What are trading halts and why do they occur?

Apr 11, 2019 · A stock halt, often referred to as a trading halt, is a temporary halt in the trading of a security. Usually, a stock halt is imposed for regulatory reasons, the anticipation of significant news, or to correct a situation in which there are excess of …

Why do stocks get halted?

Each halted stock is given a code indicating the reason for the halt, such as T1 for news pending or H5 for non-compliance with listing requirements. This …

When does trading get halted?

May 11, 2008 · Stocks are usually halted because there is some major piece of news expected out on the stock. The reason for the halt is so all investors learn of the information and have the ability to act accordingly at the same time.

When is a stock halted?

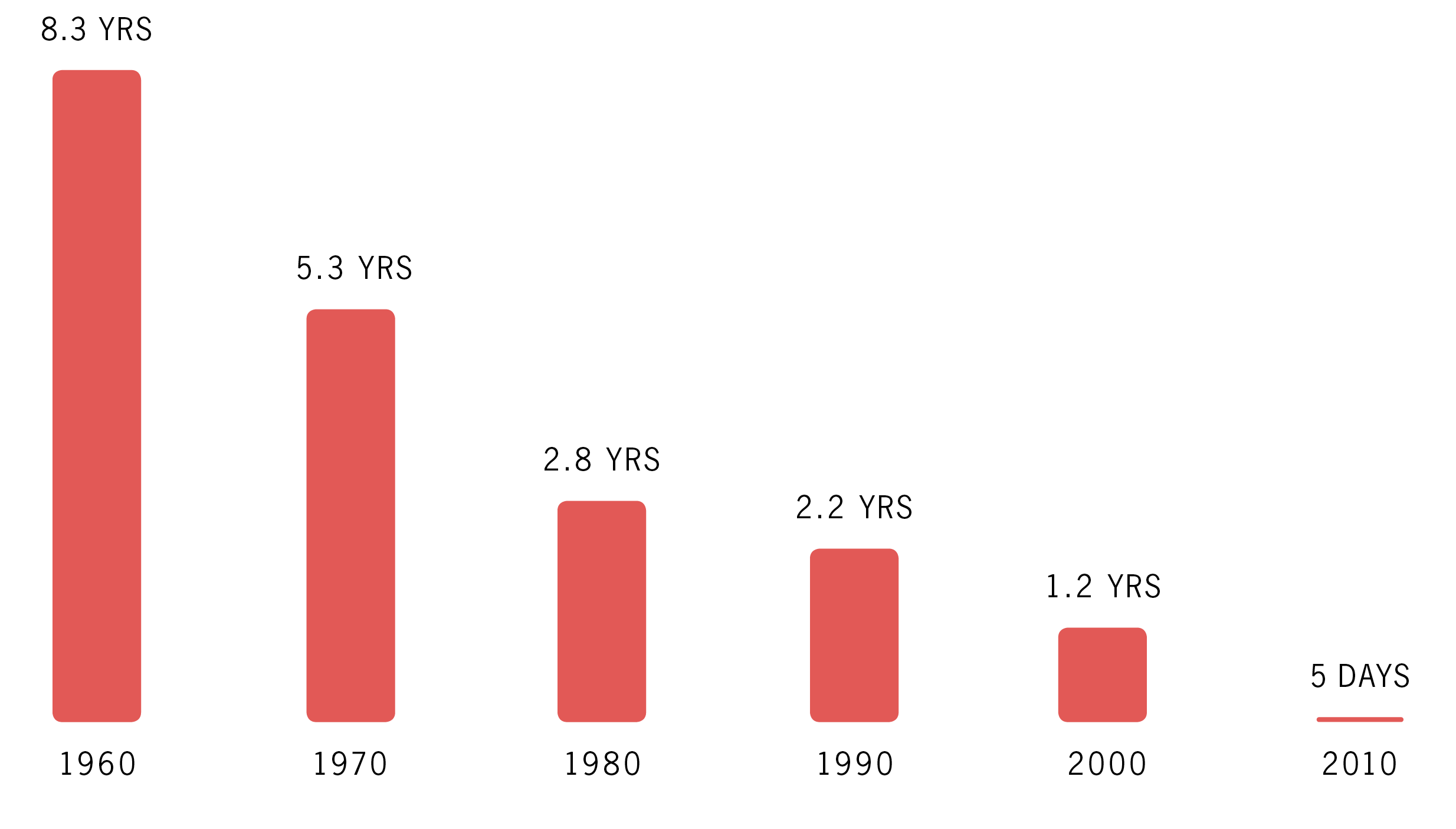

Apr 17, 2019 · Trading halts typically last 5 minutes. The SEC has the power to halt a stock up to 10 days if they feel they need to investigate a stock further. There are times the SEC feels that trading certain stocks is unsafe for the public. Usually this occurs when a company hasn’t filed its financial reports or statements.

