking Your Stocks Everyday Is Bad

You should not be checking your stocks everyday. Doing so drastically increases your chances to lose money if your a normal investor.

What happens if a stock drops to zero?

A drop in price to zero means the investor loses his or her entire investment – a return of -100%.

What happens if you short a stock?

Conversely, a complete loss in a stock's value is the best possible scenario for an investor holding a short position in the stock. Because the stock is worthless, the investor holding a short position does not have to buy back the shares and return them to the lender (usually a broker), which means the short position gains a 100% return. [ 1]

What form do you use to report worthless stock?

Americans with worthless stock use the loss to offset other income by reporting it on form 8949 and Schedule D as sold on the last day of the year for $0. For the average startup employee not trading stock outside their tax advantaged retirement accounts this effectively reduces their loss by their state and federal income tax rates although that can be spread over years.

What happens to a stock when demand sinks?

If a stock's demand sinks dramatically, it will lose much (if not all) of its value. The main factor determining the demand for a stock is the quality of the company itself. If the company is fundamentally strong, that is, if it is generating positive income, its stock is less likely to lose value.

Why are stocks worthless?

Common reasons include operating problems, product availability, delivery or quality issues and, of course, mismanagement. When a stock's value falls to zero, many of the major exchanges will delist the particular security in question.

How is the value of a stock determined?

Specifically, the value of a stock is determined by the basic relationship between supply and demand. If a lot of people want a stock (demand is high), then the price will rise. If a lot of people don't want a stock (demand is low), then the price will fall.

What happens if a company reverts to a private firm?

If a company reverts to a private firm, investors will lose their investment. If a company files Chapter 11 investors will lose their investment.

What happens when a stock hovers at a zero level?

In some cases, if a company's stock hovers at a zero level, speculative investors will offer to buy shares at extremely low prices , such as a thousandth of a penny per share. These investors are hoping that when the company returns to profitability or re-issues new common shares, it will perhaps compensate the previous class of equity shareholders.

How does stock price work?

A company's stock price reflects the total value of its equity divided by the number of common shares outstanding. The market value of its equity fluctuates based on:

How much is a stock worth?

In one sense, the stock is worth whatever investors are willing to pay for it. However, there are different types of investors participating in the market. There are long-term, buy-and-hold investors, and there are short-term investors who may buy and sell the stock many times during a single trading day. If a company's market value of equity is valued by the market to be $1 billion, and it has 500 million shares outstanding, its stock price equals $2 per share -- $1 billion market value of equity divided by 500 million shares outstanding. If the market value declines to $500 million, the stock's price falls to $1 per share, which is the threshold for non-compliance with listing requirements, at which point it would receive notice from its respective stock exchange.

What is the listing requirement for a stock?

One of the listing requirements these exchanges share is that if a company's stock price falls below $1 per share for 30 consecutive business days, it will receive a notice from the exchange stating that the company has six months to remedy the situation. If the shares continue to lose value, the company eventually will be delisted entirely.

Do stocks move in the same direction?

Common stocks tend to move in the same general direction as the overall market. The degree to which a company's stock moves in tandem with the overall market is measured by beta.

Can you trade stocks over the counter?

Eventually, as the stock's market value falls below a certain threshold, it only can be traded over-the-counter, through informal networks of broker-dealers willing to buy and sell stocks in companies with no listing requirements, and those that are not required to disclose financial information.

Why do stocks crash?

During times of fear or panic, like when the Coronavirus pandemic fears creep into the market, emotion causes prices to crash, but that’s generally a more temporary situation.

What happens when common stockholders turn?

By the time the common stockholders’ turn comes, there is a high probability that there will be nothing left in the kitty for them. It is really a harrowing scenario as they end up losing all their investment.

What causes airline stocks to tank?

For example, you have stocks of an airline operator and a firm that make hand sanitizers. The threat of a novel virus has caused airline stocks to tank, whereas the demand for hand sanitizers has gone up manifold. Thus, the loss incurred in airlines stock is compensated by stocks of firm making hand sanitizers.

What is penny stock?

Stocks trading at extremely low prices are branded as Penny stocks. Such stocks generally trade on the OTC markets, such as the OTC Bulletin Board (OTCBB).

What happens if a company goes bankrupt?

If a company goes bankrupt, the stock for all intents and purposes will be worthless as investors will see no value in it. On certain occasions, competitors may find value in assets and purchase them piecemeal. But for the most part a bankruptcy spells doom for a company.

What is short selling?

You may have started wondering by now as to what exactly is a short position. To put it in layman terms, shorting or short-selling is a speculative trading strategy, wherein an investor borrows shares speculating that the stock price will decline.

Does a well-diversified portfolio protect you from unsystematic risk?

