Total Assets = Land + Buildings + Machinery + Inventory + Sundry Debtors + Cash & Bank Total Assets = 1000000+600000+500000+350000+200000+100000 In the above total assets formula, non-current assets are Land, Buildings & Machinery, otherwise known as fixed assets.

Full Answer

What are the claims on a company's assets?

The claims on a company’s assets are comprised of liability and equity. Liability includes the claims on the company’s assets by external firms or individuals. Mortgage and loans are examples of liabilities of a company. Equity is the claim of shareholders claims on the company assets.

What is the formula for total assets?

What Is the Formula for Assets? What Is Included in Total Assets? How Do You Calculate Return on Assets? What Is the Formula for Assets? The formula used to calculate total assets is: Total Liabilities + Equity = Total Assets. The above section demonstrates how to use this formula to find total assets. Debt to Asset Ratio

What is the mathematical formula of common stock?

The mathematical formula of common stock is First Case: when total Equity, treasury stocks, additional (paid-in) capital, preferred stocks, and retained earnings are given. Common Stock=Total Equity+Treasury Stocks-Additional paid in capital-Preferred stocks-Retained earnings.

What is included in total assets of a company?

Included in total assets is cash, accounts receivable (money owing to you), inventory, equipment, tools etc. Step one above lists common assets for small businesses. The value of all of a company’s assets are added together to find total assets.

How do you calculate total assets financed by creditors?

A debt-to-assets ratio is a type of leverage ratio that compares a company's debt obligations (both short-term debt and long-term debt) to the company's total assets. It is calculated using the following formula: Debt-to-Assets Ratio = Total Debt / Total Assets.

How do I calculate total assets?

Total Assets = Liabilities + Owner's Equity The equation must balance because everything the firm owns must be purchased from debt (liabilities) and capital (Owner or stockholders equity).

What is total claims on assets?

Total claims are all the debts that the business owes to other parties. In the balance sheet, assets equal liabilities and owners' equity.

Is common stock included in total assets?

No, common stock is neither an asset nor a liability. Common stock is an equity.

What's included in total assets?

The meaning of total assets is all the assets, or items of value, a small business owns. Included in total assets is cash, accounts receivable (money owing to you), inventory, equipment, tools etc.

Is total assets the same as total equity?

Total equity, or shareholder equity, is equal to a company's total assets minus its total liabilities, both of which are documented in an organization's balance sheet. Whereas the total asset value is the sum of current and noncurrent assets, total liabilities is equal to current liabilities plus long-term liabilities.

How do you calculate total assets and liabilities?

Locate the company's total assets on the balance sheet for the period. Total all liabilities, which should be a separate listing on the balance sheet. Locate total shareholder's equity and add the number to total liabilities. Total assets will equal the sum of liabilities and total equity.

How do you calculate net income with assets and liabilities and common stock?

Logic follows that if assets must equal liabilities plus equity, then the change in assets minus the change in liabilities is equal to net income.

How do you calculate total return on assets?

The return on total assets ratio indicates how well a company's investments generate value, making it an important measure of productivity for a business. It is calculated by dividing the company's earnings after taxes (EAT) by its total assets, and multiplying the result by 100%.

How do I calculate common stock?

Common Stock = Total Equity – Preferred Stock – Additional Paid-in Capital – Retained Earnings + Treasury StockCommon Stock = $1,000,000 – $300,000 – $200,000 – $100,000 + $100,000.Common Stock = $500,000.

How do you find common stock from assets and liabilities?

Subtract a company's liabilities from its assets to get your stockholder equity. Find the common stock line item in your balance sheet. If the only two items in your stockholder equity are common stock and retained earnings, take the total stockholder equity and subtract the common stock line item figure.

How do you calculate common stock equity?

How to Calculate Shareholders' Equity. Shareholders' equity may be calculated by subtracting its total liabilities from its total assets—both of which are itemized on a company's balance sheet. Total assets can be categorized as either current or non-current assets.