Is it good when a stock is halted?

However, stock halts are actually used to protect investors and level the playing field between investors who are informed and reactive, and those who are simply not up to date on the news. The advantages of temporarily halting trading include: Allowing all market participants.

How long can a stock be halted from trading?

The halt, which can happen a few times a day per security if FINRA deems it, usually lasts for one hour, but is not limited to that. Trading halts can happen any time of day.

What happens after a stock is halted?

When trading is halted, the particular security will no longer be able to trade on the stock exchanges. It has been listed till the time the halt is lifted back. It means brokers and retail investors. They often take the services of online or traditional brokerage firms or advisors for investment decision-making.

Can you sell a halted stock?

Now, a stock called can be a pretty scary thing because when a stock is halted, you cannot buy or sell shares, so if you're in the stock while it's halted, you are literally stuck until it resumes trading, and when stocks are halted, between the time that they halt and the time they resume trading, they can open at a ...

What is a halt code on the NASDAQ?

The NASDAQ and Stock Halts. Whenever a stock is halted on the NASDAQ, as on other exchanges, the NASDAQ uses several halt code identifiers to specify in detail why the stock was halted. For example: T1: Halt – News Pending: Trading is halted pending the release of significant (or material) news. T2: Halt – News Released: Trading is halted ...

What is a stock halt?

A stock halt, often referred to as a trading halt, is a temporary halt in the trading of a security. Public Securities Public securities, or marketable securities, are investments that are openly or easily traded in a market. The securities are either equity or debt-based. . Usually, the halt is imposed for regulatory reasons, ...

What happened to Sundance Resources?

In 2010, in a tragic accident, six Australian mining executives went missing on a flight in Africa. Among those who were reported missing were the company’s CEO and the Chairman. Sundance Resources Ltd immediately requested that their stock be halted from trading on the Australian Stock Exchange to make sure that the news was properly circulated to market participants.

What does "drys" mean in stock trading?

The company, without notifying the exchange that it trades on, releases the information to the public. With material news on Company A released, the exchange that Company A trades on halts its stock to allow investors to take in and digest the new information. 1. NASDAQ: DRYS.

Why was Northview Apartments halted?

In June 2018, the stock of Northview Apartment Real Estate Investment Trust was halted due to the release of material news – the trust’s acquisition of a 623-unit portfolio of six apartment properties.

What is a REIT company?

Company A, a real estate investment trust (REIT)#N#Real Estate Investment Trust (REIT) A real estate investment trust (REIT) is an investment fund or security that invests in income-generating real estate properties . The fund is operated and owned by a company of shareholders who contribute money to invest in commercial properties, such as office and apartment buildings, warehouses, hospitals, shopping centers, student housing, hotels#N#, recently completed an acquisition of major properties in Canada. The company, without notifying the exchange that it trades on, releases the information to the public. With material news on Company A released, the exchange that Company A trades on halts its stock to allow investors to take in and digest the new information.

What are the two types of capital markets?

The capital markets consist of two types of markets: primary and secondary. This guide will provide an overview of all the major companies and careers across the capital markets. Giving other markets the opportunity to receive the news and halt trading of that stock on their own exchanges.

Why do exchanges halt trading?

To promote the equal dissemination of information, and fair trading based on that information, these exchanges may decide to halt trading temporarily, before such information is released. Material developments that warrant a trading halt can include changes that relate to a company’s financial stability, important transactions like restructurings ...

How does a halt work?

How a Trading Halt Works. A trading halt is most often instituted in anticipation of an announcement of news that will affect a stock’s price greatly, whether the news is positive or negative. There are thousands of stocks traded each day on public exchanges such as the New York Stock Exchange (NYSE) or the Nasdaq, ...

Why do we have a trading halt?

Trading halts are typically enacted in anticipation of a news announcement, to correct an order imbalance, as a result of a technical glitch, or due to regulatory concerns. When a trading halt is in effect, open orders may be canceled and options still may be exercised.

How long can the SEC suspend stock trading?

securities law also grants the Securities and Exchange Commission (SEC) the power to impose a suspension of trading in any publicly traded stock for up to 10 days. 1 The SEC will use this power if it believes that the investing public is put a risk by continued trading of the stock.

