What time does the stock market open and close?

The US stock market is open Monday to Friday from 9:30 a.m. to 4:00 p.m. Eastern Time. Many stocks can also be bought and sold in extended-hours trading. Pre-market trading opens at 4:00 a.m. and after-hours trading closes at 8 p.m. Stock trading hours are usually noted in Eastern Time because that’s the time zone of New York, where Wall Street is.

When is the stock market closed?

Crossing Session orders will be accepted beginning at 1:00 p.m. for continuous executions until 1:30 p.m. on these dates, and NYSE American Equities, NYSE Arca Equities, NYSE Chicago, and NYSE National late trading sessions will close at 5:00 pm. All times are Eastern Time.

When does market close?

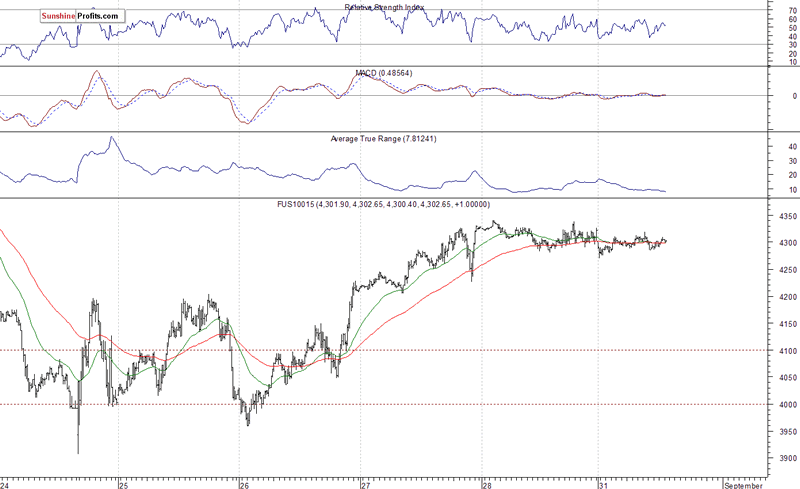

They close roughly at the same levels: the Dow +422 points, +1.22%; the S&P 500 +1.58% and the Nasdaq did one better: +349 points, or +2.53%. Small-caps won the day, withe the Russell 2000 up +2.76% on the day.

Is the Stock Exchange closed?

With stock-exchange floor closed, traders and investors grapple with uncertainty . The New York Stock Exchange closed its trading floor March 23. (Kearney Ferguson/AP) By Steven Zeitchik.

What does open and close mean in stock market?

In stock trading, the high and low refer to the maximum and minimum prices in a given time period. Open and close are the prices at which a stock began and ended trading in the same period.

What does close market mean?

Close market. An market in which there is a narrow spread between bid and offer prices, due to a high volume of trading and many competing market makers.

What does close by mean in trading?

The Close By operation allows traders to simultaneously close two opposite positions of the same financial instrument. If opposite positions have different lot values, only one of them will be left open.

Is it better to buy at market open or close?

Morning Hours For smaller companies, the market hours (post-open) are the best entry times to buy the stock. At this time, all the exchanges are quoting prices and traders have access to more shares. Traders hoping to make an intraday play can buy a stock they may want to close out at the end of the day.

Should I buy stocks when the market is closed?

Because spreads tend to be wider during after-hours trading, you are likely to pay more for shares than during regular hours. If you see a wide spread and believe it will narrow, you could watch the ECNs until the next morning and possibly score a better deal.

When should I close a trade?

The safest strategy is to exit after a failed breakout or breakdown, taking the profit or loss, and re-entering if the price exceeds the high of the breakout or low of the breakdown. The re-entry makes sense because the recovery indicates that the failure has been overcome and that the underlying trend can resume.

What happens when you close trade?

“Closing a trade” means terminating an investment. In the laymen's terms it would be called “selling” a stock or a financial asset. Selling an asset, synonymous with “short selling”, means entering into a contract with a broker, or simply an investment, where you believe an asset will decline in value.

