A stock with a high beta indicates it’s more volatile than the overall market and can react with dramatic share-price changes amid market swings. So if you don’t have the stomach for vast price changes, you may want to avoid investing in high-beta stocks. But beta is just one factor to consider when examining investments.

What stock has the highest beta?

High beta stocks have historically outperformed the market, which is why they hold great significance for investors. While beta values have been historically used to calculate stocks' volatility ...

What stocks have the highest beta?

- Microsoft has a beta of around 1.25. This means an investor can reasonably expect that this stock is 25% more volatile than the market. ...

- Walt Disney Company has a beta right around 1.03. This puts its volatility right in line with the broader market. ...

- In contrast, Duke Energy has a beta of around 0.27. ...

What is considered high beta?

Beta is valued at 0.90, while measure of average true range or ATR is currently at 9.41. In predicting price targets of as low as $108.00 and as high as $275.00, analysts are in agreement on assigning the stock over the next 12 months average price target ...

What are high beta stocks?

- Get a free copy of the StockNews.com research report on BNY Mellon High Yield Beta ETF (BKHY)

- Qualtrics International Stock is an EMS Play

- Insiders Sell SiteOne Landscape Supply, Institutions Buy It

- Matterport Shows Why the Metaverse Will Have Some Growing Pains

- Now It’s Time To Buy Roblox, Maybe

What does a high beta tell you?

Beta is a way of measuring a stock's volatility compared with the overall market's volatility. The market as a whole has a beta of 1. Stocks with a value greater than 1 are more volatile than the market (meaning they will generally go up more than the market goes up, and go down more than the market goes down).

Does higher beta mean higher stock price?

A beta greater than 1 indicates a stock's price swings more wildly (i.e., more volatile) than the overall market. A beta of less than 1 indicates that a stock's price is less volatile than the overall market. A beta of 1 indicates the stock moves identically to the overall market.

What is considered a high beta for stocks?

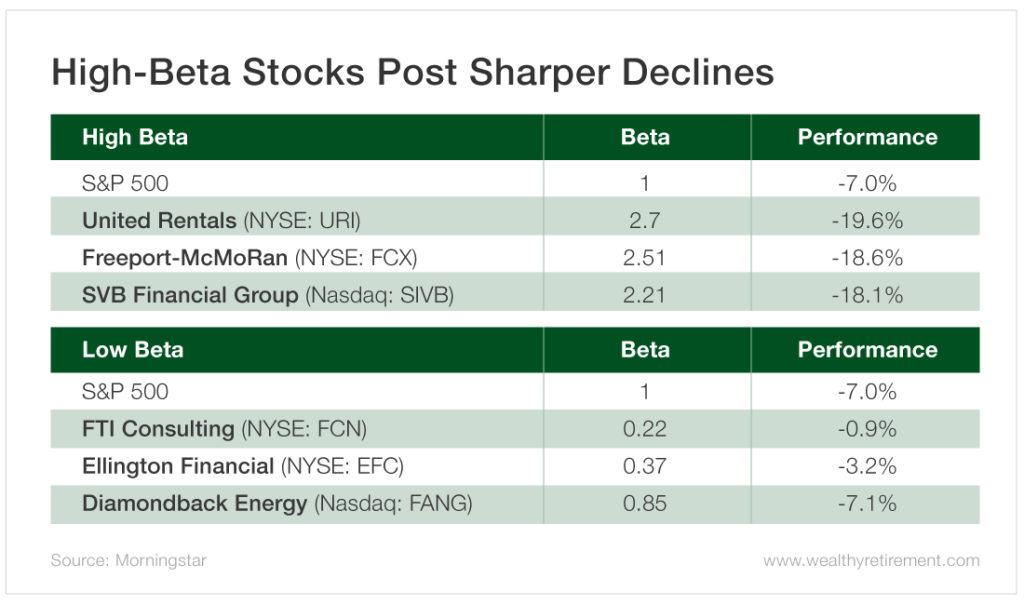

What are high-beta stocks? A high-beta stock, quite simply, is a stock that has been much more volatile than the index it's being measured against. A stock with a beta above 2 -- meaning that the stock will typically move twice as much as the market does -- is generally considered a high-beta stock.

