Stagflation

In economics, stagflation, a portmanteau of stagnation and inflation, is a situation in which the inflation rate is high, the economic growth rate slows, and unemployment remains steadily high. It raises a dilemma for economic policy, since actions designed to lower inflation may exacerbate unemployment, and vice versa.

How does inflation affect your stock portfolio?

May 15, 2021 · Inflation is supposed to be largely positive for the stock market, but signs of growing price pressures are rattling equities across the …

What is inflation, and is it good or bad?

Feb 18, 2022 · What Does Inflation Mean For Stock Prices? Using the Consumer Price Index, it provides data about price changes in certain categories. Price increases for goods and services result in shrinkage in the purchasing power of the dollar as …

What causes inflation and who profits from it?

Feb 14, 2022 · Is Inflation Good For The Stock Market? Consumer goods, stocks and the economy may be hit hardest by rising inflation. When inflation is high, value stocks outperform growth stocks, whereas a low inflation environment leads to growth stocks doing better as well. A rising inflation rate can lead to increased volatility in stocks.

What does increased inflation mean?

See the full conversation with Joshua in episode 15 of the Financial Shepherd Podcast. Available on YouTube and Spotify.

How will inflation affect the stock market?

Summary – Periods of high inflation usually lead to lower returns on the stock market because higher inflation is likely to lead to higher interest rates, lower economic growth and lower dividends.Mar 10, 2022

Do stocks do well in inflation?

That's because over time, investing in equities is generally a good way to outrun inflation. For example, the average annual return of the S&P 500 Index is about 10%, higher than the 7.9% annual inflation seen in February.Mar 22, 2022

How do you profit from inflation?

Here's where experts recommend you should put your money during an inflation surgeTIPS. TIPS stands for Treasury Inflation-Protected Securities. ... Cash. Cash is often overlooked as an inflation hedge, says Arnott. ... Short-term bonds. ... Stocks. ... Real estate. ... Gold. ... Commodities. ... Cryptocurrency.

Where should I invest in inflation?

Here are some of the top ways to hedge against inflation:Gold. Gold has often been considered a hedge against inflation. ... Commodities. ... A 60/40 Stock/Bond Portfolio. ... Real Estate Investment Trusts (REITs) ... The S&P 500. ... Real Estate Income. ... The Bloomberg Aggregate Bond Index. ... Leveraged Loans.More items...

What happens when inflation declines?

When inflation declines, so do the inflated earnings and revenues. It is a tide that raises and lowers all the boats, but it still makes getting a clear picture of the true value difficult.

How does inflation affect the economy?

As a result, the economy slows down until stability returns.

Is it good to hedge against inflation?

High-interest rates and companies raising prices don't add up to an investment profile most investors enjoy. However, stocks are still a good hedge against inflation because, in theory, a company’s revenue and earnings should grow at the same rate as inflation.

How do companies react to inflation?

While some companies can react to inflation by raising their prices, others who compete in a global market may find it difficult to stay competitive with foreign producers that don't have to raise prices due to inflation.

How much will the CPI increase in 2021?

In June 2021, the government announced that the consumer price index (CPI) increased 5% over the previous 12 months. This was the largest 12-month increase since a 5.4% jump in August 2008.

Who is Ken Little?

Ken Little is an expert in investing, including stocks and markets. He is the author of 15 books on investing and his career in finance includes roles as business news editor and VP of Marketing for a financial services firm. Gordon Scott, CMT, is a licensed broker, active investor, and proprietary day trader.

Inflation and The Value of $1

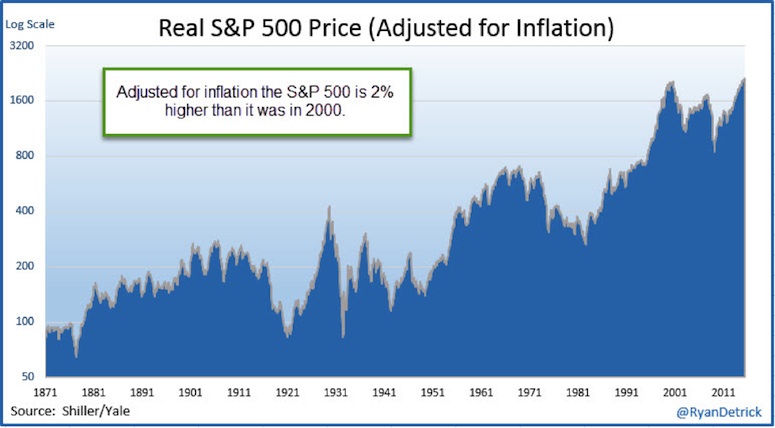

Inflation and Stock Market Returns

- Examining historical returns data during periods of high and low inflation can provide some clarity for investors. Numerous studies have looked at the effect of inflation on stock returns. Unfortunately, the studies have often produced conflicting results.78 Still, most researchers have found that higher inflation has generally correlated with lower equity valuations.9 This has also …

Growth vs. Value Stock Performance and Inflation

- Stocks are often subdivided into value and growth categories. Value stocks have strong current cash flows more likely to grow slowly or diminish over time, while growth stocks are likely to represent fast-growing companies that may not be profitable.12 Therefore, when valuing stocks using the discounted cash flow method, in times of rising interest rates, growth stocks are negat…