Why did people buy stocks in the 1920s?

What actually happens during a stock market crash?

What are facts about the stock market crash?

On September 3, 1929, the Dow Jones Industrial Average reached a record high of 381.2. At the end of the market day on Thursday, October 24, the market was at 299.5 — a …

What is the worst stock market crash?

By then, production had already declined and unemployment had risen, leaving stocks in great excess of their real value. Among the other causes of the stock market crash of 1929 were low wages, the proliferation of debt, a struggling agricultural sector and an excess of large bank loans that could not be liquidated.

What day did the stock market crash 1920's?

On Black Monday, October 28, 1929, the Dow Jones Industrial Average declined nearly 13 percent. Federal Reserve leaders differed on how to respond to the event and support the financial system. The Roaring Twenties roared loudest and longest on the New York Stock Exchange.

What Caused crash of 1929?

The main cause of the Wall Street crash of 1929 was the long period of speculation that preceded it, during which millions of people invested their savings or borrowed money to buy stocks, pushing prices to unsustainable levels.

What caused Black Thursday?

Stock Market Crash of 1929 On October 24, 1929, as nervous investors began selling overpriced shares en masse, the stock market crash that some had feared happened at last. A record 12.9 million shares were traded that day, known as “Black Thursday.”

What caused Black Monday?

Key Takeaways. The "Black Monday" stock market crash of Oct. 19, 1987, saw U.S. markets fall more than 20% in a single day. It is thought that the cause of the crash was precipitated by computer program-driven trading models that followed a portfolio insurance strategy as well as investor panic.

What stocks survived the 1929 crash?

Coca-Cola , Archer-Daniels and Deere should like this history lesson.Oct 27, 2008

What were the three major reasons that led to the stock market crash?

Terms in this set (7)Uneven Distribution of Wealth. ... People were buying less. ... overproduction of goods and agriculture. ... Massive Speculation Based on Ignorance. ... Many stocks were bought on margin. ... Market Manipulation by a Small Group of Investors. ... Very Little Government Regulation.

What got us out of the Great Depression?

Mobilizing the economy for world war finally cured the depression. Millions of men and women joined the armed forces, and even larger numbers went to work in well-paying defense jobs. World War Two affected the world and the United States profoundly; it continues to influence us even today.

Who profited from the stock market crash of 1929?

While most investors watched their fortunes evaporate during the 1929 stock market crash, Kennedy emerged from it wealthier than ever. Believing Wall Street to be overvalued, he sold most of his stock holdings before the crash and made even more money by selling short, betting on stock prices to fall.Apr 28, 2021

How long did it take the stock market to recover after the 1929 crash?

Wall Street lore and historical charts indicate that it took 25 years to recover from the stock market crash of 1929.

What was the biggest stock market crash?

1. The Great Crash Of 1929. The stock market crash of 1929, also referred to as the Great Crash or the Wall Street crash of 1929, saw both a sudden as well as a steep decline in stock prices in the United States during late October that year.Feb 9, 2022

What happened to the market on October 19 1987?

It was a bear market, and everybody's stocks went down. The Dow on Monday dropped 507.99 points, a record single-day 22.61% decline, almost 10 percentage points worse than anything 1929 or Covid could deliver. The contagion crossed the globe; it's known as Black Tuesday in Australia and New Zealand.Oct 13, 2021

What led to the stock market crash of 1987?

Understanding the Stock Market Crash of 1987 Heightened hostilities in the Persian Gulf, a fear of higher interest rates, a five-year bull market without a significant correction, and the introduction of computerized trading have all been named as potential causes of the crash.

What was the value of the stock market in 1929?

On September 3, 1929, the Dow Jones Industrial Average reached a record high of 381.2. At the end of the market day on Thursday, October 24, the market was at 299.5 — a 21 percent decline from the high.

What caused the 1999 stock market crash?

A combination of rapidly increasing stock prices in the quaternary sector of the economy and confidence that the companies would turn future profits created an environment in which many investors were willing to overlook traditional metrics, such as the price–earnings ratio, and base confidence on technological …

What caused the stock market crash of 1973?

The crash came after the collapse of the Bretton Woods system over the previous two years, with the associated ‘Nixon Shock’ and United States dollar devaluation under the Smithsonian Agreement. It was compounded by the outbreak of the 1973 oil crisis in October of that year.

When was the last stock market crash?

