A spike in the stock market can refer to a sharp rise in the price of an individual stock, commodity, precious metal or other asset, or a significant increase in a market index, such as the NASDAQ

NASDAQ

The Nasdaq Stock Market is an American stock exchange. It is the second-largest stock exchange in the world by market capitalization, behind only the New York Stock Exchange located in the same city. The exchange platform is owned by Nasdaq, Inc., which also owns the Nasdaq Nordic and Na…

Dow Jones Industrial Average

The Dow Jones Industrial Average, or simply the Dow, is a stock market index that indicates the value of 30 large, publicly owned companies based in the United States, and how they have traded in the stock market during various periods of time. These 30 companies are also included in the S&…

How can stocks change price overnight?

- Impact on Property Prices. Research suggests that Airbnb overall is increasing property prices. …

- The Impact of Increased Rental Yields. …

- Minimizing Your Risk When Selling Airbnb Properties. …

- Insurance Protection for Real Estate Professionals. …

How to trade stocks after hours?

Here’s how traders got alerted to some of the biggest rallies of this week’s resurging market

- Bullish confidence. The basic principle behind the VORTECS™ Score is a comparison between the asset’s trading conditions right now and those in the past.

- KEEP: A weekly return of +58.64% after a VORTECS™ Score of 92. ...

- MNW: A weekly return of +54.63% after a VORTECS™ Score of 90. ...

- LEO: A weekly return of +52.56% after a VORTECS™ Score of 91. ...

How to prepare for a market correction?

Here's How to Prepare

- Load up on emergency savings You never know when life might throw you a curveball, whether it's a lost job or a roof that decides to cave in and ...

- Diversify your holdings A diverse portfolio could be your ticket to riding out a stock market crash. ...

- Have the right attitude

What did the market close at Yesterday?

“I really didn’t like yesterday’s action. That wasn’t cool,” said ... “If we’re honest with ourselves, this market really, really did unbelievable things in the last year and a half,” Acampora said. Check out: The Nasdaq Composite just ...

What causes spikes in stock?

The Effect of Supply and Demand The reason for the higher share price is an increase in the number of people looking to buy this stock. This difference between the supply and demand of a stock causes the share price to rise until an equilibrium is reached.

Why do stocks spike up and down?

Stock prices are driven up and down in the short term by supply and demand, and the supply demand balance is driven by market sentiment.

Does Spike mean increase or decrease?

: to increase sharply battery sales spiked after the storm.

Why do stocks sometimes have spikes after hours?

How do stock prices move after hours? Stocks move after hours because many brokerages allow traders to place trades outside of normal market hours. Every trade has the potential to move the price, regardless of when the trade takes place.

What happens if no one sells a stock?

When there are no buyers, you can't sell your shares—you'll be stuck with them until there is some buying interest from other investors. A buyer could pop in a few seconds, or it could take minutes, days, or even weeks in the case of very thinly traded stocks.

Why do stocks drop on Monday?

The Monday effect has been attributed to the impact of short selling, the tendency of companies to release more negative news on a Friday night, and the decline in market optimism a number of traders experience over the weekend.

What is an example of a spike?

A spike is a raceme except that the flowers are attached directly to the axis at the axil of each leaf rather than to a pedicel. An example of a spike is the cattail (Typha; Typhaceae).

What does spike up mean?

to increase sharply(intransitive) to increase sharply. Prices are bound to spike up during high season.

What is the opposite of a spike?

Antonyms. undress effector inattention starve bore defeat unpin.

Is it good if a stock goes up after hours?

After-hours trading is more volatile and riskier than trading during the exchange's regular hours because of fewer participants; as a result, trading volumes and liquidity may be lower than during regular hours.

Can a stock skyrocket overnight?

Because relatively few people actually trade after the market closes, orders tend to build up overnight, and in a rising market, that will produce an upward price surge when the market opens. But during extended declines, overnight sell orders may cause prices to plummet when the market opens.

What is the best time of day to sell a stock?

Regular trading begins at 9:30 a.m. EST, so the hour ending at 10:30 a.m. EST is often the best trading time of the day. It offers the biggest moves in the shortest amount of time. Many professional day traders stop trading around 11:30 a.m., because that's when volatility and volume tend to taper off.

What is a spike in the stock market?

Every now and then, a spike occurs. A spike is a significant change in the market that can occur within a brief period.

What Is a Market Spike?

