What Does ‘Trading As’ Mean? When you carry out your business operations, you can choose to go by a name that is different from your registered business name. This new name is known as your trading name.

Full Answer

What do you mean by stock trading?

Stock trading refers to the buying and selling of shares in a particular company; if you own the stock, you own a piece of the company. Stock Trading.

What is a trading account?

Most commonly, trading account refers to a day trader’s primary account. These investors tend to buy and sell assets frequently, often within the same trading session, and their accounts are subject to special regulation as a result.

What does it mean to have a trading name?

Your trading name is the name your customers know you as. This can be different to the name you previously registered your business with. Having a trading name can be beneficial for branding purposes as it often reflects your products or services. Can a company trade under two names in NZ?

What is the difference between investing and trading?

Trading is a specific way of investing. You actively trade in, for example, a share. Trading differs from ‘traditional investing’: Investing: buying a share to achieve price gains in the long term. Trading: buying and selling a stock quickly. Trading is much more active than just investing.

What is trading considered as?

As an action, trading or to trade is the buying and selling of stocks. Trade is the result of a single action to buy or sell. If an investor makes a trade, he has purchased or sold. A trade can also be thought of as an order to buy or sell stock.

What are the 4 types of trades?

The Four Main Types of TradesBreakout/Breakdown.Retracements.Reversals.Rangebound Fades.

What are the 3 types of trade?

Active futures traders use a variety of analyses and methodologies. From ultra short-term technical approaches to fundamentals-driven buy-and-hold strategies, there are strategies to suit everyone's taste.

Is selling the same as trading?

In sales, the salesperson is the key person who needs to sale on behalf of the client. In Trading, Traders are the key people who execute the transaction. The trader's department directly needs to coordinate with the Sales department. Trader's job is to execute a buy or sell order in the secondary market.

Which type of trading is best for beginners?

For beginners, swing trading is the ultimate trading form since it takes very little time and can be executed even by those who have a full-time job, while still having great profit potential. To provide some perspective you may be able to swing trade by spending as little time as 15 minutes each day only.

How do you trade for beginners?

10 Day Trading Strategies for BeginnersKnowledge Is Power. ... Set Aside Funds. ... Set Aside Time. ... Start Small. ... Avoid Penny Stocks. ... Time Those Trades. ... Cut Losses With Limit Orders. ... Be Realistic About Profits.More items...

How do beginners trade stocks?

How to trade stocksOpen a brokerage account. ... Set a stock trading budget. ... Learn to use market orders and limit orders. ... Practice with a paper trading account. ... Measure your returns against an appropriate benchmark. ... Keep your perspective.

What type of trading is most profitable?

The safest and most profitable form of financial market trades is trading in companies stocks. Making trades in stocks tho comes with fewer downsides. Investors may handpick the best stocks in the world, from European markets, Australian markets, Hong Kong stock Exchange, FTSE 100, or anywhere else.

What is the most profitable trading strategy?

“Profit Parabolic” trading strategy based on a Moving Average. The strategy is referred to as a universal one, and it is often recommended as the best Forex strategy for consistent profits. It employs the standard MT4 indicators, EMAs (exponential moving averages), and Parabolic SAR that serves as a confirmation tool.

Is trading better than investing?

Investing is long-term and involves lesser risk, while trading is short-term and involves high risk. Both earn profits, but traders frequently earn more profit compared to investors when they make the right decisions, and the market is performing accordingly.

How soon can I sell a stock after buying it?

You can sell a stock right after you buy it, but there are limitations. In a regular retail brokerage account, you can not execute more than three same-day trades within five business days. Once you cross that threshold, you are considered a pattern day trader and must maintain a $25,000 balance in a margin account.

How long do I have to wait to sell a stock?

If you sell a stock security too soon after purchasing it, you may commit a trading violation. The U.S. Securities and Exchange Commission (SEC) calls this violation “free-riding.” Formerly, this time frame was three days after purchasing a security, but in 2017, the SEC shortened this period to two days.

How can you trade yourself?

Do you want to trade yourself? Then you need a free account with a broker. A broker is a party who, for example, makes it possible to buy and sell...

What is trading?

Trading is a specific way of investing. You actively trade in, for example, a share. Trading differs from ‘traditional investing’:

Why is trading so lucrative?

You do not need much money to start: $100 is enough to start! You can use orders and automate your trading activities. Successful trading does not...

How can you make money trading?

Making money from trading is certainly possible. As you may know, the share prices, for example, are moving up and down every day. This movement is...

What is the best way to practice?

You must practice a lot! Trading is a skill you do not learn from books. Of course, you can learn aspects of trading, such as technical and fundame...

How do you become a good trader?

After you have read this article, you will know exactly how to get started with online trading. But of course, just trading online is not enough: Y...

