By then, production had already declined and unemployment had risen, leaving stocks in great excess of their real value. Among the other causes of the stock market crash of 1929 were low wages, the proliferation of debt, a struggling agricultural sector and an excess of large bank loans that could not be liquidated.

What caused the October 29 1929 market crash?

Tuesday, October 29 the stock market crashed because many investors sold their shares or pulled their money out. Billions of dollars were lost because the buyout was less than it was worth. Soon after the crash, people were in a panic and withdrew all their money from the banks. What was the effect of the stock market crash in 1929?

What happened when the stock market crashed in October 1929?

While the October 1929 stock market crash triggered the Great Depression, multiple factors turned it into a decade-long economic catastrophe. Overproduction, executive inaction, ill-timed tariffs, and an inexperienced Federal Reserve all contributed to the Great Depression.

What exactly caused the stock market to crash in 1929?

The stock market crash of 1929 was not caused by a single factor, but a collection of events on the part of investors, regulators and international relations. Here is a quick overview of some of the main causes: Overconfidence and oversupply: Investors and institutions emerged in the early 1920s in the stock market as the economy expanded.

Why did stock prices fall in 1929?

The real root cause was mismanaged the money supply and credit by the various central banks before and after the crash in 1929. This created a situation where a triggering event like the collapse of the stock market rippled through the world leading to bank failures, which had the greatest impact.

What were three major causes of the crash of 1929?

What were the major causes of the Great Depression? Among the suggested causes of the Great Depression are: the stock market crash of 1929; the collapse of world trade due to the Smoot-Hawley Tariff; government policies; bank failures and panics; and the collapse of the money supply.

What major event happened in October of 1929?

On October 29, 1929, the United States stock market crashed in an event known as Black Tuesday. This began a chain of events that led to the Great Depression, a 10-year economic slump that affected all industrialized countries in the world.

What caused the stock market crash that began in October 1929 quizlet?

October 1929 - The steep fall in the prices of stocks due to widespread financial panic. It was caused by stock brokers who called in the loans they had made to stock investors. This caused stock prices to fall, and many people lost their entire life savings as many financial institutions went bankrupt.

What happened on 24th October 1929?

stock market crash of 1929 October 24, is known as Black Thursday; on that day a record 12.9 million shares were traded as investors rushed to salvage their losses. Still, the Dow closed down only six points after a number of major banks and investment companies bought up great blocks of stock in a successful…

What happened on October 23rd 1929?

Wednesday, October 23, 1929 1) said "Prices of Stocks Crash in Heavy Liquidation." The Washington Post (p. 1) had "Huge Selling Wave Creates Near-Panic as Stocks Collapse." In a total market value of $87 billion the market declined $4 billion — a 4.6% drop.

What were three major reasons that led to the stock market crash quizlet?

Terms in this set (7)Uneven Distribution of Wealth. ... People were buying less. ... overproduction of goods and agriculture. ... Massive Speculation Based on Ignorance. ... Many stocks were bought on margin. ... Market Manipulation by a Small Group of Investors. ... Very Little Government Regulation.

Why did stock prices drop so quickly in 1929 quizlet?

Why did stock prices drop so quickly in 1929? Investors panicked when prices fell, and they tried to sell their stocks as quickly as possible. How does a person use credit to make a purchase? One of the weaknesses in the economy of the 1920s was that too many people were relying on credit to make purchases.

What was the major cause of the collapse of the stock market quizlet?

The stock market crash was caused by a sudden loss of confidence from investors. Investors were selling and not buying stocks that were bringing in lots of profit. They were no longer confident in the millions of dollars that they were making.

What was the stock market crash of 1929?

The stock market crash of 1929 was not the sole cause of the Great Depression, but it did act to accelerate the global economic collapse ...

What happened to stock market in 1929?

Stock prices began to decline in September and early October 1929, and on October 18 the fall began. Panic set in, and on October 24, Black Thursday, a record 12,894,650 shares were traded. Investment companies and leading bankers attempted to stabilize the market by buying up great blocks of stock, producing a moderate rally on Friday. On Monday, however, the storm broke anew, and the market went into free fall. Black Monday was followed by Black Tuesday (October 29, 1929), in which stock prices collapsed completely and 16,410,030 shares were traded on the New York Stock Exchange in a single day. Billions of dollars were lost, wiping out thousands of investors, and stock tickers ran hours behind because the machinery could not handle the tremendous volume of trading.

