What caused the 1987 stock market crash?

The “Black Monday” stock market crash of October 19, 1987, saw U.S. markets fall more than 20% in a single day. It is thought that the cause of the crash was precipitated by computer program-driven trading models that followed a portfolio insurance strategy as well as investor panic.

What was the stock market like in 1987?

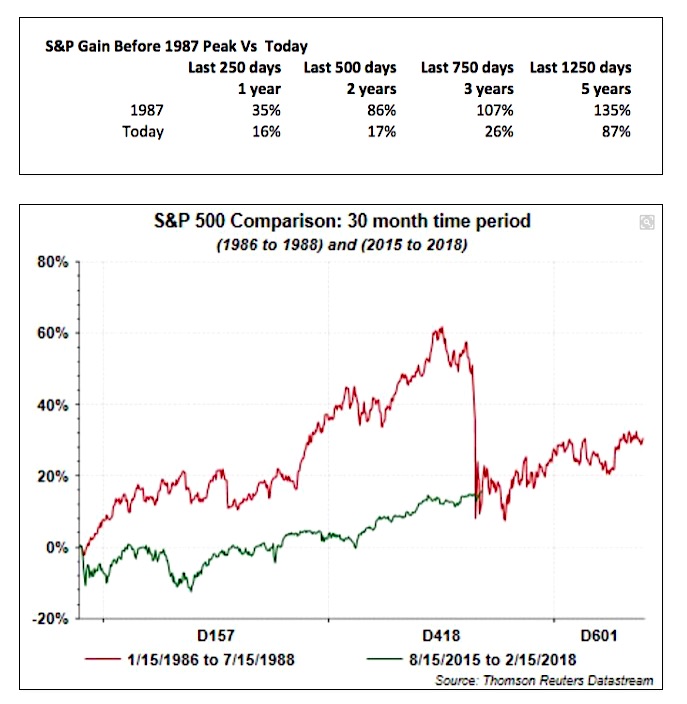

The 1987 S&P 500 bear market, which this one is often compared to, was actually milder than average. The 1987 bear market wrapped up in just 202 calendar days, Stovall says. That's one of the shortest S&P 500 bear markets on record, half the average 419 days. And the drop in the 1987 bear maxed out at 33.5%.

What happened to the stock market in 1987?

The stock market crash of 1987 was a rapid and severe downturn in U.S. stock prices that occurred over several days in late October 1987. While the crash originated in the U.S., the event impacted every other major stock market in the world.

Why did the stock market crash in 1987?

The 1987 stock market crash was due to a poor monetary policy. Member commercial bank legal reserves declined at their sharpest rate for both Sept & Oct 87 since the beginning of their series in 1913.

What caused the 1987 crash of the stock market?

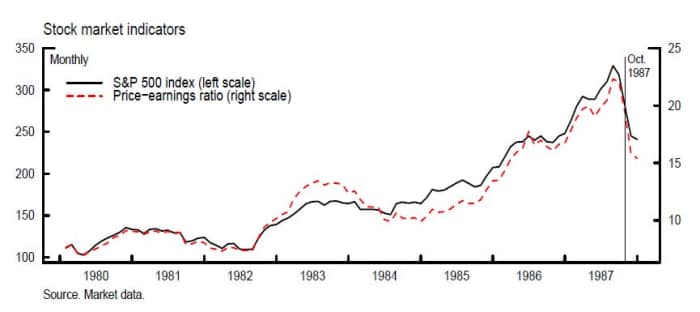

Many market analysts theorize that the Black Monday crash of 1987 was largely driven simply by a strong bull market that was overdue for a major correction. 1987 marked the fifth year of a major bull market that had not experienced a single major corrective retracement of prices since its inception in 1982.

How long did it take for the stock market to recover from the 1987 crash?

two yearsIt took only two years for the Dow to recover completely; by September of 1989, the market had regained all of the value it had lost in the '87 crash. Many feared that the crash would trigger a recession.

What did the stock market do in 1987?

The crash of Oct. 19, 1987, was preceded by a bull market in stocks that began in August 1982 and drove the Dow industrials to 2722.42 from 776.91. The index's price/earnings ratio hit a 25-year high, while interest rates reached their steepest levels in a decade.

