How do you calculate stock share price?

Jan 21, 2022 · To put it simply, the price of a stock is determined by supply and demand. If more people want the stock than the number of shares available, the price goes up. Conversely, when lots of people are looking to sell their shares, the price of the stock falls. If an investor sells when the stock is higher than the price they paid, they make a profit.

What is considered a good stock price?

Jan 16, 2018 · Generally speaking, the prices in the stock market are driven by supply and demand. This makes the stock market similar to other economic markets. When a stock is sold, a buyer and seller exchange...

What dictates stock price?

Jan 30, 2020 · For stocks traded on public stock exchanges, supply and demand for the company’s shares are a main component in determining the stock’s price at any point in the trading day. Demand is based on the...

What company has the lowest stock prices?

Mar 21, 2022 · It's the same principle for any commodity: The price is determined by supply and demand. What determines stock price Now let's get to the weighing machine part. Over the long term, stock prices are...

How is the share price calculated?

The calculation of stock price changes of a company is done using the market cap equation written below: The market cap of the company = number of...

Who decides the price of the stock of a company?

Stock prices are driven by a variety of factors, but ultimately the price at any moment is due to the supply and demand at that point on time in th...

When should you sell a stock?

The thumb-rule of selling a stock is to wait for it to break out of market capitalization and then acquire maximum profit when the share price reac...

What does a stock price tell you?

The stock price indicates the market value, true value, or the current value of the company that owns the shares. The price of the stock represents...

How long should you hold onto a stock?

Most Long term investors prefer to hold on to a stock for as long as it is profitable, which could for a few weeks. Truly long-term investors buy s...

What is the best time of day to buy a stock?

Investors suggest that Monday afternoon is almost always the most profitable hour for purchasing stocks and other securities at the stock market fo...

Understanding capital markets

To understand how share price is determined, it’s helpful to step back and consider what it means to buy a stock.

What determines stock price?

To put it simply, the price of a stock is determined by supply and demand. If more people want the stock than the number of shares available, the price goes up. Conversely, when lots of people are looking to sell their shares, the price of the stock falls. If an investor sells when the stock is higher than the price they paid, they make a profit.

What factors can affect stock price?

News and events happening at the company specifically, as well as the country or the market at large, can affect stock prices.

The bottom line

At the most basic level, the factor that determines stocks’ prices is supply and demand. Buyers and sellers trading via the market set the price. However, there are complex considerations of both the company’s performance and broader market forces that can affect that supply and demand.

How is a company's share price determined?

After a company goes public, and its shares start trading on a stock exchange, its share price is determined by supply and demand for its shares in the market. If there is a high demand for its shares due to favorable factors, the price will increase.

What happens when a stock is sold?

When a stock is sold, a buyer and seller exchange money for share ownership. The price for which the stock is purchased becomes the new market price. When a second share is sold, this price becomes the newest market price, etc.

How to calculate market cap?

Market cap is calculated by taking the current share price and multiplying it by the number of shares outstanding. For example, a company with 50 million shares and a stock price of $100 per share would have a market cap of $5 billion.

How is the market cap determined?

A company's market cap can be determined by multiplying the company's stock price by the number of shares outstanding. The stock price is a relative and proportional value of a company's worth.

Why is market capitalization inadequate?

Market capitalization is an inadequate way to value a company because the basis of it market price does not necessarily reflect how much a piece of the business is worth.

What is a DDM in stock market?

There are specific quantitative techniques and formulas that can be used to predict the price of a company's shares. Called dividend discount models (DDMs), they are based on the concept that a stock's current price equals the sum total of all its future dividend payments (when discounted back to their present value).

What is market cap?

While market cap is often used synonymously with a company's market value, it is important to keep in mind that market cap refers only to the market value of a company's equity , not its market value overall (which can include the value of its debt or assets).

What does the price of a stock mean?

The stock price indicates the market value, true value, or the current value of the company that owns the shares. The price of the stock represents the amount at which the stock shall get traded between the buyer and the seller in the stock market.

Why do stocks price at any moment?

Stock prices are driven by a variety of factors, but ultimately the price at any moment is due to the supply and demand at that point on time in the market. Buyers and sellers exchange the ownership of stocks with money. The purchase price of the stock becomes the stock’s price per share.

What is market sentiment?

Market sentiment refers to the overall attitude of investors toward a particular security or financial market. It is the feeling or tone of a market, or its crowd psychology, as revealed through the activity and price movement of the securities traded in that market. In broad terms, rising prices indicate bullish market sentiment, while falling prices indicate bearish market sentiment. Market sentiment is often subjective, biased, and obstinate. For example, you can make a solid judgment about a stock’s future growth prospects, and the future may even confirm your projections, but in the meantime, the market may myopically dwell on a single piece of news that keeps the stock artificially high or low. And you can sometimes wait a long time in the hope that other investors will notice the fundamentals. Some investors profit by finding stocks that are overvalued or undervalued based on market sentiment. They use various indicators to measure market sentiment to determine the best stocks to trade. Popular sentiment indicators include the CBOE Volatility Index (VIX), High-Low Index, Bullish Percent Index (BPI), and moving averages.