Why are stocks held at the opening?

There are three main reasons why a stock is held at the opening: New information is expected to be released by a company that may have considerable impact on its stock price; there is an imbalance between buy orders and sell orders in the market; or a stock does not meet regulatory listing requirements.

Why do companies wait until the market closes to release sensitive information to the public?

Companies will often wait until the market closes to release sensitive information to the public, to give investors time to evaluate the information and determine whether it is significant. This practice, however, can lead to a large imbalance between buy orders and sell orders in the lead-up to the market opening.

When does a level 1 circuit breaker stop trading?

A market decline that triggers a Level 1 or Level 2 circuit breaker before 3:25 p.m. Eastern time will halt trading for 15 minutes, but will not halt trading at or after 3:25 p.m. 3. Circuit breakers can also be imposed on single stocks as opposed to the whole market.

What is the trading halt code?

Trading Halt Code. The first thing a shareholder should do once their stock has been halted is identify the reason for the halt. Halts can be enacted by the exchange on which a stock is listed; the Securities and Exchange Commission; or they can be requested by the company itself if a major news event is imminent.

What happens when a stock is halted?

Once a stock is halted for pending news, the majority of the time the news will come either via a new SEC filing or a press release from the company or the exchange.

What happens when a stock is halted?

Many times, a stock that’s halted has had a parabolic move up. Once the halt is over, many times that stock then continues to rip up. As a result, you can make a nice scalp off those moves. Trading halts put a temporary stop to trading certain stocks. Many times they’re stocks that have a lot of volatility.

Why is the NASDAQ trading paused?

Trading has been paused by NASDAQ due to a 10% or more price move in the security in a five-minute period. (a Stock is moving too fast and the exchange pauses things to calm it down) T6. Halt – Extraordinary Market Activity.

How long does a stock stop trading last?

Trading halts typically last 5 minutes. The SEC has the power to halt a stock up to 10 days if they feel they need to investigate a stock further. There are times the SEC feels that trading certain stocks is unsafe for the public. Usually this occurs when a company hasn’t filed its financial reports or statements.

How long does volatility pause last?

Volatility pauses are 5 minutes. L.U.D.P stands for limit up, limit down by the way and are only triggered if the average price of the stock goes up or down more than 5% in 5 minutes time. There’s no time limit on some trading halts. That means it can last a couple months or forever, depending on the issue.. In fact, some stocks have halted and ...

What is a halt in trading?

A trading halt is the temporary suspension of trading for a particular security or securities at one exchange or across numerous exchanges for a specific amount of time. In other words, a halt puts a stop to trading for a period of time for an investigation.

How long does a stock stay halted?

Some stocks will stay halted for up to 6 months. If you’re in a stock that halts for that long, you have to wait for it to resume. There’s really nothing to be done. Many times however, trading halts resume within minutes. Open orders that haven’t been filled when a trading halt occurs can be canceled.

How long does a halt last?

There are times when a halt lasts much longer then 10 days though. That’s when your funds can be trapped in a halt. However, when a halt lasts longer than 10 days it’s referred to as a trading suspension. Make sure to find a service that isn’t pumping stocks that could cause a halt.

What happens if you trade on more than one stock exchange?

If a stock trades on more than one exchange, the trading halt applies to all of them. Brokers may not quote the stock price or trade the stock for their own accounts. When the exchange is prepared to lift the halt, it will notify brokers a few minutes beforehand.

What does it mean when a stock trades halt?

When an exchange imposes a trading halt, it issues an announcement that puts brokers and market makers on notice that trading in a particular stock has been suspended. If a stock trades on more than one exchange, the trading halt applies to all of them. Brokers may not quote the stock price or trade the stock for their own accounts. When the exchange is prepared to lift the halt, it will notify brokers a few minutes beforehand.

How long can the SEC suspend stock trading?

In addition to the individual exchanges, the Securities and Exchange Commission may also suspend trading of any U.S. security for up to 10 days. This often occurs when companies fail to follow statutory reporting requirements or fail to issue their annual and quarterly statements on time. The SEC can also halt trading if it suspects the company has issued false information, or there has been manipulation of the stock or fraud on the part of brokers or company management.

Why can't the SEC stop trading?

The SEC can also halt trading if it suspects the company has issued false information, or there has been manipulation of the stock or fraud on the part of brokers or company management.

What happens when a stock exchange calls a halt?