What caused the stock market crash of 1989?

13, 1989. That Friday, a stock market crash resulted in a 6.91% drop in the Dow. 13 Prior to this, a leveraged buyout deal for UAL, United Airlines' parent company, had fallen through. As the crash had transpired mere minutes after this announcement, it was quickly identified as the cause of the crash.

Should you buy stocks during a crash?

If you have saved enough and have other assets that generate income for you, this is the right time to buy more stocks. The reason for this is simple, a stock market crash signifies all the prices are down and this is the perfect opportunity to buy low and sell high.

What was the worst stock market crash?

September 3, 1929 to July 8, 1932 Without a doubt, this crash is the worst in stock market history. It was the first of a series of crashes that occurred during the 1930s and early 1940s, during the time commonly referred to as the Great Depression.

What are 3 main causes of the Great Depression?

What were the major causes of the Great Depression? Among the suggested causes of the Great Depression are: the stock market crash of 1929; the collapse of world trade due to the Smoot-Hawley Tariff; government policies; bank failures and panics; and the collapse of the money supply.

When did the 1987 stock market crash?

October 19, 1987Black Monday / Start date

Is Black Monday True?

Black Monday refers to the stock market crash that occurred on Oct. 19, 1987 when the DJIA lost almost 22% in a single day, triggering a global stock market decline. The SEC has built a number of protective mechanisms, such as trading curbs and circuit breakers, to prevent panic-selling.

How long did it take the 1929 crash to recover?

Wall Street lore and historical charts indicate that it took 25 years to recover from the stock market crash of 1929.

What caused the Black Friday crash?

Black Friday, in U.S. history, Sept. 24, 1869, when plummeting gold prices precipitated a securities market panic. The crash was a consequence of an attempt by financier Jay Gould and railway magnate James Fisk to corner the gold market and drive up the price.

What caused 2000 crash?

The 2000 stock market crash was a direct result of the bursting of the dotcom bubble. It popped when a majority of the technology startups that raised money and went public folded when capital went dry.

What was the stock market crash in 1987?

The stock market crash of 1987 was a rapid and severe downturn in U.S. stock prices that occurred over several days in late October 1987. While the crash originated in the U.S., the event impacted every other major stock market in the world. In the five years leading up to the 1987 crash, the Dow Jones Industrial Average ( DJIA) ...

What was the impact of the 1987 stock market crash?

The stock market crash of 1987 revealed the role of financial and technological innovation in increased market volatility. In automatic trading, also called program trading, human decision-making is taken out of the equation, and buy or sell orders are generated automatically based on the price levels of benchmark indexes or specific stocks. Leading up to the crash, the models in use tended to produce strong positive feedback, generating more buy orders when prices were rising and more sell orders when prices began to fall.

What happened in 1987?

In the five years leading up to the 1987 crash, the Dow Jones Industrial Average ( DJIA) had more than tripled. On October 19, 1987—known as Black Monday —the DJIA fell by 508 points, or by 22.6%. Up to this point in history, this was the largest percentage drop in one day. The crash sparked fears of extended economic instability around ...

What was the peak of the stock market in 1987?

After five days of intensifying declines in the stock market, selling pressure hit a peak on October 19, 1987, also known as Black Monday. Steep price declines were created as a result of significant selling; total trading volume was so large that the computerized trading systems could not process them. Some orders were left unfilled for over an hour, and these order imbalances prevented investors from discovering the true price of stocks.

What countries did the Federal Reserve depreciate the dollar?

Under the Plaza Accord of 1985, the Federal Reserve made an agreement with the central banks of the G-5 nations—France, Germany, the United Kingdom, and Japan— to depreciate the U.S. dollar in international currency markets in order to control mounting U.S. trade deficits.

What happened to the stock market in 1987?

However, studies show that during the 1987 U.S. Crash, other stock markets which did not use program trading also crashed, some with losses even more severe than the U.S. market. During the Crash, trading mechanisms in financial markets were not able to deal with such a large flow of sell orders.

Why did the stock market crash in 1987?