What happened on October 29, 1929?

On October 29, 1929, Black Tuesday hit Wall Street as investors traded some 16 million shares on the New York Stock Exchange in a single day. Billions of dollars were lost, wiping out thousands of investors. In the aftermath of Black Tuesday, America and the rest of the industrialized world spiraled downward into the Great Depression (1929-39), ...

What happened after Black Tuesday?

In the aftermath of Black Tuesday, America and the rest of the industrialized world spiraled downward into the Great Depression (1929-39), the deepest and longest-lasting economic downturn in the history of the Western industrialized world up to that time .

What were the causes of the 1929 stock market crash?

Among the other causes of the stock market crash of 1929 were low wages, the proliferation of debt, a struggling agricultural sector and an excess of large bank loans that could not be liquidated.

When did stock prices drop in 1929?

Stock prices began to decline in September and early October 1929 , and on October 18 the fall began. Panic set in, and on October 24, Black Thursday, a record 12,894,650 shares were traded.

When did the stock market peak?

During the 1920s, the U.S. stock market underwent rapid expansion, reaching its peak in August 1929 after a period of wild speculation during the roaring twenties. By then, production had already declined and unemployment had risen, leaving stocks in great excess of their real value.

What happened in 1929?

Updated September 02, 2020. The stock market crash of 1929 was a collapse of stock prices that began on Oct. 24, 1929. By Oct. 29, 1929, the Dow Jones Industrial Average had dropped 24.8%, marking one of the worst declines in U.S. history. 1 It destroyed confidence in Wall Street markets and led to the Great Depression .

What happened on September 26th 1929?

September 26: The Bank of England also raised its rate to protect the gold standard. September 29, 1929: The Hatry Case threw British markets into panic. 6. October 3: Great Britain's Chancellor of the Exchequer Phillip Snowden called the U.S. stock market a "speculative orgy.".

How much did the Dow rise in 1933?

On March 15, 1933, the Dow rose 15.34%, a gain of 8.26 points, to close at 62.1. 8. The timeline of the Great Depression tracks critical events leading up to the greatest economic crisis the United States ever had. The Depression devastated the U.S. economy.

What was the Dow down in 1932?

By July 8, 1932, the Dow was down to 41.22. That was an 89.2% loss from its record-high close of 381.17 on September 3, 1929. It was the worst bear market in terms of percentage loss in modern U.S. history. The largest one-day percentage gain also occurred during that time.

Who is Thomas Brock?

Thomas Brock is a well-rounded financial professional, with over 20 years of experience in investments, corporate finance, and accounting. The stock market crash of 1929 was a collapse of stock prices that began on Oct. 24, 1929.

Why did banks honor 10 cents for every dollar?

That's because they had used their depositors' savings, without their knowledge, to buy stocks. November 23, 1954: The Dow finally regained its September 3, 1929, high, closing at 382.74. 8.

What was the 1929 stock market crash?

The Wall Street crash of 1929, also called the Great Crash, was a sudden and steep decline in stock prices in the United States in late October of that year.

What caused the stock market to go down in 1929?

Other causes included an increase in interest rates by the Federal Reserve in August 1929 and a mild recession earlier that summer, both of which contributed to gradual declines in stock prices in September and October, eventually leading investors to panic. During the mid- to late 1920s, the stock market in the United States underwent rapid ...

What was the Great Depression?

