What is the worst stock market crash?

The worst stock market crash in history started in 1929 and was one of the catalysts of the Great Depression. The crash abruptly ended a period known as the Roaring Twenties, during which the economy expanded significantly and the stock market boomed.

What actually happens during a stock market crash?

The stock market crash of 1987 was a steep decline in U.S. stock prices over a few days in October of 1987; in addition to impacting the U.S. stock market, its repercussions were also observed in other major world stock markets.

What was the exact date the stock market crashed?

The stock market crash of 1929—considered the worst economic event in world history—began on Thursday, October 24, 1929, with skittish investors trading a record 12.9 million shares.

When was the last market crash?

Though the market was ’saved’ from a disastrous month during the last two trading days in January 2022, the results were nonetheless atrocious. Market crashes don’t necessarily have to happen in a day, week, or month. After the mid-month holiday ...

What day of the week did the stock market crash in 2008?

September 2008 On Friday, September 19, 2008, the Dow ended the week at 11,388.44. 2 It was only slightly below its Monday open of 11,416.37. 15 The Fed established the Asset-Backed Commercial Paper Money Market Mutual Fund Liquidity Facility.

How long did the stock market crash last 2008?

The US bear market of 2007–2009 was a 17-month bear market that lasted from October 9, 2007 to March 9, 2009, during the financial crisis of 2007–2009.

How long did the 2008 bear market last?

Start and End Date% Price DeclineLength in Days10/9/2007–11/20/2008-51.934081/6/2009–3/9/2009-27.62622/19/2020–3/23/2020-33.9233Average-35.6228923 more rows

What day did the stock market crash?

October 1929. On Black Monday, October 28, 1929, the Dow Jones Industrial Average declined nearly 13 percent. Federal Reserve leaders differed on how to respond to the event and support the financial system. The Roaring Twenties roared loudest and longest on the New York Stock Exchange.

Who is to blame for the Great Recession of 2008?

The Biggest Culprit: The Lenders Most of the blame is on the mortgage originators or the lenders. That's because they were responsible for creating these problems. After all, the lenders were the ones who advanced loans to people with poor credit and a high risk of default. 7 Here's why that happened.

How long did it take stocks to recover after 2008?

two years2008: In response to the housing bubble and subprime mortgage crisis, the S&P 500 lost nearly half its value and took two years to recover. 2020: As COVID-19 spread globally in February 2020, the market fell by over 30% in a little over a month.

Are we in a bear market 2022?

The stock market's slump this year briefly pulled the S&P 500 into what's known as a bear market Friday, before a late rally put the index in the green. May 20, 2022, at 4:46 p.m. NEW YORK (AP) — The bear came close to Wall Street but then backed off.

What stocks did well during 2008 crash?

Top 10 Stocks in the S&P 500 by Total Return During 2008Company Name (Ticker)1-Year Total ReturnIndustryWalmart Inc. (WMT)20.0%Discount StoresEdwards Lifesciences Corp. (EW)19.5%Medical DevicesRoss Stores Inc. (ROST)17.6%Apparel Retail7 more rows

What firm started the 2008 financial crisis?

Lehman BrothersMany point to Sept. 15, 2008 — the day Lehman Brothers, then the nation's fourth-largest investment bank, filed for bankruptcy — as a turning point in the crisis. After galloping to the rescue of other major financial institutions, the federal government drew the line with Lehman, allowing the firm to collapse.

What caused Black Tuesday?

Black Tuesday marked the beginning of the Great Depression, which lasted until the beginning of World War II. Causes of Black Tuesday included too much debt used to buy stocks, global protectionist policies, and slowing economic growth.

Why is it called Black Tuesday?

A crowd of investors gather outside the New York Stock Exchange on "Black Tuesday"—October 29, when the stock market plummeted and the U.S. plunged into the Great Depression. On October 29, 1929, the United States stock market crashed in an event known as Black Tuesday.

What was Black Thursday during the Great Depression?

On October 24, 1929, as nervous investors began selling overpriced shares en masse, the stock market crash that some had feared happened at last. A record 12.9 million shares were traded that day, known as “Black Thursday.”

The Best And Worst Stocks Of The 2008 Crash: What We Learned

The Fall of the Market in the Fall of 2008 - Investopedia

What was the financial crisis of 2008?

