What does PE mean in stocks?

What Is PE in Stocks? P/E is an acronym which is used to refer to a stock's price-earnings ratio, and is a valuation measure that describes the relative expense of a stock with respect to its earnings per share. Earnings per share must first be quantified in order calculate P/E.

What is a good PE ratio for a stock?

- The value of P/E ratio

- Seeing the bigger picture

- Predictive power of P/E ratio

What is the PE of a stock?

It just requires that you know how to use three elementary formulas:

- one for calculating earnings per share (EPS),

- one for calculating the market price per share (market price divided by the total number of shares outstanding), and

- one for calculating PE ratio (market price divided by EPS).

What is PE ratio in stock market?

The price-earnings ratio or the ratio for valuing a company stock measures its current share price relative to per-share earnings. Also called the price multiple, P/E or PE, it is the metric used for valuing a stock base on earnings. Price per share is divided by earnings per share to yield the PE ratio.

What is a good PE ratio for a stock?

So, what is a good PE ratio for a stock? A “good” P/E ratio isn't necessarily a high ratio or a low ratio on its own. The market average P/E ratio currently ranges from 20-25, so a higher PE above that could be considered bad, while a lower PE ratio could be considered better.

Is a high PE ratio good?

In general, a high P/E suggests that investors are expecting higher earnings growth in the future compared to companies with a lower P/E. A low P/E can indicate either that a company may currently be undervalued or that the company is doing exceptionally well relative to its past trends.

Is high PE good for stock?

A high P/E could mean that a stock's price is high relative to earnings and possibly overvalued. Conversely, a low P/E might indicate that the current stock price is low relative to earnings. However, companies that grow faster than average typically have higher P/Es, such as technology companies.

Are stocks with low PE better?

A high RoCE indicates that the company is lucrative. A stock with a low PE and strong business fundamentals has a decent possibility of rising in price in the future. Sales, EPS, net worth, and other metrics grow quicker when the fundamentals are strong.

Is 30 a good PE ratio?

P/E 30 Ratio Explained A P/E of 30 is high by historical stock market standards. This type of valuation is usually placed on only the fastest-growing companies by investors in the company's early stages of growth. Once a company becomes more mature, it will grow more slowly and the P/E tends to decline.

Is 50 a good PE ratio?

The average Nifty 50 PE ratio is 20. A Nifty 50 PE ratio of more than 25 means an expensive market and investors often book profits at such high levels.

Is 200 a high PE ratio?

A P/E ratio of 200 is high. But it is basically saying that people expect the company to grow earnings to be 15 to 20 times as large as they are now (so the P/E ratio would be 10 to 15).

Should I buy high or low PE ratio?

P/E ratio, or price-to-earnings ratio, is a quick way to see if a stock is undervalued or overvalued. And so generally speaking, the lower the P/E ratio is, the better it is for both the business and potential investors. The metric is the stock price of a company divided by its earnings per share.

What is Tesla's PE ratio?

88.23The PE ratio is a simple way to assess whether a stock is over or under valued and is the most widely used valuation measure. Tesla PE ratio as of June 17, 2022 is 88.23.

What is PE of 2021?

The P/E ratio reached an all-time high of 36.210 in Feb 2021 and a record low of 10.360 in Oct 2008. BSE Limited provides daily P/E Ratio.

Price Earnings Ratio Formula

P/E = Stock Price Per Share / Earnings Per ShareorP/E = Market Capitalization / Total Net EarningsorJustified P/E = Dividend Payout Ratio / R – Gwh...

P/E Ratio Formula Explanation

The basic P/E formula takes current stock price and EPS to find the current P/E. EPS is found by taking earnings from the last twelve months divide...

Why Use The Price Earnings Ratio?

Investors want to buy financially sound companies that offer cheap shares. Among the many ratios, the P/E is part of the research process for selec...

