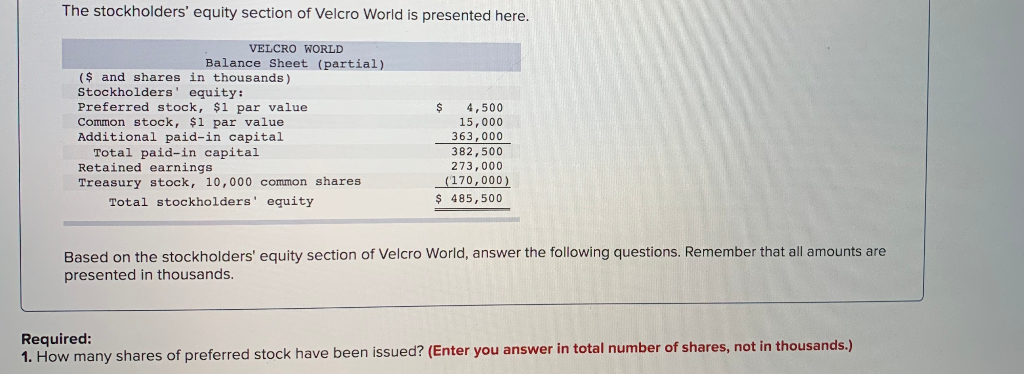

SEC Filings SEC filings are financial statements, periodic reports, and other formal documents that public companies, broker-dealers, and insiders are required to submit to the U.S. Securities and Exchange Commission (SEC). The SEC was created in the 1930s with an aim to curb stock manipulation and fraud

What are SEC filings?

SEC filings are forms companies file with the SEC to disclose business and financial information. Learn how to read SEC filings to find key stock details.

What are the forms required for registration of stock?

Registration statements are required when a company initially sells shares to the public. 4 Among the most common SEC filings are: Form 10-K, Form 10-Q, Form 8-K, the proxy statement, Forms 3,4, and 5, Schedule 13, Form 114, and Foreign Investment Disclosures.

How does an individual sell large amounts of stock?

The individual would receive a large quantity of shares through an internal program registered through an S-8 filing and then immediately sell all the shares on the public market. The issuer of the stock would, in turn, receive the proceeds. 2

What is it called when you own stock in a company?

An individual who owns stock in a company is called a shareholder and is eligible to claim part of the company’s residual assets and earnings (should the company ever be dissolved). The terms "stock", "shares", and "equity" are used interchangeably.

What is a filing used for?

Filing helps achieve workpiece function by removing some excess material and deburring the surface. Sandpaper may be used as a filing tool for other materials, such as wood.

What is a 10k filing for stocks?

What Is a 10-K? A 10-K is a comprehensive report filed annually by a publicly-traded company about its financial performance and is required by the U.S. Securities and Exchange Commission (SEC).

How do you read stock filings?

1:2013:56How to Read SEC Filings When Buying Penny Stocks | $ZYNE $YRIVYouTubeStart of suggested clipEnd of suggested clipSo I will ctrl-f. The word revenue. So they'll bring us to the consolidated statement of income. SoMoreSo I will ctrl-f. The word revenue. So they'll bring us to the consolidated statement of income. So right away you can see that this company hasn't made anything since 2014. So that's a red flag.

Is an 8-K filing good?

Is an 8K filing bad? No. Form 8-K is used to disclose any events or information that may affect investor decisions to the public, so it can contain both positive and negative events.

How do you double your money?

Below are five possible ways to double your money, ranging from the low risk to the highly speculative.Get a 401(k) match. Talk about the easiest money you've ever made! ... Invest in an S&P 500 index fund. ... Buy a home. ... Trade cryptocurrency. ... Trade options. ... How soon can you double your money? ... Bottom line.

What do investors look for in a 10-K?

Business. The first part of the 10-K provides a thorough look at what the firm does or makes, its divisions, and where in the world its products are made and sold. It also gives info on key customers and competitors, and where the company stands in its industry.

Is a 13G filing good?