Take a break on occasion

Similarly, boredom is not the trader’s enemy. It is better not to have a position at all than to lose a lot of money. When it is unclear where the...

What is a trader?

A trader is someone who actively trades on the market. Anyone can become a trader. To do so, you only need to open an account with an online broker...

What is day trading?

Day trading also means within the day. Many securities are traded within a session. For example, shares are traded during the opening hours of the...

Is there such a thing as rapid trading?

In general, rapid trading exists. Traders often open multiple positions in one day. However, you can also trade long-term. This is what we call day...

What is trading name?

Your trading name is the name your customers end up knowing you as. As such, it can become a valuable asset for your business as it gains goodwill and customer recognition. Therefore, it is crucial to take sufficient measures to protect it. If you are starting a new business, you can do this by registering a trade mark, ...

Why do companies use different trading names?

If your company uses a different trading name to its registered legal name, you need to ensure that your business documents and communications also display your company’s registered name, to avoid potential liability claims as a result of misleading your customers.

What is the difference between a trading name and a business name?

What is the difference between trading name and business name? Your trading name is the name your customers know you as. This can be different to the name you previously registered your business with. Having a trading name can be beneficial for branding purposes as it often reflects your products or services.

How to protect your trading name in New Zealand?

How to Protect Your Trading Name. When you register a company name with the New Zealand Companies Office, other companies can no longer reserve or use a name that is identical or too similar to yours. Trading names, on the other hand, are not protected unless you register a trade mark. You can do this by applying to register with IPONZ.

When buying an existing business, is it a good idea to buy its trading name?

When you buy an existing business, it is a good idea to purchase its trading name. This is generally sold as part of the business’s intangible assets. The longer a business has been trading for, the more value its trading may have, depending on goodwill and customer recognition.

Can you add a trade mark to a business?

If you are starting a new business, you can do this by registering a trade mark, or if you are buying an existing business, you can add a clause to the agreement for sale and purchase of the business. This article will discuss what are the benefits of using a trading name for your business and the risks associated with failing to protect it.

Can sole traders use a trading name in New Zealand?

In New Zealand, sole traders can use any trading name they like, since it is not compulsory to register with the NZBN. However, regardless of your business structure, it is a good idea to check whether your trading name is available before you start using it, to avoid potential intellectual property issues.

Announcements

Twitter - Include the @company's twitter name in your post title – here's why…

Posts

got default judgement against apple re:macbook 2mts old that failed - sent in HCEO's - Apple sols now saying wrong claimant?

Recommended Topics

Solartherm UK useless returns on 15K heat pump - court claim launched..

What is the difference between investing and trading?

Investing: buying a share to achieve price gains in the long term. Trading: buying and selling a stock quickly. Trading is much more active than just investing. If you want to be successful with online trading, you will need to reserve more time for it.

What is the basic of trading?

Raw materials. The basics of trading are simple: you buy when you expect the price to go up, and you sell when you expect it to decrease! However, the implementation is not necessarily simple. In online trading, emotions play an important role.

What are the different types of securities?

When you start trading, you can trade in different securities. Below is a small list of the different securities in which you can trade: 1 Shares 2 Cryptocurrencies 3 Forex 4 Raw materials

How long can you hold intraday stock?

However, this is a lot faster than traditional investing. In traditional investments, shares are often held for many years.

How to be a good trader?

A good trader needs a lot of discipline. When you make the rules too complicated, it is a lot easier to (accidentally) deviate from them. Therefore, set some rules that determine whether you open a trade or not. Then evaluate these rules constantly and adjust where necessary.

When do day traders close their positions?

Day traders try to take advantage of these fluctuations by taking one or more positions during this session. A Day trader will close his positions before the end of the trading session.

How much do traders make?

Traders often earn a high salary. The average salary is around $600 per month with outliers to $7500 per month. In addition, traders have good working conditions and you can get high bonuses. These types of positions are often extremely popular.

What does it mean to trade in financial markets?

To “trade” in the jargon of the financial markets means to buy and sell. The workings of a system that can accommodate trading of one billion shares in a single day are a mystery to most people. No doubt, our financial markets are marvels of technological efficiency.

What does it look like to trade on the NYSE?

Trading on the floor of the New York Stock Exchange (NYSE) is the image most people have, thanks to television and movie depictions of how the market works. When the market is open, you see hundreds of people rushing about shouting and gesturing to one another, talking on phones, watching monitors, and entering data into terminals. It looks like chaos.

What is floor trading?

In stock-market jargon, "trading" refers to buying and selling stocks rather than making direct stock-for-stock trades. Floor traders execute trades on the floor of the exchange by finding buyers or sellers for stocks that you wish to trade through your broker. Floor trades can often take a few days to settle completely.

