Different Types of Stocks to Invest In: What Are They?

- Common stock and preferred stock. Most stock that people invest in is common stock. ...

- Large-cap, mid-cap, and small-cap stocks. ...

- Domestic stocks and international stocks. ...

- Growth stocks and value stocks. ...

- IPO stocks. ...

- Dividend stocks and non-dividend stocks. ...

- Income stocks. ...

- Cyclical stocks and non-cyclical stocks. ...

- Safe stocks. ...

- Stock market sectors. ...

- Common stock.

- Preferred stock.

- Large-cap stocks.

- Mid-cap stocks.

- Small-cap stocks.

- Domestic stock.

- International stocks.

- Growth stocks.

What are the different types of stocks to invest in?

Sep 28, 2018 · The main types of stock are common and preferred. Stocks are also categorized by company size, industry, geographic location and style. Here's what you should know about the different types of...

Which are the best types of investments?

Sep 27, 2021 · You can trade ETFs, mutual funds, bonds, and annuities just to name 4 different types of investments. You can even think outside the box. NFTs are becoming more and more popular. In fact, Tom Brady started a company that does NFTs for athletes. Instead of collecting signed balls, we could see a new revolution within investing.

What are the 5 different types of investments?

Feb 10, 2022 · Defensive stocks, meanwhile, are shares of companies whose businesses are less impacted by the ups and downs of the business cycle. Utilities stocks, healthcare stocks and consumer staples stocks...

What are the best short term stock investments?

Apr 22, 2022 · Stocks are categorized by size, industry & ownership structure. Learn the different types of stocks you can invest in, and diversify your portfolio accordingly.

What are the 4 types of stocks?

What Are The Different Types Of Stock?Common Stock. When investment professionals talk about stock, they almost always mean common stock. ... Preferred Stock. ... Class A Stock and Class B Stock. ... Large-Cap Stocks. ... Mid-Cap Stocks. ... Small-Cap Stocks. ... Growth Stocks. ... Value Stocks.More items...•Feb 10, 2022

What are the 8 types of stocks?

SummariesWhite stock: A clear, pale liquid made by simmering poultry, beef, or fish bones.Brown stock: An amber liquid made by first browning/roasting poultry, beef, veal, or game bones.Fumet: A highly flavored stock made with fish bones.Court bouillon: An aromatic vegetable broth.More items...

What are the 9 types of stocks?

How to Invest In Different Types of Stocks.Stock Type #1: Blue Chip Stocks.Stock Type #2: Income Stocks.Stock Type #3: Growth Stocks.Stock Type #4: Tech Stocks.Stock Type #5: Speculative Stocks.Stock Type #6: Cyclical Stocks.Stock Type #7: Defensive Stocks.More items...•May 14, 2020

What are the 4 types of ways to invest?

Types of InvestmentsStocks.Bonds.Mutual Funds and ETFs.Bank Products.Options.Annuities.Retirement.Saving for Education.More items...

What is difference between stocks and shares?

Definition: 'Stock' represents the holder's part-ownership in one or several companies. Meanwhile, 'share' refers to a single unit of ownership in a company. For example, if X has invested in stocks, it could mean that X has a portfolio of shares across different companies.

What is the best type of stock to invest in?

Preferred stock prices are less volatile than common stock prices, which means shares are less prone to losing value, but they're also less prone to gaining value. In general, preferred stock is best for investors who prioritize income over long-term growth.

What types of stocks to invest in for beginners?

The Best Stocks To Invest In for Beginners in 2022Amazon (NASDAQ: AMZN)Alphabet (NASDAQ: GOOG)Apple (NASDAQ: AAPL)Costco (NASDAQ: COST)Disney (NYSE: DIS)Facebook (NASDAQ: FB)Mastercard (NYSE: MA)Microsoft (NASDAQ: MSFT)More items...•Jan 7, 2022

What are the 5 classification of stocks?

There are probably over one dozen stock classifications but we will describe only the following five here: blue-chip, growth, income, cyclical, and interest-rate-sensitive stocks.

What are the main categories of stocks?