When did the stock market crash? Most recently, the 2020 stock market crash began on March 9. The Dow Jones Industrial Average set three record point-loss drops within a week. On March 12, it fell a record 2,352.60 points to close at

What is the longest bear market in history?

Since World War II, bear markets have lasted about 13 months on average. The longest bear market, which began in 2000 after the dot-com bubble burst, lasted almost 31 months. The speed of the recovery from the bear market was also historic.

How much will stocks go down in 2020?

Stock market live Tuesday: Dow drops 410 points, down 23% in 2020, Worst first quarter ever. The market wrapped up a brutal quarter on Tuesday as investors searched for a bottom in the fastest bear market ever amid the coronavirus crisis.

Can I lose all my money in the stock market?

Due to the way stocks are traded, investors can lose quite a bit of money if they don’t understand how fluctuating share prices affect their wealth. For example, suppose an investor buys 1,000 shares in a company for a total of $1,000. Due to a stock market crash, the price of the shares drops 75%.

What happened to the stock market in the 1920s?

Unemployment soared to 19%, and the stock market collapsed to half its former high. Countless U.S. businesses went bankrupt during the recession at the beginning of the 1920s. But it did lower inflated prices, and fast. That fueled demand for exports, and foreign money flooded the country.

What made the 20s roar?

The major trends that caused it — innovations in manufacturing, the rise of automobiles, the electrification of America, mass marketing platforms such as radio, and loosening credit markets — were all poised to accelerate in the 1910s.

How many people died from the Spanish flu?

A shocking 50 million people worldwide died of the Spanish Flu, according to the CDC. America fared better than many nations, but still lost an estimated 675,000 people to the virus.

When was the assembly line invented?

Technically, Henry Ford invented the assembly line in 1913. But the practice didn’t spread and become mainstream until the 1920s. When it did, it revolutionized manufacturing. Suddenly, factories didn’t rely on a few high-skill workers that were difficult and expensive to train.

How many people were unemployed in 1931?

Two more mass bank runs followed in the spring and fall of 1931, when the unemployed grew to 6 million. Then a fourth and final major bank run hit in the fall of 1932. By then, 15 million Americans were unemployed — more than 20% of the workforce.

Did the federal government take a hands off approach to the recession?

Rather than slash interest rates or print more money, the federal government took a more hands-off approach to the recession. They feared the additional inflationary impact of another money printing spree so soon, and they instead forecast a relatively short but painful recession.

What was the stock market like in the 1920s?

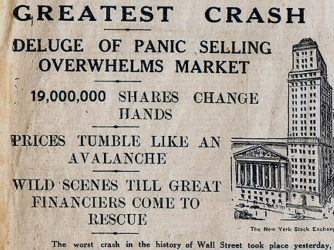

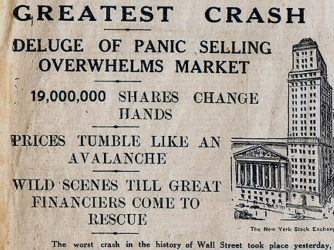

In This picture it is showing the stock market during the 1920s. The Roaring Twenties seemed to people as if it was a endless era of prosperity. In the 1920s, large number that continued to build up grew interest in Wall-Street and buying stocks.

What happened in 1929 in New York?

On Thursday the 24th of October 1929, the vice president of the New-York Stock Exchange and Broker for the House of Morgan, ...

How did the stock market crash of 1929 affect the economy?

To say that the Stock Market Crash of 1929 devastated the economy is an understatement. Although reports of mass suicides in the aftermath of the crash were most likely exaggerations, many people lost their entire savings. Numerous companies were ruined. Faith in banks was destroyed.

What was the worst day in the stock market?

Black Tuesday, October 29, 1929. Oct. 29, 1929, became famous as the worst day in stock market history and was called, "Black Tuesday.". There were so many orders to sell that the ticker again quickly fell behind. By the end of close, it was 2 1/2 hours behind real-time stock sales.

What happened on Black Tuesday 1929?

When the stock market took a dive on Black Tuesday, October 29, 1929, the country was unprepared. The economic devastation caused by the Stock Market Crash of 1929 was a key factor in the start of the Great Depression .

When did people start to get into the stock market?

By early 1929, people across the United States were scrambling to get into the stock market. The profits seemed so assured that even many companies placed money in the stock market. Even more problematic, some banks placed customers' money in the stock market without their knowledge.

When did the stock market reach its peak?

