The price-to-earnings (PE) ratio is the ratio between a company's stock price and earnings per share. It measures the price of a stock relative to its profits. You calculate the PE ratio by dividing the stock price with earnings per share (EPS).

What does a PE ratio tell you?

Aug 07, 2020 · The price-to-earnings ratio, or P/E ratio, helps you compare the price of a company’s stock to the earnings the company generates. This comparison helps you understand whether markets are ...

What is a good PE ratio for a stock?

The price-to-earnings (PE) ratio is the ratio between a company's stock price and earnings per share. It measures the price of a stock relative to its profits. You calculate the PE ratio by dividing the stock price with earnings per share (EPS).

How to find the historical PE ratio for any stock?

PEG Ratio PEG Ratio is the P/E ratio of a company divided by the forecasted Growth in earnings (hence "PEG"). It is useful for adjusting high growth companies. The ratio adjusts the traditional P/E ratio by taking into account the growth rate in earnings per …

What can P/E ratio tell you?

Apr 03, 2022 · The P/E ratio, in simplistic terms, is how much one dollar of profits cost to invest in the company. In the Amazon example, an investor is effectively paying $100 for every $1 of profits. Again, the P/E ratio, sometimes referred to as the earnings multiple, is not a good measure of value on a standalone basis.

What is a good PE ratio for stocks?

Is 30 a good PE ratio?

A P/E of 30 is high by historical stock market standards. This type of valuation is usually placed on only the fastest-growing companies by investors in the company's early stages of growth. Once a company becomes more mature, it will grow more slowly and the P/E tends to decline.

Is PE ratio of 1 GOOD?

Is PE ratio high or low better?

What is Microsoft PE ratio?

What's a good dividend yield?

Who is the most accurate stock analyst?

Why PE ratio is important?

How is P E calculated?

Which stock has the highest dividend?

...

25 high-dividend stocks.

| Symbol | Company name | Dividend yield |

|---|---|---|

| MO | Altria Group Inc | 6.47% |

| OKE | ONEOK Inc | 5.9% |

| UVV | Universal Corp | 5.39% |

| ALE | ALLETE Inc. | 4.38% |

What if PE ratio is negative?

What is the current PE ratio of Nifty 50?

Price Earnings Ratio Formula

P/E = Stock Price Per Share / Earnings Per ShareorP/E = Market Capitalization / Total Net EarningsorJustified P/E = Dividend Payout Ratio / R – Gwh...

P/E Ratio Formula Explanation

The basic P/E formula takes current stock price and EPS to find the current P/E. EPS is found by taking earnings from the last twelve months divide...

Why Use The Price Earnings Ratio?

Investors want to buy financially sound companies that offer cheap shares. Among the many ratios, the P/E is part of the research process for selec...

Limitations of Price Earnings Ratio

Finding the true value of a stock cannot just be calculated using current year earnings. The value depends on all expected future cash flows and ea...

Why use P/E ratio?

The most common use of the P/E ratio is to gauge the valuation of a stock or index. The higher the ratio, the more expensive a stock is relative to its earnings. The lower the ratio, the less expensive the stock. In this way, stocks and equity mutual funds can be classified as “growth” or “value” investments.

What is the Shiller P/E ratio?

A third approach is to use average earnings over a period of time. The most well known example of this approach is the Shiller P/E ratio, also known as the CAP/E ratio (cyclically adjusted price earnings ratio).

Is Amazon a growth company?

An investment with an above average price-to-earnings ratio, for example, might be classified as a growth investment . Amazon, with a PE currently at about 123, is an example of a growth company.

What is PE ratio?

The PE ratio is often referred to as the “earnings multiple” or simply “the multiple.”. You can write it as either PE or P/E. A simple way to think about the PE ratio is how much you are paying for one dollar of earnings per year. A ratio of 10 indicates that you are willing to pay $10 for $1 of earnings.

Why is PE ratio important?

It is essential to consider other valuation metrics and evaluate the company’s future growth prospects.

How to calculate PE ratio?

