What happened to PDL stock?

As announced on December 8, 2020, the voluntary suspension of trading and subsequent delisting of PDL’s common stock (Nasdaq: PDLI) occurred prior to market opening on December 31, 2020. The Company’s transfer books closed as of the filing of the certificate of dissolution on January 4, 2021 (the “Final Record Date”).

Who is PDL BioPharma’s (pdli) major shareholder?

PDL BioPharma, Inc. (NASDAQ:PDLI) major shareholder Silver Point Capital L.P. bought 640,000 shares of the firm’s stock in a transaction that occurred on Monday, December 14th. The stock was purchased at an average cost of $2.62 per share, with a total value of $1,676,800.00. The acquisition was disclosed in a filing with the Securities & […]

What are the risks associated with pdli?

There is downside risk too, from payments being pushed out years into the future, a class action related to Glumetza pricing and other uncertainties. On balance, PDLI presents an opportunity for patient investors capable of owning illiquid investments.

How will PDL provide information to stockholders about a distribution?

We will provide necessary information to stockholders when an actual distribution will be made and expect to provide updates of other material developments by posting on the Company’s website PDL.com. Is it possible for a market to develop for your stock? PDL will not participate in any future market for its stock.

See more

How were PDL BioPharma's earnings last quarter?

PDL BioPharma, Inc. (NASDAQ:PDLI) released its quarterly earnings data on Thursday, August, 6th. The biotechnology company reported ($0.43) earning...

Who are PDL BioPharma's key executives?

PDL BioPharma's management team includes the following people: Mr. Dominique P. Monnet , CEO, Pres & Director (Age 59, Pay $1.2M) Mr. Edward A....

Who are some of PDL BioPharma's key competitors?

Some companies that are related to PDL BioPharma include Amgen (AMGN) , Gilead Sciences (GILD) , Regeneron Pharmaceuticals (REGN) , Vertex Phar...

What other stocks do shareholders of PDL BioPharma own?

Based on aggregate information from My MarketBeat watchlists, some companies that other PDL BioPharma investors own include AT&T (T) , OPKO Healt...

What is PDL BioPharma's stock symbol?

PDL BioPharma trades on the NASDAQ under the ticker symbol "PDLI."

What is PDL BioPharma's stock price today?

One share of PDLI stock can currently be purchased for approximately $2.47.

How much money does PDL BioPharma make?

PDL BioPharma has a market capitalization of $282.86 million and generates $54.76 million in revenue each year.

How many employees does PDL BioPharma have?

PDL BioPharma employs 109 workers across the globe.

What is PDL BioPharma's official website?

The official website for PDL BioPharma is www.pdl.com .

What is PDL BioPharma's stock price today?

One share of PDLI stock can currently be purchased for approximately $2.47.

When will PDL Biopharma release its earnings?

PDL BioPharma is scheduled to release its next quarterly earnings announcement on Thursday, August 5th 2021. View our earnings forecast for PDL BioPharma.

Where are PDL BioPharma's headquarters?

PDL BioPharma is headquartered at 932 SOUTHWOOD BLVD, INCLINE VILLAGE NV, 89 451.

What is the P/E ratio of PDL Biopharma?

The P/E ratio of PDL BioPharma is -2.19, which means that its earnings are negative and its P/E ratio cannot be compared to companies with positive earnings.

What is PDL Biopharma?

PDL BioPharma, Inc. manages various patents in the United States and internationally. The company's patents cover humanization of antibodies. It also offers notes and other long-term receivables services, as well as engages in the equity investment activities. The company was formerly known as Protein Design Labs, Inc. and changed its name to PDL BioPharma, Inc. in 2006. PDL BioPharma, Inc. was founded in 1986 and is headquartered in Incline Village, Nevada.

Is there enough data for PDL Biopharma?

There is not enough analysis data for PDL BioPharma.