The 2008 financial crisis had its origins in the housing market, for generations the symbolic cornerstone of American prosperity. Federal policy conspicuously supported the American dream of homeownership since at least the 1930s, when the U.S. government began to back the mortgage market. It went further after WWII, offering veterans cheap home loans through the G.I. Bill. Policymakers reasoned they could avoid a return to prewar slump conditions so long as the undeveloped lands around cities could fill up with new houses, and the new houses with new appliances, and the new driveways with new cars. All this new buying meant new jobs, and security for generations to come.

What was the Commodity Futures Modernization Act of 2000?

Congress gave them one way to do so in 2000, with the Commodity Futures Modernization Act, deregulating over-the-counter derivatives—securities that were essentially bets that two parties could privately make on the future price of an asset. Like, for example, bundled mortgages.

Why did the stock market crash in 2008?

The stock market crashed in 2008 because too many had people had taken on loans they couldn’t afford. Lenders relaxed their strict lending standards to extend credit to people who were less than qualified. This drove up housing prices to levels that many could not otherwise afford.

What was the impact of the 2008 stock market crash?

The stock market crash of 2008 was a result of a series of events that led to the failure of some of the largest companies in U.S. history. As the housing bubble burst, it affected banks and financial institutions who were betting on the continued increase in home prices.

How did the bailout affect the Dow Jones?

Each bailout announcement affected the Dow Jones, sending it tumbling as markets responded to the financial instability. The Fed announced a bailout package, which temporarily bolstered investor confidence. The bank bailout bill made its way to Congress, where the Senate voted against it on September 29, 2008.

Why did Lehman Brothers collapse?

In September 2008, investment firm Lehman Brothers collapsed because of its overexposure to subprime mortgages. It was the largest bankruptcy filing in U.S. history up to that point. Later that month, the Federal Reserve announced yet another bailout.

What was the unemployment rate in 2007?

The economy continued to lose hundreds of thousands of jobs, and the unemployment rate peaked at 10 percent, double the December 2007 national unemployment rate of 5 percent. Three of the biggest automakers (known as the Big Three) were in trouble and asked the government for help.

What was the Great Recession?

Between late 2007 and mid-2009, the period widely referred to as the “Great Recession,” the economy lost nearly 8.7 million jobs. Consumers cut spending to a level not seen since World War II. Many experienced a sharp decline in retirement savings, which compounded unemployment and housing instability.

When did the housing market slow down?

While the housing market slowed down in 2007, many missed the warning bells of the impending recession. The World Bank sounded the alarm in January 2008 when it predicted that global economic growth would slow down as a result of the credit crunch. Few envisioned the severity of the market crash of 2008 or the steep economic decline caused by ...

Why did the stock market crash in 2008?

In all, the stock market crash 2008 as a result of a series of events that eventually led to the failure of some of the largest companies in the US.

What was the impact of the 2008 stock market crash?

There is no doubt behind the saying, that the crash pushed the banking system towards the edge of collapse.

What was the Dow value in September 2008?

The day was ended at the Dow value of 11,388.44. On September 20, 2008, the bank bailout bill was sent to Congress by Secretary Paulson and Federal Reserve Chair. The Dow fell to 777.68 points during the intraday trading that increased panic in the Global Market.

How many points did the Dow drop in 2008?

By September 17, 2008, the Dow fell by 446.92 points. By the end of the week on September 19, 2008, the Fed established the Asset-Backed Commercial Paper Money Market Mutual Fund Liquidity Facility that committed to offer loans to banks to buy Commerical paper from the money market funds.

How much did the Fed lose from Lehman Brothers?

By making $85 billion loans for 79.9% equity the Fed took ownership of the AIG. With the collapse of Lehman Brothers, there was a loss of $196 billion that increased the panic among many businesses. Bank has driven up the rates as they were afraid to lend money. By September 17, 2008, the Dow fell by 446.92 points.

What was the fourth cause of the 2008 financial crisis?

The fourth cause of the crash of 2008 was found to be the depression era Glass Steagall Act (1933) that allowed banks, securities firms and other insurance companies to enter into each other’s markets resulting in the formation of the bank that was too big to fail.

What were the causes of the Federal Reserve's crash?

Some of the top reasons for the crash are: Mild Recession in the Federal Reserve. Federal Reserve the Central Bank was facing a mild recession since 2001. The recession period resulted in the reduction of the federal funds rate from 6.5 to 1.75 from May 2000 to December 2001.

What happened in 2008?