Limitations of Price Earnings Ratio

Finding the true value of a stock cannot just be calculated using current year earnings. The value depends on all expected future cash flows and ea...

What is PE ratio?

The PE ratio is often referred to as the “earnings multiple” or simply “the multiple.”. You can write it as either PE or P/E. A simple way to think about the PE ratio is how much you are paying for one dollar of earnings per year. A ratio of 10 indicates that you are willing to pay $10 for $1 of earnings.

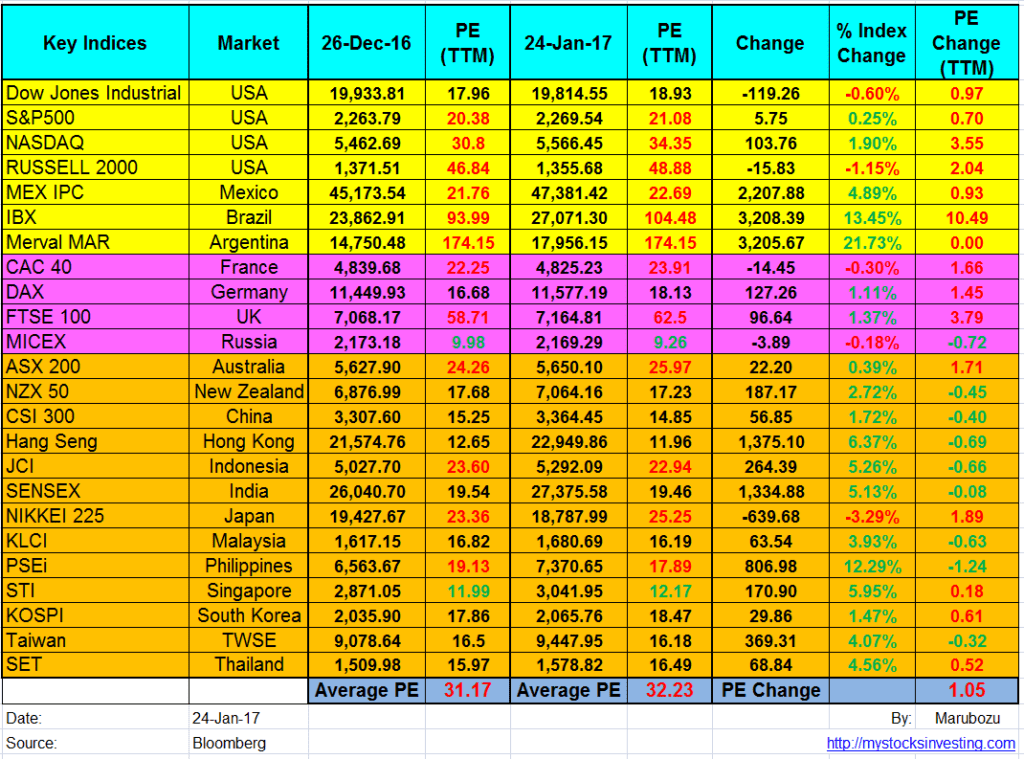

Why do investors compare the PE ratio of the US stock market to the European stock market?

Some investors might compare the PE ratio of the US stock market and the European stock market to find out which one might have better investments. Others may use the PE ratio to compare the valuation of different industries, such as comparing the technology industry to the financial industry.

What is a negative PE ratio?

Negative PE ratios. A stock with negative earnings per share also has a negative PE ratio. Many finance websites (including Stock Analysis) don’t show the PE ratio if EPS is negative because a negative PE ratio isn’t very informative. Instead, they show n/a, which stands for “not applicable.”.

Why is PE ratio important?

It is essential to consider other valuation metrics and evaluate the company’s future growth prospects.

What does a low PE ratio mean?

Generally speaking, a low PE ratio indicates that a stock is cheap, while a high ratio suggests that a stock is expensive. However, the PE ratio can also indicate how much investors expect earnings to grow in the future. The higher the ratio, the better the growth prospects.

