What happened to Oasis Petroleum?

· Oasis Petroleum declared a quarterly dividend on Wednesday, May 4th. Investors of record on Friday, May 20th will be paid a dividend of $0.585 per share on Wednesday, June 1st. This represents a $2.34 annualized dividend and a yield of 1.67%. The ex-dividend date is Thursday, May 19th.

Is Oasis Petroleum (OAS) a good stock to buy?

· Here’s what investors in OAS stock need to know about the Oasis Petroleum bankruptcy. The company notes that it is entering bankruptcy in hopes of reducing its total debt by $1.8 billion. That...

How has covid-19 affected Oasis Petroleum's stock?

· Oasis Petroleum Inc. (NASDAQ: OAS) ("Oasis" or the "Company") today announced the closing of the previously announced merger between Oasis Midstream Partners LP …

Is Oasis energy the biggest problem with penny stocks?

· Oasis Petroleum Inc. (NYSE:OAS) announced its quarterly earnings data on Wednesday, February, 23rd. The company reported $4.25 earnings per share for the quarter, …

What happened to my shares of Oasis Petroleum?

On the date of the Company's emergence from bankruptcy (November 19, 2020), all shares of the Company's old common stock were cancelled, and holders of old Oasis common stock were issued warrants exercisable for shares of new Oasis common stock, as provided in the plan of reorganization.

Is Oasis Petroleum stock a good buy?

Oasis Petroleum has received a consensus rating of Buy. The company's average rating score is 2.83, and is based on 5 buy ratings, 1 hold rating, and no sell ratings.

Is Oasis Petroleum going out of business?

Oasis Petroleum declared bankruptcy in September 2020 and emerged, recapitalized, on November 19, 2020. In May 2021, it announced the acquisition, for $745 million, of Diamondback Energy's Bakken reserves and production.

Who bought Oasis Petroleum?

March 7 (Reuters) - Oasis Petroleum Inc (OAS. O) and Whiting Petroleum Corp (WLL. N) will merge in a $6 billion deal including debt, the U.S. shale oil and gas producers said on Monday.

When did Oasis Petroleum Public?

In 2010, the company became a public company via an initial public offering which raised over $400 million.

Who bought Oasis Petroleum Permian assets?

Percussion PetroleumOasis Petroleum Inc. (NASDAQ: OAS) (“Oasis” or the “Company”) announced today it has entered into a series of definitive agreements to sell its entire Permian Basin position for total gross potential consideration of $481MM.

Who bought Whiting Oil and gas?

Oasis Petroleum Inc.Denver-based Whiting Petroleum Corp. is merging with Houston-based Oasis Petroleum Inc. in a deal combining two major North Dakota oil and gas producers into one valued at $6 billion. The deal, the latest in a series of recent oil and gas company mergers, will move the Whiting headquarters out of Denver.

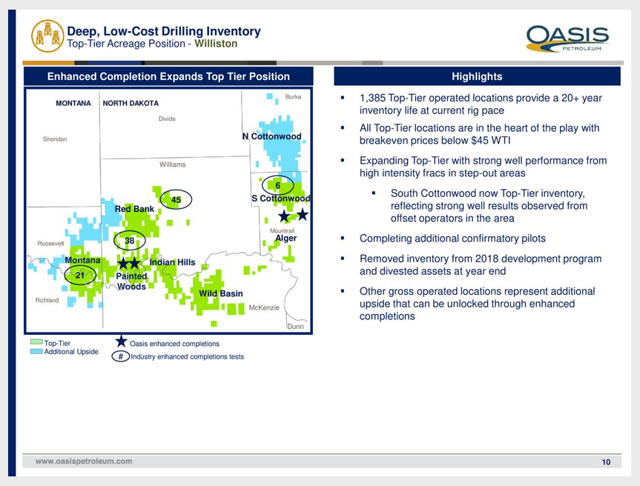

Where is the Williston Basin?

Williston Basin, large sedimentary basin along the eastern edge of the Rocky Mountains in western North Dakota, eastern Montana, and southern Saskatchewan, Can.

Is Oasis Petroleum a buy right now?

6 Wall Street research analysts have issued "buy," "hold," and "sell" ratings for Oasis Petroleum in the last year. There are currently 1 hold rati...

When is Oasis Petroleum's next earnings date?