The 1987 stock market crash was due to a poor monetary policy. Member commercial bank legal reserves declined at their sharpest rate for both Sept & Oct 87 since the beginning of their series in 1913.

What did the 1987 crash accomplish?

Bruce Bartlett: What the 1987 crash ultimately accomplished was to teach politicians that markets heed their words and actions carefully, reacting immediately when threatened. Thus the crash initiated a new era of market discipline on bad economic policy.

Why were stocks not traded on the New York Stock Exchange?

Many common stocks in the New York Stock Exchange were not traded until late in the morning of October 19 because the specialists could not find enough buyers to purchase the amount of stocks that sellers wanted to get rid of at certain prices. As a result, trading was terminated in many listed stocks.

What was the trigger for the market crash?

Another important trigger in the market crash was the announcement of a large U.S. trade deficit on October 14, which led Treasury Secretary James Baker to suggest the need for a fall in the dollar on foreign exchange markets.

What was the Dow's high in 1987?

According to Facts on File, an authoritative source of current-events information for professional research and education, the 1987 crash"marked the end of a five-year 'bull' market that had seen the Dow rise from 776 points in August 1982 to a high of 2,722.42 points in August 1987.". Unlike what hapopened in 1929, however, ...

What happened on October 19, 1987?

On October 19, 1987, a date that subsequently became known as"Black Monday," the Dow Jones Industrial Average plummeted 508 points, losing 22.6% of its total value. The S&P 500 dropped 20.4%, falling from 282.7 to 225.06. This was the greatest loss Wall Street had ever suffered on a single day.

How much did the stock market gain in 1987?

Stock markets raced upward during the first half of 1987. By late August, the DJIA had gained 44 percent in a matter of seven months, stoking concerns of an asset bubble. 4 In mid-October, a storm cloud of news reports undermined investor confidence and led to additional volatility in markets. The federal government disclosed a larger-than-expected ...

Who reported the stock market crash of 1987?

Composite of newspaper headlines reporting the Stock Market Crash of 1987 (Associated Press) by Donald Bernhardt and Marshall Eckblad, Federal Reserve Bank of Chicago.

How much did the DJIA lose on October 16?

By the end of the trading day on October 16, which was a Friday, the DJIA had lost 4.6 percent. 5 The weekend trading break offered only a brief reprieve; Treasury Secretary James Baker on Saturday, October 17, publicly threatened to de-value the US dollar in order to narrow the nation’s widening trade deficit.

What is Dow Jones Industrial Average?

The Dow Jones Industrial Average is a closely watched stock price index computed by Dow Jones & Co. Founded in 1882, the benchmark index consists of twenty transportation stocks, fifteen utility stocks, and thirty selected industrial stocks, as well as a composite average of all three. 3.

What did the Fed do in 1987?

In a statement on October 20, 1987, Fed Chairman Alan Greenspan said, “The Federal Reserve, consistent with its responsibilities as the Nation's central bank, affirmed today its readiness to serve as a source of liquidity to support the economic and financial system ” (Carlson 2006, 10). Behind the scenes, the Fed encouraged banks to continue to lend on their usual terms. Ben Bernanke, writing in 1990, noted that “making these loans must have been a money-losing strategy from the point of view of the banks (and the Fed); otherwise, Fed persuasion would not have been needed. But lending was a good strategy for the preservation of the system as a whole” (Bernanke 1990). According to Bernanke, the 10 largest New York banks nearly doubled their lending to securities firms during the week of October 19 even though discount window borrowings didn’t themselves increase (Garcia 1989).

Why did the New York Stock Exchange put circuit breakers in place?

According to the New York Stock Exchange’s current website: “In response to the market breaks in October 1987 and October 1989, the New York Stock Exchange instituted circuit breakers to reduce volatility and promote investor confidence.

What was the Fed's response to Black Monday?

Some experts argue the Fed’s response to Black Monday ushered in a new era of investor confidence in the central bank’s ability to calm severe market downturns. Unlike many prior financial crises, the sharp losses stemming from Black Monday were not followed by an economic recession or a banking crisis.

How much did the stock market fall in 1987?