What happens when you close position?

Closing a position refers to executing a security transaction that is the exact opposite of an open position, thereby nullifying it and eliminating the initial exposure. Closing a long position in a security would entail selling it, while closing a short position in a security would involve buying it back.

What is the closing of a trade?

The close is a reference to the end of a trading session in the financial markets when the markets close for the day. The close can also refer to the process of exiting a trade or the final procedure in a financial transaction in which contract documents are signed and recorded.

What is the most visible example of a market close?

The most visible example of a market close is the close of the New York Stock Exchange (NYSE) when the closing bell is rung, but closing times vary between markets and exchanges .

Why is it important to know the closing times of a trade?

Understanding the closing times of various markets is important to avoid making any costly mistakes. Closing can also refer to closing out, or completing, a trade—or to the end of a deal or transaction, depending on the context.

What does it mean when there is less liquidity in after hours trading?

Limited Liquidity: Fewer traders are active in after-hours trading, which means that there’s less liquidity, inefficient pricing, and higher bid-ask spreads.

Why is it important to know when markets open and close?

Being aware of when markets open and close is essential for efficient trading, regardless of the exchange or type of security. Knowing when and how to close out a trade is also critical for market participants.

What time does the bond market open?

The bond markets tend to be open a bit longer from 8:00 a.m. Eastern Time to 5:00 p.m. Eastern Time. Futures market hours vary widely based on the exchange and commodity—traders should see the exchanges’ websites for more details. The most common market holidays include: New Year’s Day. Martin Luther King Jr. Day.

Is there a guarantee that after hours prices reflect a security’s opening price the next day?

No Guarantees: There is no guarantee that after-hours prices reflect a security’s opening price the next day since they are entirely different sessions.

What does "close" mean in trading?

Next, we move to the term close.The trading term close refers to two different things.First, it is the official exchange rate of the particular trading day.This is the rate of exchange which is in effect when the market closes for the day.The close also refers to the exact time of day when the exchange actually closes.This means that if a transaction is said to be set `on close', the close time is when the transaction is finalized.

What does "open" mean in stock market?

Let's start with the term open.The term open is actually referring to a particular exchange rate. The open exchange rate is the official rate at which the stock market exchange opens on a trading day.This rate is not going to stay for particularly long, however.

What does it mean when the stock market is closed?

This means that even though the stock market is closed, the stock is still available to trade. The New York Stock Exchange, NASDAQ and other markets have limited before and after hours trading. In such a case, the stock's after-market price may be slightly different than ...

What is the closing price of a stock?

A closing price for a stock is the price at the end of a trading day. It's a standard figure watched by investors, financial institutions and other organizations making decisions about the stock and the company.

Why is closing price important?

The closing stock price is significant for several reasons. Investors, traders, financial institutions, regulators and other stakeholders use it as a reference point for determining performance over a specific time such as one year, a week and over a shorter time frame such as one minute or less.

What does it mean to short a stock?

He decides to "short" the stock with the expectation of the price falling lower. Shorting a stock means that he makes money if the stock declines in value. It's a process that lets investors borrow shares of the stock from other investors for a small fee, sell them and buy them back to return to the original owner at a later date.

What does the opening bell mean in the stock market?

At the opening bell of the stock market, investors around the world take notice of the opening price of the market and individual stocks. Where the stock closes for the day determines how well or poorly a stock performed, which is a big deal for not only investors but also financial institutions and other stakeholders.

How much is a 2 for 1 stock split?

For example, in a 2-for-1 stock split, each shareholder will receive two new shares for each old share. If the stock was previously valued at $14, this will usually mean each new share is worth $7. After the split, old closing prices will be divided by two to adjust them and make them comparable to new, post-split closing prices.

What is the difference between "open" and "low"?

The "high" is the highest at which the stock traded for the day and the "low" is the lowest price for the trading day. You'll also notice a "52-week range" for the stock.

What does "close" mean in stock market?