What does a high beta mean for a company?

A high beta index is a basket of stocks that exhibits greater volatility than a broad market index such as the S&P 500 Index. The S&P 500 High Beta Index is the most well-known of these indexes. It tracks the performance of 100 companies in the S&P 500 that are the most sensitive to changes in market returns. 1

Are high beta stocks good?

High beta stocks have historically outperformed the market, which is why they hold great significance for investors. While beta values have been historically used to calculate stocks' volatility, it is not wise to depend entirely on the beta alone to measure the potential of a company.

Do you want a high or low beta?

A stock that swings more than the market over time has a beta above 1.0. If a stock moves less than the market, the stock's beta is less than 1.0. High-beta stocks are supposed to be riskier but provide higher return potential; low-beta stocks pose less risk but also lower returns.

Is Tesla a high beta stock?

In accordance with the recently published financial statements, Tesla Inc has a Beta of 2.08. This is 147.62% higher than that of the Consumer Cyclical sector and 147.62% higher than that of the Auto Manufacturers industry....Tesla Beta Analysis.20212022 (projected)Revenues53.82 B58.07 B1 more row

Is a low stock beta good?

The lower the Beta value, the less volatility the stock or portfolio should exhibit against the benchmark. This is beneficial for investors for obvious reasons, particularly those that are close to or already in retirement, as drawdowns should be relatively limited against the benchmark.

What are the best high beta stocks?

High Beta StocksCompanyCurrent PriceBetaCDEV Centennial Resource Development$8.59 +1.5%5.22SM SM Energy$50.22 +3.3%5.17BTBT Bit Digital$1.64 -4.7%5.01KODK Eastman Kodak$4.74 -0.2%4.8241 more rows

What's a good beta for a portfolio?

For example, a portfolio with an overall beta of +0.7 would be expected to earn 70% of the market's return under normal circumstances. Portfolios, however, can also have betas greater than 1.0, such that a portfolio with a beta of +1.25 would be expected to earn 125% of the market's return and so on.

What is a good beta for a portfolio?

A beta value that is less than 1.0 means that the security is theoretically less volatile than the market. Including this stock in a portfolio makes it less risky than the same portfolio without the stock.

What is an example of a high beta?

A high beta index refers to a market index made up of stocks with higher-than-average volatility compared to the overall stock market. Examples include the S&P 500 High Beta Index, the TSX Composite High Beta Index, the Hang Seng High Beta Index, and the S&P Emerging Markets High Beta Index.

What is beta in stocks?

What Is Beta? Beta is a measure of a stock's volatility in relation to the overall market. By definition, the market, such as the S&P 500 Index, has a beta of 1.0, and individual stocks are ranked according to how much they deviate from the market.

What does beta mean in investing?

Of course, when investors consider risk, they are thinking about the chance that the stock they buy will decrease in value. The trouble is that beta, as a proxy for risk, doesn't distinguish between upside and downside price movements. For most investors, downside movements are a risk, while upside ones mean opportunity.

What is beta in CAPM?

Beta is a component of the capital asset pricing model (CAPM), which is used to calculate the cost of equity funding. The CAPM formula uses the total average market return and the beta value of the stock to determine the rate of return that shareholders might reasonably expect based on perceived investment risk.

Why is beta important?

To followers of CAPM, beta is useful. A stock's price variability is important to consider when assessing risk. If you think about risk as the possibility of a stock losing its value, beta has appeal as a proxy for risk. Intuitively, it makes plenty of sense.

Why does beta change over time?

A stock's beta will change over time because it compares the stock's return with the returns of the overall market. Benjamin Graham, the "father of value investing," and his modern advocates tried to spot well-run companies with a "margin of safety"—that is, an ability to withstand unpleasant surprises.

Why do analysts use beta?

Analysts use it often when they want to determine a stock's risk profile. However, while beta does say something about price risk, it has its limits for investors looking to determine fundamental risk factors.

What does value investor mean?

A value investor would argue that a company represents a lower-risk investment after it falls in value —investors can get the same stock at a lower price despite the rise in the stock's beta following its decline.