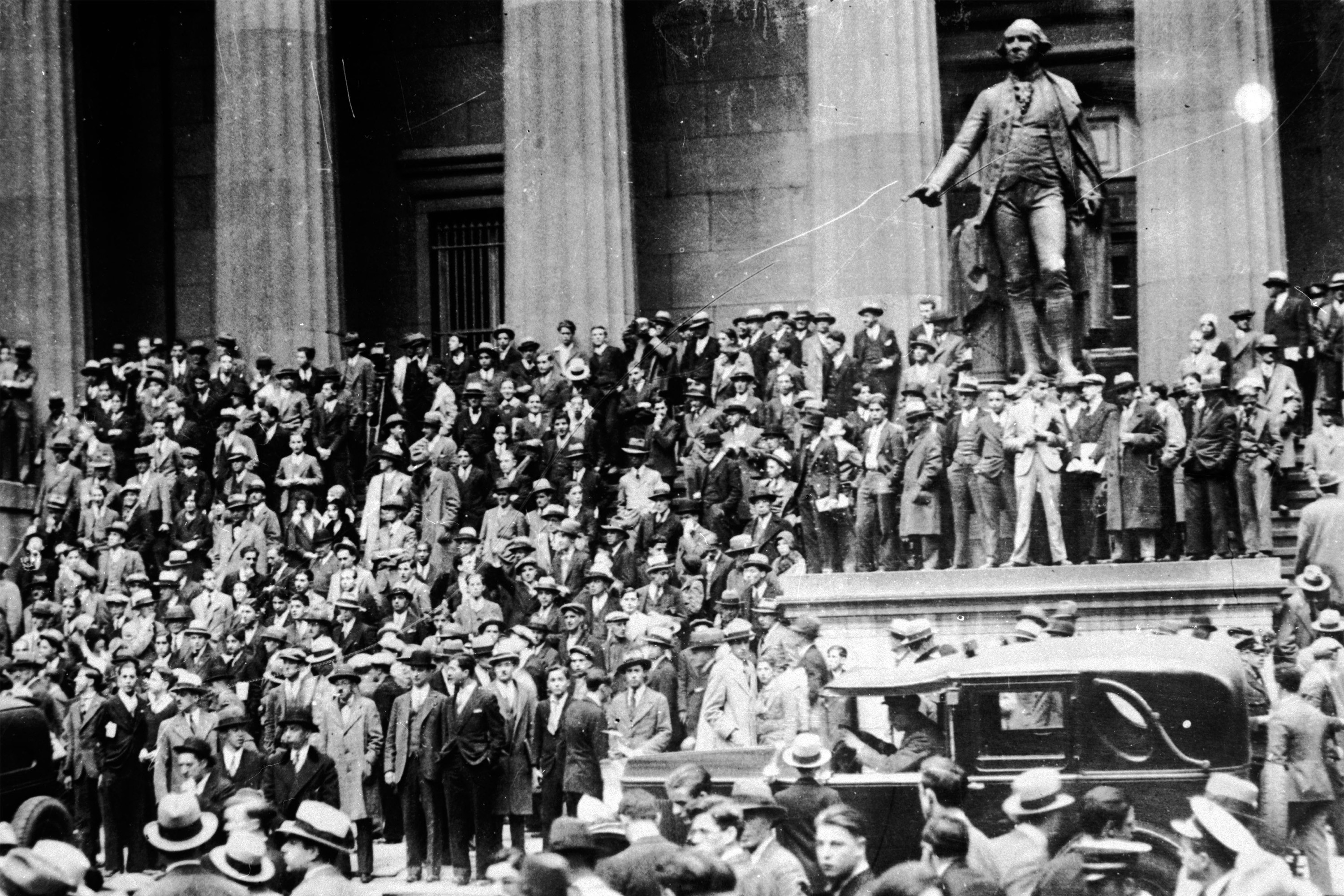

Stock market crash of 1929, also called the Great Crash, a sharp decline in U.S. stock market values in 1929 that contributed to the Great Depression of the 1930s. The Great Depression lasted approximately 10 years and affected both industrialized and nonindustrialized countries in many parts of the world. Crowds gathering outside the New York ...

How many points did the Dow close down?

Still, the Dow closed down only six points after a number of major banks and investment companies bought up great blocks of stock in a successful effort to stem the panic that day. Their attempts, however, ultimately failed to shore up the market. The panic began again on Black Monday (October 28), with the market closing down 12.8 percent.

What was the cause of the 1929 Wall Street crash?

The main cause of the Wall Street crash of 1929 was the long period of speculation that preceded it , during which millions of people invested their savings or borrowed money to buy stocks, pushing prices to unsustainable levels. Other causes included an increase in interest rates by the Federal Reserve in August 1929 and a mild recession earlier ...

Why did people sell their Liberty bonds?

People sold their Liberty Bonds and mortgaged their homes to pour their cash into the stock market. In the midsummer of 1929 some 300 million shares of stock were being carried on margin, pushing the Dow Jones Industrial Average to a peak of 381 points in September.

What happened in 1929?