What is total assets?

Total Assets Total Assets is the sum of a company's current and noncurrent assets. Total assets also equals to the sum of total liabilities and total shareholder funds. Total Assets = Liabilities + Shareholder Equity read more

What are some examples of assets?

Examples include property, plant, equipment, land & building, bonds and stocks, patents, trademark. read more. are those assets that a company holds for more than one financial year, which are not readily convertible into cash or cash equivalents.

What is non current asset?

Non-Current Assets Non-current assets are long-term assets bought to use in the business, and their benefits are likely to accrue for many years. These Assets reveal information about the company's investing activities and can be tangible or intangible.

How to calculate assets?

1. List Your Assets. To calculate assets, first you need to know what assets you have. Assets are any resources of financial value to a business. Start by listing the value of any current assets (assets that can easily be converted to cash) like cash, money owed to you and inventory.

What is total assets?

The meaning of total assets is all the assets, or items of value, a small business owns. Included in total assets is cash, accounts receivable (money owing to you), inventory, equipment, tools etc. Step one above lists common assets for small businesses. The value of all of a company’s assets are added together to find total assets.

How to calculate total assets on a balance sheet?

To calculate total assets on a balance sheet, plug in your assets first. Usually assets are divided into categories such as current or fixed assets—which are assets that are easy to convert into cash (inventory) versus assets that are harder to convert into cash (buildings).

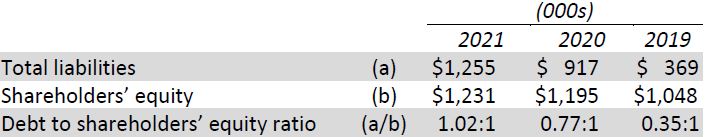

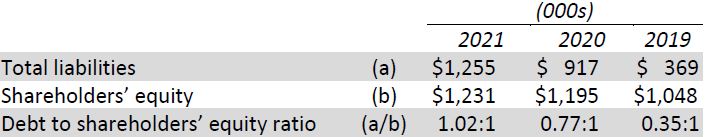

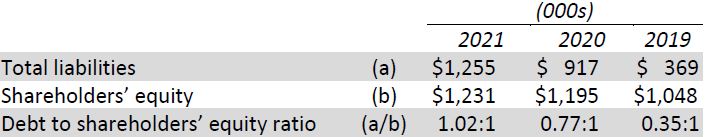

What does it mean when your debt percentage is higher?

A higher percentage means more of your assets are financed through debt, which could be problematic. The company is at higher risk of bankruptcy or insolvency (unable to pay its debts), according to The Balance. For example, a small business has a debt to asset ratio of 45 percent.

What is total liabilities plus equity?

Total Liabilities + Equity = Total Assets. Equity is the net worth of a company (also known as capital). A liability is what a business owes, such as business loans, taxes owing or operating expenses. According to the above formula, your total liabilities plus equity must equal total assets.

What is debt to asset ratio?

The debt to asset ratio is another important formula for assets. This ratio shows how much of a company’s assets were purchased with borrowed money. For example, a new business laptop could be paid for using a line of credit.

What is a balance sheet?

A balance sheet is an important financial statement that shows a company’s assets, as well as its liabilities and equity (net worth). Making a balance sheet will help you calculate your assets.

What is a claim on a company's assets?

The claims on a company’s assets are comprised of liability and equity. Liability includes the claims on the company’s assets by external firms or individuals. Mortgage and loans are examples of liabilities of a company.

Why are common stocks listed in the equity section?

Common stocks are listed in the equity section because stocks are considered as an asset. From the total number of stocks, we can calculate the number of outstanding stocks. Outstanding stocks are stocks that are issued to the public and owned by stockholders, investors, and company members. If we deduct the number of treasury stocks ...

What is equity in a company?