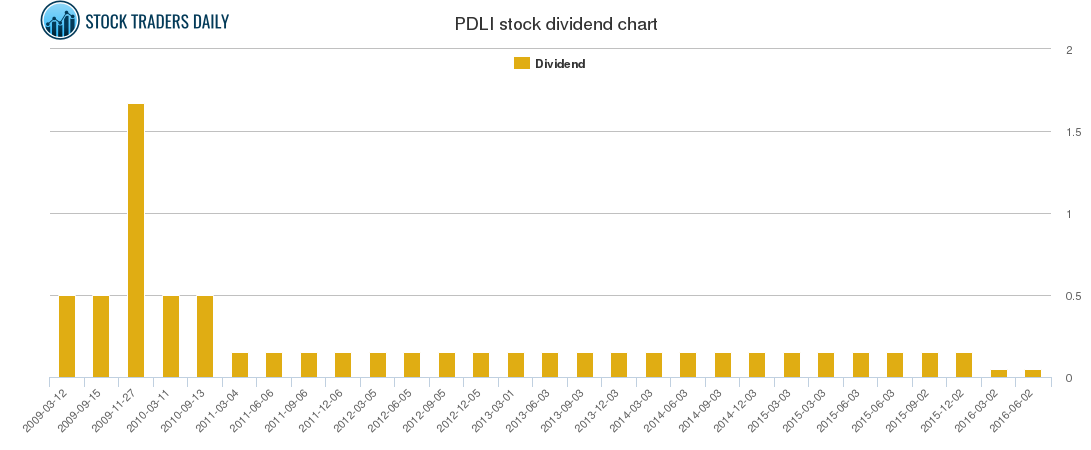

Does PDL Biopharma pay dividends?

PDL BioPharma does not currently pay a dividend.

Silver Point Capital L.P. Acquires 640,000 Shares of PDL BioPharma, Inc. (NASDAQ:PDLI) Stock

PDL BioPharma, Inc. (NASDAQ:PDLI) major shareholder Silver Point Capital L.P. bought 640,000 shares of the firm’s stock in a transaction that occurred on Monday, December 14th. The stock was purchased at an average cost of $2.62 per share, with a total value of $1,676,800.00.

PDL Announces Timeline for Voluntarily Delisting from Nasdaq

INCLINE VILLAGE, Nev., Dec. 8, 2020 /PRNewswire/ -- PDL BioPharma, Inc. ("PDL" or the "Company") (Nasdaq: PDLI) today announced that it has formally notified The Nasdaq Stock Market, Inc. of its intent to delist the Company's common stock from the Nasdaq Global Select Market ("Nasdaq")…. Read more

David W. Gryska Sells 75,000 Shares of PDL BioPharma, Inc. (NASDAQ:PDLI) Stock

PDL BioPharma, Inc. (NASDAQ:PDLI) Director David W. Gryska sold 75,000 shares of the firm’s stock in a transaction that occurred on Thursday, December 3rd. The shares were sold at an average price of $2.52, for a total value of $189,000.00. Following the completion of the sale, the director now owns 30,337 shares in the company, […] Read more

Reviewing PDL BioPharma (NASDAQ:PDLI) & Acorda Therapeutics (NASDAQ:ACOR)

PDL BioPharma (NASDAQ:PDLI) and Acorda Therapeutics (NASDAQ:ACOR) are both small-cap medical companies, but which is the better business? We will contrast the two businesses based on the strength of their valuation, dividends, profitability, earnings, institutional ownership, risk and analyst recommendations.

PDL BioPharma Completes Divestiture of the Noden Pharmaceutical Business to Stanley Capital

INCLINE VILLAGE, Nev., Sept. 9, 2020 /PRNewswire/ -- PDL BioPharma, Inc. ("PDL" or the "Company") (Nasdaq: PDLI) announces the closing of the sale of its wholly owned subsidiaries Noden Pharma DAC and Noden Pharma USA (collectively "Noden") to Stanley Capital. The total value of the… Read more

PDL BioPharma Announces Offer to Purchase Convertible Notes Due 2021 and 2024

INCLINE VILLAGE, Nev., Aug. 28, 2020 /PRNewswire/ -- PDL BioPharma, Inc. ("PDL" or the "Company") (Nasdaq: PDLI) today announced that holders of its 2.75% Convertible Senior Notes due in December 2021 (the "2021 Notes") and in December 2024 (the "2024 Notes" and together with the 2021… Read more

PDL BioPharma Reports 2020 Second Quarter Financial Results

INCLINE VILLAGE, Nev., Aug. 6, 2020 /PRNewswire/ -- PDL BioPharma, Inc. ("PDL" or "the Company") (Nasdaq: PDLI) reports financial results for the three and six months ended June 30, 2020 and provides an update on important milestones achieved in the execution of its monetization plan: "I… Read more

NASDAQ

A biopharmaceutical company focused on discovering, developing and commercializing innovative therapies for severe or life-threatening illnesses.

Environmental, Social, and Governance Rating

"B" score indicates good relative ESG performance and an above-average degree of transparency in reporting material ESG data publicly and privately. Scores range from AAA to D.

Business Summary

A biopharmaceutical company focused on discovering, developing and commercializing innovative therapies for severe or life-threatening illnesses.

When will PDLI delist?

