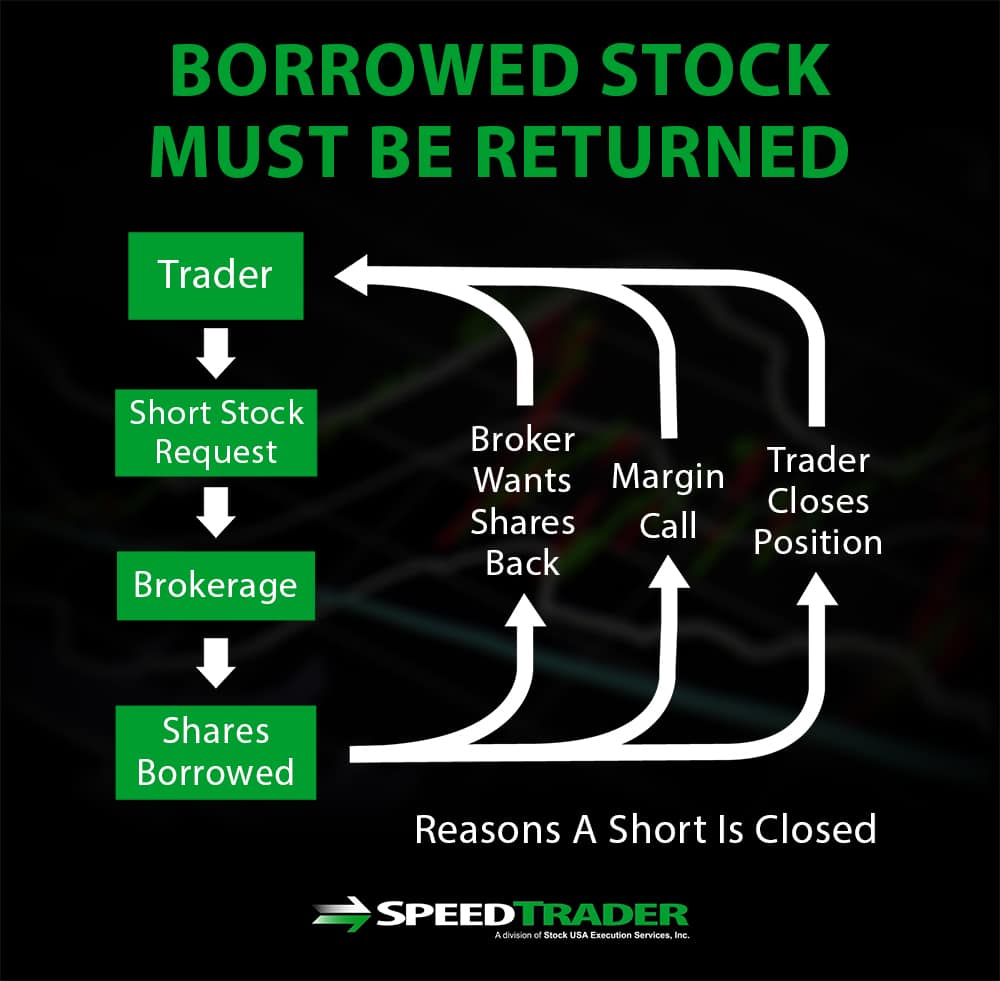

A stock borrow is the traditional mechanism used for short selling. A trader who wants to short a stock requests from their brokerage to borrow shares of the stock from another trader within the brokerage, which the brokerage will facilitate while charging interest.

What is stock lending and borrowing?

Oct 25, 2012 · Stock lending and borrowing (SLB)is a system in which traders borrow shares that they do not already own, or lend the stocks that they own but do not intend to sell immediately. Just like in a loan, SLB transaction happens at a rate of interest and tenure that is fixed by the two parties entering the transaction.

How do stock borrows work?

Feb 24, 2022 · Stock loan fees are charged to clients of brokerages for borrowing stock. This is typically done for the purposes of short selling. The more …

What is a hard to borrow stock?

What is a “Borrow”? When you short sell a stock, you are selling something you don’t own and taking a negative position. This begs an answer to the question, “How can you sell something you don’t actually own?” The short answer is that you are borrowing shares that you will return at a later point. Compare this to a real-world situation.

What is a borrow fee for stocks?

Oct 26, 2021 · If you have just $25,000 in assets (vs. Schwab’s higher $100,000 requirement), you can access this product and borrow against up to 30% of your portfolio. The Wealthfront Portfolio Line of Credit is a margin lending product so you can take the …

How does borrowing a stock work?