Formula: PE Ratio = Price Per Share / Earnings Per Share. Generally speaking, a low PE ratio indicates that a stock is cheap, while a high ratio suggests that a stock is expensive. However, the PE ratio can also indicate how much investors expect earnings to grow in the future. The higher the ratio, the better the growth prospects.

What does a low PE ratio mean?

Generally speaking, a low PE ratio indicates that a stock is cheap, while a high ratio suggests that a stock is expensive. However, the PE ratio can also indicate how much investors expect earnings to grow in the future. The higher the ratio, the better the growth prospects.

What does low P/E mean in stocks?

Companies with a low Price Earnings Ratio are often considered to be value stocks. It means they are undervalued because their stock price trade lower relative to its fundamentals. This mispricing will be a great bargain and will prompt investors to buy the stock before the market corrects it. And when it does, investors make a profit as a result of a higher stock price. Examples of low P/E stocks can be found in mature industries that pay a steady rate of dividends#N#Dividend A dividend is a share of profits and retained earnings that a company pays out to its shareholders. When a company generates a profit and accumulates retained earnings, those earnings can be either reinvested in the business or paid out to shareholders as a dividend.#N#.

What is justified P/E ratio?

The justified P/E ratio#N#Justified Price to Earnings Ratio The justified price to earnings ratio is the price to earnings ratio that is "justified" by using the Gordon Growth Model. This version of the popular P/E ratio uses a variety of underlying fundamental factors such as cost of equity and growth rate.#N#above is calculated independently of the standard P/E. In other words, the two ratios should produce two different results. If the P/E is lower than the justified P/E ratio, the company is undervalued, and purchasing the stock will result in profits if the alpha#N#Alpha Alpha is a measure of the performance of an investment relative to a suitable benchmark index such as the S&P 500. An alpha of one (the baseline value is zero) shows that the return on the investment during a specified time frame outperformed the overall market average by 1%.#N#is closed.

What is fair value?

Fair Value Fair value refers to the actual value of an asset - a product, stock, or security - that is agreed upon by both the seller and the buyer. Fair value is applicable to a product that is sold or traded in the market where it belongs or under normal conditions - and not to one that is being liquidated.

What is fair value in accounting?

Fair value is applicable to a product that is sold or traded in the market where it belongs or under normal conditions - and not to one that is being liquidated. of the company. The P/E ratio shows the expectations of the market and is the price you must pay per unit of current earnings. Net Income Net Income is a key line item, ...

Why is profit margin important?

Earnings are important when valuing a company’s stock because investors want to know how profitable a company is and how profitable. Profit Margin In accounting and finance, profit margin is a measure of a company's earnings relative to its revenue. The three main profit margin metrics. it will be in the future.

What is it called when you own stock?

An individual who owns stock in a company is called a shareholder and is eligible to claim part of the company’s residual assets and earnings (should the company ever be dissolved). The terms "stock", "shares", and "equity" are used interchangeably. of different prices and earnings levels.

What is equity research analyst?

Equity Research Analyst An equity research analyst provides research coverage of public companies and distributes that research to clients.

Do you have to calculate P/E ratio?

Most financial websites openly publish the P/E ratio, so you don’t have to calculate it from scratch. However, understanding where they are getting the numbers is always useful. A P/E ratio includes a company’s stock price, which can be found in any number of stock research websites.

What is a negative P/E ratio?

Firstly, companies that make no earnings have a “0” or “N/A” P/E ratio. If earnings are negative, the P/E ratio can be calculated, but a negative P/E ratio is generally not useful for comparison purposes. The P/E also can’t be used to compare companies of different industries.

Is a good P/E ratio good?

A “good” P/E ratio isn’t necessarily a high ratio or a low ratio on its own. The market average P/E ratio currently ranges from 20-25, so a higher PE above that could be considered bad, while a lower PE ratio could be considered better. However, the long answer is more nuanced than that.

What does a high P/E mean?

The P/E is meant to be a quick way to assess a company based on its earnings. A high P/E ratio relative to its peers, or historically, means investors are expecting higher future earnings growth, and thus are willing to pay more right now . A lower P/E suggests investors believe earnings growth may slow going forward.

Is the S&P 500 overvalued?