Oasis Petroleum is scheduled to release its next quarterly earnings announcement on Monday, May 2nd 2022. View our earnings forecast for Oasis Pet...

How were Oasis Petroleum's earnings last quarter?

Oasis Petroleum Inc. (NASDAQ:OAS) issued its quarterly earnings results on Wednesday, February, 23rd. The company reported $4.25 earnings per share...

How often does Oasis Petroleum pay dividends? What is the dividend yield for Oasis Petroleum?

Oasis Petroleum declared a dividend on Friday, March 11th. Stockholders of record on Monday, March 21st will be paid a dividend of $3.00 per share...

Is Oasis Petroleum a good dividend stock?

Oasis Petroleum pays an annual dividend of $2.34 per share and currently has a dividend yield of 1.55%. The dividend payout ratio of Oasis Petroleu...

What price target have analysts set for OAS?

6 brokers have issued twelve-month price targets for Oasis Petroleum's stock. Their forecasts range from $157.00 to $201.00. On average, they antic...

Who are Oasis Petroleum's key executives?

Oasis Petroleum's management team includes the following people: Mr. Taylor L. Reid , Pres & COO (Age 58, Pay $2.37M) Mr. Michael H. Lou , CFO...

Who are some of Oasis Petroleum's key competitors?

Some companies that are related to Oasis Petroleum include EQT (EQT) , Galp Energia, SGPS (GLPEY) , Chesapeake Energy (CHK) , Toray Industries...

What other stocks do shareholders of Oasis Petroleum own?

Based on aggregate information from My MarketBeat watchlists, some companies that other Oasis Petroleum investors own include Luckin Coffee (LKNCY...

Is Oasis Petroleum a good dividend stock?

Oasis Petroleum pays an annual dividend of $2.34 per share and currently has a dividend yield of 1.67%.

Who are some of Oasis Petroleum's key competitors?

Some companies that are related to Oasis Petroleum include Chesapeake Energy (CHK) , TotalEnergies (TTE) , Transglobe Energy (TGA) , Contango O...

What other stocks do shareholders of Oasis Petroleum own?

Based on aggregate information from My MarketBeat watchlists, some companies that other Oasis Petroleum investors own include Alkaline Water (WTER...

What is Oasis Petroleum's stock symbol?

Oasis Petroleum trades on the New York Stock Exchange (NYSE) under the ticker symbol "OAS."

How do I buy shares of Oasis Petroleum?

Shares of OAS can be purchased through any online brokerage account. Popular online brokerages with access to the U.S. stock market include WeBull...

What is Oasis Petroleum's stock price today?

One share of OAS stock can currently be purchased for approximately $145.02.

How much money does Oasis Petroleum make?

Oasis Petroleum has a market capitalization of $2.81 billion.

How many employees does Oasis Petroleum have?

Oasis Petroleum employs 432 workers across the globe.

What is Oasis Petroleum's official website?

The official website for Oasis Petroleum is www.oasispetroleum.com .

When will Oasis Petroleum release its earnings?

What is Oasis Petroleum?

Oasis Petroleum is scheduled to release its next quarterly earnings announcement on Tuesday, August 3rd 2021. View our earnings forecast for Oasis Petroleum.

What is the OAS symbol?