Why are high beta stocks important?

Understanding beta and its uses can be important for growth investors seeking to identify the best-performing stocks at large. Below we take a look at the market’s highest beta stocks with the highest returns.

What does beta mean in stocks?

Beta is a statistical measure of a stock's relative volatility to that of the broader market (typically the S&P 500), where it can be interpreted as a measure of riskiness. A stock's beta is arrived at using regression analysis that infers the correlation in price changes in the stock to the S&P 500. Therefore, a beta of 1.0 indicates that a stock’s volatility is parallel to that of the market, and so will often move in tandem with the index and at the same magnitudes.

What does volatility mean in stocks?

Volatility is usually an indicator of risk and higher betas mean higher risk while lower betas mean lower risk. Thus, stocks with higher betas may gain more in up markets but also lose more in down markets.

What does a beta of 1.0 mean?

Therefore, a beta of 1.0 indicates that a stock’s volatility is parallel to that of the market, and so will often move in tandem with the index and at the same magnitudes. A beta of above 1.0 means that the stock will have greater volatility than the market and a beta less than 1.0 indicates lower volatility. ...

What is high beta?

High beta stocks are those that are positively correlated with returns of the S&P 500, but at an amplified magnitude. Because of this amplification, these stocks tend to outperform in bull markets, but can greatly underperform in bear markets. Here, we look at 3 of the highest beta stocks among the S&P 500 companies in 2019 as illustrative examples.

Is a high beta stock a long term buy and hold?

Thus, in the case of a bear market reversal, these stocks could also be expected to lose the most, so it is important to keep an eye on them as high beta stocks are generally not long-term buy-and-hold investments.

Is high beta a good investment?

High beta stocks can be great investments in bull markets since they are expected to outperform the S&P 500 by a marginal amount. They do however require a great deal of active management due to their market sensitivity. These are highly volatile and therefore risky investments in isolation. Thus, in the case of a bear market reversal, these stocks could also be expected to lose the most, so it is important to keep an eye on them as high beta stocks are generally not long-term buy-and-hold investments.

What does it mean when a stock has a beta of over 100?

If you see a beta of over 100 on a research site it is usually a statistical error or the stock has experienced a wild and probably fatal price swing. For the most part, stocks of established companies rarely have a beta higher than 4.

Why do stocks have beta?

The beta is the number that tells the investor how that stock acts compared to all other stocks, or at least in comparison to the stocks that comprise a relevant index.

Why should gold stocks have negative beta?

Some investors argue that gold and gold stocks should have negative betas because they tend to do better when the stock market declines.

What does a beta of utility mean?

Many utility sector stocks have a beta of less than 1. Essentially, beta expresses the trade-off between minimizing risk and maximizing return. Say a company has a beta of 2. This means it is two times as volatile as the overall market. We expect the market overall to go up by 10%.

What is the beta of cash?

Beta of 0: Basically, cash has a beta of 0. In other words, regardless of which way the market moves, the value of cash remains unchanged (given no inflation). Beta between 0 and 1 : Companies that are less volatile than the market have a beta of less than 1 but more than 0. Many utility companies fall in this range.

What does beta mean in investing?

In investing, beta does not refer to fraternities, product testing, or old videocassettes. Beta is a measurement of market risk or volatility. That is, it indicates how much the price of a stock tends to fluctuate up and down compared to other stocks.

What does a beta of 1 mean?

A beta of 1 indicates that the security's price tends to move with the market. A beta greater than 1 indicates that the security's price tends to be more volatile than the market. A beta of less than 1 means it tends to be less volatile than the market.

What is beta in stocks?

Beta is a measure of the volatility — or systematic risk — of a security or portfolio compared to the market as a whole. Beta is used in the capital asset pricing model (CAPM), which describes the relationship between systematic risk and expected return for assets (usually stocks). CAPM is widely used as a method for pricing risky securities ...

What does it mean when a stock has a beta of less than 1.0?

Beta Value Less Than One. A beta value that is less than 1.0 means that the security is theoretically less volatile than the market. Including this stock in a portfolio makes it less risky than the same portfolio without the stock.