By acquiring 5% or more of a stock, a 13G investor may be signaling that a stock is a good value that won't be cheap for long.

What does Warren Buffett look for in a 10-K?

The 10-K offers an in-depth look at a public company's financials, the risks it faces, and operating results for the previous year. Warren Buffett is famous for reading 500 pages a day, and the majority of those are 10-Ks.

How often are 10qs filed?

Form 10-K is an annual report, filed at the end of a company's fiscal year. Filed just once, it summarizes all the data for the year, including the fourth quarter. In contrast, Form 10-Q is filed three times a year, at the end of a company's fiscal quarter.

What are 6k filings?

Form 6-K, used by foreign private issuers (FPIs) to update their disclosures with the US Securities and Exchange Commission (SEC), seems straightforward. The form calls for sending to the SEC press releases, shareholder reports, and other information that an FPI has already published.

What is 8k rule in stock market?

What is the 8k Rule in PSE stock market investing? The 8k Rule says that to optimize fees (i.e., to make the most fees paid), invest at least 8,000 pesos. Online brokers charge commissions of “0.25% of the amount invested or 20 pesos, whichever is higher.”

What triggers an 8k?

item is triggered when the company enters into an agreement enforceable against the company, whether or not subject to conditions, under which the equity securities are to be sold. If there is no such agreement, the company should file the Form 8-K within four business days after the closing of the transaction.

Why do companies file 10ks?

The SEC mandates that all public companies file regular 10-Ks to keep investors aware of a company's financial condition and to allow them to have enough information before they buy or sell securities issued by that company.

How long does it take to file a 10K?

Companies must submit this lengthy annual filing within 60 to 90 days of the close of their fiscal year. 5 . The Form 10-K is comprised of several parts. These include:

Why do foreign companies need to file ADRs?

Foreign issuers must file forms with the SEC in a similar fashion to domestic companies to provide investors with accurate and up-to-date information.

Why was the SEC created?

Roosevelt. 1 The act was intended to help restore investor confidence following the stock market crash of 1929.

What is a registration statement?

Registration statements provide information about the securities being offered by a company as well as its financial condition. A company preparing to offer securities to the public will file a Form S-1 registration statement with the SEC. The statement consists of two parts: 4

What is the difference between a 10-K and an annual report?

The 10-K is a longer, more thorough technical document that will have all of the company's financial statements available for fundamental analysis.

When is the deadline for filing a 10Q?

The Form 10-Q must be filed for the first three quarters of the company's fiscal year. The deadline to file is within 40 days from the end of the quarter. Unlike Form 10-K, the financial statements in Form 10-Q are unaudited, and the information required is less detailed. 9 .

What is an S8 filing?

What Is an S-8 Filing? An S-8 filing is an SEC filing required for companies wishing to issue equity to their employees. The S-8 form outlines the details of an internal issuing of stock or options to employees similar to filing a prospectus.

How long do you have to be a shell company before filing an S8?

The requirements state that a registrant for an S-8 filing must not be a shell company nor been a shell company for at least 60 days prior to the filing. If the issuer had been a shell company at any time prior it must file documents with the SEC at least 60 before its S-8 filing to show that is not a shell company any more. 3 . ...

What is it called when you own stock?

An individual who owns stock in a company is called a shareholder and is eligible to claim part of the company’s residual assets and earnings (should the company ever be dissolved). The terms "stock", "shares", and "equity" are used interchangeably.

What is investment in finance?

An investment is any asset or instrument purchased with the intention of selling it for a price higher than the purchase price at some future point in time (capital gains), or with the hope that the asset will directly bring in income (such as rental income or dividends). .

What are the types of SEC filings?

What are the Main Types of SEC Filings? SEC Filings SEC filings are financial statements, periodic reports, and other formal documents that public companies, broker-dealers, and insiders are required to submit to the U.S. Securities and Exchange Commission (SEC).

Why do companies need to file S-4?

The filing is needed by investors looking to make quick gains from mergers or acquisitions. Therefore, companies submitting SEC filing S-4 are required to disclose essential facts about their financial and operating activities.