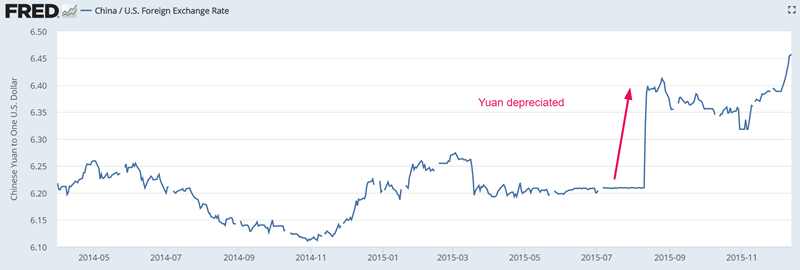

A spike in a stock market index occurs when the value of all of the stocks in an index (which creates the index’s average) dramatically rises or falls. If the U.S. Federal Reserve Bank raises or lowers interest rates and/or gives a warning or positive projection for the near-term performance of the economy, stock prices might quickly rise or fall.

What affects stock price?

High demand for a stock drives the stock price higher, but what causes that high demand in the first place? It's all about how investors feel:

Why is demand for a stock so high?

Ultimately, demand for a stock is driven by how confident investors are about that stock's prospects. In the short term, things like quarterly earnings reports that beat expectations, analyst upgrades, and other positive business developments can lead investors to be willing to pay a higher price to acquire shares. On the flip side, disappointing earnings reports, analyst downgrades, and negative business developments can cause investors to lose interest, thus reducing demand and forcing sellers to accept lower prices.

What is demand increase in stocks?

Sometimes demand for stocks in general increases, or demand for stocks in a particular stock market sector increases. A broad-based demand increase can drive individual stocks higher without any company-specific news. One example: The COVID-19 pandemic led to consumers increasing spending online at the expense of brick-and-mortar stores. Some investors believe this change is here to stay, which led to an increase in demand and higher prices for e-commerce stocks across the board.

Why is the value of a stock important?

In the long term, the value of a stock is ultimately tied to the profits generated by the underlying company. Investors who believe a company will be able to grow its earnings in the long run, or who believe a stock is undervalued, may be willing to pay a higher price for the stock today regardless of short-term developments. This creates a pool of demand undeterred by day-to-day news, which can push the stock price higher or prevent big declines.

What does a huge volume spike mean?

Often those huge volume spikes actually represent an off market transaction that is being reported over the market feed.

What time does the stock market close?

These transactions are often reported at, or just after the official market close at 4:00 pm. You should be able to see many examples of this.

What is short squeeze?

A short squeeze; this is when a large percentage of people have short positions on the stock and it moves up un-expectantly. This causes a situation where the short positions have to cover their shorts and need to buy stock immediately.

Do people understand what drives markets?

The truth is, very few, if any, people understand what drives markets in the short term well enough to “make a quick buck”. Those who do are very careful to protect this information, for if other market participants found out, it would no longer be of value. That is not to say markets are necessarily efficient, but just that they are highly complex and dynamic systems, and understanding what drives them is hard.

Is anyone paying attention to make a quick buck?

From the phrasing of your question, I think you are suffering from a bit of hindsight bias. “ Anyone paying attention stands to make a quick buck”. This isn’t the case. Seemingly obvious patterns are only “obvious” after the fact. Be weary of human inclination to explain an event only after it has occurred. For example, after Trump won the presidency, it seemed like every pundit had an expla

Do people make mistakes when investing in the stock market?

Regardless of how accurate that is or not, many people do make costly mistakes when it comes to investing in the stock market.

Why do stocks spike?

The reason for such a spike in trading is that buyers and sellers of a stock tend to switch their positions at the same time, Buyers start selling a stock that has been trending upward or sellers ...

What does it mean when a stock has a volume spike?

Conversely, declining volume indicates weak support for an existing price trend, indicating it may change soon. A volume spike is a sudden large increase in volume. Spikes show that a lot of traders are shifting their money into or out of a stock, making it likely that the existing trend is about to reverse direction.

What does spike mean in the market?

IF during market hours a spike happen means —its a short covering rally of that time frame.if during the grind phase ,more shorts are added,they will be nullified by a single spike that typically hits most stops ,as these stops are visible to programmes. and vice versa .its more likely the rush of trapped tarders than any fresh buys/sells.markets typically create short swings to make money as programmes scale in and out of positions where as traders cant do that .this is the idea of moves n counter moves even in trend.these moves vary in intensity n duration depending on overall longs n shorts

Why do stocks spike in the pre market?