Commercial banks continued to loan money to speculators, and other lenders invested increasing sums in loans to brokers. In September 1929, stock prices gyrated, with sudden declines and rapid recoveries.

What happened on Black Monday 1929?

On Black Monday, October 28, 1929, the Dow Jones Industrial Average declined nearly 13 percent. Federal Reserve leaders differed on how to respond to the event and support the financial system.

How much did the Dow drop in 1932?

The slide continued through the summer of 1932, when the Dow closed at 41.22, its lowest value of the twentieth century, 89 percent below its peak.

What lessons did the Federal Reserve learn from the 1929 stock market crash?

9. First, central banks – like the Federal Reserve – should be careful when acting in response to equity markets. Detecting and deflating financial bubbles is difficult.

When did the Dow Jones Industrial Average increase?

The Dow Jones Industrial Average increased six-fold from sixty-three in August 1921 to 381 in September 1929 . After prices peaked, economist Irving Fisher proclaimed, “stock prices have reached ‘what looks like a permanently high plateau.’” 2. The epic boom ended in a cataclysmic bust.

Who published a monetary history of the United States in 1963?

Consensus coalesced around the time of the publication of Milton Friedman and Anna Schwartz’ s A Monetary History of the United States in 1963.

Who created the Dow Jones Industrial Average?

Dow Jones Industrial Average (Created by: Sam Marshall, Federal Reserve Bank of Richmond) Enlarge. The financial boom occurred during an era of optimism. Families prospered. Automobiles, telephones, and other new technologies proliferated. Ordinary men and women invested growing sums in stocks and bonds.

Stock Market 1929 Facts

Below is an outline of the events surrounding the Stock Market Crash of 1929:

The Roaring Twenties

The Roaring Twenties were a time of great prosperity for many, but especially for large corporations. The development of new technology and refined industrial methods inspired hope for many who had suffered through the first World War.

Market Saturation

In hindsight, it was clear the stock market was saturated in early 1929. The small market slide in the spring of that year, coupled with the response from the Federal Reserve, indicated that boundless confidence in Wall Street was likely unfounded.

What happened in October 1929?

1929. In late October 1929 the stock market crashed, wiping out 40 percent of the paper values of common stock.

What happened to the stock market in 1933?

By 1933 the value of stock on the New York Stock Exchange was less than a fifth of what it had been at its peak in 1929. Business houses closed their doors, factories shut down and banks failed. Farm income fell some 50 percent.

How did the stock market crash affect the economy?

The stock market crash crippled the American economy because not only had individual investors put their money into stocks, so did businesses. When the stock market crashed, businesses lost their money. Consumers also lost their money because many banks had invested their money without their permission or knowledge.

How many stocks were traded in 1929?

The situation worsened yet again on the infamous Black Tuesday, October 29, 1929, when more than 16 million stocks were traded.

How many shares of stock were traded on October 26th?

On that day, nearly 13 million shares of stock were traded. It was a record number of stock trades for the U.S. J.P. Morgan and a few other bankers attempted to bail out the banking system using their own money. They were unsuccessful. Their move led to a slight increase in stock price on Saturday, October 26.

Why did consumers lose money?

Consumers also lost their money because many banks had invested their money without their permission or knowledge. Even after the stock market collapse, however, politicians and industry leaders continued to issue optimistic predictions for the nation’s economy.

When was the sound of the crash?

“Sounds of the Crash” – On the 70th anniversary of the great stock market crash of October 29th, 1929 , Marketplace presented an audio collage of music resulting from that event. Peter Stenshoel’s collage is announced by host, David Brancaccio.

What was the stock market crash of 1929?

The stock market crash of 1929 followed an epic period of economic growth during what's now known as the Roaring Twenties. The Dow Jones Industrial Average ( DJINDICES:^DJI) was at 63 points in August 1921 and increased six-fold over the next eight years, closing at a high of 381.17 points on Sept. 3, 1929. That September day marked the peak of the ...

What happened to the stock market in 1929?

When the stock market crashed in September 1929, all of the entwined investment trusts similarly collapsed. In the wake of the crash, the banks and other lenders that financed the stock-buying spree had little means to collect what they were owed. Their only collateral was stocks for which the amount of debt outstanding exceeded the stocks' worth.

What was the total non-corporate debt in 1929?