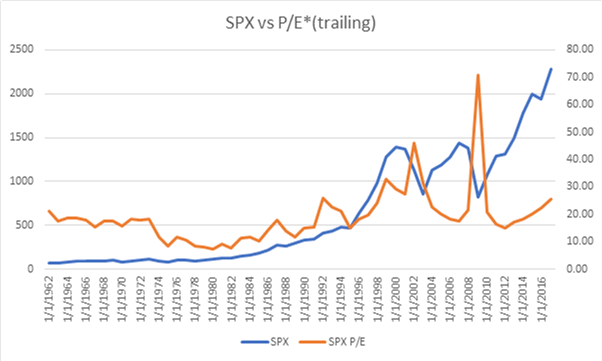

Based on the historical average, the S&P 500 is slightly overvalued today. That is, the economic and earnings outlook for the S&P 500 is expected to be below historical norms. When the economy is booming, P/E ratios will be higher than average, and vice versa when the economy is on rocky ground.

What is a good PE ratio?

A good PE ratio is a lower PE Raio. When comparing two companies in the same industry with the same future growth and earnings expectations, then the better PE ratio is the lower one. The company with the lower PE ratio represents better value as you are paying less per share for the same earnings and growth potential.

Why is a low PE ratio bad?

A low PE ratio can be bad when the company in question is in a declining market, and the prospects are bleak. As profits decrease, so does the stock price as the current investors are selling the stock, and the demand for the stock is decreasing also. This is why the earnings season is so important.

Who used the P/E ratio?

The P/E ratio was used by the late Benjamin Graham. Not only was he Warren Buffett's mentor, but he is also credited with coming up with " value investing ." 1

Is a low P/E ratio good?

Without broader context, you can't be sure that a low P/E truly signals a good investment. Some investors may prefer the price-to-earnings growth ( PEG) ratio instead, because it factors in the earnings growth rate. 7 Other investors may prefer the dividend-adjusted PEG ratio because it uses the basic P/E ratio.

Who is Joshua Kennon?

Joshua Kennon is an expert on investing, assets and markets, and retirement planning. He is the managing director and co-founder of Kennon-Green & Co., an asset management firm. A price-to-earnings ratio, or P/E ratio, is the measure of a company's stock price in relation to its earnings.

What is a PE ratio?

A company’s price-to-earnings ratio, or PE ratio, is a single number that packs a lot of punch, and one of the most common ways to value a company’s stock shares.

How to calculate PE ratio?

PE ratio compares a company’s current stock price to its earnings per share, or EPS, which can be calculated based on historical data (for trailing PE) or forward-looking estimates (for forward PE). It's a standard part of stock research investors use to: 1 Compare the stock prices of similar companies to find outliers. 2 Determine if the stock is undervalued, appropriately priced or overvalued. 3 Decide, based on its value, if they should buy, sell or hold any particular stock.

Why is a stock's PE ratio higher than its historical ratio?

If a stock’s PE ratio is significantly higher than those of other similar companies — or even than the company’s own historical PE ratio — it could be due to growth prospects, but it’s also possible the stock is overvalued.

Is a stock overvalued?

THE STOCK MAY BE OVERVALUED. If a stock’s PE ratio is significantly higher than those of other similar companies — or even than the company’s own historical PE ratio — it could be due to growth prospects, but it’s also possible the stock is overvalued.

What does a low PE ratio mean?

A low PE ratio may signal that the stock price doesn’t accurately reflect the true value of the company based on its earnings. In this instance, the stock price may stay the same while the company’s earnings increase, which would send the PE ratio lower. Investors may see this as an opportunity to buy the stock with the expectation ...

Is PE ratio good?

While PE ratio can be a good way for investors to evaluate companies, it has its drawbacks. Aaron Sherman, a certified financial planner and president of Odyssey Group Wealth Advisors in Lancaster, Pennsylvania, cautions investors against using PE ratio alone in making their investment decisions.

Does NerdWallet offer brokerage services?

NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks or securities. A company’s price-to-earnings ratio, or PE ratio, is a single number that packs a lot of punch, and one of the most common ways to value a company’s stock shares.