Close refers to the price of an individual stock when the stock exchange closed shop for the day. It represents the last buy-sell order executed between two traders. In many cases, this occurs in the final seconds of the trading day. For less actively traded stocks, the last trade of the day could be well before the closing bell, depending on when the last buy and sell orders were last paired.

What is the meaning of "open and close"?

The open and close reference the prices at which a stock begins and ends the period.

How do dividends affect stock value?

Let’s say a company pays a quarterly dividend in the form of cash or additional shares of stock. We can incorporate these into the share price by adding them back to come up with an adjusted value that reflects the shareholder payments. Although dividends are a welcomed bonus for shareholders, they lower a stock’s value. This is because by distributing dividends, a company moves cash or stock to shareholders’ pockets rather than investing the funds back into the business.

What is OHLCV in stock trading?

When discussing open, high, low, close, and volume (OHLCV) of a securities price, it’s essential to understand the period. Unless otherwise specified, the period is commonly daily; however, traders incorporate multiple periods when reviewing the price action of a security. This is called multiple timeframe analysis. For example, a stock could be in a daily uptrend with a series of higher highs and higher lows, but be in a weekly downtrend with a string of lower highs and lower lows. With this out of the way, let’s dig deeper into these definitions through the lens of the most common trading period: the daily time period.

What does "open" mean in the morning newspaper?

The header on one of them is “open”. Open means the price at which a stock started trading when the opening bell rang.

What does volume mean in stock trading?

Volume refers to the number of shares that exchange hands for a stock with a specific period. Closing on a ‘high’ note, all of these terms help give us a better picture of a stock’s price action at a given point in time, helping us to make better trading decisions.

What determines how a stock performs during the day?

While much fanfare surrounds the stock market’s opening bell and opening prices, it is a stock’s closing price that determines how a share performed during the day.

What About the Options Market?

You might have read some headlines last year about the SEC looking into having the options market open all day. The CBOE or Chicago Board Options Exchange has opened up trading of S&P 500 options and VIX options to 24 hours per day from Monday to Friday.

What About the Crypto Market?

The crypto market is a completely different beast though. These massive trillion-dollar markets are open 24 hours per day, seven days per week, even on holidays. Why can the crypto markets stay open for so long?

Advantages to the Stock Market Closing

Well, every cloud has a silver lining, right? There have to be some advantages to the stock market actually closing every day. Aside from the reasons I already covered above, there are certainly advantages for both companies and traders to see the market close.

Allows Traders to Reset

This is so important. The stock market is a great way to invest and make money, but it can be exhausting to follow the ebbs and flows each day.

Trading Near the Bell

There is actually a viable trading strategy to trading right after the opening and directly before the close. This is called Trading Near the Bell and it allows traders to take advantage of some reasonably steady patterns that take place during most sessions.

Conclusion on Why Does the Stock Market Close

Why does the stock market close? It’s a question that has been asked repeatedly by investors for decades now. In my opinion, these traders just do not know what they are asking for! Imagine tracking your favorite stocks all night long? I am sure a lot of traders would not be able to sleep at night.

Why is the closing price of a stock different from the open price?

That's because news about a company can, and often does, come out while the market is closed, shifting what investors are willing to pay to own a share of the company.

What is the difference between open and closed stock?

Previous close by definition in stock market language refers to essentially the last trading price of the previous day, while open price refers to the first trading price of the day. Investors can change their minds based on new information about what a stock is worth while it's closed, meaning prices can shift without any trades taking place.

What time does the stock market close?

The major U.S. exchanges are generally open from 9:30 a.m. to 4 p.m. Eastern time. The closing price is just a snapshot of the stock at 4 p.m. This price does carry a lot of psychological weight, as it's often interpreted as the market's "final say" on a stock for the day.

What is the difference between closing and opening price?

Just as the closing price is the price paid in the last transaction of a business day, the opening price is the price from the first transaction of a business day. That price can be influenced by anything that has happened since the previous close.

What does "bid price" mean in stock trading?