By September 1929, total noncorporate debt in the U.S. amounted to 40% of the nation's Gross Domestic Product (GDP). At the same time that readily available credit was fueling consumer spending, the buoyant stock market gave rise to many new brokerage houses and investment trusts, which enabled the average person to buy stocks.

What happened after 1929?

The bursting of the stock market's bubble unleashed a cascade of market forces that plagued the U.S. economy for years after 1929 . The economy likely could have recovered more quickly in those ensuing years had the combined effects of excessive borrowing, business closures, and mass layoffs not exacerbated and prolonged the crisis.

What percentage of all consumer purchases were made on installment plans in 1927?

By 1927, 15% of all major consumer purchases were being made on installment plans. People in the 1920s acquired six of every 10 automobiles and eight of every 10 radios on credit.

When did the Dow drop?

By mid-November 1929, the Dow had declined by almost half. It didn't reach its lowest point until midway through 1932, when it closed at 41.22 points -- 89% below its peak. The Dow didn't return to its September 1929 high until November 1954.

What happens when investment trusts are heavily leveraged?

Some investment trusts, themselves heavily leveraged, also invested in other similarly leveraged investment trusts , which, in turn, invested in other investment trusts employing the same strategy. As a result, each of these trusts became inordinately affected by the movements of others' stock holdings. When the stock market crashed in September ...

What was the volume of the stock market in 1929?

October 21, 1929 — A Monday. Volume hit 6,091,870, the third-highest in history. The ticker tape lagged from the open and wouldn’t catch up until an hour and forty minutes after the market closed. This was a common occurrence on heavily traded days. Except, few cared because most of those days, they ended richer.

How much did the loan increase in 1929?

Loans increased by roughly $400,000,000 per month over the prior three months. September 5, 1929 — The market broke. The Times average fell 10 points (The Dow also fell 10 points, a 2.6% decline). A day earlier, Roger Babson warned, “Sooner or later a crash is coming and it may be terrific.”.

What was the autumn of 1929?

All of the autumn of 1929 was a terrible time, and all of that year was one of climax. With the invaluable aid of hindsight it is possible to see that for many previous months the stage was being set for the final disaster. Galbraith then set about clearing up the issue.

When did the bull market start?

January 1, 1929 — The bull market is at least four years old. The New York Times average — an index of 25 industrial stocks (the standard at the time) — began 1924 at 110, then began 1925 at 135 (The Dow Jones began 1924 at 95.7 and 1925 at 121.3). Calvin Coolidge is President.

When did the stock market surge?

March 4, 1929 — Herbert Hoover is inaugurated as President. The market surged after his November election win and gave him an “inaugural market” surge in March. Days before leaving office, Calvin Coolidge proclaimed that things were sound and stocks were a good buy.

When did the Federal Reserve issue a warning on margin loans?

Most months ended higher, with the exception of early 1926 and early 1928. February 1929 — The Federal Reserve issues a warning on margin loans: “a member bank is not within its reasonable claims for rediscount facilities at the Federal Reserve Bank when it borrows for the purpose of making speculative loans.”.

Was the Great Crash a single day?

The Great Crash was not a single day but a sequence of events that started months in advance. Galbraith’s prepared statement offered a clear timeline that culminated in what everyone knows as the 1929 Crash. Note: Galbraith refers to The New York Times industrial average.

A Timeline of What Happened

Financial Climate Leading Up to The Crash

- Earlier in the week of the stock market crash, the New York Times and other media outlets may have fanned the panic with articles about violent trading periods, short-selling, and the exit of foreign investors; however many reports downplayed the severity of these changes, comparing the market instead to a similar "spring crash" earlier that year, after which the market bounced b…

Effects of The Crash

- The crash wiped many people out. They were forced to sell businesses and cash in their life savings. Brokers called in their loans when the stock market started falling. People scrambled to find enough money to pay for their margins. They lost faith in Wall Street. By July 8, 1932, the Dow was down to 41.22. That was an 89.2% loss from its record-high close of 381.17 on September …

Key Events

- March 1929:The Dow dropped, but bankers reassured investors.

- August 8: The Federal Reserve Bank of New York raised the discount rate to 6%.16

- September 3: The Dow peaked at 381.17. That was a 27% increase over the prior year's peak.1

- September 26: The Bank of England also raised its rate to protect the gold standard.17