What is a sideways market in stocks?

Answer (1 of 10): Recently, that has not been very common. But back a few days ago, that meant the stock was trading within a defined range for a few days or more.. Generally, this is a consolidation period before a new price move begins. Even now, markets look like they may be beginning a consol...

What is sideways market/sideways drift?

Answer: If there is accumulation, it shows up in a chart as a generally rising price over time. While yes, every buy implies a sell, if buying dominates, the price will rise over time. Other evidence would include relatively shallow drops on market down …

What does go sideways mean?

Sep 10, 2015 · NEW YORK ( TheStreet) -- The Bollinger "squeeze" is a useful addition to your trading toolbox, particularly if you're looking for a signal that will tell you a …

What are the benefits of trading sideways?

How we identify the trade of the week; Why we believe it will perform ; The technical conditions of the stock; How you can use find your own trades of the week

What is sideways market?

A sideways market is when prices of investments remain within a tight range for any period. They don't make higher highs or a breakout above the previous highest price. If they did, that would indicate a bull market. They don't make lower lows or drop below the previous level of support.

How to identify a sideways market?

To identify a sideways market, you must first find out the levels of support and resistance. Support is the price where buyers come back in. They don't let the price fall below that level. Resistance is where buyers sell the investment. They don't believe it will go much higher.

What would happen if the stock market fell 20%?

If they fell 20%, that would be a bear market . A sideways trend often refers to the stock market. That includes the Dow Jones Industrial Average, the S&P 500, or the NASDAQ. But it can occur in any investment, including bonds, commodities, or foreign exchange.

When did the Dow go sideways?

A sideways trading pattern began in January 2018. The Dow hit a record closing high of 26,616.71 on January 26, 2018. 1 It then plummeted into correction territory. Since then, it's traded in a sideways range of 23,000 to 25,700. 2

When does consolidation occur?

There is a critical exception. That's if it occurs during a transition of the business cycle. A sideways market then signals the next phase of the business cycle.

What is sideways market?

A sideways market consists of relatively horizontal price movements that occur when the forces of supply and demand are nearly equal for some period of time. This typically occurs during a period of consolidation before the price continues a prior trend or reverses into a new trend.

What is frequent trading?

Frequent trading generates commissions that eat into a trader’s profits. Traders who employ range-bound strategies do not have the advantage of letting their profits run to offset commission charges. Time Consuming: Frequently buying and selling a security to seek out a profit in a sideways market is time-consuming.

What is stop loss order?

A stop-loss order placed slightly below the sideways market’s support level minimizes the trade's downside. Risk and Control: Traders chase smaller profits when trading a sideways market; therefore, each trade is typically not open for more than a few days or weeks.

What is a straddle and strangle?

For example, straddles and strangles can be used by options traders that predict that the price will remain within a certain range. For instance, you could sell a straddle—both an at-the-money call and a put option for the same underlying asset in the same strike and same expiration month.

Who is Adam Hayes?

Adam Hayes is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7 & 63 licenses. He currently researches and teaches at the Hebrew University in Jerusalem.

The signs they send each other to move stock prices

Many traders believe that market makers will "signal" moves in advance by using small amounts of buys or sells as "signals". The "signals" are from one market maker to another.

Why signals? Why not just message or email?

One simple reason... calling/emailing one or more of the other market makers and telling them to "take the price down" or "I am going to gap the stock" would be 100% ILLEGAL. Collusion at it's finest. If caught, handcuffs could replace their Rolex for a trip downtown.

When 100 Actually Means 25,000

When watching larger stocks, market makers from large firms will often bid for 100 shares when they actually want several thousand shares.

Take a look at what volume tells you

First, before I share with you some examples on the charts, let’s take a look at what volume tells you? Well, it shows you the energy of a stock move, and if a move is real. The more volume a stock has on a break, the more likely it is to stay above that break.

What happens next when the A, B, C, D pattern is complete?

Once an A, B, C, D pattern is complete, something new happens. And in this case you can see – okay, let’s take a look, zoom back out. You see we have that A, B, C, D pattern all the way to the left and now we get sideways action and then what happens next?

The Rubber Band Effect

You can see the difference here as we look at the volume overall we have a lot of buying volume that makes it a little bit thicker — a lot of buying volume coming in right there, drying up area or some selling pressure coming up here.

Nature of Price Movements

If you start seeing more volume coming this way, especially on the cell side if you see that stock had a little bit lower to find an excellent level where it becomes a value buy and you can it bounce and hit higher again.

Final Thoughts

Some final thoughts, much of spotting price action takes time and practice. And it takes the time to look at more charts, find trends, and see if you can predict stock movements based on volume.

245 Money making stock chart set up books

What I’ve done to help people practice this thing is that created my 245 money making stock chart set up books which focus a lot on looking at charts specifically. And it’s all books just 95% of them charts. It’s not about reading, and it’s about reading the charts and looking and practicing the charts.