Equity is the claim of shareholders claims on the company assets. By purchasing stocks of the company, they have the right to claim ownership in the company. Their ownership percentage is determined by the ratio of shares owned to the total number of outstanding shares.

What is Treasury stock?

Treasury stocks are stocks that have been repurchased by the company that issued the stocks in the first place. These shares have no voting rights or dividend payments. Neither does this stock receive any assets after the company liquidates. To summarize the formula, Outstanding stocks = Issued stocks – Treasury stocks.

Is equity a common stock?

Keep in mind that equity is not just comprised of common stocks. It also includes retained earnings, treasury stock, and preferred stocks. When you add up the liabilities and stockholder equity, their sum will always be equal to the total value of the company’s assets.

What is total equity?

Total Equity: Total Equity is the total net worth or capital of the company. When the liabilities are deducted from the assets, it gives the total equity of the company.

Why do people invest in common stocks?

Investors invest in common stocks to generate income at a high rate.The advantage associated with the common stocks that holders acquire a voting right. Single stock provides one vote. Dividends are also offered to them when left. In case of bankruptcy, all preferred stockholders, bondholders, creditors get their dividends before the common stockholders. If the company does not have any dividend left after paying off all other holders, the common stockholder will get nothing. In such situations, it becomes risky to invest in common stocks. Here you will get finance assignment help from our assignment finance experts.

What is preferred stock?

Preferred Stocks– When a person invests in the Preferred stocks, he or she is preferred over common stock investors in terms of getting dividends from the company. The downside of the preferred stock is that preferred stockholders do not have a right to vote.

What is dividend in accounting?

What is dividends -Dividend is a reward, money, stocks which are distributed among the shareholders of that company. Dividends are decided by the board of directors and need the approval of shareholders. Common stocks are represented in the stockholder equity section on a balance sheet.

Why do corporations sell their shares?

A corporation sells its shares in order to make money from the individuals so that it can invest this money in the further progress of the corporation. In replacement, the company provides voting rights to the stockholders and the dividends when it is issued. In simple words, stockholders are the partial owner of the company and get dividends ...

What are the two types of stocks?

Types of Stocks– There are two types of stocks. Common Stocks. Preferred Stocks. 1. Common Stocks – An investor can purchase both types of stocks when available as both have their own privileges. But common stocks are the share that most people invest in. One share allows one vote to the buyer.

Can issued shares be greater than authorized shares?

The issued share cannot be greater than the authorized shares. Treasury Stocks: These stocks are never issued to the public and always keep in a company’s treasury. Outstanding Shares: Outstanding shares are the shares that are distributed between all shareholders of a company.

What is common stock?

Common stock is a security that represents ownership in a corporation. In a liquidation, common stockholders receive whatever assets remain after creditors, bondholders, and preferred stockholders are paid. There are different varieties of stocks traded in the market. For example, value stocks are stocks that are lower in price in relation ...

Where is common stock reported?

Common stock is reported in the stockholder's equity section of a company's balance sheet.

What is the largest stock exchange in the world?

NYSE had a market capitalization of $28.5 trillion in June 2018, making it the biggest stock exchange in the world by market cap. There are also several international exchanges for foreign stocks, such as the London Stock Exchange and the Tokyo Stock Exchange.

What is the difference between growth and value stocks?

There are also several types of stocks. Growth stocks are companies that tend to increase in value due to growing earnings. Value stocks are companies lower in price in relation to their fundamentals. Value stocks offer a dividend, unlike growth stocks.

When was the first common stock invented?

The first-ever common stock was established in 1602 by the Dutch East India Company and introduced on the Amsterdam Stock Exchange. Larger US-based stocks are traded on a public exchange, such as the New York Stock Exchange (NYSE) or NASDAQ.

Is common stock riskier than debt?

This makes common stock riskier than debt or preferred shares. The upside to common shares is they usually outperform bonds and preferred shares in the long run. Many companies issue all three types of securities. For example, Wells Fargo & Company has several bonds available on the secondary market.