On Sept. 3, 1929, the stock market reached its peak with the Dow Jones Industrial Average closing at 381.17. Two days later, the market started dropping.

What was the end of World War I?

The end of World War I in 1919 heralded a new era in the United States. It was an era of enthusiasm, confidence, and optimism, a time when inventions such as the airplane and the radio made anything seem possible. Morals from the 19th century were set aside. Flappers became the model of the new woman, and Prohibition renewed confidence in the productivity of the common man.

What was the role of flappers in the 1920s?

In the 1920s, many invested in the stock market.

What happened to stock market in 1929?

Stock prices began to decline in September and early October 1929, and on October 18 the fall began. Panic set in, and on October 24, Black Thursday, a record 12,894,650 shares were traded. Investment companies and leading bankers attempted to stabilize the market by buying up great blocks of stock, producing a moderate rally on Friday. On Monday, however, the storm broke anew, and the market went into free fall. Black Monday was followed by Black Tuesday (October 29, 1929), in which stock prices collapsed completely and 16,410,030 shares were traded on the New York Stock Exchange in a single day. Billions of dollars were lost, wiping out thousands of investors, and stock tickers ran hours behind because the machinery could not handle the tremendous volume of trading.

What were the causes of the 1929 stock market crash?

Among the other causes of the stock market crash of 1929 were low wages, the proliferation of debt, a struggling agricultural sector and an excess of large bank loans that could not be liquidated.

What happened on October 29, 1929?

On October 29, 1929, Black Tuesday hit Wall Street as investors traded some 16 million shares on the New York Stock Exchange in a single day. Billions of dollars were lost, wiping out thousands of investors. In the aftermath of Black Tuesday, America and the rest of the industrialized world spiraled downward into the Great Depression (1929-39), ...

When did the stock market peak?

During the 1920s, the U.S. stock market underwent rapid expansion, reaching its peak in August 1929 after a period of wild speculation during the roaring twenties. By then, production had already declined and unemployment had risen, leaving stocks in great excess of their real value.

What happened after Black Tuesday?

In the aftermath of Black Tuesday, America and the rest of the industrialized world spiraled downward into the Great Depression (1929-39), the deepest and longest-lasting economic downturn in the history of the Western industrialized world up to that time .

When was the New York Stock Exchange founded?

The New York Stock Exchange was founded in 1817, although its origins date back to 1792 when a group of stockbrokers and merchants signed an agreement under a buttonwood tree on Wall Street.

What was the New Deal?

The relief and reform measures in the “ New Deal ” enacted by the administration of President Franklin D. Roosevelt (1882-1945) helped lessen the worst effects of the Great Depression; however, the U.S. economy would not fully turn around until after 1939, when World War II (1939-45) revitalized American industry.

What was the cause of the 1929 stock market crash?

Cause. Fears of excessive speculation by the Federal Reserve. The Wall Street Crash of 1929, also known as the Great Crash, was a major American stock market crash that occurred in the autumn of 1929. It started in September and ended late in October, when share prices on the New York Stock Exchange collapsed.

What happened to the stock market in 1929?

On September 20, 1929, the London Stock Exchange crashed when top British investor Clarence Hatry and many of his associates were jailed for fraud and forgery. The London crash greatly weakened the optimism of American investment in markets overseas: in the days leading up to the crash, the market was severely unstable.

How did the stock market crash of 1929 affect the world?

The stock market crash of October 1929 led directly to the Great Depression in Europe. When stocks plummeted on the New York Stock Exchange, the world noticed immediately. Although financial leaders in the United Kingdom, as in the United States, vastly underestimated the extent of the crisis that ensued, it soon became clear that the world's economies were more interconnected than ever. The effects of the disruption to the global system of financing, trade, and production and the subsequent meltdown of the American economy were soon felt throughout Europe.

When did the Dow Jones go up?

The largest percentage increases of the Dow Jones occurred during the early and mid-1930s. In late 1937, there was a sharp dip in the stock market, but prices held well above the 1932 lows. The Dow Jones did not return to the peak closing of September 3, 1929, until November 23, 1954.

What was the biggest stock crash in 1929?

The Great Crash is mostly associated with October 24, 1929, called Black Thursday, the day of the largest sell-off of shares in U.S. history, and October 29, 1929, called Black Tuesday, when investors traded some 16 million shares on the New York Stock Exchange in a single day.

When did the uptick rule start?