Technically, there are bid prices, meaning what people are offering for the stock, and ask prices, meaning what people are looking to be paid for it. When those prices converge, trades take place.

Can you trade stocks after hours?

Trading in stocks continues even after exchanges close. Investors can place " after-hours" buy and sell orders. Depending on the system, these orders either are filled immediately or are queued up to be filled when the market opens. Those trades will affect the next day's opening price.

Is the stock market fluid?

But in the stock market, prices are fluid. The price quoted for a stock at any point is simply the price paid the last time that stock changed hands. There's no guarantee that you'll get that price if you place an order to buy or sell shares.

When are closes and adjusted closes equal?

Usually closes and adjusted closes are equal to each other before the first ex-dividend date. At this point we should take the dividend payment into the account:

What is a stock split?

A stock split is an event of a company’s owners deciding to multiply the amount of company stock traded on the market to make each individual stock “cheaper” and more accessible. To do so, existing stock is split according to the owners’ wishes – 2 to 1, 3 to 1, 10 to 1, etc. With the company’s market capitalization intact.

How to compare stock prices during lifetime?

To compare stock prices during the stock’s lifetime, prices need to be adjusted to get the value of adjusted close – retroactively. This means prices get adjusted back in time from the date when an affecting event occurred.

What does reverse stock split mean?

A stock that cost $60 will now cost $30 (20, 6) – and that will be its adjusted price. There’s also a Reverse Stock Split which is, essentially, a stock merge.

What is the OHLC close?

The close (of the OHLC, open-high-low-close) is more or less straightforward: the closing price of a stock that was registered at the end of the period. And for end of day data, it’s the trading day. It’s a raw value, and it shows just how much raw cash a stock cost at the end of the day. It does just that: tells how much a stock cost at a given date.

Can you compare the price of a stock to its lifetime?

This value, though, cannot be used to compare all the prices of a stock to during its entire lifetime directly to each other – because, during the lifetime, there most certainly have been corporate actions that affected the price of the stock. Two primaries of those are splits and dividends. To compare stock prices during the stock’s lifetime, prices need to be adjusted to get the value of adjusted close – retroactively. This means prices get adjusted back in time from the date when an affecting event occurred.

Why do I use closing price in stock?

The second reason for using the stock closing price is a validation function. I’ve had this experience many times: I entered a trade during the day only to see the price reverse its move during the final hours of trading and return or went below my entry price.

Do you use the close price in stock chart?

But some traders often ask whether it’s more important to use the close price compared with the high or low price levels. There are several ways to use these data points.

What is an on close order?

These "on close" orders can lead to an imbalance on the buy or sell side of the ledger, known as a close sell imbalance.

When do you fill a buy on close order?

A buy-on-close will be filled at the last price of the day, as long as there is a sell-on-close order in the system with a matching number of shares. Limit buy or sell orders can only be filled if the closing price is at or better than the set limit price and there is an opposing "on close" order that can paired to the limit order.

What happens if there is an imbalance in the stock market?

If an imbalance exists on a stock, the stock exchange will only accept the opposite type of on-close orders during the final minute of the market day. For example, if there is a close sell imbalance, starting at 3:59, only buy-on-close orders will be accepted up to the number of shares counted in the sell imbalance.

Understanding Close Positions

- When trades and investors transact in the market, they are opening and closing positions. The initial position that an investor takes on a security is an open position, and this could be either taking a long position or short position on the asset. In order to get out of the position, it needs t…

Special Considerations

- While most closing positions are undertaken at the discretion of investors, positions are sometimes closed involuntarily or by force.For example, a long position in a stock held in a margin account may be closed out by a brokerage firm if the stock declines steeply, and the investor is unable to put in the additional margin required. Likewise, a short position may be subject to a bu…

Example of A Closed Position

- Suppose an investor has taken a long position on stock ABC and is expecting its price to increase 1.5 times from the date of his investment. The investor will close out his investment, after the price reaches the desired level, by selling the stock.