What happened after the stock market crash?

By 1933 the value of stock on the New York Stock Exchange was less than a fifth of what it had been at its peak in 1929. Business houses closed their doors, factories shut down and banks failed. Farm income fell some 50 percent. By 1932 approximately one out of every four Americans was unemployed.

What happened after the stock market crashed in August 1929?

Public panic in the days after the stock market crash led to hordes of people rushing to banks to withdraw their funds in a number of “bank runs,” and investors were unable to withdraw their money because bank officials had invested the money in the market.Apr 27, 2021

How long did it take the stock market to recover after the 1929 crash?

25 yearsIt took the DOW 25 years to regain its 1929 highs in nominal terms. Including dividends, which reached a high of 14% at the depths of the crash (when the market was down almost 90%), it took about 10 years for 1929 DOW investors to get their money back.Apr 26, 2009

Who made money in 1929 crash?

While most investors watched their fortunes evaporate during the 1929 stock market crash, Kennedy emerged from it wealthier than ever. Believing Wall Street to be overvalued, he sold most of his stock holdings before the crash and made even more money by selling short, betting on stock prices to fall.Apr 28, 2021

What happened in 1929?

Updated September 02, 2020. The stock market crash of 1929 was a collapse of stock prices that began on Oct. 24, 1929. By Oct. 29, 1929, the Dow Jones Industrial Average had dropped 24.8%, marking one of the worst declines in U.S. history. 1 It destroyed confidence in Wall Street markets and led to the Great Depression .

What happened on September 26th 1929?

September 26: The Bank of England also raised its rate to protect the gold standard. September 29, 1929: The Hatry Case threw British markets into panic. 6. October 3: Great Britain's Chancellor of the Exchequer Phillip Snowden called the U.S. stock market a "speculative orgy.".

How much did the Dow rise in 1933?

On March 15, 1933, the Dow rose 15.34%, a gain of 8.26 points, to close at 62.1. 8. The timeline of the Great Depression tracks critical events leading up to the greatest economic crisis the United States ever had. The Depression devastated the U.S. economy.

What was the Dow down in 1932?

By July 8, 1932, the Dow was down to 41.22. That was an 89.2% loss from its record-high close of 381.17 on September 3, 1929. It was the worst bear market in terms of percentage loss in modern U.S. history. The largest one-day percentage gain also occurred during that time.

Why did banks honor 10 cents for every dollar?

That's because they had used their depositors' savings, without their knowledge, to buy stocks. November 23, 1954: The Dow finally regained its September 3, 1929, high, closing at 382.74. 8.

Who is Thomas Brock?

Thomas Brock is a well-rounded financial professional, with over 20 years of experience in investments, corporate finance, and accounting. The stock market crash of 1929 was a collapse of stock prices that began on Oct. 24, 1929.

What happened in 1929?

Commercial banks continued to loan money to speculators, and other lenders invested increasing sums in loans to brokers. In September 1929, stock prices gyrated, with sudden declines and rapid recoveries.

What lessons did the Federal Reserve learn from the 1929 stock market crash?

9. First, central banks – like the Federal Reserve – should be careful when acting in response to equity markets. Detecting and deflating financial bubbles is difficult.

How much did the Dow drop in 1932?

The slide continued through the summer of 1932, when the Dow closed at 41.22, its lowest value of the twentieth century, 89 percent below its peak.

What happened on Black Monday 1929?

On Black Monday, October 28, 1929, the Dow Jones Industrial Average declined nearly 13 percent. Federal Reserve leaders differed on how to respond to the event and support the financial system.

When did the Dow Jones Industrial Average increase?

The Dow Jones Industrial Average increased six-fold from sixty-three in August 1921 to 381 in September 1929 . After prices peaked, economist Irving Fisher proclaimed, “stock prices have reached ‘what looks like a permanently high plateau.’” 2. The epic boom ended in a cataclysmic bust.

Who published a monetary history of the United States in 1963?

Consensus coalesced around the time of the publication of Milton Friedman and Anna Schwartz’ s A Monetary History of the United States in 1963.

Who created the Dow Jones Industrial Average?