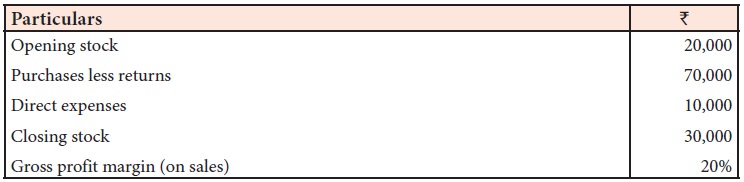

What is trading account?

Trading account is the first step in the process of preparing the final accounts of a company. As the name suggests it includes all the trading activities conducted by a business to ascertain the Gross Profit/Loss. Trading account is a nominal account in nature.

What is the opening stock?

Opening Stock – The unsold stock remaining from the previous accounting period is the opening stock of the current accounting period. It consists of raw material, work in progress, and finished goods.

What is the term for unsold stock at the end of a current accounting period?

Items once sold may be returned by the customers due to various reasons which are termed as sales returns or returns inward. Closing Stock – The unsold stock in hand at the end of the current accounting period is placed under the head “closing stock”.

What is a purchase return?

Purchase and Purchase Returns – Goods and services bought for resale are collectively termed as purchases for the business. The goods may have been acquired in cash or credit and once purchased if the goods are returned to the supplier for any reason it becomes a part of purchase returns or returns outward.

How does trading work?

Trading involves more frequent transactions, such as the buying and selling of stocks, commodities, currency pairs, or other instruments. The goal is to generate returns that outperform buy-and-hold investing. While investors may be content with annual returns of 10% to 15%, traders might seek a 10% return each month. Trading profits are generated by buying at a lower price and selling at a higher price within a relatively short period of time. The reverse also is true: trading profits can be made by selling at a higher price and buying to cover at a lower price (known as " selling short ") to profit in falling markets.

What is trading strategy?

Trading involves short-term strategies to maximize returns daily, monthly, or quarterly. Investors are more likely to ride out short-term losses, while traders will attempt to make transactions that can help them profit quickly from fluctuating markets.

How do investors and traders profit?

Both investors and traders seek profits through market participation. In general, investors seek larger returns over an extended period through buying and holding. Traders, by contrast, take advantage of both rising and falling markets ...

What is the goal of investing?

Investing. The goal of investing is to gradually build wealth over an extended period of time through the buying and holding of a portfolio of stocks, baskets of stocks, mutual funds, bonds, and other investment instruments.

How long are swing trades held?

Swing Trader: Positions are held from days to weeks. Day Trader: Positions are held throughout the day only with no overnight positions. Scalp Trader: Positions are held for seconds to minutes with no overnight positions.

Do investors ride out downtrends?

While markets inevitably fluctuate, investors will "ride out" the downtrends with the expectation that prices will rebound and any losses eventually will be recovered. Investors typically are more concerned with market fundamentals, such as price-to-earnings ratios and management forecasts.

What is a stock trader?

A stock trader is a person who attempts to profit from the purchase and sale of securities such as stock shares. Stock traders can be professionals trading on behalf of a financial company or individuals trading on behalf of themselves. Stock traders participate in the financial markets in various ways. Individual traders, also called retail ...

What are the different types of stock traders?

Types of stock traders include day traders, swing traders, buy and hold traders, and momentum traders.

What does liquidity mean in stock market?

Liquidity means there's enough volume of trades as well as buyers and sellers in the market so that stocks can be bought or sold easily. Factors that stock traders tend to focus on include: Supply and Demand: Traders observe their trades within a single day by examining how prices and money move in the market.

