How to increase your dividend for Apple stock?

The following ETF (s) have AAPL as a top-10 holding:

- SPDR Select Sector Fund - Technology ( AAPL)

- Fidelity MSCI Information Technology Index ETF ( AAPL)

- Vanguard Information Tech ETF ( AAPL)

- iShares U.S. Technology ETF ( AAPL)

- iShares Global Tech ETF ( AAPL ).

When will Apple Pay its next dividend?

Apple's last dividend payment date was on 2022-02-10, when Apple shareholders who owned AAPL shares before 2022-02-04 received a dividend payment of $0.2200 per share. Apple's next dividend payment date has not been announced yet. Add AAPL to your watchlist to be reminded of . AAPL 's next dividend payment.

Is Apple going to raise its dividend?

The third reason Apple will increase its dividend soon is simple. They’ve already said they will. Apple’s most recent annual shareholder meeting took place on February 23, 2021. Apple’s CEO Tim Cook gave us great news. Taken from part of a longer statement on the dividend, he said exactly this: …”we plan for annual dividend increases…”

How much stock does Apple give to their employees?

Apple is giving shares to all of its employees -- for free. Previously, these stock grants had been limited to high-ranking execs. Generally they were issued by the tech giant to retain top talent.

How much does Apple pay in dividends?

What is the dividend payout ratio for Apple?

What is the dividend yield for Apple in 2021?

Is Apple paying dividends in 2021?

See more

About this website

Is Apple a good dividend stock?

Apple has delivered robust dividend growth From 2012 to 2021, the company has increased its dividend per share from $0.10 to $0.85. That means shareholders saw their dividends grow more than eightfold in that time. In that same period, earnings per share rose from $1.58 to $5.61.

How much of a dividend does Apple stock pay?

Tech giant Apple (ticker:AAPL) declared a quarterly dividend of 23 cents a share, up by a penny, or 4.5%. The stock, which yields 0.5%, has returned about minus 8% this year through April 28, dividends included, compared with nearly minus 10% for the S&P 500 SPX –2.91% .

What would $1000 invested in Apple be worth today?

So, if you had invested in Apple a decade ago, you're probably feeling pretty good about your investment today. A $1000 investment made in March 2012 would be worth $7,995.58, or a 699.56% gain, as of March 24, 2022, according to our calculations.

Which stock pays the highest dividend?

Most American dividend stocks pay investors a set amount each quarter, and the top ones increase their payouts over time, so investors can build an annuity-like cash stream....25 high-dividend stocks.SymbolCompany NameDividend YieldMOAltria Group Inc.6.66%OKEONEOK Inc.5.68%UVVUniversal Corp.4.96%LAMRLamar Advertising Co4.90%21 more rows

What dividend does Amazon pay?

Amazon does not pay any dividends, has never paid any dividends, and there is no statement by executives that indicates that Amazon is about to pay dividends any time soon.

Will Apple stock make me rich?

Few companies exemplify how long-term investing can help you retire rich as Apple, which is up, 2,127X over the last 35 years. The good news is that Apple is still one of the best companies on earth, and is expected to grow 14.5% over time, meaning it can make you rich over time.

Is it worth it to buy 1 share of stock?

While purchasing a single share isn't advisable, if an investor would like to purchase one share, they should try to place a limit order for a greater chance of capital gains that offset the brokerage fees.

What will Apple be worth in 10 years?

The Bottom Line Assuming 18% compound annual growth over the next decade, your $10,298 investment in Apple would be worth $53,898.

What is Apple's dividend yield?

The current dividend yield for Apple (NASDAQ:AAPL) is 0.61%. Learn more on AAPL's dividend yield history.

How much is Apple's annual dividend?

The annual dividend for Apple (NASDAQ:AAPL) is $0.92. Learn more on AAPL's annual dividend history.

How often does Apple pay dividends?

Apple (NASDAQ:AAPL) pays quarterly dividends to shareholders.

When was Apple's most recent dividend payment?

Apple's most recent quarterly dividend payment of $0.23 per share was made to shareholders on Thursday, May 12, 2022.

Is Apple's dividend growing?

Over the past three years, Apple's dividend has grown by an average of 7.06% per year.

What track record does Apple have of raising its dividend?

Apple (NASDAQ:AAPL) has increased its dividend for the past 11 consecutive years.

When did Apple last increase or decrease its dividend?

The most recent change in Apple's dividend was an increase of $0.01 on Thursday, April 28, 2022.

What is Apple's dividend payout ratio?

The dividend payout ratio for AAPL is: 14.94% based on the trailing year of earnings 15.06% based on this year's estimates 13.86% based on next...

AAPL Dividend Yield 2022, Date & History (Apple)

Is Apple (NASDAQ:AAPL) a good stock for dividend investors? View AAPL's dividend yield, history, and payment date at MarketBeat.