Dow Jones Industrial Average (Created by: Sam Marshall, Federal Reserve Bank of Richmond) Enlarge. The financial boom occurred during an era of optimism. Families prospered. Automobiles, telephones, and other new technologies proliferated. Ordinary men and women invested growing sums in stocks and bonds.

What was the stock market crash of 1929?

The stock market crash of 1929 was not the sole cause of the Great Depression, but it did act to accelerate the global economic collapse ...

What happened to stock market in 1929?

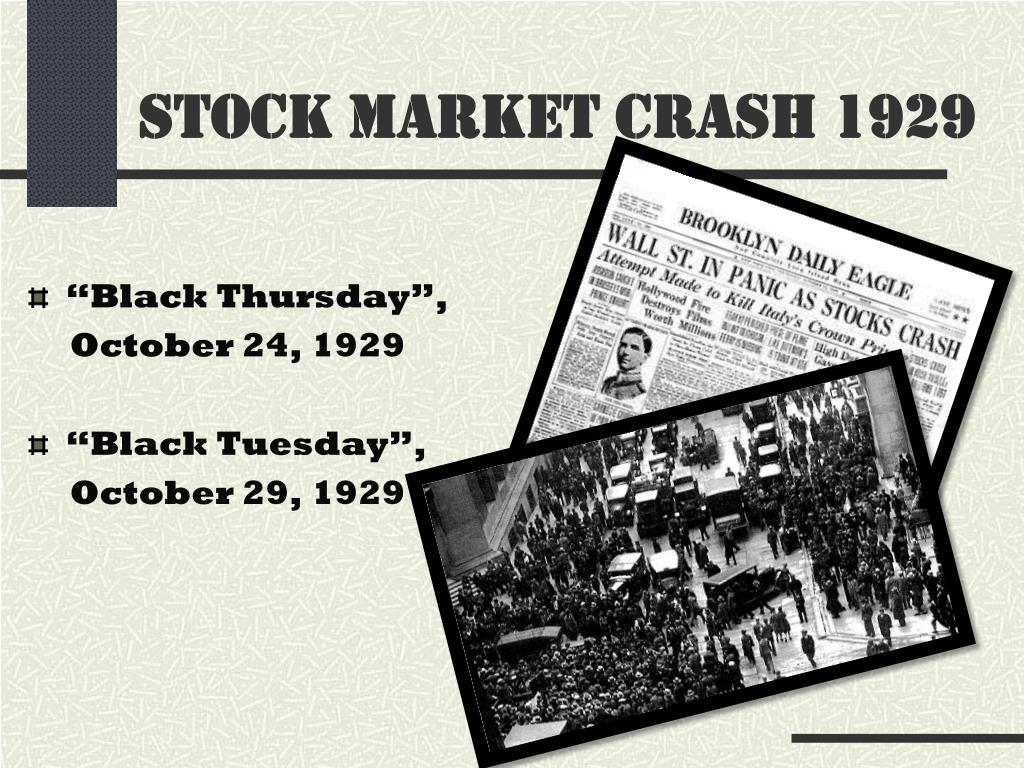

Stock prices began to decline in September and early October 1929, and on October 18 the fall began. Panic set in, and on October 24, Black Thursday, a record 12,894,650 shares were traded. Investment companies and leading bankers attempted to stabilize the market by buying up great blocks of stock, producing a moderate rally on Friday. On Monday, however, the storm broke anew, and the market went into free fall. Black Monday was followed by Black Tuesday (October 29, 1929), in which stock prices collapsed completely and 16,410,030 shares were traded on the New York Stock Exchange in a single day. Billions of dollars were lost, wiping out thousands of investors, and stock tickers ran hours behind because the machinery could not handle the tremendous volume of trading.

What happened on October 29, 1929?

On October 29, 1929, Black Tuesday hit Wall Street as investors traded some 16 million shares on the New York Stock Exchange in a single day. Billions of dollars were lost, wiping out thousands of investors. In the aftermath of Black Tuesday, America and the rest of the industrialized world spiraled downward into the Great Depression (1929-39), ...

What happened after Black Tuesday?

In the aftermath of Black Tuesday, America and the rest of the industrialized world spiraled downward into the Great Depression (1929-39), the deepest and longest-lasting economic downturn in the history of the Western industrialized world up to that time .