By the fall of 2008, borrowers were defaulting on subprime mortgages in high numbers, causing turmoil in the financial markets, the collapse of the stock market, and the ensuing global Great Recession.

How much did the Dow drop in 2008?

The Dow would plummet 3,600 points from its Sept. 19, 2008 intraday high of 11,483 to the Oct. 10, 2008 intraday low of 7,882. The following is a recap of the major U.S. events that unfolded during this historic three-week period.

How much credit did Fannie Mae and Freddie Mac extend in 2002?

As of 2002, government-sponsored mortgage lenders Fannie Mae and Freddie Mac had extended more than $3 trillion worth of mortgage credit. In his 2002 book Conquer the Crash, Prechter stated, "confidence is the only thing holding up this giant house of cards.". 2 .

What bank did the FDIC take over?

After a 10-day bank run, the Federal Deposit Insurance Corporation (FDIC) seizes Washington Mutual, then the nation's largest savings and loan, which had been heavily exposed to subprime mortgage debt. Its assets are transferred to JPMorgan Chase (JPM). 8

When did the subprime mortgage market start?

Read on to learn how the explosive growth of the subprime mortgage market, which began in 1999, played a significant role in setting the stage for the turmoil that would unfold just nine years later in 2008 when both the stock market and housing market crashed.

When did consumer debt hit $2 trillion?

In 2004, consumer debt hit $2 trillion for the first time. Howard S. Dvorkin, president and founder of Consolidated Credit Counseling Services Inc., a nonprofit debt management organization, told the Washington Post at the time, "It's a huge problem.

What bank bought Merrill Lynch?

Panic ensued in the money market fund industry, resulting in massive redemption requests. On the same day, Bank of America (BAC) announced it was buying Merrill Lynch, the nation's largest brokerage company.

What happened in 2008?

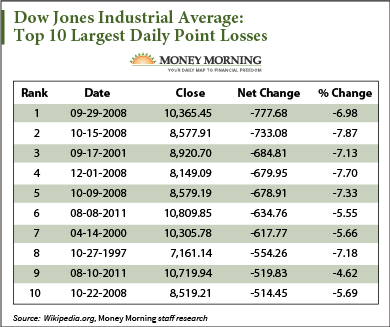

The market crash of 2008 began with the Dow's 777.68-point drop on Sept.29, 2008. At that time, it was the biggest point drop in the history of the New York Stock Exchange. It fell from 11,143.13 to 10,365.45, a 7% decline. Investors panicked when the Senate voted against the bailout bill. Without government intervention, other banks would follow Lehman Brothers into bankruptcy. The Dow lost more than 50% of its value between its 2007 peak and its bottom in March 2008,

When did the NASDAQ crash?

The dot-com crash occurred in the NASDAQ starting in March 2000. The tech#N#index reached a peak of 5,048.62 on March 10, 2000. On April 3, it fell 7.6% or 349.15 points. It fell 7.1% on April 12, 9.7% on April 14, and 7.2% on April#N#18. It also had significant declines on May 30 (7.9%), Oct. 13 (7.9%), and#N#Oct.19 (7.8%). The worst crash of the year was on Dec.5, when it fell#N#10.5%. On Dec. 20, it declined 7.1%. The NASDAQ ended the year at 2,470.52, losing 51.1% of its value from its peak.

How much did the Dow drop in February 2018?

In February 2018, the Dow dropped 2,270.96 points in three trading days. On Feb. 5, it lost 1,175.21 points by the end of the day, the biggest point loss in history. It had plummeted 1,600 in intra-day trading. Many felt that it was computer programs run amok. Despite all that, it was an 8.5% decrease, not quite a crash.

Why did the dot com crash happen?

The dot-com crash was caused by investors who created a bubble in high-tech stock prices. They thought all tech companies were guaranteed money makers. They didn't realize that tech's corporate profits were caused by the Y2K scare.

What happened on Black Monday 1987?

Black Monday, the crash of 1987, occurred on Oct.19,1987. The Dow dropped 22.6% which is the largest one-day percentage loss in stock market history. It took two years before the market returned to pre-crash levels. The crash followed a 43% increase earlier that year. Three factors caused it.

What happened to Lehman Brothers in 2008?

Without government intervention, other banks would follow Lehman Brothers into bankruptcy. The Dow lost more than 50% of its value between its 2007 peak and its bottom in March 2008, The Dow fell 680 points on Dec. 1, 2008. It was an 8% drop, from 8,829.04 to 8,149.09.