PDLI is liquidating, it should delist from the NASDAQ on December 31, 2020. Patient investors can ultimately expect a return of approximately 40% based on net assets. The Glumetza royalties may be undervalued today based on arguably a punitive discount rate, creating closer to 60% upside under a 5% discount rate for the portfolio.

How much royalties does PDLI receive?

PDLI is receiving cash royalties for the Assertio royalties currently, with $15M received in Q3 and $35M received for the 9 months ended in September 2020. However, these figures represent a 38% and 33% decline from 2019 respectively.

Is PDLI a safe harbor?

PDLI will follow a safe-harbor procedure under Delaware law. Even if there is a sale of royalties in the near term, this process involves putting funds aside for contingencies before a distribution to shareholders, this may delay any distribution to 2022 or beyond. Indeed, payments for various disposals are phased through to 2023 in some cases, so even if the safe harbor process is faster there is still a need to wait for certain payments. Therefore, patience is needed. The Glumetza class action may complicate this process further as that is an uncertain and large liability.

Is PDLI irrational?

This is not necessarily irrational because not all investors can or will tolerate the illiquidity of the expected delisting and then probable delay in cash distributions. In the best case there may be 60% upside with the bulk of cash distributions in 1-2 years. In the worst case there is perhaps 50% downside and investors may wait 6 years for complete cash distributions.

When did PDL stock delist?

As announced on December 8, 2020, the voluntary suspension of trading and subsequent delisting of PDL’s common stock (Nasdaq: PDLI) occurred prior to market opening on December 31, 2020. The Company’s transfer books closed as of the filing of the certificate of dissolution on January 4, 2021 (the “Final Record Date”).

When did PDL dissolve?

Following a resolution by PDL’s Board at its November 5, 2020 meeting, PDL filed the Certificate of Dissolution on January 4, 2021. Please refer to the Plan of Dissolution in PDL’s Proxy Statement for a detailed discussion of dissolution, but note the following:

What is PDL's safe harbor procedure?

Before distributions are made to PDL’s stockholders, PDL will follow the procedures found in the Plan of Dissolution and Sections 280 and 281 (a) of the Delaware General Corporate Law (DGCL) (the “Safe Harbor Procedures”) that, in summary, provide that the Company may give notice of PDL’s dissolution to potential claimants, accept or reject claims received, and offer a security for payment of contingent or unmatured contractual claims. Generally, the Safe Harbor Procedures reduce the potential liability of the Company’s stockholders and directors from future claims related to distributions made in liquidation. Under the Safe Harbor Procedures, after giving notice to holders of current, contingent and likely unknown claims and otherwise complying with the Safe Harbor Procedures to resolve those claims, PDL will petition the Delaware Court of Chancery to determine the amount and form of security that will be reasonably likely to be sufficient to pay known pending claims, contingent or unmatured contract claims, and unknown claims that are likely to arise based on facts known to PDL pursuant to the time periods and parameters set forth in the Plan of Dissolution and the DGCL. Upon completion of these steps and paying or making provision to pay claims described in the Plan of Dissolution, PDL will distribute its remaining assets to its stockholders. PDL does not anticipate making any distributions to stockholders before the Safe Harbor Procedures are completed, which are expected to take 12 – 18 months.

How long does a PDL last?

PDL will continue its existence for three years after filing the Certificate of Dissolution, or such longer period as the Delaware Court of Chancery may direct, for the purpose of prosecuting and defending suits, settling and closing its business, disposing of and conveying its property, discharging its liabilities and distributing to its stockholders any remaining assets.

When did PDL issue its proxy statement?

In July 2020 , PDL issued its proxy statement that requested approval by its stockholders of a Plan of Dissolution as the most efficient manner of winding up the Company’s business, paying and making provision to pay its creditors, and distributing the proceeds of its liquidation process to its stockholders pursuant to the Plan of Dissolution.

When did PDL file for dissolution?

At PDL’s 2020 Annual Meeting of Stockholders on August 19, 2020 , PDL’s stockholders approved the Plan of Dissolution and authorized the PDL Board of Directors (“the Board”) to direct the officers of the Company to file a certificate of dissolution with the State of Delaware (the “Certificate of Dissolution”) upon the Board’s determination that such a filing was in the best interests of PDL’s stockholders.

When will PDL disband in 2021?

We have not yet determined the timing or amount of future distributions, which will be determined by our Board of Directors and depend on our progress through the Safe Harbor Procedures in Delaware, the state in which PDL is incorporated and where it filed its certificate of dissolution on January 4, 2021.

When will PDL stock be suspended?

Trading in PDL's Common Stock on Nasdaq to be Suspended Prior to Market Opening on December 31, 2020

When will PDL close?

