What does limited stock at Home Depot mean?

Simply, should a store, Home Depot in this case, list known depleted, absent, zero inventory as "Limited Stock", when it should be, and actually is "Out of Stock"? And further, in a pandemic, why would a store list something as if there might be some on the shelves?

How do you Buy Home Depot stock?

This is second hand info from a couple different people but it has seemed like a lot more counts have been off since i heard about this change. level 1. Jschevy. · 2 yr. ago D94. I always tell customers that say “it says limited stock” that that usually means we are out of it. Same thing if it’s a low count of something.

Who owns Home Depot stock?

May 17, 2020 · It means that they won't tell you if there's stock ... They may have, they may not have. Check stocktrack I make Ridgid to Ryobi Adapter and other adapters from Ridgid as well +2 Reply Reply with quote May 17th, 2020 10:36 am #4 emilio911 [OP] Sr. Member Jul 13, 2016 940 posts 557 upvotes

Is Home Depot publicly traded?

Definition of limited stock in the Definitions.net dictionary. Meaning of limited stock. What does limited stock mean? Information and translations of limited stock in the most comprehensive dictionary definitions resource on the web.

Are we missing a good definition for limited stock? Don't keep it to yourself..

The ASL fingerspelling provided here is most commonly used for proper names of people and places; it is also used in some languages for concepts for which no sign is available at that moment.

Definitions & Translations

Get instant definitions for any word that hits you anywhere on the web!

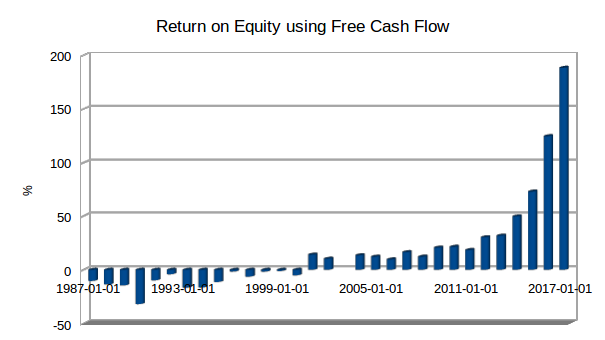

Is the company abnormally efficient at generating returns on the capital it employs?

Every time I read a Home Depot ( HD -0.31% ) quarterly report, I have to stop and marvel at its off-the-charts return on invested capital, or ROIC. This vital metric tracks the percentage return a company earns over the cost of its debt and equity capital.

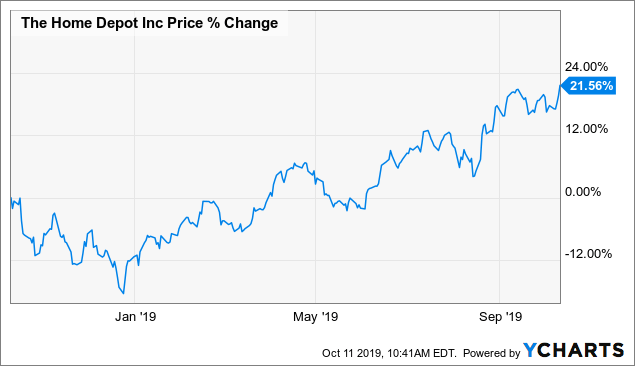

NYSE: HD

Home Depot's third-quarter 10-Q earnings filing discloses that management calculates ROIC by dividing trailing 12-month net operating income after taxes, or NOPAT, by average debt and equity for the most recent 12-month period.

Why the invested capital base seems undersized

Now, if you're an armchair financial sleuth, you may have already guessed that Home Depot must have very little long-term debt on its books, since the average of its debt and equity is so small relative to annual earnings. But this surmise would be well off the mark.

How share repurchases influence Home Depot's ROIC

Publicly traded companies account for shares they've repurchased on the open market in the treasury stock account. This account has a negative, or "contra," balance against equity. Cash outflows to purchase common stock are balanced on a company's books by corresponding increases to the treasury account, thereby trimming equity.

Premium Investing Services

Invest better with the Motley Fool. Get stock recommendations, portfolio guidance, and more from the Motley Fool's premium services.

Does Home Depot have fewer stores?

Home Depot also not ed that shoppers are visiting fewer stores, making fewer trips overall, and concentrating their spending at places that allow for in-store pickup of online orders. These assets helped sales growth more than triple from quarter to quarter.

Is Home Depot bullish in 2020?

Executives closed the chat with one more major way that 2020 is unprecedented when it comes to business trends. Normally, Home Depot would be issuing a bullish forecast after having added $9 billion to its sales base in just the last six months.