How much did the Dow lose in March 2020?

1929 Black Monday slide of 12.8% for one session. By the last day of March 2020, the Dow had closed down 13.74% for the month, its worst month since October 2008.

What happened to the stock market after the 1929 crash?

After the crash, the stock market mounted a slow comeback. By the summer of 1930, the market was up 30% from the crash low. But by July 1932, the stock market hit a low that made the 1929 crash. By the summer of 1932, the Dow had lost almost 89% of its value and traded more than 50% below the low it had reached on October 29, 1929.

What is a stock crash?

Stock Market Crash is a strong price decline across majority of stocks on the market which results in the strong decline over short period on the major market indexes (NYSE Composite, Nasdaq Composite DJIA and S&P 500).

How much wealth was lost in the 2000 crash?

The Crash of 2000. A total of 8 trillion dollars of wealth was lost in the crash of 2000. From 1992-2000, the markets and the economy experienced a period of record expansion. On September 1, 2000, the NASDAQ traded at 4234.33. From September 2000 to January 2, 2001, the NASDAQ dropped 45.9%.

What happened in 1987?

The Crash of 1987. During this crash, 1/2 trillion dollars of wealth were erased. The markets hit a new high on August 25, 1987 when the Dow hit a record 2722.44 points. Then, the Dow started to head down. On October 19, 1987, the stock market crashed. The Dow dropped 508 points or 22.6% in a single trading day.

How much did the Dow drop in 1987?

On October 19, 1987, the stock market crashed. The Dow dropped 508 points or 22.6% in a single trading day. This was a drop of 36.7% from its high on August 25, 1987.

How much wealth was lost in the 1929 stock market crash?

The Crash of 1929. In total, 14 billion dollars of wealth were lost during the market crash. On September 4, 1929, the stock market hit an all-time high. Banks were heavily invested in stocks, and individual investors borrowed on margin to invest in stocks.

When did banks go out of business?

When these banks started to invest heavily in the stock market, the results proved to be devastating, once the market started to crash. By 1932, 40% of all banks in the U.S. had gone out of business.

2007

2008

- At the end of January, the BEA revised its fourth-quarter 2007 GDP growth estimate down.9 It said growth was only 0.6%. The economy lost 17,000 jobs, the first time since 2004.10 The Dow shrugged off the news and hovered between 12,000 and 13,000 until March.2 On March 17, the Federal Reserve intervened to save the failing investment bank, Bear Stearns. The Dow dropped …

September 2008

- The month started with chilling news. On Monday, September 15, 2008, Lehman Brothers declared bankruptcy. The Dow dropped more than 200 points.2 On Tuesday, September 16, 2008, the Fed announced it was bailing out insurance giant American International Group Inc. It made an $85 billion loan in return for 79.9% equity, effectively taking ownership. AIG had run out of cash. It wa…

November 2008

- The month began with more bad news. The Labor Department reported that the economy had lost a staggering 240,000 jobs in October.34 The AIG bailout grew to $150 billion.35 The Bush administration announced it was using part of the $700 billion bailouts to buy preferred stocks in the nations' banks.36 The Big Three automakers asked for a federal bailout. By November 20, 20…

December 2008

- The Fed dropped the fed funds rate to 0%, its lowest level in history.29 The Dow ended the year at a sickening 8,776.39, down almost 34% for the year.2

2009

- On January 2, 2009, the Dow climbed to 9,034.69.2 Investors believed the new Obama administration could tackle the recession with its team of economic advisers. But the bad economic news continued. On March 5, 2009, the Dow plummeted to its bottom of 6,594.44.37 Soon afterward, President Barack Obama's economic stimulus plan instilled the confidence nee…

Aftermath

- Investors bore the emotional scars from the crash for the next four years. On June 1, 2012, they panicked over a poor May jobs report and the eurozone debt crisis. The Dow dropped 275 points.39 The 10-year benchmark Treasury yield dropped to 1.47.40 This yield was the lowest rate in more than 200 years.41It signaled that the confidence that evaporated during 2008 had not q…

The Bottom Line

- The stock market crash of 2008 was a result of defaults on consolidated mortgage-backed securities. Subprime housing loans comprised most MBS. Banks offered these loans to almost everyone, even those who weren’t creditworthy. When the housing market fell, many homeowners defaulted on their loans. These defaults resounded all over the financial industry, which heavily i…