What were the causes of the 1929 stock market crash?

Among the other causes of the stock market crash of 1929 were low wages, the proliferation of debt, a struggling agricultural sector and an excess of large bank loans that could not be liquidated.

When did stock prices drop in 1929?

Stock prices began to decline in September and early October 1929 , and on October 18 the fall began. Panic set in, and on October 24, Black Thursday, a record 12,894,650 shares were traded.

When did the stock market peak?

During the 1920s, the U.S. stock market underwent rapid expansion, reaching its peak in August 1929 after a period of wild speculation during the roaring twenties. By then, production had already declined and unemployment had risen, leaving stocks in great excess of their real value.

How did the stock market crash of 1929 affect the economy?

To say that the Stock Market Crash of 1929 devastated the economy is an understatement. Although reports of mass suicides in the aftermath of the crash were most likely exaggerations, many people lost their entire savings. Numerous companies were ruined. Faith in banks was destroyed.

What happened on Oct 24 1929?

On the morning of Thursday, Oct. 24, 1929, stock prices plummeted. Vast numbers of people were selling their stocks. Margin calls were sent out. People across the country watched the ticker as the numbers it spit out spelled their doom.

What was the role of flappers in the 1920s?

In the 1920s, many invested in the stock market.

What was the worst day in the stock market?

Black Tuesday, October 29, 1929. Oct. 29, 1929, became famous as the worst day in stock market history and was called, "Black Tuesday.". There were so many orders to sell that the ticker again quickly fell behind. By the end of close, it was 2 1/2 hours behind real-time stock sales.

What were the signs of trouble in 1929?

Signs of Trouble. By early 1929, people across the United States were scrambling to get into the stock market. The profits seemed so assured that even many companies placed money in the stock market. Even more problematic, some banks placed customers' money in the stock market without their knowledge.

What happened on Black Tuesday 1929?

When the stock market took a dive on Black Tuesday, October 29, 1929, the country was unprepared. The economic devastation caused by the Stock Market Crash of 1929 was a key factor in the start of the Great Depression .

What was the end of World War I?

The end of World War I in 1919 heralded a new era in the United States. It was an era of enthusiasm, confidence, and optimism, a time when inventions such as the airplane and the radio made anything seem possible. Morals from the 19th century were set aside. Flappers became the model of the new woman, and Prohibition renewed confidence in the productivity of the common man.

What was the cause of the 1929 stock market crash?

Most economists agree that several, compounding factors led to the stock market crash of 1929. A soaring, overheated economy that was destined to one day fall likely played a large role.

Why did the stock market crash make the situation worse?

Public panic in the days after the stock market crash led to hordes of people rushing to banks to withdraw their funds in a number of “bank runs,” and investors were unable to withdraw their money because bank officials had invested the money in the market.

What was the economic climate in the 1920s?

Additionally, the overall economic climate in the United States was healthy in the 1920s. Unemployment was down, and the automobile industry was booming. While the precise cause of the stock market crash of 1929 is often debated among economists, several widely accepted theories exist. 17. Gallery.

What was the worst economic event in history?

The stock market crash of 1929 was the worst economic event in world history. What exactly caused the stock market crash, and could it have been prevented?

Why did people buy stocks in the 1920s?

During the 1920s, there was a rapid growth in bank credit and easily acquired loans. People encouraged by the market’s stability were unafraid of debt.

When did the Dow go up?

The market officially peaked on September 3, 1929, when the Dow shot up to 381.

Who was the bankrupt investor who tried to sell his roadster?

Bankrupt investor Walter Thornton trying to sell his luxury roadster for $100 cash on the streets of New York City following the 1929 stock market crash. (Credit: Bettmann Archive/Getty Images) Bettmann Archive/Getty Images.

What happened to the stock market after the 1929 crash?

Only a few years after the Wall Street stock market crashed in October 1929, America had fallen into the Great Depression - the greatest financial crisis in its history.

Why did the Wall Street crash happen in 1929?

However, whilst people were buying less cars, houses and luxury goods, they still kept buying shares. The Wall Street Crash was also caused by innate weaknesses in the American banking system - in the 1920s America had ...

How did the 1920s affect the economy?