When a stock exchange calls a halt to trading of a stock, your broker will be unable to buy or sell any position in the shares. There are limited circumstances under which an exchange will call a halt, and a set of rules about when trading can resume. In rare instances, an entire stock exchange will halt trading.

Can a stock exchange suspend trading?

A stock exchange can suspend trading before or after the announcement of news expected to have a material effect, such as a pending merger or a change in key management. (Listed companies have an obligation to notify an exchange of important news before it is released.)

Does the New York Stock Exchange have a vested interest in keeping the flow orderly?

The New York Stock Exchange and the Nasdaq have a vested interest in keeping the flow orderly. Whenever major news is reported or trading orders go out of balance, investors can suffer unexpected financial losses and hold the exchange itself responsible. Therefore, under certain circumstances, the exchange has the option of halting trades.

What is the purpose of a trading halt?

The purpose of a trading halt is to pause the trading in anticipation of a major order imbalance and allow the market to digest the news.

Why do companies have trading suspensions?

The reasons can stem from concerns or investigations into a publicly traded company’s operations, financials, corporate structure, trading activity, filings or failure to meet certain regulatory ...

What is a trading halt?

A trading halt is implemented by the stock exchange, which pauses all trading in the security for a certain period of time. The length of time depends on the circumstances for the halt. The purpose of a trading halt is to pause the trading in anticipation of a major order imbalance and allow the market to digest the news.

What happens when a stock is halted?

When a stock is halted, trading is prohibited usually across all exchanges . During the halt, specialists and market makers determine the severity of the order imbalance to decide what price to re-open the trading at. In situations with significantly negative news (ie: lower earnings guidance), a stock may re-open at a dramatically lower price.

How long do halts last?

These types of halts can last from minutes to hours. Non-regulatory halts are like speed bumps that trigger when a stock breaches a price percentage move threshold either up or down too quickly. These halts are often referred to as “circuit breakers” and meant to pause the action to stabilize the order imbalance.

Why are companies delisted?

Companies are delisted when they fail to meet requirements for their respective exchange. The most stringent listing requirements are on the New York Stock Exchange (NYSE) also known as the Big Board. Companies on the NYSE must maintain a minimum requirement based either on a valuation or earnings basis.

Can you trade stocks that are delisted?

Stocks that are delisted from a major exchange (NYSE, NASDAQ, AMEX) can still trade on the Over-The-Counter Bulletin Board (OTCBB) market provided the financials are up-to-date and filed with the SEC. These types of stocks usually get delisted mainly due to failing to meet the minimal stock price requirement.

What does "halted" mean?

Halted usually means some type of serious news is pending, or some type or order imbalance market makers need to get hold of like WCG today it was down $75.00 .. It got raided by the FEDS..

Why is stock halted?

This is generally done to insure the timely dissemination of important information to everyone at the same time so that no one is able to gain an advantage via inside information (despite the fact that it is often trading in a range based on the data before the release as insider trading still runs rampant) It is 'halted' in the sense that it can't be traded until the press release is done and trading is resumed. The news can be anything from an earnings release to pending litigation against the company. Unless you are already in a position, it is best to wait a little while before trading once it is resumed as the specialist/market makers and big players like funds and institutional traders will often cause cut throat pricing as soon as it is resumed (whether up or down, depending on the release).

What does "unfit" mean in the military?

1. halt- disabled in the feet or legs; "a crippled soldier"; "a game leg". crippled, game, gimpy, halting, lame. unfit- not in good physical or mental condition; out of condition; "fat and very unfit"; "certified as unfit for army service"; "drunk and unfit for service".

What does "halt" mean?

halt. (hɔːlt) . n. 1. an interruption or end to activity, movement, or progress. 2. (Railways) chieflyBrita minor railway station, without permanent buildings. 3. call a halt to put an end (to something); stop.

How Does It Work?

- Stock halt is a rare scenario where a stock exchange will announce a prohibition on the trading of a particular share. During this phase, brokers will not be allowed to trade on the stock, i.e., bu...

- During exceptional events, an entire exchange may also halt from trading. The main purpose …

- Stock halt is a rare scenario where a stock exchange will announce a prohibition on the trading of a particular share. During this phase, brokers will not be allowed to trade on the stock, i.e., bu...

- During exceptional events, an entire exchange may also halt from trading. The main purpose is to match the demand and supply of the stock, i.e., to match the buyers and sellers for the particular s...

- Both NASDAQ and NYSE have got the best of their interest to keep the process of trading smooth and orderly. It is the motto of all exchanges around the world. Thus when there is some big and signif...