PDL intends to file a certificate of dissolution with the Delaware Secretary of State on or about January 4, 2021 and close its stock transfer books at the close of business on this date.

When will PDL dissolve?

On August 19, 2020, PDL announced at the Company's 2020 Annual Meeting of Stockholders approval by stockholders for a Plan of Dissolution authorizing the Company to liquidate and dissolve the Company in accordance with the Plan of Dissolution. At its November 5, 2020 meeting, the Board resolved that the Certificate of Dissolution will be filed on ...

When is PDL delisting?

The voluntary delisting and deregistration are part of PDL's previously announced voluntary Plan of Dissolution that was approved by the Board of Directors in February 2020 and at the Annual Meeting of the Company's stockholders on August 19, 2020.

When was PDL Biopharma founded?

PDL BioPharma was founded in 1986 as Protein Design Labs, Inc. when it pioneered the humanization of monoclonal antibodies, enabling the discovery of a new generation of targeted treatments that have had a profound impact on patients living with different cancers as well as a variety of other debilitating diseases.

When will PDL file 10K?

The suspension of PDL's reporting obligations, including the obligation to file Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, will be effective upon filing the Form 15. PDL does however intend to file its Annual Report on Form 10-K for the fiscal year ended December 31, 2020 in March 2021.

Is PDL filing a 15?

PDL also intends to file a Form 15 with the SEC as soon as practicable following the effectiveness of the delisting to in definitely suspend its reporting obligations under the Securities Exchange Act of 1934, as amended. The suspension of PDL's reporting obligations, including the obligation to file Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, will be effective upon filing the Form 15. PDL does however intend to file its Annual Report on Form 10-K for the fiscal year ended December 31, 2020 in March 2021.

When did PDL stock delist?

As announced on December 8, 2020, the voluntary suspension of trading and subsequent delisting of PDL’s common stock (Nasdaq: PDLI) occurred prior to market opening on December 31, 2020. The Company’s transfer books closed as of the filing of the certificate of dissolution on January 4, 2021 (the “Final Record Date”).

When did PDL dissolve?

Following a resolution by PDL’s Board at its November 5, 2020 meeting, PDL filed the Certificate of Dissolution on January 4, 2021. Please refer to the Plan of Dissolution in PDL’s Proxy Statement for a detailed discussion of dissolution, but note the following:

How long does a PDL last?

PDL will continue its existence for three years after filing the Certificate of Dissolution, or such longer period as the Delaware Court of Chancery may direct, for the purpose of prosecuting and defending suits, settling and closing its business, disposing of and conveying its property, discharging its liabilities and distributing to its stockholders any remaining assets.

When did PDL issue its proxy statement?

In July 2020 , PDL issued its proxy statement that requested approval by its stockholders of a Plan of Dissolution as the most efficient manner of winding up the Company’s business, paying and making provision to pay its creditors, and distributing the proceeds of its liquidation process to its stockholders pursuant to the Plan of Dissolution.

When did PDL file for dissolution?

At PDL’s 2020 Annual Meeting of Stockholders on August 19, 2020 , PDL’s stockholders approved the Plan of Dissolution and authorized the PDL Board of Directors (“the Board”) to direct the officers of the Company to file a certificate of dissolution with the State of Delaware (the “Certificate of Dissolution”) upon the Board’s determination that such a filing was in the best interests of PDL’s stockholders.

What is PDL's safe harbor procedure?

Before distributions are made to PDL’s stockholders, PDL will follow the procedures found in the Plan of Dissolution and Sections 280 and 281 (a) of the Delaware General Corporate Law (DGCL) (the “Safe Harbor Procedures”) that, in summary, provide that the Company may give notice of PDL’s dissolution to potential claimants, accept or reject claims received, and offer a security for payment of contingent or unmatured contractual claims. Generally, the Safe Harbor Procedures reduce the potential liability of the Company’s stockholders and directors from future claims related to distributions made in liquidation. Under the Safe Harbor Procedures, after giving notice to holders of current, contingent and likely unknown claims and otherwise complying with the Safe Harbor Procedures to resolve those claims, PDL will petition the Delaware Court of Chancery to determine the amount and form of security that will be reasonably likely to be sufficient to pay known pending claims, contingent or unmatured contract claims, and unknown claims that are likely to arise based on facts known to PDL pursuant to the time periods and parameters set forth in the Plan of Dissolution and the DGCL. Upon completion of these steps and paying or making provision to pay claims described in the Plan of Dissolution, PDL will distribute its remaining assets to its stockholders. PDL does not anticipate making any distributions to stockholders before the Safe Harbor Procedures are completed, which are expected to take 12 – 18 months.