How long does it take to get back a PE of 10?

If earnings remain constant, a PE ratio of 10 means it will take ten years to earn back your initial investment. The PE ratio is commonly used to value individual stocks, or even entire markets or industries. You can also use it to compare two or more stocks or markets against one another.

Is a high PE ratio good?

It is very hard to determine what is a “good” or “bad” PE ratio. That’s because price-to-earnings isn’ t a good way to value all the different types of stocks. For example, companies with a high growth potential tend to have a high PE ratio, while companies with slow or even negative growth tend to have a low PE ratio.

Why are stocks high in P/E?

Stocks typically have high P/Es when a company’s EPS growth rate is high and investors are willing to pay more (relative to earnings prospects) for its stock. Low P/E ratios are associated with companies that have lower--or slower--earnings growth rates and attract less interest from investors.

How to calculate P/E?

P/E is determined by dividing a stocks price by the EPS for the past 12-month period. If a stock has a share price of $95 and EPS of $10, its price-earnings ratio is 9.5, or 9.5 times earnings. P/E can also be calculated on estimated future earnings .

Why is P/E important?

It's important to evaluate it compared to other companies in that group as well as in relation to the EPS trends of the company and group in the future.

What is EPS in accounting?

Earnings per share (EPS) is the total net earnings of a company divided by the total number of shares outstanding. For example, a company has earned $1.7 billion dollars over the past year and has 170 million shares out. It has a trailing annual EPS of $10.

What does low P/E mean in stocks?

Companies with a low Price Earnings Ratio are often considered to be value stocks. It means they are undervalued because their stock price trade lower relative to its fundamentals. This mispricing will be a great bargain and will prompt investors to buy the stock before the market corrects it. And when it does, investors make a profit as a result of a higher stock price. Examples of low P/E stocks can be found in mature industries that pay a steady rate of dividends#N#Dividend A dividend is a share of profits and retained earnings that a company pays out to its shareholders. When a company generates a profit and accumulates retained earnings, those earnings can be either reinvested in the business or paid out to shareholders as a dividend.#N#.

How to find current P/E?

The basic P/E formula takes the current stock price and EPS to find the current P/E. EPS is found by taking earnings from the last twelve months divided by the weighted average shares outstanding#N#Weighted Average Shares Outstanding Weighted average shares outstanding refers to the number of shares of a company calculated after adjusting for changes in the share capital over a reporting period. The number of weighted average shares outstanding is used in calculating metrics such as Earnings per Share (EPS) on a company's financial statements#N#. Earnings can be normalized#N#Normalization Financial statements normalization involves adjusting non-recurring expenses or revenues in financial statements or metrics so that they only reflect the usual transactions of a company. Financial statements often contain expenses that do not constitute a company's normal business operations#N#for unusual or one-off items that can impact earnings#N#Net Income Net Income is a key line item, not only in the income statement, but in all three core financial statements. While it is arrived at through#N#abnormally. Learn more about normalized EPS#N#Normalized EPS Normalized EPS refers to adjustments made to the income statement to reflect the up and down cycles of the economy.#N#.

What is justified P/E ratio?

The justified P/E ratio#N#Justified Price to Earnings Ratio The justified price to earnings ratio is the price to earnings ratio that is "justified" by using the Gordon Growth Model. This version of the popular P/E ratio uses a variety of underlying fundamental factors such as cost of equity and growth rate.#N#above is calculated independently of the standard P/E. In other words, the two ratios should produce two different results. If the P/E is lower than the justified P/E ratio, the company is undervalued, and purchasing the stock will result in profits if the alpha#N#Alpha Alpha is a measure of the performance of an investment relative to a suitable benchmark index such as the S&P 500. An alpha of one (the baseline value is zero) shows that the return on the investment during a specified time frame outperformed the overall market average by 1%.#N#is closed.

What is a growth stock?