Stock spike in pre-market and after-hours because of a lack of liquidity in the market. During normal trading hours there are much more participants in the market. This means that matching buyers of stock with sellers of the same stock is very easy.

What happens after hours trading?

After-hours trading volume in specific stocks often surges upon the occurrence of market-moving events, such as earnings reports, pre-earnings announcements or M&A activity. Lower liquidity and wider bid-ask spreads are a common feature of after-hours trading. However, investors may consider this a small price to pay for the privilege of exiting a losing position before regular trading commences, or initiating a new position ahead of the crowd. After-hours trading is heaviest in the first hour or two after markets close, before tapering off sharply. As financial markets become increasingly integrated with the advent of globalization, after-hours trading is likely to expand going forward.

What happens if you add more shorts during the ground phase?

if during the ground phase, more shorts are added, they will be nullified by a single spike that typically hits most stops, as these stops are visible to programs. and vice versa .its more likely the rush of trapped traders than any fresh buys/sells. markets typically create short swings to make money as programs scale in and out of positions whereas traders cant do that .this is the idea of moves n counter moves even in trend.these moves to vary in intensity n duration depending on overall longs n shorts in different time frames. each time frame has punters n programs of its own.big instituti

What is a stock exchange?

Continue Reading. A stock exchange is a place where markets for shares of ownership in companies are made. To “make a market” means to offer for sale (and offer to purchase) shares of that company.

Do you have to report a trade on the stock exchange?

Now, we are still required (by the company’s listing on the exchange) to report the trade and the price. A deal like this, though, will be negotiated for weeks (instead of in seconds or milliseconds, like a through-the-exchange trade) and might include special terms (a pre-set price, regardless of what the market price is).

Why is the price spike called the spike?

Indeed, the name “spike” is because of the shadow of the candlestick that forms the price spike trade setup.

Why do forex prices spike?

This phenomenon can 99% be seen on the Forex market because it is a too volatile market, and the price starts moving strongly very fast and then it changes it direction. These strong movements form because of the sudden huge transactions that are triggered at the same time based on an economic event like an important news. For example, a sudden and unexpected change in the interest rate of a currency. Such movements and spikes and can be the subject of a kind of trading style which is called Forex Spike Trading.

Why do traders wait for the price spikes to form on the charts?

Forex spike traders wait for the price spikes to form on the charts to enter the market, because they believe (1) spike trading is more profitable, and (2) there is a stronger guarantee of making profit.

How to have a better exit on the market?

To have a better exit, you can use the tools like Fibonacci extensions. The below chart is the exactly the above one, but I have applied the Fibonacci levels on it. It shows the importance of the 161.80% and 261.80% levels in collecting the profit and exiting the market on time, specially with the left spike:

Is it hard to see price spikes?

As you can see with both of the price spikes, they are completely VISIBLE, OUTSTANDING and STRONG compared to the other parts of the chart and the other candlesticks. So, it is not that hard to find the spikes on the chart. You have to wait for these kinds of visible, outstanding and strong spikes to form on the longer time frames to enter ...

How to manipulate a stock?

It is easier to manipulate a stock when its volume is low. All a manipulator needs to do is execute a few carefully timed trades to create the illusion that a stock is moving so he can get others to buy or sell. The goal is to raise the price if he wants to sell and to lower the price if he wants to buy. If you are suckered in by such a move, your position can quickly turn into a loss as the stock you just bought suddenly reverses course on increased volume.

What does it mean when a stock starts trading at low volumes?

When a stock begins irregularly trading at low volumes, it's usually a warning sign: proceed with caution. Low-volume stocks may express trading volatility, market uncertainty or a liquidity risk.

What does volume mean in stock trading?

What Does Volume Mean When Trading Stocks? A stock's trade volume represents the total number of shares or contracts that are traded for a specific security during a specific time period. A stock's volume is high when its securities are more actively trading and, conversely, a stock's volume is low when its securities are less actively trading.

Why is the price of a stock lower during after hours?

I don't think there is a pattern. Because volatility volume is lower during after-hours, the price of the stock is determined by only a fraction of traders. When the market opens the next day, the price could be lower or higher than in after-hours, depending on how well the after-hours traders represented the entire trading population.

Can you post stock on /r/stocks?

Almost any post related to stocks is welcome on /r/stocks. Don't hesitate to tell us about a ticker we should know about, but read the sidebar rules before you post. Check out our wiki and Discord!