When inflation is low, growth stocks are preferred, whereas value stocks get the spotlight in periods of high inflation. High inflation makes the stock market more volatile and lowers valuations of equities, suggesting we can expect more weakness in the stock market and negative real returns. Source: Sauko Andrei / Shutterstock

Are stocks good during inflation?

“It’s a good strategy to diversify across different types of investments. For instance, stocks more than bonds ... have historically out-performed during inflation … Additionally, tangible ...

How do stocks perform during periods of inflation?

Warren Buffett explains how to invest in stocks when inflation hits markets

- When you are doing great, it is the time to remember inflation. ...

- During high inflation, earnings are not the dominant variable for investors. ...

- Understand the math of the ‘Misery Index.’. ...

- Inflation is a ‘tapeworm’ that makes bad businesses even worse for shareholders. ...

- Focus on companies that generate rather than consume cash. ...

How does inflation hurt stocks?

Nutrien: A Value Stock to Load Up on Amid Rising Inflation

- Positive fundamentals make Nutrien a value stock to consider. One of the key reasons I like Nutrien’s value proposition is the company’s fundamentals. ...

- Inflation hedges are hard to come by. I think it’s worth harping on the inflation hedge aspect of Nutrien’s business model for a second. ...

- Bottom line. A company’s valuation isn’t everything. ...

How do bank stocks perform when inflation and recessions hit?

Inflation became ... a great degree. “… value stocks should begin to perform better after posting dismal numbers since 2011. In general, value stocks such as banks have been lagging due ...

Why should stocks hedge against inflation?

In theory, stocks should provide some hedge against inflation, because a company's revenues and profits should grow at the same rate as inflation, after a period of adjustment. However, inflation's varying impact on stocks confuses the decision to trade positions already held or to take new positions.

What is the effect of inflation?

Investors, the Federal Reserve, and businesses continuously monitor and worry about the level of inflation. 1 Inflation—the rise in the price of goods and services —reduces the purchasing power each unit of currency can buy. Rising inflation has an insidious effect: input prices are higher, consumers can purchase fewer goods, ...

What happens to the purchasing power of a dollar when inflation increases?

When inflation increases, purchasing power declines, and each dollar can buy fewer goods and services. For investors interested in income-generating stocks, or stocks that pay dividends, the impact of high inflation makes these stocks less attractive than during low inflation, since dividends tend to not keep up with inflation levels. 19

How to predict expected inflation?

One way investors can predict expected inflation is to analyze the commodity markets, although the tendency is to think that if commodity prices are rising, stocks should rise since companies “produce” commodities. However, high commodity prices often squeeze profits, which in turn reduces stock returns.

Why is inflation greater than or less than this range?

Inflation greater than or less than this range tends to signal a U.S. macroeconomic environment with larger issues that have varying impacts on stocks. 14 Perhaps more important than the actual returns are the volatility of returns inflation causes and knowing how to invest in that environment.

How does rising inflation affect the economy?

Rising inflation has an insidious effect: input prices are higher, consumers can purchase fewer goods, revenues, and profits decline, and the economy slows for a time until a measure of economic equilibrium is reached.

What is the difference between growth and value stocks?

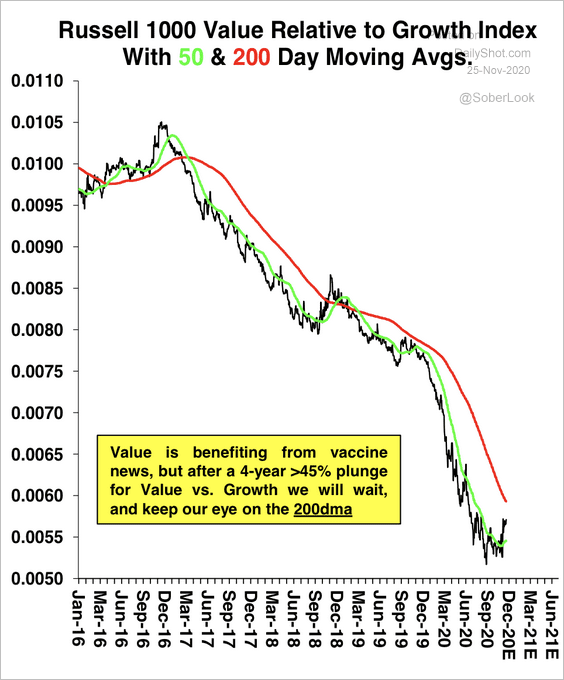

Stocks are often broken down into subcategories of value and growth. Value stocks have strong current cash flows that will slow over time, while growth stocks have little or no cash flow today but are expected to gradually increase over time. 15

Inflation and The Value of $1

Inflation and Stock Market Returns

- Examining historical returns data during periods of high and low inflation can provide some clarity for investors. Numerous studies have looked at the effect of inflation on stock returns. Unfortunately, the studies have often produced conflicting results.78 Still, most researchers have found that higher inflation has generally correlated with lowe...

Growth vs. Value Stock Performance and Inflation

- Stocks are often subdivided into value and growth categories. Value stocks have strong current cash flows more likely to grow slowly or diminish over time, while growth stocks are likely to represent fast-growing companies that may not be profitable.12 Therefore, when valuing stocks using the discounted cash flow method, in times of rising interest rates, growth stocks are negat…

The Bottom Line

- Investors try to anticipate the factors that impact portfolio performanceand make decisions based on their expectations. Inflation is one of the factors that may affect a portfolio. In theory, stocks should provide some hedge against inflation, because a company's revenues and profits should grow with inflation after a period of adjustment. However, inflation's varying impact on st…