Companies with a high Price Earnings Ratio are often considered to be growth stocks. This indicates a positive future performance, and investors have higher expectations for future earnings growth and are willing to pay more for them. The downside to this is that growth stocks are often higher in volatility, and this puts a lot of pressure on companies to do more to justify their higher valuation. For this reason, investing in growth stocks will more likely be seen as a risky#N#Risk Aversion Risk aversion refers to the tendency of an economic agent to strictly prefer certainty to uncertainty. An economic agent exhibiting risk aversion is said to be risk averse. Formally, a risk averse agent strictly prefers the expected value of a gamble to the gamble itself.#N#investment. Stocks with high P/E ratios can also be considered overvalued.

What is the difference between EPS and fair value?

It is a popular ratio that gives investors a better sense of the value. Fair Value Fair value refers to the actual value of an asset - a product, stock, or security - that is agreed upon by both the seller and the buyer.

What is it called when you own stock?

An individual who owns stock in a company is called a shareholder and is eligible to claim part of the company’s residual assets and earnings (should the company ever be dissolved). The terms "stock", "shares", and "equity" are used interchangeably. of different prices and earnings levels.

What is equity research analyst?

Equity Research Analyst An equity research analyst provides research coverage of public companies and distributes that research to clients.

Why use P/E ratio?

The most common use of the P/E ratio is to gauge the valuation of a stock or index. The higher the ratio, the more expensive a stock is relative to its earnings. The lower the ratio, the less expensive the stock. In this way, stocks and equity mutual funds can be classified as “growth” or “value” investments.

What is the Shiller P/E ratio?

A third approach is to use average earnings over a period of time. The most well known example of this approach is the Shiller P/E ratio, also known as the CAP/E ratio (cyclically adjusted price earnings ratio).

Is Shiller PE a good predictor of future returns?

A recent study found that the Shiller PE was a reliable predictor of market returns between 1995 and 2020. In contrast, a recent Vanguard study found that the Shiller PE and other P/E ratio measures “had little or no correlation with future stock returns.”.

Something on option premiums and the strike price

Premium is the money required to be paid by the option buyer to the option seller/writer. Against the payment of premium, the option buyer buys the right to exercise his desire to buy (or sell in case of put options) the asset at the strike price upon expiry. Option premiums play an extremely crucial role when it comes to trading options.

What is CE in the stock market?

CE is the short form of the Call option. More precisely, it is known as Call European. These types of investment contracts provide the option investor the right, but not the obligation, to purchase a stock, bond, product, or any other asset at a pre-determined coast within a certain time period.

What is PE in the stock market?

PE is the short form of Put Option. It is specifically known as Put European. A put option is a contract that gives the holder of the option the privilege but not the commitment, to sell the security at a specific price (strike price) within a certain time period.

Some basic yet important pointers to consider while trading in options

Buy a call option or sell a put option only when you expect the market to go up.

Conclusion

Discussed above were some of the important terminologies that one needs to know before diving deep in the world of options. While loads of money can be made by trading in options, it is not as easy as it looks.

What is a PE ratio?

PE Ratios are best deployed to compare companies within the same industry. Some industries may have a very high average PE Ratio and some a very low PE Ratio, depending on where the industry is in its lifecycle. If an industry is new, fast-growing, and requires a lot of investment, the PE ratio may well be high on average, such as the Big Data Analytics industry. If an industry is stable and slow-growing, the average PE ratio may be lower, for example, in the Utilities Industry.

What is industry PE ratio?

Industry PE Ratio. PE Ratios are best deployed to compare companies within the same industry. Some industries may have a very high average PE Ratio and some a very low PE Ratio, depending on where the industry is in its lifecycle.

Why is a low PE ratio bad?

A low PE ratio can be bad when the company in question is in a declining market, and the prospects are bleak. As profits decrease, so does the stock price as the current investors are selling the stock, and the demand for the stock is decreasing also. This is why the earnings season is so important.