The trader borrows the asset, then—by a specified later date—buys it back and returns it to the asset's owner. The investment philosophy is that the borrowed asset will decline in price and the investor will earn a profit by selling at a higher price and buying back at the lower price.

Why would you borrow a stock?

Why do traders borrow stocks? The main function of borrowed stocks is to short-sell them in the market. When a trader has a negative view on a stock price, then s/he can borrow shares from SLB, sell them, and buy them back when the price falls.Oct 25, 2012

What is the difference between borrowing and buying a stock?

Money can be made in the equities markets without actually owning any shares of stock. Short selling involves borrowing stock you do not own, selling the borrowed stock, and then buying and returning the stock only if and when the price drops.

Does Robinhood lend your stocks?

Robinhood Markets Inc.'s plan to let users loan out their stocks to other financial institutions -- a program known as fully paid securities lending -- is taking shape within its app, part of a push to compete with more conventional brokerages.Mar 16, 2022

Can I short on Robinhood?

Shorting stocks on Robinhood is not possible at present, even with a Robinhood Gold membership, the premium subscriptions which allows Robinhood investors to use margin for leveraging returns. Instead, you must either use inverse ETFs or put options.

How do brokers borrow stocks?

It's called securities lending. In this program, your broker pays you a fee to borrow your stocks to lend them to someone else. Typically, that person is a short seller who wants to borrow your stock and sell it ahead of an expected decline. The borrower hopes to buy it back at cheaper price to return it to you.Apr 19, 2017

How do investors borrow a stock?

Borrow the stock you want to bet against. Contact your broker to find shares of the stock you think will go down and request to borrow the shares. The broker then locates another investor who owns the shares and borrows them with a promise to return the shares at a prearranged later date. You get the shares.Nov 8, 2021

Can a broker lend my shares?

To be clear, your brokerage firm cannot lend out your stocks without your permission. However, you may have signed a customer agreement that explicitly allows your broker to lend out your securities. This clause is often tucked deep within the customer agreement, and few investors pay much attention to it.Mar 31, 2021

How to borrow stock?

How to Borrow a Stock With 4 Steps to Short Sell 1 Contact your broker. You need to see if they have shares of the stock you want to bet against. Your broker will then find an investor who owns the shares and is willing to loan them to the brokerage firm. With, of course, a fee for the so-called “renting” of their shares. Unfortunately for you, you’ll have to foot this bill. 2 Immediately sell the shares you borrow on the market. At this point, you will have cash in your pocket due to the sale. 3 Wait. Wait for the stock price to plummet and then repurchase the shares at the new, cheaper price. 4 You return what you borrowed. The shares to back to the brokerage you borrowed them from, and you pocket the difference.

Why do people invest in stocks?

People invest in stocks with the hope of making money. Their goal is to ride the profit train on the ta ils of a company’s positive news and soaring profits. But, did you know there’s a whole other class of traders out there, called short sellers, who do just the opposite. The complete opposite.

What is short selling?

Short selling is a matter of timing, and you must, therefore, make a substantial amount that gives you returns and helps you pay the broker. You might also want to consider a dealer who allows you to pay once you have made a profitable sale. Such a broker or dealer is confident that his insight was helpful.

What does research tell you about a company?

Research also points at the number of stocks you can take to reap the rewards you are anticipating. The performance of the company in the stock market will give you the green light to deal or to avoid it. This information tells you what other investors think about a particular company.

What is stock lending & borrowing?

Text: Nihar Gokhale, ET Bureau#N#Stock lending and borrowing (SLB)is a system in which traders borrow shares that they do not already own, or lend the stocks that they own but do not intend to sell immediately.#N#Just like in a loan, SLB transaction happens at a rate of interest and tenure that is fixed by the two parties entering the transaction.

What is the rate of interest in SLB?

The interest rate in a stock lending and borrowing transaction is dependent on the stock’s value on that day. Most commonly, rates are calculated on a per-month basis.

What's the tenure of a borrowed stock?

Stocks borrowed can be of any tenure up to 12 months. Each SLB transaction is marked with the month in which is due to be settled.

Why do traders borrow stocks?

The main function of borrowed stocks is to short-sell them in the market. When a trader has a negative view on a stock price, then s/he can borrow shares from SLB, sell them, and buy them back when the price falls.#N#The difference between the selling and buying price, minus the interest rate (and other costs) is the trader’s profit.

Who lends these shares?

Stocks are lent by long-term investors like HNIs who own large number of shares that they do not intend to sell in the near future.

What is a stock loan fee?

