A few key concepts to take note of regarding standard deviation are:

- The standard deviation of a stock determines the dispersion of a dataset in relation to its mean.

- A high standard deviation represents volatile stocks, while a low standard deviation usually points to consistent blue-chip stocks.

- The greater the standard deviation, the riskier the stock.

How do you calculate standard deviation of stock?

· The standard deviation of a stock determines the dispersion of a dataset in relation to its mean. A high standard deviation represents volatile stocks, while a low standard deviation usually points to consistent blue-chip stocks. The greater the standard deviation, the riskier the stock.

What do you consider a good standard deviation?

Description. Standard deviation is the statistical measure of market volatility, measuring how widely prices are dispersed from the average price. If prices trade in a narrow trading range, the standard deviation will return a low value that indicates low volatility. Conversely, if prices swing wildly up and down, then standard deviation returns a high value that indicates high volatility.

What is the formula for calculating standard deviation?

The standard deviation of a particular stock can be quantified by examining the implied volatility of the stock’s options. The implied volatility of a stock is synonymous with a one standard …

What does high/low standard deviation mean in real terms?

What does standard deviation tell you? The standard deviation is the average amount of variability in your data set. It tells you, on average, how far each score lies from the mean. In normal …

What is a good standard deviation in stocks?

When using standard deviation to measure risk in the stock market, the underlying assumption is that the majority of price activity follows the pattern of a normal distribution. In a normal distribution, individual values fall within one standard deviation of the mean, above or below, 68% of the time.

What does the standard of deviation tell you?

A standard deviation (or σ) is a measure of how dispersed the data is in relation to the mean. Low standard deviation means data are clustered around the mean, and high standard deviation indicates data are more spread out.

How do you interpret the standard deviation of a stock return?

Understanding the Standard Deviation The greater the standard deviation of securities, the greater the variance between each price and the mean, which shows a larger price range. For example, a volatile stock has a high standard deviation, while the deviation of a stable blue-chip stock is usually rather low.

Is a high standard deviation good?

A high standard deviation shows that the data is widely spread (less reliable) and a low standard deviation shows that the data are clustered closely around the mean (more reliable).

What does a standard deviation of 15 mean?

The standard deviation is a measure of spread, in this case of IQ scores. A standard devation of 15 means 68% of the norm group has scored between 85 (100 – 15) and 115 (100 + 15). In other words, 68% of the norm group has a score within one standard deviation of the average (100).

How do you use standard deviation indicator in trading?

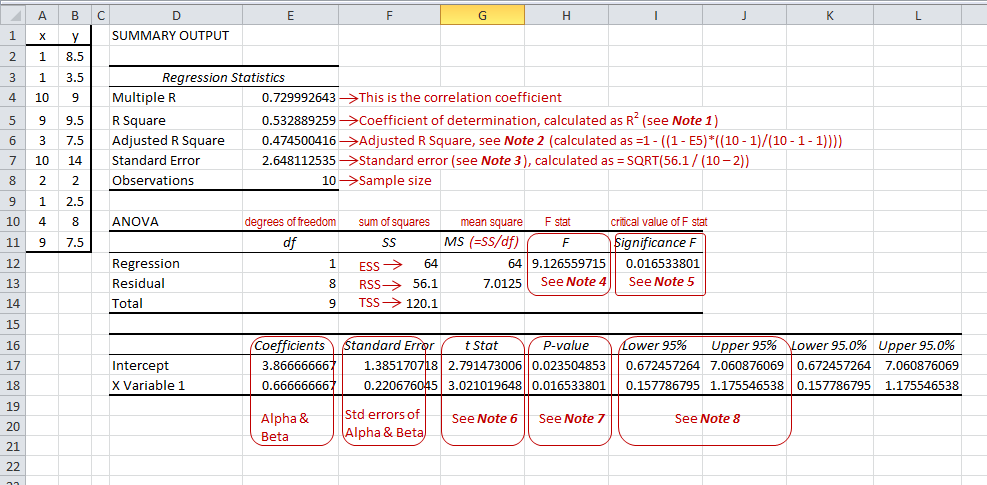

The standard deviation calculation is based on a few steps:Find the average closing price (mean) for the periods under consideration (the default setting is 20 periods)Find the deviation for each period (closing price minus average price)Find the square for each deviation.Add the squared deviations.More items...•

Is standard deviation same as volatility?