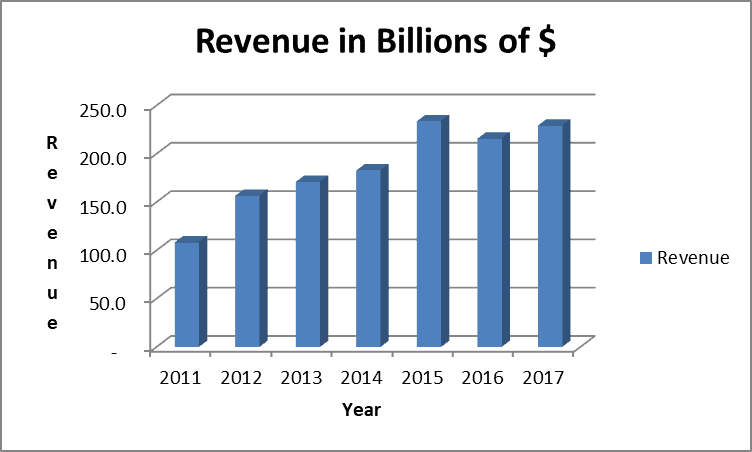

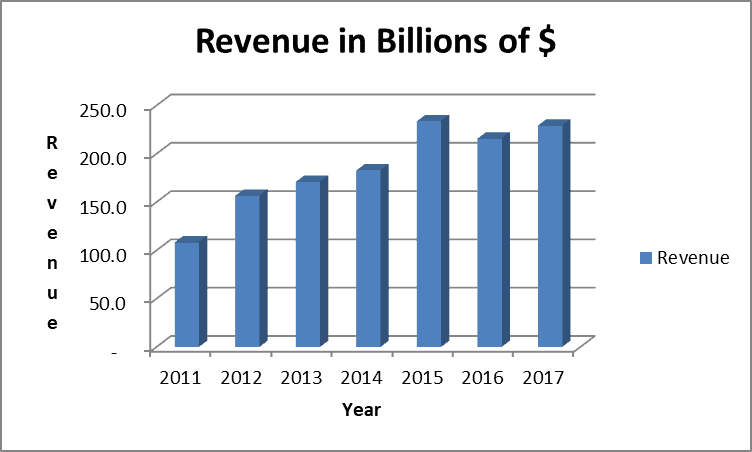

Apple Common Stock Dividends Paid 2010-2022 | AAPL

Apple annual/quarterly common stock dividends paid history and growth rate from 2010 to 2022. Common stock dividends paid can be defined as the cash outflow for dividends paid on a company's common stock

Apple 5-Year Dividend Growth Rate | AAPL - GuruFocus.com

For the Consumer Electronics subindustry, Apple's 5-Year Dividend Growth Rate, along with its competitors' market caps and 5-Year Dividend Growth Rate data, can be viewed below: * Competitive companies are chosen from companies within the same industry, with headquarter located in same country, with closest market capitalization; x-axis shows the market cap, and y-axis shows the term value ...

Apple - 33 Year Dividend History | AAPL | MacroTrends

Historical dividend payout and yield for Apple (AAPL) since 1989. The current TTM dividend payout for Apple (AAPL) as of June 14, 2022 is $0.92 . The current dividend yield for Apple as of June 14, 2022 is 0.70% .

Apple Inc. (AAPL) Dividend History, Dates & Yield | Stock Analysis

AAPL News. 1 hour ago - Apple (AAPL) Likely to Launch Its VR Headset in Early 2023 - Zacks Investment Research 1 hour ago - Apple (AAPL) Watch Gets FDA Nod for Parkinson's Monitoring - Zacks Investment Research 3 hours ago - Forecast: Apple Music To Hit 110 Million Subscribers By 2025 - Forbes 3 hours ago - Apple's new 13-inch MacBook Pro with M2 chip goes on sale Friday - CNBC

MSFT Dividend Yield 2022, Date & History (Microsoft)

Is Microsoft (NASDAQ:MSFT) a good stock for dividend investors? View MSFT's dividend yield, history, and payment date at MarketBeat.

What is Apple's dividend yield?

When was Apple's most recent dividend payment?

The current dividend yield for Apple (NASDAQ:AAPL) is 0.55%. Learn more

What track record does Apple have of raising its dividend?

Apple's most recent quarterly dividend payment of $0.22 per share was made to shareholders on Thursday, February 10, 2022.

When did Apple last increase or decrease its dividend?

Apple (NASDAQ:AAPL) has increased its dividend for the past 11 consecutive years.

How much is the AAPL dividend in 2021?

The most recent change in Apple's dividend was an increase of $0.0150 on Wednesday, April 28, 2021.

Does Apple pay dividends?

AAPL Dividend 2021. While there are no guarantees for the future, we know that the company is currently paying $0.205 per quarter. Since the company currently pays a quarterly dividend (four times per year), we can assume the AAPL dividend for 2021 will be at least – $0.82.