A stock loan fee, or borrow fee, is a fee charged by a brokerage firm to a client for borrowing shares. A stock loan fee is charged pursuant to a Securities Lending Agreement (SLA) that must be completed before the stock is borrowed by a client (whether a hedge fund or retail investor ). A stock loan fee can be contrasted with a stock loan rebate, ...

What is a street name stock?

Most shares held by brokerage firms on behalf of their clients are in “street name,” which means that they are held in the name of the brokerage firm or other nominee rather than in the name of the client . This way the brokerage can loan the stock out to other investors. Stock is generally borrowed for the purpose of making a short sale.

What is short sale?

A short sale involves the sale of borrowed securities. These securities must be first located and loaned to the short seller in a margin account. While the shares are being borrowed, the short seller must pay interest and other charges on the loaned shares.

What happens when a security is transferred?

When a security is transferred as part of the lending agreement, all rights are transferred to the borrower. This includes voting rights, the right to dividends, and the rights to any other distributions. Often, the borrower sends payments equal to the dividends and other returns back to the lender .

Who is Adam Hayes?

Adam Hayes is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance.

What is short selling?

This activity is called short selling, which is performed by selling a stock with the intent to buy back lower so you can keep the difference as profit. In order to sell shares of a stock you don’t own, the shares must first be “borrowed” from someone willing to lend them.

What is the adage "buy low and sell higher"?

The adage, “buy low and sell higher” underscores the strategy for taking a long position – a strategy that largely dominates the market. Whether you’re a trader or an investor, the goal is to capture a profit from rising shares prices.

Is day trading risky?

Every trader has a different risk tolerance and you should consider your own tolerance and financial situation before engaging in day trading. Day trading can result in a total loss of capital. Short selling and margin trading can significantly increase your risk and even result in debt owed to your broker.

What happens if you fall under maintenance margin?

If you fall under the maintenance margin, it can trigger an intraday margin call. Your broker may initiate forced liquidation to bring the account back under the maintenance margin levels .

What is DMA broker?

Direct market access (DMA) brokers may use independent clearing firms that accommodate more sophisticated, experienced and risk tolerant customers like active traders. These firms may have better access to short locates or relationships with other clearing firms with extensive short inventory.

Can a stock go below zero?

On the long side, the stock’s price cannot go below zero. On the short side, there is no limit on how high the price can go. There are also fees that can be much higher on the short side than the long, such as short interest charges and locate fees.

What is short selling?

Short selling of stocks is built on the notion that an individual trader or investor, wanting to profit from a decrease in a stock's price, is able to borrow shares of that stock from the broker. Brokerages have a variety of ways to provide access to shares that can be sold short.

How to enter a short sale?

To enter a short sale, a brokerage client must first borrow the shares from their broker. To provide the shares, the broker can use its own inventory or borrow from the margin account of another client or another brokerage firm. The borrower (i.e., the short seller) must pay interest and fees on the borrowed shares.

Who is Gordon Scott?

Gordon Scott has been an active investor and technical analyst of securities, futures, forex, and penny stocks for 20+ years. He is a member of the Investopedia Financial Review Board and the co-author of Investing to Win. Gordon is a Chartered Market Technician (CMT). He is also a member of ASTD, ISPI, STC, and MTA.

Do brokers update their hard to borrow lists?

Brokerage firms update their hard-to-borrow lists daily. A broker must be able to provide or locate the shares to loan to their client before executing the client's short sale transaction.

Why do brokers use hard to borrow?

Brokers use a “hard-to-borrow” list to keep track of which shares are difficult to find. The hard-to-borrow list is typically internal, but many firms make a related easy-to-borrow list available to their clients on a daily basis.

What are the disadvantages of shorting stocks?

One of the major disadvantages of shorting stocks that appear on a hard-to-borrow list is the extremely high fees associated with the trade. In extreme cases, hard-to-borrow fees can approach 100 percent on an annualized basis. In addition to the fees, there are other concerns when it comes to shorting hard-to-borrow stocks.

What does it mean when the borrow rate is increased?

An increase in the borrow rate would mean that more people than average are borrowing it, or a few people are borrowing large amounts; either way, it reflects a changed expectation in what that stock will do.

What is an IPO?

When stock is initially issued, it is done so by the corporation. This is called an “Initial Public Offering” (IPO). This activity is done so that the corporation can raise capital for its operations. Once stock is initially purchased in an IPO, it is sold back and forth between owners.

What is secondary market?

The secondary market is just people (or businesses), trading between each other - the company is not receiving any of the money from shares traded in the secondary market. When the stock market fluctuates the way that it has recently, that fluctuation actually has nothing to do directly with the company.

What happens when interest rates are high?

If rates are high, the lender may rebate part of the interest earned.