What is a beta of 1.0?

A stock with a beta of 1.0 has systematic risk. However, the beta calculation can’t detect any unsystematic risk. Adding a stock to a portfolio with a beta of 1.0 doesn’t add any risk to the portfolio, but it also doesn’t increase the likelihood that the portfolio will provide an excess return.

Why is beta important?

Beta is useful in determining a security's short-term risk, and for analyzing volatility to arrive at equity costs when using the CAPM. However, since beta is calculated using historical data points, it becomes less meaningful for investors looking to predict a stock's future movements.

How does beta work?

How Beta Works. A beta coefficient can measure the volatility of an individual stock compared to the systematic risk of the entire market. In statistical terms, beta represents the slope of the line through a regression of data points.

What is beta in capital asset pricing?

Beta, primarily used in the capital asset pricing model (CAPM), is a measure of the volatility–or systematic risk–of a security or portfolio compared to the market as a whole.

What does a negative beta mean?

Some stocks have negative betas. A beta of -1.0 means that the stock is inversely correlated to the market benchmark. This stock could be thought of as an opposite, mirror image of the benchmark’s trends. Put options and inverse ETFs are designed to have negative betas.

Why is equity beta called equity beta?

It is also commonly referred to as “equity beta” because it is the volatility of an equity based on its capital structure. Capital Structure Capital structure refers to the amount of debt and/or equity employed by a firm to fund its operations and finance its assets. A firm's capital structure.

What is asset beta?

Unlevered Beta / Asset Beta Unlevered Beta (Asset Beta) is the volatility of returns for a business, without considering its financial leverage. It only takes into account its assets. , on the other hand, only shows the risk of an unlevered company relative to the market.

What is leveraged beta?

Levered beta, also known as equity beta or stock beta, is the volatility of returns for a stock, taking into account the impact of the company’s leverage from its capital structure. It compares the volatility (risk) of a levered company to the risk of the market. Levered beta includes both business risk. Systemic Risk Systemic risk can be defined ...

Is a company with a 0f 0.79 more volatile than the market?

Also, a company with a β of 1.30 is theoretically 30% more volatile than the market. Similarly, a company with a β 0f 0.79 is theoretically 21% less volatile than the market.

What is high beta stock?

High Beta Stocks. Beta is the result of a calculation that measures the relative volatility of a stock in correlation to a particular standard . For U.S. stocks that standard is usually, but not always, the S&P 500. Beta is a form of regression analysis and it can be useful for investors regardless of their risk tolerance.

Why is beta important in stock?

But even then, a stock’s beta can provide a forecast of how volatile it will be in the future—and in turn, build a capital asset pricing model to determine potential reward. Because of its utility as an assessment of volatility, beta is a metric used in both fundamental analysis and technical analysis.

What does a negative beta mean?

Beta of less than 0 (i.e. a negative beta): This means a stock is inversely correlated to the market. The tendency of the stock is to move in the opposite direction as the market. The higher the negative number, the more volatile the stock. As you can see, beta is all about its relationship to the number 1.

What is covariance in stock market?

Covariance helps measure how closely individual stocks move relative to the overall market or index. If the direction of their momentum, the beta will be positive. If their momentum is oppositional, the beta will be negative. Variance is a measure of the momentum of the stock market, relative to its mean.

What is a personally calculated beta?

A personally calculated beta, on the other hand, is one that investors will calculate for themselves. To calculate beta, investors will have to know the covariance between the return of the stock being analyzed and the return of the benchmark for that stock as well as the variance of the market returns.

What is smart beta?

A smart beta strategy can be used to minimize the risk impact of high beta stocks. This type of strategy might combine something passive and more stable, like a dividend investing strategy, with active trading in order to minimize losses from the most volatile stocks in the fund.

What is beta in fundamental analysis?

Beta is considered one of the few data points that can be beneficial for practitioners of fundamental analysis and technical analysis . Investors who tend to analyze stocks using fundamental analysis will use beta along with the price-to-earnings ratio, shareholders equity, debt-to-equity ratio, and other factors.