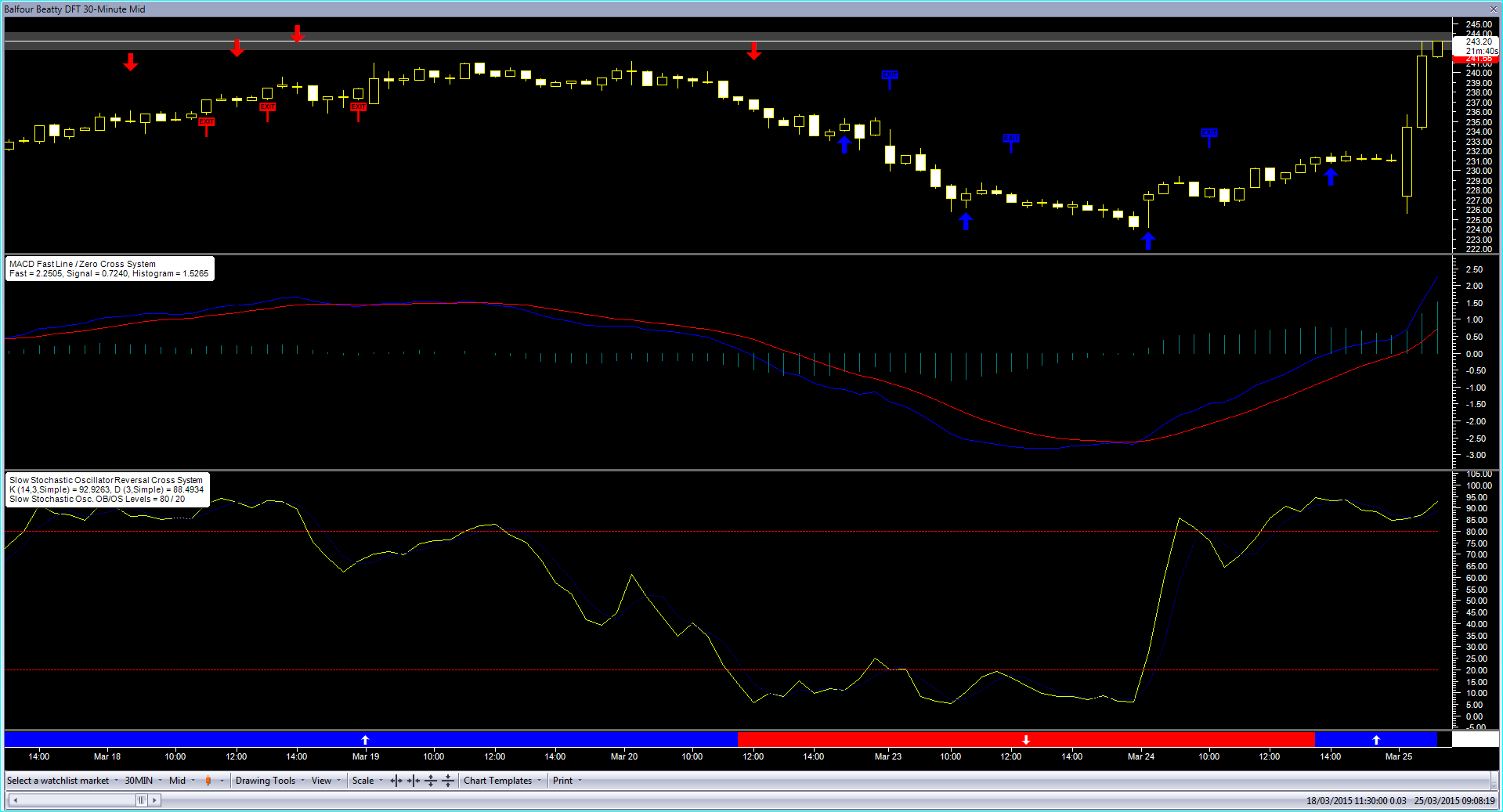

How does a swing trader work?

A swing trader takes more time to monitor stocks while evaluating the opportunities available. Swing traders can hold a position for days with the goal of capturing the majority of a move in a security's price. Swing traders might study the market for days or weeks before making a trade, buy when there's an upward trend, and sell when the market has expected to have topped out. Swing traders, like many traders, use chart patterns and technical analysis to search for entry setups and exit points.

What is fundamental trading?

A fundamental trader might initiate trades using this analysis to predict how good or bad news will impact certain stocks and industries. Technical traders, on the other hand, rely on charts, moving averages, patterns, and momentum to make key decisions.

How can institutional traders influence the market?

As a result, institutional traders can have a greater influence on the markets since their trades are much larger than those of retail traders. Becoming a stock trader requires an investment of capital and time, as well as research and knowledge of the markets.

What is an informed trader?

Informed traders can be classified as fundamental and technical traders and make trades designed to beat the broader market . A fundamental trader might focus on earnings, economic data, and financial ratios. A fundamental trader might initiate trades using this analysis to predict how good or bad news will impact certain stocks and industries. Technical traders, on the other hand, rely on charts, moving averages, patterns, and momentum to make key decisions.

What Does ‘Trading As’ Mean?

- When you carry out your business operations, you can choose to go by a name that is different from your registered business name. This new name is known as your trading name. Companies in New Zealand often use this approach, as it can be beneficial for branding reasons. If your company uses a different trading name to its registered legal name, you...

Can You Use Multiple Trading names?

- As a limited liability company, you can use more than one trading name, but the Companies Office will only record the first one. For invoicing and legal purposes, you need to mention your current and previous names.

How to Protect Your Trading Name

- When you register a company name with the New Zealand Companies Office, other companies can no longer reserve or use a name that is identical or too similar to yours. Trading names, on the other hand, are not protected unless you register a trade mark. You can do this by applying to register with IPONZ. When you purchase an existing business, you need to take some measures …

Key Takeaways

- When you choose a name for your business, it is vital to get it right, not just from a branding perspective, but also from a legal perspective. Some key points to consider include that: 1. you can choose to trade using a different name from the one you registered with; 2. your trading name is a valuable asset for your business, so it is crucial to protect it; 3. if you are starting a new ente…