One thing to note here is that though well-diversified stock portfolio can protect you from unsystematic risk (probability of loss associated with a unique industry or segment), it may fail to work its magic in case of systematic risk ( risks arising out of macroeconomic factors).

What happens if a stock price falls to zero?

If a stock price falls to zero, you lose all of your investment in the company. However, stock prices don't usually fall to zero even if the company goes bankrupt. The company still has some value. One example of a stock that has fallen to almost zero is Helios and Matheson Analytics.

What happened to the stock market in the first quarter?

When U.S. stock markets crashed in the first quarter, many stocks fell to their all-time lows. There was also a series of bankruptcies, especially in the energy industry. Can stock prices ever go negative? First, you need to distinguish the market value and book value. Also, it's important to understand the concept of price versus value.

What is reverse stock split?

In a reverse stock split, the company lowers its outstanding shares by consolidating them. In June, Office Depot announced a reverse stock split. In 2019, Blue Apron also announced a reverse stock split. In contrast, companies with high stock prices split them to increase liquidity.

When did Amazon split its stock?

Many people think that even Amazon should split its stock. The last time Amazon split its stock was in 1999.

Can you trade penny stocks on the pink sheet?

However, even if the company is delisted, it can trade in the OTC markets or in the pink sheet system. These markets are loosely regulated compared to established exchanges like the NYSE. Penny stocks trade in these markets.

Is a stock price below zero?

In his 2008 shareholder letter, Berkshire Hathaway chairman Warren Buffett said, “Long ago, Ben Graham taught me that ‘Price is what you pay; value is what you get.’ Whether we’re talking about socks or stocks.” So, even though a stock may trade in the positive, its value might be zero or even in the negative. The stock price can never go below zero.

Can a stock go negative?

The simple answer to whether the stock price of a listed company can go negative is no. It's based on the concept of limited liability. Your liability can't be higher than your invested amount. However, a stock’s book value can be negative. There are many examples where a company's book value goes negative as accumulated losses surpass ...

Why does a stock price fall to zero?

The cause-and-effect relationship is almost always the other way around: a company's stock price falls towards zero because investors are worried that the company will go bankrupt.

What happens when a company's stock price falls?

Sometimes a company's falling stock price may hasten or contribute to its downfall. This is especially true for companies whose business models relied heavily on the availability of equity or other [1] financing to fund an underlying business that was fundamentally loss-making. SunEdison was an example of this. When the MLP market dried up and its stock price plummeted, SUNE's viability was put in question. Coupled with a heavy debt load, the stock price has crashed spiraled in recent months.

Why is 3$ more likely to drop?

You must assume that the price tells you how near towards the end a stock is, so at 3$ is much more likely that it will drop further because the risk of bankrupt is increasing.

What does EV mean in stock market?

On the other hand, EV is the Exchange Traded or Market (Demand & Supply forces) driven value of the share which is always far from IV. Therefore, theoretically if EV of the share is Zero it does not mean the Company has gone Bankrupt. But Practically, the market price reflects the true value of the share after discounting all news related to that share that means if the share price is close to zero the company is surely in some trouble and may lead to its Bankruptcy.

Why are stocks worthless?

The reasons for this precipitous "fall from grace" can be many. The result, unfortunately, is most often the same worthless stocks. Common reasons include company bankruptcy, operating problems, product availability, delivery or quality issues and, of course, mismanagement .

What happens if the market is wrong?

If the market is wrong, and people are estimating that the risk of a bankrupt is greater than it is, or that assets, growth, products etc etc, are better than the price reflects, then you have the alpha -> so you have value to invest in a company, so distressed and the chance of a turn around are high.

Why do companies go bankrupt?

Besides, the actual reason for Bankruptcy of a company is its financial mismanagement or improper usage of its working capital funds and long terms funds. Companies need to understand the way it should finance its Cash flow Gaps. Funding Long term cash flow deficit with short term financing is one of the reason to go bankrupt.

What happens if a stock drops to zero?

A drop in price to zero means the investor loses his or her entire investment – a return of -100%.

How is the value of a stock determined?

Specifically, the value of a stock is determined by the basic relationship between supply and demand. If a lot of people want a stock (demand is high), then the price will rise. If a lot of people don't want a stock (demand is low), then the price will fall.

What determines the value of a stock?

Supply and demand determine the value of a stock, with higher demand driving the price higher in turn.

Can a stock lose its value?

To summarize, yes, a stock can lose its entire value. However, depending on the investor's position, the drop to worthlessness can be either good (short positions) or bad (long positions).

Is a loss in a stock arbitrary?

So, although stocks carry some risk, it would not be accurate to say that a loss in a stock's value is completely arbitrary. There are other factors that drive supply and demand for companies.