Important Points

- Mid-cap is the concept or the term which is given to companies having a market capitalization between $2 billion and $10 billion.

- The portfolio of the investor should be well-diversified. ...

- The investors find the mid-caps appealing because it is expected they will grow in the future and increase the profits, share in the market, and productivity.

What are the best mid cap stocks?

The 4 Best Mid Cap Stocks to Buy Now

- Five Below (NASDAQ: FIVE)

- Clover Health (NASDAQ CLOV)

- Digital Turbine (NASDAQ: APPS)

- FuboTV (NYSE: FUBO)

What are some examples of mid cap stocks?

- Market value: $17.6 billion

- Dividend yield: 0.1%

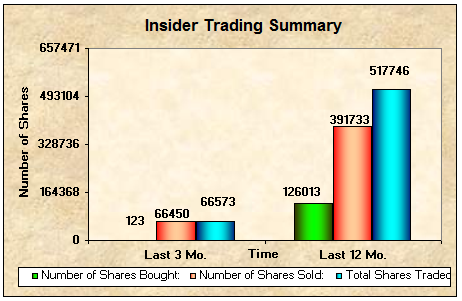

- StockReports+ scores: Earnings (10), Fundamental (10), Relative Valuation (1), Risk (7), Price Momentum (10), Insider Trading (8)

- Optimized total score: 10

What are examples of mid cap companies?

Example of the Mid-Cap Stocks. For example, Company XYZ Ltd. has the $ 1000,000 outstanding shares in the market, and the price of one share of the company is $4 per share. Market capitalization is the measure of the company’s market value, which is calculated by multiplying the outstanding number of shares of the company with its stock price.

How to analyze mid cap stocks?

- Fifth Third Bancorp (NASDAQ: FITB)

- Realty Income (NYSE: O)

- McDonald’s (NYSE: MCD)

- Automatic Data Processing (NASDAQ: ADP)

- Goldman Sachs (NYSE: GS)

- Disney (NYSE: DIS)

- Lowe’s (NYSE: LOW)

What qualifies as mid-cap stocks?

between $2 billion and $10 billionMid-cap is the term given to companies with a market cap (capitalization)—or market value—between $2 billion and $10 billion.

What is difference between large-cap and mid-cap?

According to SEBI, large caps are the top 100 companies in terms of market cap; mid caps are those companies that are ranked 101 to 250 and small caps are all the companies after number 251 in market cap. Large-cap mutual funds invest a larger proportion of their portfolio in large-cap companies.

What defines a small-cap stock?

Small-cap stocks are shares of companies with total market capitalization in the range of about $300 million to $2 billion. Small-cap companies have the potential for high rates of growth, making them appealing investments, though their stocks may experience more volatility and pose higher risks to investors.

What is considered a large-cap stock?

Large cap refers to a company with a market capitalization value of more than $10 billion. Also referred to as “big cap,” large cap describes a class of popular stocks preferred by investors for their stability.

How do I know if I have large cap or midcap?

SEBI established a rule in the year 2017, according to which companies that are ranked from 101 to 250 in terms of market capitalization are known as mid-cap companies. The market cap for these companies will be around Rs. 5000 to Rs. 20000 crores.

What is Blue Chip fund?

Large caps funds are also known as or coined as Blue chip funds. Blue chip mutual funds are a type of equity funds that primarily invest in equity and equity related securities of large cap companies that can be distinguished by adjectives such as large and well-established, renowned and prestigious.

How large is mid-cap?

about $2 billion to $10 billionMid-cap stocks are shares of companies with total market capitalization in the range of about $2 billion to $10 billion.

What is a penny stock or Pink Sheets?

Pink sheets are listings for stocks that trade over-the-counter (OTC). Pink sheet listings are not listed on a major U.S. stock exchange. Most pink sheet stocks are small-company penny stocks. Pink sheet stocks are highly risky due to a lack of regulatory oversight and low liquidity.

What companies are mid-cap?

Mid-cap stocks are companies with market capitalizations generally between $2 billion and $10 billion. As implied, in size they fall in the middle of small-cap and large-cap stocks.

Does money double every 7 years?

According to Standard and Poor's, the average annualized return of the S&P index, which later became the S&P 500, from 1926 to 2020 was 10%. At 10%, you could double your initial investment every seven years (72 divided by 10).

What is small/mid and large-cap?

Market capitalisation: Large-cap companies have a market cap of Rs 20,000 crore or more. Meanwhile, the market cap of mid-cap companies is between Rs 5,000 crore and less than Rs 20,000 crore. Small-cap companies have a market cap of below Rs 5,000 crore.

Is Coca Cola a blue chip stock?

For example, Coca-Cola is a blue chip company that might not suffer from a recession because many choose to drink its products, regardless of economic conditions. Blue chip companies are known to have very stable growth rates.

What is a mid cap stock?