There are two main types of stocks: common stock and preferred stock.Common Stock. Common stock is, well, common. ... Preferred Stock. Preferred stock represents some degree of ownership in a company but usually doesn't come with the same voting rights. ... Different Classes of Stock.

How do beginners invest in stocks?

Here are five steps to help you buy your first stock:Select an online stockbroker. The easiest way to buy stocks is through an online stockbroker. ... Research the stocks you want to buy. ... Decide how many shares to buy. ... Choose your stock order type. ... Optimize your stock portfolio.

How do beginners invest in stocks with little money?

One of the best ways for beginners to get started investing in the stock market is to put money in an online investment account, which can then be used to invest in shares of stock or stock mutual funds. With many brokerage accounts, you can start investing for the price of a single share.

What are groups of stocks called?

Sector - A group of similar securities, such as equities in a specific industry. Sector breakdown - Breakdown of securities in a portfolio by industry categories. Securities - Another name for investments such as stocks or bonds.

What is common stock?

Common stock represents partial ownership in a company, with shareholders getting the right to receive a proportional share of the value of any remaining assets if the company gets dissolved.

How to distinguish domestic and international stocks?

Domestic stocks and international stocks. You can categorize stocks by where they're located. For purposes of distinguishing domestic U.S. stocks from international stocks, most investors look at the location of the company's official headquarters.

What is considered a large cap?

There's no precise line that separates these categories from each other. However, one often-used rule is that stocks with market capitalizations of $10 billion or more are treated as large-caps, with stocks having market caps between $2 billion and $10 billion qualifying as mid-caps and stocks with market caps below $2 billion getting treated as ...

Why are cyclical stocks important?

Cyclical stocks include shares of companies in industries like manufacturing, travel, and luxury goods, because an economic downturn can take away customers' ability to make major purchases quickly. When economies are strong, however, a rush of demand can make these companies rebound sharply.

How does preferred stock work?

Preferred stock works differently, as it gives shareholders a preference over common shareholders to get back a certain amount of money if the company dissolves. Preferred shareholders also have the right to receive dividend payments before common shareholders do.

What is safe stock?

Safe stocks. Safe stocks are stocks whose share prices make relatively small movements up and down compared with the overall stock market. Also known as low-volatility stocks, safe stocks typically operate in industries that aren't as sensitive to changing economic conditions.

What are cyclical stocks?

National economies tend to follow cycles of expansion and contraction, with periods of prosperity and recession. Certain businesses have greater exposure to broad business cycles, and investors therefore refer to them as cyclical stocks.

What are the different types of stocks?

The 9 different types of stocks include: -Blue Chip stocks. – Income stocks. – Growth stocks. – Tech stocks.

What are defensive stocks?

Tend to hold their own, and even do well, when the economy starts to falter. Defensive stocks are countercyclical. Includes public utilities, industrial/ consumer goods companies producing beverages, foods, drugs at lower prices. Example: Walmart, Extendicare.

What is the value of medium sized stocks?

Medium-sized stocks, generally with a market value range of $1 billion to $4-5 billion. Advantage: Offer a nice alternative to large-cap stocks without the uncertainties of the small-cap stocks. Disadvantages: Appropriate for investors who are willing to tolerate a bit more risk and volatility than large-caps.

What are some examples of companies that are closely linked to the general state of the economy?

Examples: Tesla, Alcoa, Caterpillar, Genuine Parts, Lennar, Timken.

Is $4.95 a penny stock?

Sure, that could be stocks trading for fractions of a penny, but even a stock trading for $4.95 could still be considered a penny stock. While penny stocks can sometimes be super risky as the company isn’t well established yet, some investors have been able to take the risk into opportunity.

What is stock investment?

A stock is an investment into a public company. When a company sells shares of stock to the public, those shares are typically issued as one of two main types of stocks: common stock or preferred stock. Here’s a breakdown.

What are stocks categorized by?

Stocks are also categorized by company size, industry, geographic location and style. Here's what you should know about the different types of stock. Arielle O'Shea May 9, 2021. Many or all of the products featured here are from our partners who compensate us.