Standard deviation is a measurement of investment volatility and is often simply referred to as “volatility”. For a given investment, standard deviation measures the performance variation from the average.

How can standard deviation be used in investment analysis?

Standard deviation is a measure of the risk that an investment will fluctuate from its expected return. The smaller an investment's standard deviation, the less volatile it is. The larger the standard deviation, the more dispersed those returns are and thus the riskier the investment is.

How do you interpret standard deviation in descriptive statistics?

A low standard deviation indicates that the data points tend to be close to the mean of the data set, while a high standard deviation indicates that the data points are spread out over a wider range of values.

Is a standard deviation of 10 high?

from that image I would I would say that the SD of 5 was clustered, and the SD of 20 was definitionally not, the SD of 10 is borderline. More mathematically, The SD of 5 has 68% of the values within 10% of the range. The SD of 10 has 68% of the values within 20% of the range.

What are the two main methods for calculating interquartile range?

The two most common methods for calculating interquartile range are the exclusive and inclusive methods. The exclusive method excludes the median...

What is effect size?

Effect size tells you how meaningful the relationship between variables or the difference between groups is. A large effect size means that a rese...

What’s the difference between a point estimate and an interval estimate?

Using descriptive and inferential statistics , you can make two types of estimates about the population : point estimates and interval estimate...

What’s the difference between standard error and standard deviation?

Standard error and standard deviation are both measures of variability . The standard deviation reflects variability within a sample, while the...

What is standard error?

The standard error of the mean , or simply standard error , indicates how different the population mean is likely to be from a sample mean. It...

How do you know whether a number is a parameter or a statistic?

To figure out whether a given number is a parameter or a statistic , ask yourself the following: Does the number describe a whole, complete popul...

What are the different types of means?

The arithmetic mean is the most commonly used mean. It’s often simply called the mean or the average. But there are some other types of means you...

How do I find the mean?

You can find the mean , or average, of a data set in two simple steps: Find the sum of the values by adding them all up. Divide the sum by the num...

When should I use the median?

The median is the most informative measure of central tendency for skewed distributions or distributions with outliers. For example, the median...

What is standard deviation in finance?

Standard deviation is a statistical measurement in finance that , when applied to the annual rate of return of an investment, sheds light on that investment's historical volatility . The greater the standard deviation of securities, the greater the variance between each price and the mean, which shows a larger price range.

How to use standard deviation?

Using the standard deviation, statisticians may determine if the data has a normal curve or other mathematical relationship. If the data behaves in a normal curve, then 68% of the data points will fall within one standard deviation of the average , or mean, data point. Larger variances cause more data points to fall outside the standard deviation. Smaller variances result in more data that is close to average.

How much did Apple stock return in 2016?

Or consider shares of Apple (AAPL) for the last five years. Returns for Apple’s stock were 12.49% for 2016, 48.45% for 2017, -5.39% for 2018, 88.98% for 2019 and, as of Sep., 60.91% for 2020. The average return over the five years was 41.09%. 1

How to find the mean of a mean of 5.5?

Say we have the data points 5, 7, 3, and 7, which total 22. You would then divide 22 by the number of data points, in this case, four—resulting in a mean of 5.5. This leads to the following determinations: x̄ = 5.5 and N = 4.

Why is variance more difficult to grasp than standard deviation?

If the data values are all close together, the variance will be smaller. However, this is more difficult to grasp than the standard deviation because variances represent a squared result that may not be meaningfully expressed on the same graph as the original dataset.

Why is variance smaller than standard deviation?

However, this is more difficult to grasp than the standard deviation because variances represent a squared result that may not be meaningfully expressed on the same graph as the original dataset.

Why is variance important?

The variance helps determine the data's spread size when compared to the mean value. As the variance gets bigger, more variation in data values occurs, and there may be a larger gap between one data value and another. If the data values are all close together, the variance will be smaller.

What is standard deviation in statistics?

Standard deviation is the statistical measure of market volatility, measuring how widely prices are dispersed from the average price.

What does it mean when the market tops are accompanied by increased volatility?

Market tops that are accompanied by increased volatility over short periods of time indicate nervous and indecisive traders. Market tops with decreasing volatility over long time frames indicate maturing bull markets.