Mid-cap stocks are shares of companies with total market capitalization in the range of about $2 billion to $10 billion. Along with large-cap stocks and small-cap stocks, mid-cap stocks are one of the three main stock categories and offer a compromise between the growth, risk and volatility tradeoffs of their larger and smaller counterparts.

What is market cap?

Market cap is equal to the price of a company’s stock multiplied by the number of shares outstanding. A company with 100 shares outstanding each worth $100, for example, would have a market cap of $10,000 (100 shares x $100).

Why is market cap important?

That’s why it can be useful to divvy up the stock market into large-, mid- and small-cap categories. Market cap also comes in handy for a few reasons: Index membership. Index providers use market cap data to decide which companies will be included in major benchmarks.

What is the market cap of a company in 2020?

As of August 2020, the median market cap of companies in this benchmark was nearly $3.9 billion. Russell Midcap Index. The Russell Midcap Index tracks nearly twice the number of companies—approximately 800—and is a subset of the larger Russell 1000 Index.

How much does a midcap company cost?

Mid-cap companies typically have a market value that ranges from approximately $2 billion to $10 billion. These companies usually have an established business model and foothold in their respective industries and may experience rapid growth as they expand market share.

What is a small cap company?

Small-cap companies typically have a narrower focus, offering a smaller number of products or services in fewer locations than mid-caps. Small-caps often become mid-caps as their businesses expand. Geography. It’s common for U.S.-based small- and mid-cap companies to operate primarily in the U.S.

Which is more risky, midcap or large cap?

Large-cap companies have more established business models, which typically means their stocks are less risky than mid-caps. Mid-cap companies that are expanding market share could see dramatic jumps in quarterly performance while the opposite may be true of companies that are struggling. Volatility.

What is a mid cap stock?

Mid-cap stocks are the shares of the public companies which have the market capitalization between $2 billion and $5 billion. According to some analysts, companies having the market capitalization of as large as the $10 billion are also considered to be the mid-cap.

Why are mid cap stocks underfollowed?

Stocks of the mid-cap companies are underfollowed in the stock market when compared with the large-cap stocks. It gives a huge opportunity to investors who make wise decisions for growing their investment at a great pace.

What is the market capitalization of XYZ?

Market capitalization is the measure of the company’s market value, which is calculated by multiplying the outstanding number of shares of the company with its stock price. So the market capitalization of Company XYZ Ltd. is $ 4000,000 ($ 1000,000 * $4). Since the market capitalization of the company XYZ ltd is $ 4 billion, which is between the ranges required for being the mid-cap stock company, i.e., between $ 1 billion to $ 10 billion, so the stocks of the Company XYZ ltd will be the mid-cap stocks.

How to calculate market capitalization?

Market capitalization is the measure of the company’s market value, which is calculated by multiplying the outstanding number of shares. Outstanding Number Of Shares Outstanding shares are the stocks available with the company's shareholders at a given point of time after excluding the shares that the entity had repurchased.

Why are mid cap companies not as stable as large cap companies?

The mid-cap companies are not as stable as the large-cap company as they do not have much capital so that they can last through any economic downturn coming making them riskier in the contraction phase of the business cycle. Also, usually, they are focused on one business type or market type, and in case the market disappears, then they will also have to shut down their operations.

What are the disadvantages of mid cap companies?

Disadvantages. The mid-cap companies are not as stable as the large-cap company as they do not have much capital so that they can last through any economic downturn coming making them riskier in the contraction phase of the business cycle.

Why is mid cap important in expansion phase?

expansion phase, mid-cap companies perform well as the growth of these companies is generally stable with the low-interest rates and cheap capital. Because of this, it becomes easy for the managers of the mid-cap to get low-cost loans whenever required in order to fulfill the rising demand.

What is a mid cap value?

What Is a Mid-Cap Value Stock? In finance, the term “mid-cap value stocks” refer to moderately-sized companies (by market capitalization) that are also perceived as an investment candidate by value investors based on fundamental analysis.

What type of funds do passive investors use?

On the other hand, more passive investors can also rely on third-party indexes, mutual funds, and exchange-traded funds (ETFs) which will allow to invest in a diversified portfolio of mid-cap value stocks using a single investment vehicle.

What is a mid cap stock?

Mid-cap stocks are shares of public companies with market capitalizations between $2 billion and $10 billion. 1 The market cap is the company's number of shares times the stock price. These are familiar companies that have good growth potential.

What are the mid cap companies?

Here's a list of some well-known mid-cap corporations: 1 3D Systems Corp: Market cap of $1.2 billion. Manufacturer of 3D printers. 2 Dollar Tree Inc .: Market cap of $24.3 billion. Discount retailer. 3 Nu Skin Enterprises: Market cap of $2.6 billion. Multilevel marketing personal care products. 4 Pitney Bowes: Market cap of $1.17 billion. The technology company is most known for its postage meters.

Is growth stable in mid cap?