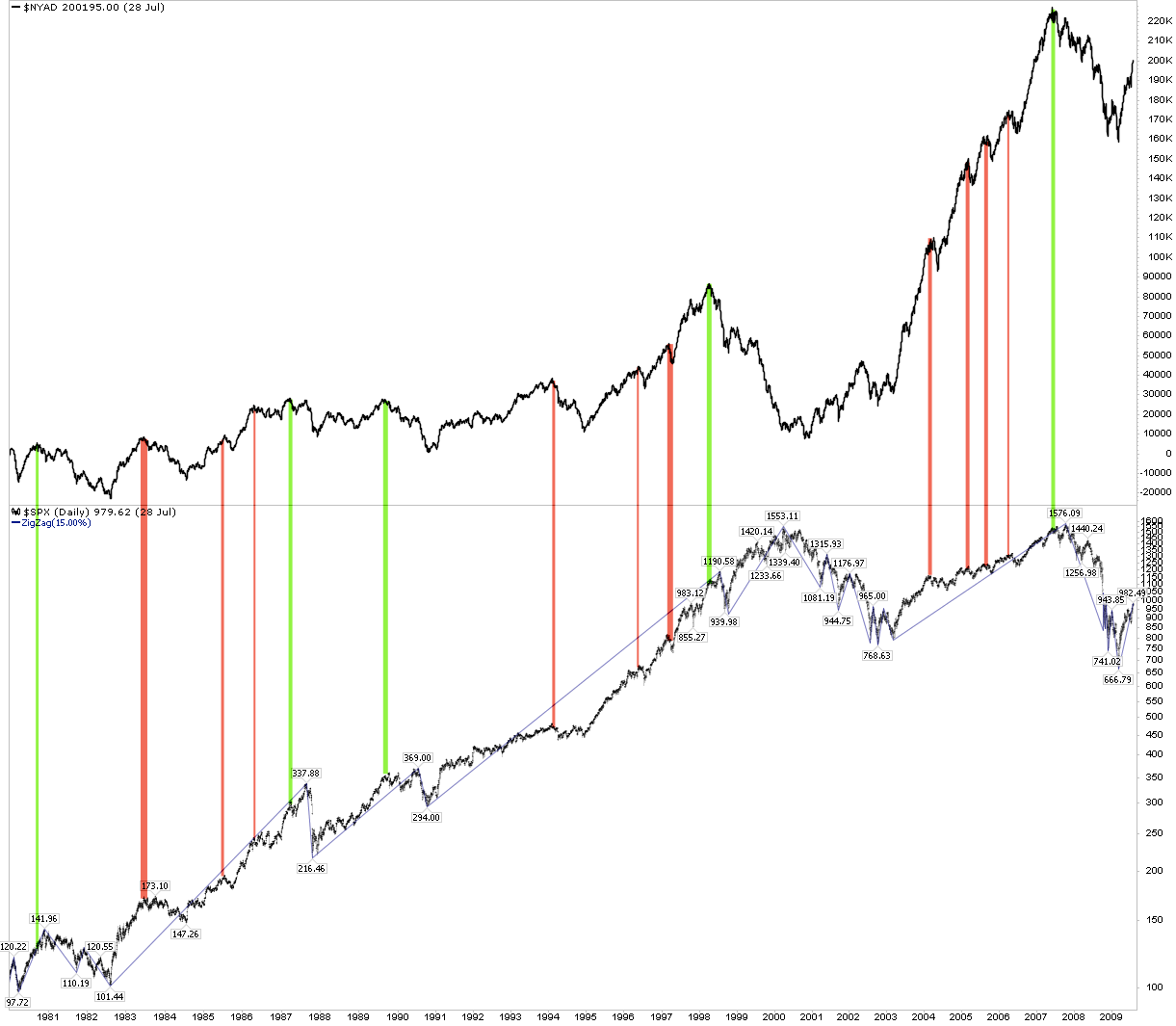

What A Sideways Market Tells You

How to Identify A Sideways Market

- To identify a sideways market, you must first find out the levels of support and resistance. Support is the price where buyers come back in. They don't let the price fall below that level. Resistance is where buyers sell the investment. They don't believe it will go much higher. A sideways market will trade within those two levels of resistance and support. That's also called …

Strategies

- A sideways market is a difficult environment to make money for day traders. It is a welcome sign for those who are more likely to buy and hold. With patience, the market will reveal which direction it will head into next. It's especially important to watch when the economy has been at any business cycle phase for an extended period. The best way to make money in a sideways m…

Examples

- A sideways trading pattern began in January 2018. The Dow hit a record closing high of 26,616.71 on January 26, 2018.1 It then plummeted into correction territory. Since then, it's traded in a sideways range of 23,000 to 25,700.2 A sideways market also occurred at the end of the contraction phase of the cycle in 2011 when gold prices hit $2,000 an ounce. Investors boos…