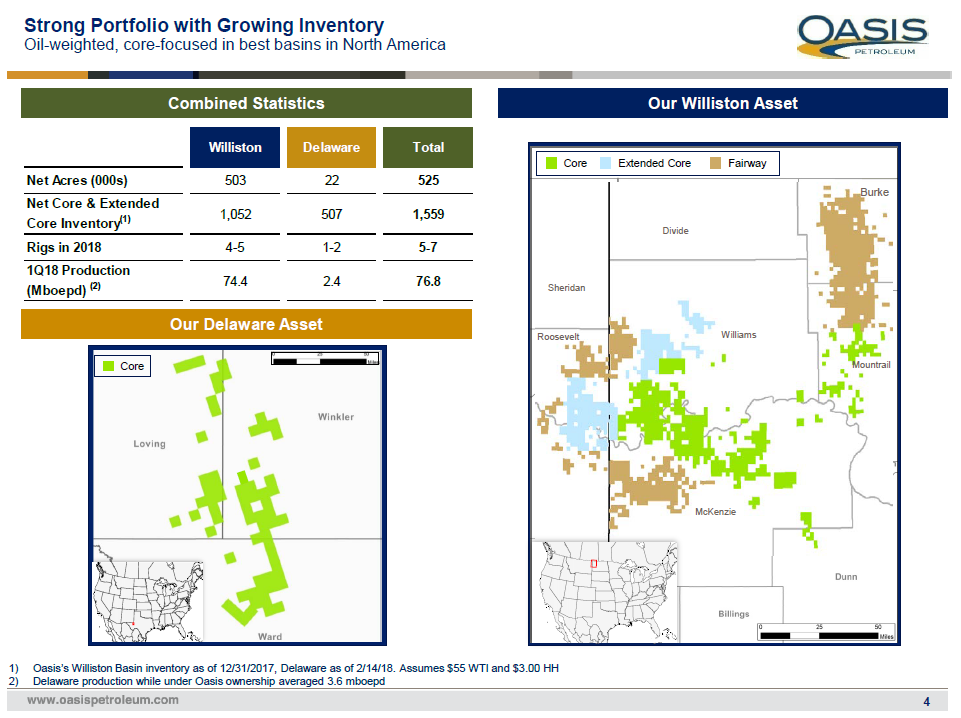

Oasis Petroleum Inc., an independent exploration and production company, focuses on the acquisition and development of onshore unconventional oil and natural gas resources in the United States. It operates through Exploration and Production (E&P), and Midstream segments. The E&P segment engages in the acquisition and development of oil and gas properties. The Midstream segment offers midstream services, such as natural gas gathering, compression, processing and, gas lift supply; crude oil gathering, terminaling, and transportation; produced and flowback water gathering, and disposal; and water distribution. As of December 31, 2020, the company had 401,766 net leasehold acres in the Williston Basin; and 24,396 net leasehold acres in the Permian Basin, as well as approximately 152.2 million barrels of oil equivalent of estimated net proved reserves. The company sells its crude oil and natural gas to refiners, marketers, and other purchasers that have access to pipeline and rail facilities. Oasis Petroleum Inc. was founded in 2007 and is headquartered in Houston, Texas.

What is the P/B ratio of Oasis Petroleum?

Oasis Petroleum trades on the NASDAQ under the ticker symbol "OAS."

How much of Oasis Petroleum is held by institutions?

Oasis Petroleum has a P/B Ratio of 2.26. P/B Ratios below 3 indicates that a company is reasonably valued with respect to its assets and liabilities.

Who bought OAS stock?

95.07% of the stock of Oasis Petroleum is held by institutions. High institutional ownership can be a signal of strong market trust in this company.

When is Oasis Petroleum earnings call?

OAS stock was acquired by a variety of institutional investors in the last quarter, including TCW Group Inc.. Company insiders that have bought Oasis Petroleum stock in the last two years include John E Hagale, Taylor L Reid, and Thomas B Nusz.

Who is the CEO of Oasis Petroleum?

Oasis Petroleum will be holding an earnings conference call on Wednesday, August 4th at 10:00 AM Eastern. Interested parties can register for or listen to the call using this link or dial in at 412-317-0088 with passcode "10159032".

Is OAS a bankruptcy?

Thomas Nusz, president and CEO of Oasis Petroleum, said the following about the bankruptcy news. “We are confident that we are taking the right steps to position the business for long-term success.

Is OAS going bankrupt?

Oasis Petroleum (NASDAQ: OAS) is voluntarily entering chapter 11 bankruptcy protection as it looks to reduce its debt.

What happened

September 30, 2020. Oasis Petroleum (NASDAQ: OAS) is voluntarily entering chapter 11 bankruptcy protection as it looks to reduce its debt. Source: Shutterstock. Here’s what investors in OAS stock need to know about the Oasis Petroleum bankruptcy.

So what

Shares of U.S. energy company Oasis Petroleum ( OAS ) rocketed over 40% at the open of trading on Friday. Over the next half-hour, the stock gave back most of that advance, hovering at around a 15% gain by 10 a.m. EDT. Shortly after, it was near a loss of 13%.

Now what

Over the past year, Oasis' stock has lost 90% of its value. This year alone, it is down around 80%. Its market cap has fallen from roughly $2 billion a year ago to around $200 million today.

Premium Investing Services

This really isn't the kind of excitement that long-term investors should be looking for. Oasis, and most other penny stocks, are best left to others. All but the most aggressive investors should steer clear of this roller coaster.