How to diversify your investment portfolio?

You can diversify your investment portfolio by investing not only in companies that do business in the U.S., but also in companies based internationally and in emerging markets, which are areas that are poised for expansion. (Here’s more on how to invest in international stocks.)

What is growth stock?

Growth stocks are from companies that are either growing quickly or poised to grow quickly. Investors are typically willing to pay more for these stocks, because they’re expecting bigger returns. Value stocks are essentially on sale: These are stocks investors have deemed to be underpriced and undervalued.

Why do stocks move together?

Stocks in the same industry — for example, the technology or energy sectors — may move together in response to market or economic events. That’s why it’s a good rule of thumb to diversify by investing in stocks across sectors. (Just ask someone who held a portfolio of tech stocks during the dot-com crash.)

What is preferred stock?

The other main type of stock, preferred stock, is frequently compared to bonds. It typically pays investors a fixed dividend. Preferred shareholders also get preferential treatment: Dividends are paid to preferred shareholders before common shareholders, including in the case of bankruptcy or liquidation.

What is a large cap company?

Company size: You might’ve heard the words large-cap or mid-cap before; they refer to market capitalization, or the value of a company. Companies are generally divided into three buckets by size: Large cap (market value of $10 billion or more), mid-cap (market value between $2 billion and $10 billion) and small-cap ...