What is valuation multiple?

The valuation multiple expresses future expectations. It is based on the discounted present value of the future earnings stream, which is itself a function of inflation and the perceived risk of the stock. Factors that determine the valuation multiple includes: 1. The expected growth in the earnings base.

What factors determine the valuation multiple?

Factors that determine the valuation multiple includes: 1. The expected growth in the earnings base. 2. The discount rate used to calculate the present value of the future stream of earnings. A higher growth rate will earn the stock a higher multiple, but a higher discount rate will earn a lower multiple.

How does inflation affect the stock market?

The process of inflation in the business market often delays the sale volume of stocks and thereby driving down profits . It also results in a steep inclination in the interest rates that decreases the share price for shareholders.

How does bad performance affect stock prices?

If there are two or more companies competing in the same market, then the bad performance of one of the companies can drive up the stock prices of the other companies due to the rise in demand for the stocks of the other companies. Investors of the company that is not performing up to par shift to the stocks of the other companies. So, the performance of the companies in the industry affects the market conditions and, in turn, affects the stock prices.

What factors affect stock price?

Another factor that can affect stock price is company buybacks of stocks. Companies will sometimes buy back their own stock from investors, thereby reducing the supply of shares to the public. They do this in an attempt to increase stock prices. If companies issue more shares of stock, they are then increasing the supply, which can cause the price to decrease.

How is a stock valuation made?

The valuation of a stock is made by looking at the company’s past and projected earnings, large trades made by institutional investors, overall market trends of the S&P 500, and ratios and calculations made by analysts.

What is the current stock price?

If investors have reason to believe that a company will be successful in the future, they will invest in the company, causing the price of shares to increase. Similarly, if the outlook for a company doesn’t look good, investors may sell off the shares they own, causing the price to decrease.

What happens after an IPO?

After the IPO ends, the stock gets listed on stock exchanges and the price starts to fluctuate as shares get bought and sold —and supply and demand begin to play a role in share price.

What can influence the price of a stock?

The activity of large institutional investors can influence the price of the stock in terms of large trades they might execute. This might include large endowments or pension plans, mutual funds, hedge funds and others.

What is demand and supply in stock market?

For stocks traded on public stock exchanges, supply and demand for the company’s shares are a main component in determining the stock’s price at any point in the trading day. Demand is based on the number of traders and investors looking to buy shares. If the demand for a company’s shares is high this will tend to drive up the price.

What is the process of IPO?

When a company initially decides to issue stock that will be publicly available, they work with investment bankers who underwrite the initial issuance of the stock, known as an IPO or initial public offering. They establish an initial price for the stock offering and work to line up investors to buy the shares.

What is Gordon Growth Model?

The Gordon Growth Model is a dividend discount model using an assumption that a company that pays a dividend will continue to do so and places a value on the stock based on this assumption.

What do analysts look for in a company?

Analysts look at a company’s earning prospects as a primary factor in assigning a valuation to a company. While this doesn’t directly influence the price on a daily basis, many investors pay attention to the opinions of key analysts in making their investment decisions.

What is a market maker?

There are intermediaries called market makers on the exchanges and they play a role in most trades. When the demand for a stock is low, they can play a key role in moving the transaction forward and matching a buyer with a seller. TST Recommends. PRESS RELEASES.

Can you buy and sell shares on the secondary market?

Once the initial offering of the stock is complete, investors will be able to buy and sell these shares on the secondary market, meaning the various stock exchanges where the stock might be listed. The ability to trade shares provides shareholders with the liquidity they need should they desire to sell their shares. This is where the concept of the supply of and demand for the shares comes into play to influence the price.

How do stock prices work?

It starts with the initial public offering (IPO). Companies work with investment bankers to set a primary market price when a company goes public. That price is set based on valuation and demand from institutional investors.

What determines stock price

Now let's get to the weighing machine part. Over the long term, stock prices are determined by the earnings power of the business. Remember, a stock is a share of an actual business. The better the business does, the better the stock will do.

How market cap comes into play

The market cap of a stock is equal to the total shares times the share price. It's the price it would take to buy all of a company's outstanding shares. Many stocks issue more shares to fund the business, so it is important to base valuation on the market cap and not just the stock price.