Examples of Stock Halt

- Few examples are as follows: You are free to use this image on your website, templates etc, Please provide us with an attribution linkHow to Provide Attribution?Article Link to be Hyperlinked For eg: Source: Stock Halt(wallstreetmojo.com)

Rules

- There are generally few scenarios when the trading halt takes place, and securities are coded with a unique identification number. When a share is halted from trading by exchange, it will issue an announcement to all the brokers and market about the suspension of the stock from trading. When a stock is trading at more than one exchange, the halt is applicable for all exchanges. Bro…

Triggers of Stock Halt

- The trading halt is primarily an effect of news and price volatility.

- When the price of a stock is changing, which is impacting its prices or 10% or more within five minutes, it is a situation when a stock halt scenario gets triggered, and an exchange can put a halt...

- The stock price can fluctuate up and down and get halted from trading due to frequent chang…

- The trading halt is primarily an effect of news and price volatility.

- When the price of a stock is changing, which is impacting its prices or 10% or more within five minutes, it is a situation when a stock halt scenario gets triggered, and an exchange can put a halt...

- The stock price can fluctuate up and down and get halted from trading due to frequent changes in volatility or circuit breaker scenarios. SEC can suspend many penny stocks from trading when they do...

- Also, a type of T12 halt is applied, which is considered a bad halt, for the share, which had traded a lot, but there was so ground reason for the long run. Generally, in these cases, when the halt...

Reasons For Halt

- Merger and acquisition.

- Important news or information, be it positive or negative, about the company in the market.

- SEC may impose regulatory imposition and prohibit the stock from doing business on rounds of doubt or fraudulent activities.

- An occasion when massive or materialistic changes happen to the financial health of the co…

- Merger and acquisition.

- Important news or information, be it positive or negative, about the company in the market.

- SEC may impose regulatory imposition and prohibit the stock from doing business on rounds of doubt or fraudulent activities.

- An occasion when massive or materialistic changes happen to the financial health of the company.

Advantages

- To provide the entire market participant to be aware of some vital information about a stock or security.

- To eradicate any kind of illegal practice of arbitragePractice Of ArbitrageArbitrage in finance means simultaneous purchasing and selling a security in different markets or other exchanges to gener...

- To provide the entire market participant to be aware of some vital information about a stock or security.

- To eradicate any kind of illegal practice of arbitragePractice Of ArbitrageArbitrage in finance means simultaneous purchasing and selling a security in different markets or other exchanges to gener...

- To provide other markets or exchanges, receive the news simultaneously.

- To protect investors from suffering substantial monetary losses.

Disadvantages

- There are specific scenarios when, after a halt is lifted, the share price comes plummeting down.

- A long halt may lead to losses in the form of interested investors to the share who lose the opportunity of trading.

- The investor is at a loss as they cannot buy the stock at rock bottom prices and profit from th…

- There are specific scenarios when, after a halt is lifted, the share price comes plummeting down.

- A long halt may lead to losses in the form of interested investors to the share who lose the opportunity of trading.

- The investor is at a loss as they cannot buy the stock at rock bottom prices and profit from the rise in the stock price.

Recommended Articles

- This article has been a guide to the stock halt and its definition. Here we discuss examples, rules, triggers, and how does stock halt work. You may learn more about financing from the following articles – 1. Program Trading 2. Stock Market Crash in 1987 3. Limit Order 4. Block Trade

What Is A Trading Halt?

How A Trading Halt Works

- A trading halt is most often instituted in anticipation of an announcement of news that will affect a stock’s price greatly, whether the news is positive or negative. There are thousands of stocks traded each day on public exchanges such as the New York Stock Exchange (NYSE) or the Nasdaq, and each of these companies agrees to pass on material information to the exchanges …

Trading Halts at Market Open

- Companies will often wait until the market closes to release sensitive information to the public, to give investors time to evaluate the information and determine whether it is significant. This practice, however, can lead to a large imbalance between buy orders and sell orders in the lead-up to the market opening. In such an instance, an exchangemay decide to institute an opening dela…

Exchange Circuit Breakers

- Stock exchanges can also take measures to ease panic selling by invoking Rule 48 and halting trading when markets have severe downward movements. Under 2012 rules, market-wide circuit breakers (or “curbs”) kick in when the Standard & Poor’s (S&P) 500 index drops 7% for Level 1; 13% for Level 2; and 20% for Level 3 from the prior day’s close. A market decline that triggers a L…