Why are publicly traded companies required to disclose information?

Publicly traded companies are required by the law to disclose relevant information concerning their business and corporate structure. The information enables investors to understand the company’s business model and helps them to predict the company’s future performance.

What is S-1 form?

Form S-1 is an initial registration form that companies must issue to investors the first time they go public. It is also known as a prospectus#N#Prospectus A prospectus is a legal disclosure document that companies are required to file with the Securities and Exchange Commission (SEC). The document provides information about the company, its management team, recent financial performance, and other related information that investors would like to know.#N#. The form is critical because there is little public information for companies in the initial stages of going public. It provides information on the planned use of the funds, the number of shares#N#Stock What is a stock? An individual who owns stock in a company is called a shareholder and is eligible to claim part of the company’s residual assets and earnings (should the company ever be dissolved). The terms "stock", "shares", and "equity" are used interchangeably.#N#to be issued, the company’s business model, competition, offering price methodology, and risk factors.

What does it mean to own a stock?

Most people realize that owning a stock means buying a percentage of ownership in the company, but many new investors have misconceptions about the benefits and responsibilities of being a shareholder. Many of these misconceptions stem from a lack of understanding of the amount of ownership that each stock represents.

Do stockholders own shares?

Stockholders own shares of a company, but the level of ownership may not present the benefits and responsibilities sought after. Most shareholders have no direct control over a company's operations, although some have voting rights affording some authority, such as voting for the board of directors members.

Does a discount affect C's stock?

Since revenue is the main driver of stock price and the loss from a discount would mean a drop in stock price, the negative impact of a discount would be more substantial for C's Brewing. So, even though an owner of stock may have saved on a purchase of the company's goods, they would lose on the investment in the company's stock.

Does ownership in a company translate into discounts?

Another misconception is that ownership in a company translates into discounts. Now, there are definitely some exceptions to the rule. Berkshire Hathaway (BRK/A), for example, has an annual gathering for its shareholders where they can buy goods at a discount from Berkshire Hathaway's held companies.

Key Takeovers

The Schedule 13D is a required SEC filing for entities acquiring more than 5% of the stock of a public company.

Hostile Takeover Strategy

In a hostile takeover, however, the acquiring company will often make a toehold purchase that falls below the minimum disclosure level. When the funding has been finalized and is in place, as with a leveraged buyout (LBO), the black knight will buy additional shares and then file the Schedule 13D and the tender offer simultaneously.

The 13G form

This alternative form indicates a large purchase by an entity that has no takeover intentions. 4

The Funding Disclosure

Investors and arbitrageurs often refer to the 13D to judge an acquisition's chances of success. Because the funding sources are disclosed, it's easier to see whether the acquiring company is over-leveraging itself.

The Schedule 13G

There is a Schedule 13G filing specifically for entities that acquire between 5% and 20% without intending a takeover or any other action that will materially impact the company's shares. 4

Article Sources

Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate.

What is S-1 SEC?

What is SEC Form S-1? The purpose of the SEC Form S-1 is to register a company's securities prior to listing them on a public exchange, such as the New York Stock Exchange.

Do companies have to file S-1 before going public?

Nearly every company must file SEC Form S-1 before going public. Source: SEC website. There are lots of SEC forms that investors have to wade through, but few are as important as the SEC Form S-1, which is generally filed by companies in anticipation of their initial public offering. What is SEC Form S-1?

What is shelf offering?

A shelf offering is a Securities and Exchange Commission (SEC) provision that allows an equity issuer (such as a corporation) to register a new issue of securities without having to sell the entire issue at once.

How long can you register a shelf offering?

Companies that issue a new security can register a shelf offering up to three years in advance, which effectively gives it that long to sell the shares in the issue.

How long can an issuer sell a security?

The issuer can instead sell portions of the issue over a three-year period without re-registering the security or incurring penalties. 1 . A shelf offering is also known as a shelf registration; it is formally known as SEC Rule 415. 1 .