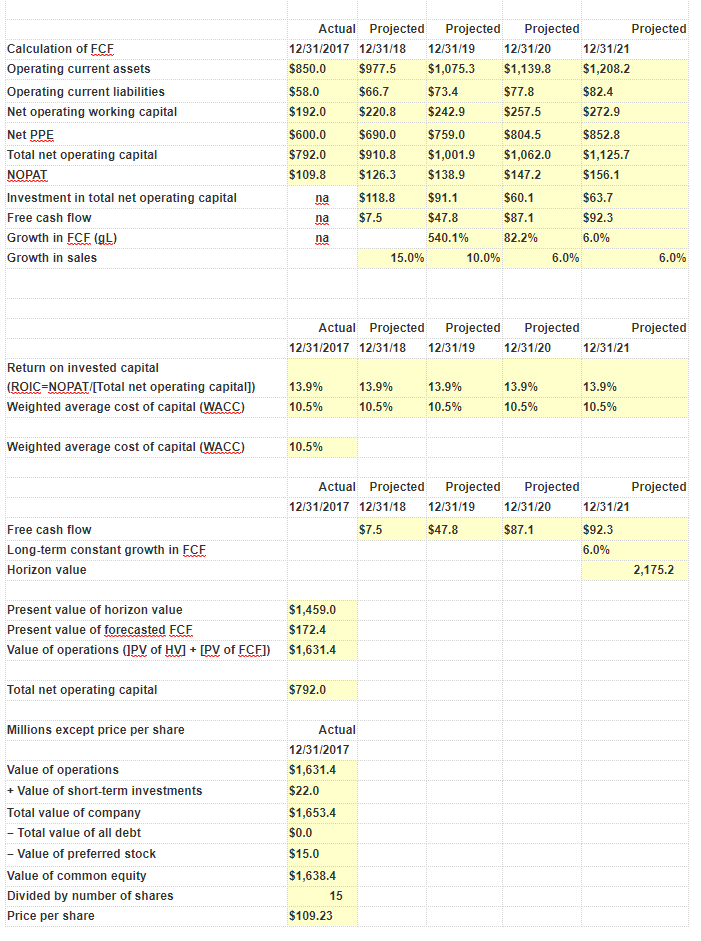

Example of a share price valuation

We don't have the space here to do a full-blown discounted cash flow analysis as Buffet would like, but we can use a shortcut. The price-earnings ratio (P/E) shows the price of the stock relative to earnings. It's calculated by dividing the stock price by earnings per share.

Conclusion

In the short term, the price of a stock is vulnerable to the emotional whims of the crowd. But, in the long term, smart investors can pinpoint where the emotions of the crowd set up opportunity. Focus on the long term in your investing, and don't let other people's emotions affect your investment decisions.

What factors contribute to the price of a stock?

There are five important factors that contribute to the pricing of any given publicly traded stock. Markets are forward thinking , therefore share price represents the forward value of a company. A solid understanding of these factors will help you to react prudently.

How to describe a stock's perception?

The general perception of a stock can be summarized through sentiment. A stock with negative sentiment can be trading at a discount to its value, whereas a stock with very positive sentiment can be trading at a large premium. Sentiment can be influenced when industry and sector leaders make the news.

What does float mean in stock market?

As mentioned above, supply and demand make the markets. The outstanding shares of a stock indicate the total issued supply of shares and the float represents the actual supply of the tradable shares. The float represents shares that are free trading and can be traded in the open market at any given time. The true trading float is the real mystery as there may only be a limited amount of buyers or sellers at any given time. When news or a fundamental catalyst is triggered, the trading float may expand or contract as each individual investor and fund has their own parameters for exiting or entering a position. During situations where volume expands dramatically, like an earnings miss or an FDA approval, the trading float may expand or contract just as dramatically.

Why is the public perception of pharmaceutical stocks so bearish?

For example, when the public perception turned sour on pharmaceutical stocks due to the sharp increase in certain medication prices , sentiment turned bearish. This has resulted in weak price performance. The media spurred Congress to further investigate drug-pricing practices, which continues to depress pharmaceutical companies.

What is the basic premise of stock pricing?

The basic premise of stock pricing is based on supply and demand. If there is more demand with less supply, the shares should rise in value. On the flip-side, if there is more supply and thinning demand, the shares should fall in value.

What are the fundamentals of a stock?

The fundamentals of a stock pertain to the financial performance of the underlying business. It serves to answer the age-old question of valuation: what is the intrinsic value of the company now and in the future? Although a company’s intrinsic value will not always align with its public valuation (stock price), it can still have an effect on supply and demand. For example, a company that appears to be undervalued, may have a higher demand. Therefore, there will be higher buying volume that can push the stock price up.

What is a trading float?

The true trading float is the real mystery as there may only be a limited amount of buyers or sellers at any given time. When news or a fundamental catalyst is triggered, the trading float may expand or contract as each individual investor and fund has their own parameters for exiting or entering a position.