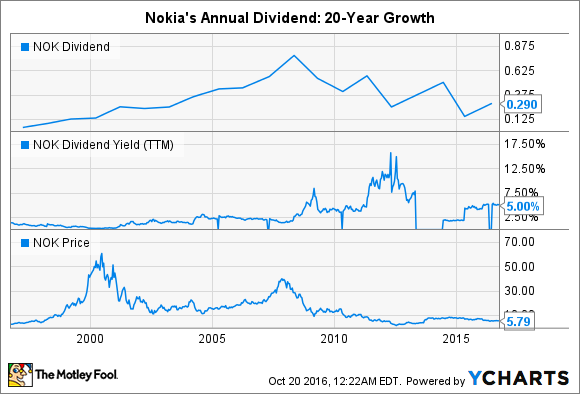

Does Apple have dividend growth?

You may be surprised, but yes Apple (ticker symbol – AAPL) does indeed pay a dividend. In fact, the company has been raising their dividend for 9 consecutive years (as of 2021) … which is impressive. Most dividend investors may point to blue chip companies like McDonald’s (MCD) or Procter & Gamble ...

2 AAPL Dividend Payouts Since Aug 09, 2012

However, income investors looking for future yield will begin to factor in the the dividend growth rates of a company like Apple. Higher dividend growth rates can offset a lower yield when it comes to building an income producing portfolio of stocks.

3 Apple Inc (AAPL) Dividend History

Do you want to know how often AAPL has been paying dividends? Here is your answer. Since Aug 09, 2012 there have been 39 dividend payouts.

4 Apple Inc (AAPL) Dividend Growth

Let us now check the historical payments since Aug 09, 2012 till Feb 04, 2022.

Conclusion: How To Assess A Stock Based On Dividends

The growth of dividends is a key metric in accessing companies that pay dividends. Below table shows the year on year growth rate of AAPL dividends.

Want to become a smart investor?

Some stocks pay dividends while others don't. Many investors believe, choosing a dividend paying stock helps with steady income apart from possible capital gains.

What is annualized dividend yield?

Netcials reports section helps you with deep insights into the performance of various assets over the years. We are constantly upgrading and updating our reports section. Feel free to access them. Do not forget to leave your feedback.

How to determine dividend reliability?

Dividend Yield is the relation between a stock’s Annualized Dividend and its current stock price. Click here to learn more. Annualized Dividend is a standard in finance that lets you compare companies that have different payout frequencies.

Is a high dividend yield risky?

A stock’s dividend reliability is determined by a healthy payout ratio that is higher than other stocks. A company that pays out close to half its earnings as dividends and retains the other half of earnings has ample room to grow its business and pay out more dividends in the future. Dividend Uptrend.

When did Apple pay dividends?

If a stock’s yield is above or near the market average then it will be rated higher within this parameter. High dividend yields (usually over 10%) should be considered extremely risky, while low dividend yields (1% or less) are simply not very beneficial to long-term investors. Dividend Reliability.

Will Apple do a stock split in 2020?

Apple paid a pretty consistent dividend from 1987 – 1995 but then took a significant hiatus, just to pick the dividend back up again in 2012 and pay it up to today, April 2021.

Is Apple a disruptor?

Not only did Apple do a stock split in 2020, but they also have done many other stock splits over the years: Stock splits are kinda cool despite there not being any true monetary change – I just think it’s fun to own more shares of a company! 100% psychological and no actual analysis, just opinion!

Is dividend guaranteed?

When you think about it, Apple really was a true disruptor (moving the world from CDs to MP3s), and anytime that you have a company like that, it’s going to take significant funding from the company, so paying out a dividend was just not in the cards.

How much does Apple pay in dividends?

1 – dividends are guaranteed return. Not in the sense that the dividend is guaranteed, but once you’re paid that dividend then it’s money that the company can never get back from you. Let me give you an example: You bought 10 shares of a company whose share price was $100/share for a total investment of $1,000.

What is the dividend payout ratio for Apple?

For the past three years, Apple's dividend payout ratio has stayed relatively steady. In both 2020 and 2019, the company paid out $14.1 billion in dividends, and in 2018 it paid $13.7 billion. In the meantime, its cash hoard of cash and cash equivalents remains relatively high at $38 billion. 6 7 2.

What is the dividend yield for Apple in 2021?

Its dividend payout ratio for the fiscal year 2020 was 25%, which is in line with what it was for 2018 and 2019. Apple's quarterly dividend grew by an annualized rate of 9.1% from the second quarter of 2016 to the second quarter of 2021.

Is Apple paying dividends in 2021?

As of July 18, 2021, Apple's dividend yield was 0.6%. During the second quarter of 2021, Apple paid a $0.22 per share dividend—this was a 7% increase from the $0.205 per share dividend paid in the first quarter. Its dividend payout ratio for the fiscal year 2020 was 25%, which is in line with what it was for 2018 and 2019.