What does beta mean in stock market?

Beta is represented as a number. Based on beta analysis, the overall stock markethas a beta of 1. And the beta of individual stocks determines how far they deviate from the broader market. A stock with a beta equal to 1 assumes its price moves hand-in-hand with the market.

What is beta in stock?

Beta can be a useful metric to determine how a stock’s price may move in relation to the overall market by examining its past performance. It can also be a useful indicator of risk, especially for investors who make trades frequently. However, beta has its limitations.

What does it mean when a stock has a beta of 1?

If the stock has a beta less than 1, you can conclude that it’s less volatile than the overall market. This means that adding it to your portfolio may mitigate risk and may help in diversifying your investments. Betas can also dip below 1 into negative territory. This indicates that the stock may respond in the opposite direction ...

Why is beta high?

A stock with a high beta indicates it’s more volatile than the overall market and can react with dramatic share-price changes amid market swings. So if you don’t have the stomach for vast price changes, you may want to avoid investing in high-beta stocks.

What is beta in investing?

Nonetheless, beta can be one of many useful tools to have when evaluating your investments. So it’s important to at least calculate the beta of a stock you may be interested in purchasing. Before You Calculate Beta. Remember, beta measures how volatile a stock’s price may be in relation to a market benchmark. ...

What does it mean to have a high beta?

In essence, it would have a high beta and mean more risk.

Is beta a factor?

But beta is just one factor to consider when examining investments. This article will help you understand what it means and how you can use it to build a better portfolio that matches your risk tolerance. A financial advisorcan also help you take advantage of beta to make better investment decisions.

What Is Beta?

Calculating Beta

- Beta is calculated using regression analysis. Numerically, it represents the tendency for a security's returns to respond to swings in the market. The formula for calculating beta is the covariance of the return of an asset with the return of the benchmarkdivided by the variance of the return of the benchmark over a certain period. Beta=CovarianceVariance\text{Beta} = \frac{\text…

The Advantages of Beta

- To followers of CAPM, beta is useful. A stock's price variability is important to consider when assessing risk. If you think about risk as the possibility of a stock losing its value, beta has appeal as a proxy for risk. Intuitively, it makes plenty of sense. Think of an early-stage technology stock with a price that bounces up and down more than the market. It's hard not to think that stock wil…

The Disadvantages of Beta

- If you are investing based on a stock's fundamentals, beta has plenty of shortcomings. For starters, beta doesn't incorporate new information. Consider a utility company: let's call it Company X. Company X has been considered a defensive stockwith a low beta. When it entered the merchant energy business and assumed more debt, X's historic beta no longer captured the …

Assessing Risk

- The well-worn definition of risk is the possibility of suffering a loss. Of course, when investors consider risk, they are thinking about the chance that the stock they buy will decrease in value. The trouble is that beta, as a proxy for risk, doesn't distinguish between upside and downsideprice movements. For most investors, downside movements are a risk, while upside ones mean oppor…

The Bottom Line

- Ultimately, it's important for investors to make the distinction between short-term risk—where beta and price volatility are useful—and longer-term, fundamental risk, where big-picture risk factors are more telling. High betas may mean price volatility over the near term, but they don't always rule out long-term opportunities.

Beta and Risk

Investing in High Beta Stocks

- High beta stocks can be great investments in bull markets since they are expected to outperform the S&P 500 by a marginal amount. They do however require a great deal of active management due to their market sensitivity. These are highly volatile and therefore risky investments in isolation. Thus, in the case of a bear market reversal, these stocks...

Historical Examples of High-Beta Stocks

- Below, we look at three stocks from the year 2019 as historical examples of stocks with betas of around 2.5, and which were members of the S&P 500 index. Note that these historical examples are for informational purposes only to give insight into how high-beta stocks typically behave, and are intended as investment advice.

The Bottom Line

- High beta stocks require a great deal of active management. They are also often small to mid-cap stocks that are maturing with significant volatility around new announcements. All three of the stocks here are in the small-cap realm with Largo and California Resources pushing into the mid-cap territory. Each has a few growth catalysts that have helped to propel their returns. Keep in m…