What is standard deviation in statistics?

The standard deviation is the average amount of variability in your data set. It tells you, on average, how far each score lies from the mean. In normal distributions, a high standard deviation means that values are generally far from the mean, while a low standard deviation indicates that values are clustered close to the mean.

How many values are within 1 standard deviation of the mean?

Around 68% of values are within 1 standard deviation of the mean.

What is variance test?

Statistical tests such as variance tests or the analysis of variance (ANOVA) use sample variance to assess group differences of populations. They use the variances of the samples to assess whether the populations they come from significantly differ from each other.

What is the best measure of variability for skewed distributions?

The interquartile range is the best measure of variability for skewed distributions or data sets with outliers. Because it’s based on values that come from the middle half of the distribution, it’s unlikely to be influenced by outliers.

What is the median of a number?

If n is an even number, the median is the mean of the values at positions n / 2 and ( n / 2) + 1.

What does standard error mean?

The standard error of the mean, or simply standard error, indicates how different the population mean is likely to be from a sample mean. It tells you how much the sample mean would vary if you were to repeat a study using new samples from within a single population.

What is the difference between standard deviation and variance?

Variance is the average squared deviations from the mean, while standard deviation is the square root of this number. Both measures reflect variability in a distribution, but their units differ:

What does it mean when a stock has a low standard deviation?

When prices move wildly, standard deviation is high, meaning an investment will be risky. Low standard deviation means prices are calm, so investments come with low risk.

What is standard deviation in investing?

In investing, standard deviation is used as an indicator of market volatility and thus of risk. The more unpredictable the price action and the wider the range, the greater the risk. Range-bound securities, or those that do not stray far from their means, are not considered a great risk.

What can we determine from the smaller standard deviation?

So what can we determine from this? The smaller the standard deviation, the less risky an investment will be, dollar-for-dollar. On the other hand, the larger the variance and standard deviation, the more volatile a security. While investors can assume price remains within two standard deviations of the mean 95% of the time, this can still be a very large range. As with anything else, the greater the number of possible outcomes, the greater the risk of choosing the wrong one.

When using standard deviation to measure risk in the stock market, what is the underlying assumption?

When using standard deviation to measure risk in the stock market, the underlying assumption is that the majority of price activity follows the pattern of a normal distribution. In a normal distribution, individual values fall within one standard deviation of the mean, above or below, 68% of the time. Values are within two standard deviations 95% of the time.

What does low standard deviation mean?

Low standard deviation means prices are calm, so investments come with low risk.

How to determine risk of an investment?

One of the most common methods of determining the risk an investment poses is standard deviation. Standard deviation helps determine market volatility or the spread of asset prices from their average price. When prices move wildly, standard deviation is high, meaning an investment will be risky.

What is the most common metric used to assess volatility?

Traders and analysts use a number of metrics to assess the volatility and relative risk of potential investments, but the most common metric is standard deviation . Read on to find out more about standard deviation, and how it helps determine risk in the investment industry.

What does standard deviation tell us?

So, what does standard deviation tell us? Standard deviation tells us about the variability of values in a data set. It is a measure of dispersion, showing how spread out the data points are around the mean. Together with the mean, standard deviation can also indicate percentiles for a normally distributed population.

Why is standard deviation used in statistics?

Standard deviation is used often in statistics to help us describe a data set, what it looks like, and how it behaves. However, this raises the question of how standard deviation helps us to understand data.

What is the range of a data set?

Remember that the range of a data set is the difference between the maximum and the minimum values. Using the range of a data to tell us about the spread of values has some disadvantages:

How many standard deviations are there in a data interval?

We know that any data value within this interval is at most 5 standard deviations from the mean. Some of this data is close to the mean, but a value that is 5 standard deviations above or below the mean is extremely far away from the mean (and this almost never happens).

How many standard deviations are there in a normal distribution?

For a data set that follows a normal distribution, approximately 99.99% (9999 out of 10000) of values will be within 4 standard deviations from the mean.

How many values are within one standard deviation from the mean?

For a data set that follows a normal distribution, approximately 68% (just over 2/3) of values will be within one standard deviation from the mean.

How many standard deviations are there within a standard deviation interval?

We know that any data value within this interval is at most 1 standard deviation from the mean. We could say that this data is relatively close to the mean.