Also, the uptick rule, which allowed short selling only when the last tick in a stock's price was positive, was implemented after the 1929 market crash to prevent short sellers from driving the price of a stock down in a bear raid.

What was the Roaring 20s?

The " Roaring Twenties ", the decade following World War I that led to the crash, was a time of wealth and excess. Building on post-war optimism, rural Americans migrated to the cities in vast numbers throughout the decade with the hopes of finding a more prosperous life in the ever-growing expansion of America's industrial sector.

What were the effects of the 1929 stock market crash?

The prosperous decade leading up to the stock market crash of 1929, with easy access to credit and a culture that encouraged speculation and risk-taking, put into place the conditions for the country’s fall. The stock market, which had been growing for years, began to decline in the summer and early fall of 1929, precipitating a panic that led to a massive stock sell-off in late October. In one month, the market lost close to 40 percent of its value. Although only a small percentage of Americans had invested in the stock market, the crash affected everyone. Banks lost millions and, in response, foreclosed on business and personal loans, which in turn pressured customers to pay back their loans, whether or not they had the cash. As the pressure mounted on individuals, the effects of the crash continued to spread. The state of the international economy, the inequitable income distribution in the United States, and, perhaps most importantly, the contagion effect of panic all played roles in the continued downward spiral of the economy.

How much did the stock market lose in 1929?

Between September 1 and November 30, 1929, the stock market lost over one-half its value, dropping from $64 billion to approximately $30 billion. Any effort to stem the tide was, as one historian noted, tantamount to bailing Niagara Falls with a bucket.

How to explain the stock market crash?

By the end of this section, you will be able to: 1 Identify the causes of the stock market crash of 1929 2 Assess the underlying weaknesses in the economy that resulted in America’s spiraling from prosperity to depression so quickly 3 Explain how a stock market crash might contribute to a nationwide economic disaster

Why did banks fail?

Many banks failed due to their dwindling cash reserves. This was in part due to the Federal Reserve lowering the limits of cash reserves that banks were traditionally required to hold in their vaults, as well as the fact that many banks invested in the stock market themselves.

What was Hoover's agenda?

Upon his inauguration, President Hoover set forth an agenda that he hoped would continue the “Coolidge prosperity ” of the previous administration. While accepting the Republican Party’s presidential nomination in 1928, Hoover commented, “Given the chance to go forward with the policies of the last eight years, we shall soon with the help of God be in sight of the day when poverty will be banished from this nation forever.” In the spirit of normalcy that defined the Republican ascendancy of the 1920s, Hoover planned to immediately overhaul federal regulations with the intention of allowing the nation’s economy to grow unfettered by any controls. The role of the government, he contended, should be to create a partnership with the American people, in which the latter would rise (or fall) on their own merits and abilities. He felt the less government intervention in their lives, the better.

How many shares were traded on Black Tuesday?

On Black Tuesday, October 29, stock holders traded over sixteen million shares and lost over $14 billion in wealth in a single day. To put this in context, a trading day of three million shares was considered a busy day on the stock market. People unloaded their stock as quickly as they could, never minding the loss.

When did the Dow Jones Industrial Average peak?

As September began to unfold, the Dow Jones Industrial Average peaked at a value of 381 points, or roughly ten times the stock market’s value, at the start of the 1920s.

The Leadup to The Roaring ‘20s

- The boom and bust cycles of the 1920s didn’t occur in a vacuum. To understand what happened, you first have to understand the context.

What Made The ‘20s Roar

- In some ways, the economic expansion of the 1920s was inevitable. The major trends that caused it — innovations in manufacturing, the rise of automobiles, the electrification of America, mass marketing platforms such as radio, and loosening credit markets — were all poised to accelerate in the 1910s. Then WWI interrupted the country’s economic trends, and the aftermath of the war…

The Crash

- The stock market did so well in the 1920s that Wall Street became a place of unbridled speculation. Everyone from CEOs to janitors threw their savings into stocks, with no cash emergency fund or preparedness for market downturns. When one finally came in 1929, the world panicked. Never mind that there had just been an enormous bear market only eigh...

Final Word

- The same economic policies that pulled the U.S. out of the post-pandemic and post-WWI recession eventually overheated the economy, creating a financial bubble like the world had never seen. Economists and laypeople alike continue to argue the role of the government to regulate the economy. How much regulation is ideal? Where’s the balance between keeping taxes low to spu…