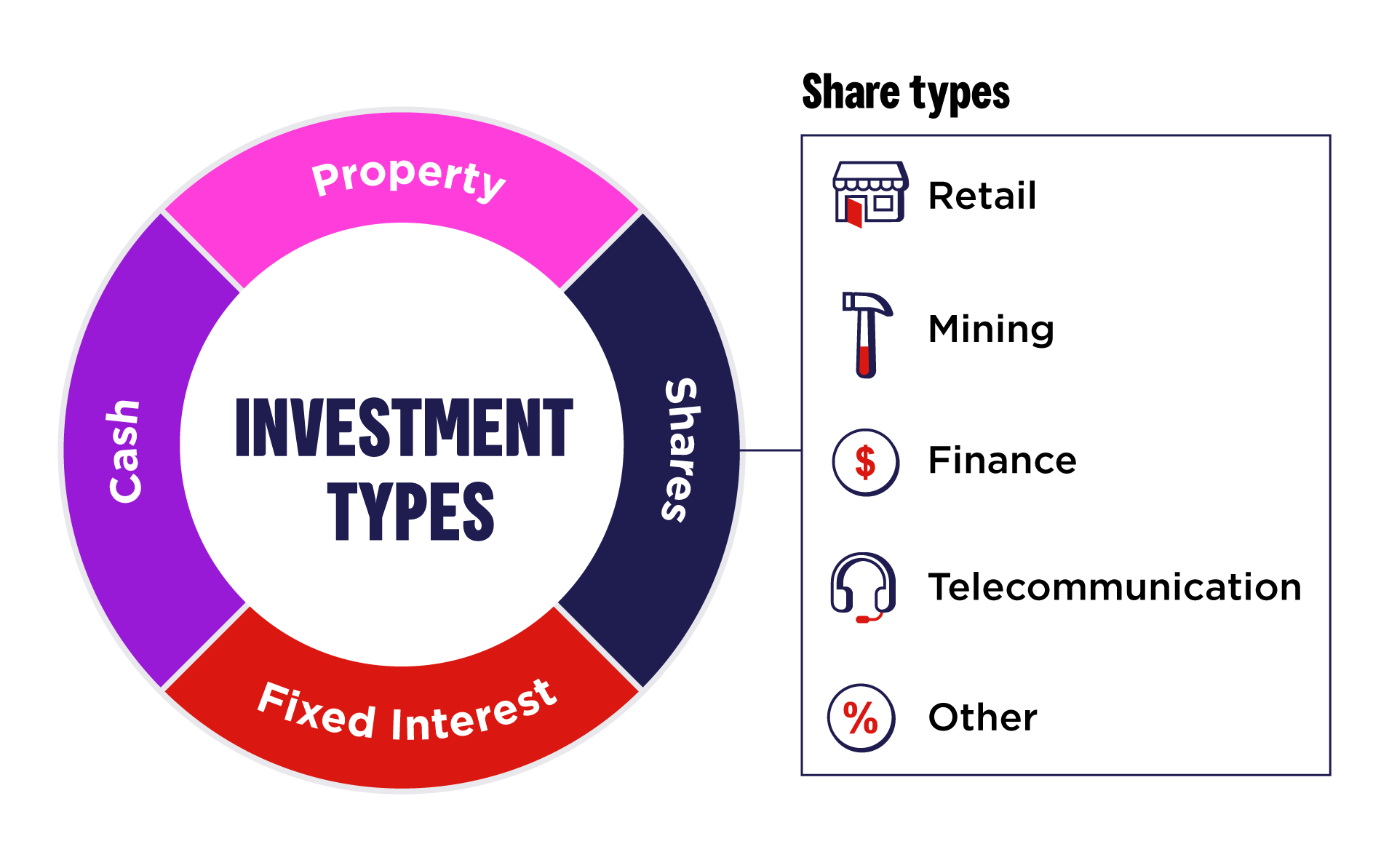

The Traditional Investments

Stocks: Any conversation about investing has to begin with stocks. Like I said earlier, I used to think stocks were the only way to invest. The beautiful thing about the stock market is that you can be any type of investor you want.

Real Estate

Many believe that real estate is actually the safest investment you can make with your money. The concept of real estate dates back centuries to when owning land was a symbol of wealth and authority. These days, real estate can be used for your own personal living quarters, rented out to tenants, or even used on digital platforms such as Airbnb.

Modern Investments

Cryptocurrencies: Over the past couple of years, cryptocurrencies have surged into the mainstream discussion of investing. Cryptos like Bitcoin, Ethereum, and DogeCoin have become just as well known as blue-chip stocks.

NFTs

One of the major buzzwords for 2021, NFTs or Non-Fungible Tokens are one of the hottest new ways to invest. This is the digital renaissance of art investing, right down to the scarcity and uniqueness of each NFT.

Conclusion on Different Types of Investments

As you can see, there are different types of investments you can make, so don’t just limit yourself to the stock market. With the advancement in technology, it is becoming easier than ever to diversify your investment portfolio and add in some non-traditional forms of investing. The blockchain could end up being a gamechanger for investors.

What is option in stock?

Options. An optionis a somewhat more complicated way to buy a stock. When you buy an option, you’re purchasing the ability to buy or sell an asset at a certain price at a given time. There are two types of options: call options, for buying assets, and put options, for selling options.

What are the different types of retirement plans?

There are a number of types of retirement plans. Workplace retirement plans, sponsored by your employer, include 401(k) plansand 403(b) plans . If you don’t have access to a retirement plan, you could get an individual retirement plan(IRA), of either the traditional or Roth variety.

What is the difference between mutual funds and ETFs?

Their price fluctuates throughout the trading day, whereas mutual funds’ value is simply the net asset valueof your investments , which is calculated at the end of each trading session. ETFs are often recommended to new investors because they’re more diversified than individual stocks.

What happens when you buy a stock?

The risk, of course, is that the price of the stock could go down, in which case you’d lose money. Brokers sell stocks to investors. You can either opt for an online brokerage firmor work face-to-face with a broker.

What is passively managed fund?

A passively managed fund, also known as an index fund, simply tracks a major stock market index like the Dow Jones Industrial Average or the S&P 500. Mutual funds can invest in a broad array of securities: equities, bonds, commodities, currencies and derivatives.

What is CD in banking?

A certificate of deposit (CD) is a very low-risk investment. You give a bank a certain amount of money for a predetermined amount of time. When that time period is over, you get your principal back, plus a predetermined amount of interest. The longer the loan period, the higher your interest rate.

Is a Treasury bond a safe investment?

Treasury bonds, notes and bills, however, are considered a very safe investments. Mutual Funds. A mutual fundis a pool of many investors’ money that is invested broadly in a number of companies. Mutual funds can be actively managed or passively managed.