The stock market fell by 22% over two days in October 1987. This sharp correction was outside the experience of most City professionals. It raised fears about this being a repeat of the stock market crash of 1929 and a harbinger of an economic depression to follow. Both fears proved to be unfounded.

Why was Wall Street so weak on Black Monday?

Also, many in the City were unable to get to their trading desks that day because of the disruption caused by the storms over the previous night.

Why did the stock market crash in 1987?

Portfolio Insurance refers to a strategy to hedge or limit losses by buying and selling stocks and futures. People tend to buy in a rising market, which may create a bubble and sell in a falling market, which may lead to a crash, which it did. They short sell futures in expectation of the falling market, and if the market falls further, they short sell even more , thus destabilizing the market.

What happened in 1987?

Stock Market Crash in 1987, also known as Black Monday, was one where DJIA (Dow Jones Industrial Average) fell 22% (508 points) on a single day (19 October 1987) and had a contagious effect in the sense that the fall not only affected the US, but the whole world.

What happened to margin calls in the stock market?

When the market fell, margin calls were triggered, which required futures position holders to deposit a margin, failing, which resulted in the selling future position. Due to large and sudden fall in the stock market, many futures position holders were not able to deposit margin, which led to the liquidation of their holding.

Why did the futures market go down?

Meanwhile, the futures market was open, and due to large sell orders, prices went down in the future market. When the stock market opened, the difference between futures and market was huge. Futures that are supposed to trade at a premium were trading at a huge discount.

What is the purpose of stock exchange?

People traded on stock exchanges. Stock Exchanges Stock exchange refers to a market that facilitates the buying and selling of listed securities such as public company stocks, exchange-traded funds, debt instruments, options, etc., as per the standard regulations and guidelines—for instance, NYSE and NASDAQ. read more.

Why is the dollar falling?

A falling dollar due to widening trade deficit and market participants pulling their money out in dollar-denominated assets led to an increase in interest rates and thereby making yields attractive on bonds. People who were already skeptical about the stock market, the attractive yield on bond provided them with a good alternative.

When did futures trade?

But on 19 October 1987, futures were trading at a discount whereas futures trade at a premium to their underlying. Due to selling pressure across the world on that day, large sell orders were placed on the stock market in the US.

What was the stock market crash in 1987?

The stock market crash in 1987 has been described mainly as a “trading event” rather than being the direct result of any single fundamental or economic event. This is significant compared to such crashes as 1929 (the great depression) and 2008 (global financial crisis) which each had a precise series of economic catalysts and a much longer duration.

What was the cause of the 1987 crash?

This proposed bill came about due to the highly leveraged mergers and acquisitions environment at the time .

What was the yield on long term bonds in 1987?

At the start of 1987, the yield on long-term bonds was just 7.5%, less than half of what it was back in 1981 and the trade deficit reported in November 1986 had set a record level, eight times higher than it was in 1981.

How to survive a stock crash?

So armed with the knowledge that it could happen and we don’t know when, the best action you can take is to trade stocks systematically in a way that will help you survive anything that happens in the markets. This means: 1 Use little to no leverage because this will decimate your portfolio if there is a crash 2 Use small position sizes so you can get out of your trades easily 3 Use stop losses to get you out if the market starts collapsing 4 Trade long and short so that you can profit from a crash 5 Backtest your trading systems with as much data as you can to understand their performance during a stock market crash

When did the Dow drop?

The crash began Wednesday, 14th October 1987 as news of the Ways and Means Committee’s agreement to the take-over tax proposals became far reaching headlines causing the Dow to fall. It dropped 95 points (3.81%) on Wednesday, another 58 points (2.4%) on the Thursday, down over 12% from the 25th August all-time highs.

When did portfolio insurance become popular?

Portfolio insurance became increasingly popular by 1987 with many institutional investors. The market had rallied strongly in the four and a half years before 1987, and that year itself was bellowing. In summary, institutions who bought the product engaged in an agreement to sell short S&P 500 futures if the stock market fell by a certain amount. They obligated to “sell into a falling market” due to their portfolio insurance agreements. However, portfolio insurance played a role, most likely as an accelerant rather than a causal factor.