Is the average PE ratio lower?

If an industry is stable and slow-growing, the average PE ratio may be lower, for example, in the Utilities Industry. This makes comparing companies in different industries with the PE ratio not advisable.

Can a company have a negative PE ratio?

Yes. A company can have a negative PE Ratio if it has not made any profit in the previous year. But it is not possible to put a value or number on the ratio because the PE ratio consists of Price divided by Earnings, and if there are no earnings, the formula does not work.

Does negative earnings affect PE ratio?

However, negative earnings would adversely impact the PE Ratio, meaning if the profits were reduced, the PE ratio would increase, which means the stock price would need to fall to compensate for it. The PE Ratio needs to be combined with other fundamental measures to get a much better picture of the stock.

Understanding The P/E Ratio

- The price-to-earnings ratio (P/E) is one of the most widely used tools by which investors and analysts determine a stock's relative valuation. The P/E ratio helps one determine whether a stock is overvalued or undervalued. A company's P/E can also be benchmarked against other stocks i…

Forward Price-To-Earnings

- These two types of EPS metrics factor into the most common types of P/E ratios: the forward P/E and the trailing P/E. A third and less common variation uses the sum of the last two actual quarters and the estimates of the next two quarters. The forward (or leading) P/E uses future earnings guidancerather than trailing figures. Sometimes called "estimated price to earnings," thi…

Trailing Price-To-Earnings

- The trailing P/E relies on past performance by dividing the current share price by the total EPS earnings over the past 12 months. It's the most popular P/E metric because it's the most objective—assuming the company reported earnings accurately. Some investors prefer to look at the trailing P/E because they don't trust another individual’s earnings estimates. But the trailing …

valuation from P/E

- The price-to-earnings ratio or P/E is one of the most widely used stock analysis tools by which investors and analysts determine stock valuation. In addition to showing whether a company's stock price is overvalued or undervalued, the P/E can reveal how a stock's valuation compares to its industry group or a benchmark like the S&P 500 Index. In essence, the price-to-earnings ratio i…

Example of The P/E Ratio

- As a historical example, let's calculate the P/E ratio for Walmart Inc. (WMT) as of Feb. 3, 2021, when the company's stock price closed at $139.55.2 The company's earnings per share for the fiscal year ending Jan. 31, 2021, was $4.75, according to The Wall Street Journal.3 Therefore, Walmart's P/E ratio is $139.55 / $4.75 = 29.38.

Investor Expectations

- In general, a high P/E suggests that investors are expecting higher earnings growth in the future compared to companies with a lower P/E. A low P/E can indicate either that a company may currently be undervalued or that the company is doing exceptionally well relative to its past trends. When a company has no earnings or is posting losses, in both cases, the P/E will be expressed a…

P/E vs. Earnings Yield

- The inverse of the P/E ratio is the earnings yield(which can be thought of as the E/P ratio). The earnings yield is thus defined as EPS divided by the stock price, expressed as a percentage. If Stock A is trading at $10, and its EPS for the past year was 50 cents (TTM), it has a P/E of 20 (i.e., $10 / 50 cents) and an earnings yield of 5% (50 cents / $10). If Stock B is trading at $20 and its E…

P/E vs. Peg Ratio

- A P/E ratio, even one calculated using a forward earnings estimate, doesn't always tell you whether the P/E is appropriate for the company's forecasted growth rate. So, to address this limitation, investors turn to another ratio called the PEG ratio. A variation on the forward P/E ratio is the price/earnings-to-growth ratio, or PEG. The PEG ratio measures the relationship between t…

Limitations of Using The P/E Ratio

- Like any other fundamental designed to inform investors as to whether or not a stock is worth buying, the price-to-earnings ratio comes with a few important limitationsthat are important to take into account because investors may often be led to believe that there is one single metric that will provide complete insight into an investment decision, which is virtually never the case. …