Growth is stable while interest rates are still low and capital is cheap. As a result, mid-cap managers can get the low-cost loans they need to meet rising demand. They grow either through investment in capital equipment, mergers, or acquisitions. 2. Mid Cap Versus Small-Cap.

Is a mid cap company as stable as a large cap company?

A mid-cap company will not be as stable as a large-cap company. First, they don't have as much capital to last through a downturn. Therefore, they will be riskier in the contraction phase of the business cycle. Second, they are usually focused on one type of business or market. If that market disappears, they will too.

Do mid-size companies have low earnings?

They may enjoy running a mid-size firm. There are some with solid earnings but are in an unattractive segment of the stock market. As a result, they have a low price-to-earnings ratio. Even though their sales are strong, investors don't like their industry.

Can a mid cap company pay off?

If the switch is generous, you could gain a lot. 3. Mid Cap Versus Large-Cap. A mid-cap company will not be as stable as a large-cap company.

Why are stocks called midcap?

A stock is classified as mid-cap when the total value of all of the company's shares outstanding falls between $2 billion and $10 billion. Here’s how stocks are generally classified by market capitalization: Chart by Author. Category.

What are mid cap ETFs?

Not sure which individual mid-cap stock or stocks to pick? A mid-cap-focused exchange-traded fund (ETF) can help to diversify your portfolio by providing exposure to a wide range of mid-cap stocks. Two of our picks for mid-cap-focused ETFs are: 1 Vanguard Mid-Cap ETF ( NYSEMKT:VO ): This ETF tracks the performance of the CRSP US Mid Cap Index. This fund holds both growth- and value-oriented companies and contains 349 stocks in total. It pays a small dividend and is affordable, with an expense ratio -- the fund's annual management fee -- of just 0.04%. 2 iShares S&P Mid-Cap 400 ( NYSEMKT:IJK ): This fund invests specifically in mid-cap growth stocks. The ETF holds a basket of U.S. stocks (227 in total) with particularly high growth potentials but also relatively volatile share prices. This ETF is an inexpensive option, with an expense ratio of just 0.17% annually.

What happens if a company's stock price is not growing?

Profit growth: A stock's price tends to correlate with the company's profits. If a company's earnings are growing, then its stock price typically rises.

Is mid cap a household name?

Don't be surprised if you do not immediately know the name of every mid-cap stock that we highlight below. Some mid-cap companies are household names, but many aren't, especially those that operate in specialized industries.

Is a mid cap stock volatile?

While small-cap stocks are often fast-growing but volatile, and large-cap stocks tend to be relatively slow-growing but stable, the best mid-cap stocks are often somewhere in between. Mid-cap companies are both less volatile ...

Why are mid cap funds so popular?

Mid cap funds are one of the most popular choices of funds available because they fit the risk and growth potential of the average investor.

What is the cap of a company?

The “cap” portion of these terms is short for market cap or market capitalization. A company’s market cap is the total market value of a company. This is found by multiplying the stock price by the total outstanding shares of the company.

What are some small cap companies?

A few well known small cap companies include Buffalo Wild Wings, Pappa John’s Pizza, Revlon, and Boston Beer Co. A mutual fund or ETF categorized as a small cap fund will look to investmost of the funds money in small cap companies.

Is a large cap fund risky?

These funds tend to avoid the erratic swings in the day-to-day stock market. Though large cap funds still hold some risk as an investment, they are seen as less risky than a mid or small cap fund.

Do small cap funds take risk?

These funds will look for very high growth rates and in doing so will tend to take on much more risk than a large cap fund. These funds can be quite volatile and tend to over exaggerate the stock markets movements. When the stock market is doing well, small cap funds, generally, do much better. When the stock market is doing poorly, small cap ...

How to calculate market cap of mutual funds?

To calculate market cap, take the share price and multiply it by the number of shares outstanding (meaning shares that anyone can buy).

What to consider when investing in stocks?

One thing to consider is your own personal level of risk tolerance. Everyone’s asset allocation for stocks is going to be different based on the level of risk that they’re willing to take on. The first thing to consider is your allocation between stocks and bonds.

What is diversified portfolio?

Building a diversified portfolio means investing in a mix of large, stable corporations and smaller companies with growth potential. Here's what you need to understand about market capitalization and how it should inform your asset allocation strategy.

What is the minimum balance for M1 finance?

M1 charges no commissions or management fees, and their minimum starting balance is just $100. Visit Site

Do you have to pick a small company to invest in?

You don’t have to pick individual small companies to invest in. You immediately diversify yourself and invest in a basket of smaller companies. So while investing in a small-cap ETF or mutual fund can be riskier than investing in a large-cap fund, it’s a necessary element in a diversified portfolio.

Do small cap companies outperform large cap companies?

Lastly, small cap companies have the ability to outperform large cap companies. This doesn’t come without risk, though.

Is a large cap ETF a small cap company?

For example, a large-cap ETF will hold stock in only large-cap companies. There are a few other types of market caps you may see, but not as often.