To fund the mass consumption of the 1920s, many consumers used bank credit and loans. People placed so much confidence in the economy that they took out loans they couldn’t pay back. Many used loans to buy shares on the stock market - this was called buying shares on the margin. When confidence started failing in 1929, those people who had borrowed rushed to sell their shares and pay back their debts. This panic selling of shares caused a dramatic fall in the value of the market.

Why did Wall Street crash?

The Wall Street Crash was also caused by innate weaknesses in the American banking system - in the 1920s America had over 30,000 banks; this meant that many were prone to going bankrupt if they run out of funds. On average, more than 600 banks failed each year between 1921 and 1929.

What was the economic situation in the 1920s?

America in the 1920s was generally a place of economic prosperity. Mass production and mass consumption increased the standard of living for many Americans. However, this prosperity was not as widespread as many imagined - 60 per cent of the population still lived below the poverty line. The were many reasons for the Wall Street Crash.

How many banks failed in 1921?

On average, more than 600 banks failed each year between 1921 and 1929. An increase in bank failures at the end of the decade triggered a run on deposits. Confidence in the banking system started to decline, and bank runs became more common.

What caused the 1929 stock market crash?

The crash of 1929, like every other crash was caused by speculation. 1929 was the only crash where investors money did not come back. Every other crash, including 2008, if you held on to your stock or property, you recouped your money. There were huge money making opportunities to be had from the crash in 2008.

What happened before 1929?

Prior to the events of 1929 – 1932 businesses and financial markets were largely unregulated. The unbridled capitalism at the turn of the century resulted in monopolies, stock manipulation, and other abuses – all of it legal – finally ending in the excessive speculation that drove stock prices to unsupportable heights in the twenties.

How does a crash in the stock market affect the economy?

Whether you have savings, or are invested or not, having roads that are paved, bridges that don't fall down and a police force can be useful for the average citizen.

What was the Fair Labor Standards Act of 1938?

- The Fair Labor Standards Act of 1938, which set a minimum wage and outlawed child labor. 2.8K views. ·.

Why did Ford crush Model T cars?

Ford, for instance, crushed thousands of Model T cars as a result of overproduction, and they were hardly alone. Overproduction led to needing fewer workers, and fewer workers, who had no unemployment insurance, meant less consumer spending. This was the beginning of a downward-spiralling cycle.

Who was the first chairman of the SEC?

Joseph P. Kennedy, father to John F., was the SEC’s first chairman. - The Social Security act of 1935, making it mandatory for businesses to deduct social security taxes from wages, and guaranteeing some form of government backed pension for workers.

Does a collapse in the price of stocks cause a recession?

But a collapse in the price of stocks does not have to cause a recession, much less a depression.

A Timeline of What Happened

Financial Climate Leading Up to The Crash

- Earlier in the week of the stock market crash, the New York Times and other media outlets may have fanned the panic with articles about violent trading periods, short-selling, and the exit of foreign investors; however many reports downplayed the severity of these changes, comparing the market instead to a similar "spring crash" earlier that year, after which the market bounced b…

Effects of The Crash

- The crash wiped many people out. They were forced to sell businesses and cash in their life savings. Brokers called in their loans when the stock market started falling. People scrambled to find enough money to pay for their margins. They lost faith in Wall Street. By July 8, 1932, the Dow was down to 41.22. That was an 89.2% loss from its record-h...

Key Events

- March 1929:The Dow dropped, but bankers reassured investors.

- August 8: The Federal Reserve Bank of New York raised the discount rate to 6%.16

- September 3: The Dow peaked at 381.17. That was a 27% increase over the prior year's peak.1

- September 26: The Bank of England also raised its rate to protect the gold standard.17

Introduction : Stock Market Crash of 1929

Before The Crash: A Period of Phenomenal Growth

The Great Crash

What Was The Crash?

Causes of The Stock Market Crash of 1929

in The Aftermath of The Crash

- After the crash, Hoover announced that the economy was “fundamentally sound.” On the last day of trading in 1929, the New York Stock Exchange held its annual wild and lavish party, complete with confetti, musicians, and illegal alcohol. The U.S. Department of Labor predicted that 1930 would be “a splendid employment year.” These sentiments were not...

Conclusion