Best Value Defense Stocks

| Price ($) | Market Capitalization (Market Cap) ($B) | 12-Month Trailing P/E Ratio | |

| Northrop Grumman Corp. ( NOC) | 472.45 | 73.4 | 13.1 |

| BAE Systems PLC ( BAESY) | 39.70 | 31.3 | 13.2 |

| Huntington Ingalls Industries Inc. ( HII ... | 214.25 | 8.6 | 16.1 |

- iShares US Aerospace & Defense (ITA)

- Invesco Aerospace & Defense ETF (PPA)

- SPDR S&P Aerospace & Defense ETF (XAR)

What are the best defensive stocks?

The Best Defense Stocks For Today — And The Future

- Boeing Stock. Boeing ( BA) is known for its commercial jets, but its defense and space programs accounted for $6.88 billion in the second quarter.

- Northrop Grumman Stock. Northrop Grumman's ( NOC) revenue was $1.04 billion in Q2 and $36.8 billion in 2020. ...

- Lockheed Martin Stock. ...

- Raytheon Technologies Stock. ...

- General Dynamics Stock. ...

What are the best consumer defensive stocks?

- Albertsons Companies Inc.: Albertsons Companies is a grocery store company that operates food and drug retail stores. ...

- Costco Wholesale Corp.: Costco Wholesale operates membership-only warehouses in the U.S. and around the world. ...

- Bunge Ltd.: See above for company description.

Should you invest in defensive stocks?

stock market. You never know when the economy is going to plummet and with the look of things you can t be sure whether the stock you have invested in is going to increase in price or not. In order to secure your financial future, it is necessary that you invest in defensive stocks. A defensive stock is a type of stock that investors particularly opt for at times of uncertainty.

What are some examples of defensive stock?

That means stocks in the following categories tend to be defensive stocks:

- Foods: We need to eat, no matter the economic conditions.

- Beverages: Again, we need to drink, no matter the recession.

- Utilities: Try living without water or electricity!

- Hygiene products: Soap doesn't seem truly necessary, but it's a bit unpleasant not to properly wash yourself, not to mention risky to your health.

What is the best defense stocks to buy?

The eight best defense stocks to buy in 2022:Lockheed Martin Corp. (LMT)Boeing Co. (BA)AeroVironment Inc. (AVAV)BWX Technologies Inc. (BWXT)Raytheon Technologies Corp. (RTX)General Dynamics Corp. (GD)Textron Inc. (TXT)CAE Inc. (CAE)

What are good defensive mutual funds?

Here are the best Consumer Defensive fundsFidelity® Select Consumer Staples Port.Rydex Consumer Products Fund.T. Rowe Price Global Consumer Fund.Vanguard Consumer Staples Fund.

Is there a mutual fund for defense stocks?

The Fidelity Select Defense and Aerospace Portfolio invests in companies engaged primarily in the manufacture and sale of products and services in the defense and aerospace industries. The fund mainly invests in the common stocks of these companies and normally invests at least 80 percent of its assets in this sector.

Does Vanguard have a defense ETF?

Product highlights Online is the quickest, easiest, and most cost-effective way to transact with Vanguard. Lower costs may mean we can pass more savings on to you. iShares U.S. Aerospace & Defense ETF is offered by prospectus only.

What is the best defense ETF?

Top 3 Defense ETFs (PPA, XAR)iShares US Aerospace & Defense (ITA)Invesco Aerospace & Defense ETF (PPA)SPDR S&P Aerospace & Defense ETF (XAR)

What is the best defensive ETF?

Top defensive ETFs for portfolio protectioniShares Edge MSCI Min Vol USA ETF (USMV) ... Fidelity MSCI Utilities ETF (FUTY) ... Invesco S&P 500 High Div Low Vol ETF (SPHD) ... Vanguard Consumer Staples ETF (VDC) ... Utilities Select Sector SPDR ETF (XLU) ... iShares 1-3 Year Treasury Bond ETF (SHY)

What should I invest in during war?

Stocks will stay resilient amid the war. Steiner said past precedent shows stocks can maintain value during major conflicts. "If we take a historical view looking at the geopolitical lens, most portfolios heavily weighted in equities tend to be pretty resilient."

Is there a defensive stock ETF?

One of the most common defensive ETFs that is used by retail investors is the Invesco Defensive Equity ETF (DEF).

Does fidelity have a defense ETF?

as of 2:31:05pm ET 06/28/2022 Quotes delayed at least 15 min....Compare.ITA ISHARES US AEROSPACE & DEFENSE ETFAsset Class MedianBeta (1 Year Month-End) AS OF 06/28/20220.40%0.84Annual Turnover Ratio AS OF 03/31/202227.00%29.00%Net Expense Ratio AS OF 07/30/20210.42%0.57%4 more rows

What is a defense stock ETF?

Aerospace & Defense ETFs invest in stocks of companies that manufacture and distribute aircraft and aircraft parts, as well as producers of components and equipment for the defense industry, including military aircraft, radar equipment and weapons.

Is there an ETF for firearms?

Firearms Involvement ETFs can be evaluated across three metrics: Civilian Firearms Involvement, Civilian Firearms Retailer and Civilian Firearms Producer.

What ETF has Lockheed Martin?

Unlock all 345 ETFs with exposure to Lockheed Martin Corporation (LMT)TickerETFWeightingXLIIndustrial Select Sector SPDR Fund3.92%ROKTSPDR S&P Kensho Final Frontiers ETF3.63%SCHDSchwab US Dividend Equity ETF3.53%XARSPDR S&P Aerospace & Defense ETF3.46%21 more rows

What are the best defense stocks?

Best Value Defense Stocks 1 Maxar Technologies Inc.: Maxar Technologies provides satellite communications services. It offers both ground and space infrastructure, including designing and manufacturing satellites and spacecraft components for communications, Earth observation, exploration and on-orbit servicing and assembly. 2 Huntington Ingalls Industries Inc.: Huntington Ingalls is a shipbuilding company that designs, builds, and maintains nuclear and non-nuclear ships for the U.S. Navy and Coast Guard. It also provides ship repair and maintenance services. 3 Northrop Grumman Corp.: Northrop Grumman is a global security company that provides services and security systems to clients in the aerospace, information systems, and electronics industries, among others. Its products include manned and unmanned aircraft, and electronic warfare systems. The company announced in late April financial results for Q1 of its 2021 fiscal year ( FY ), the three-month period ended March 31, 2021. Net earnings rose 152.9% on a 6.2% increase in sales. Net earnings were boosted by a one-time gain on the sale of the company's IT services business. 2

What is the defense industry?

The defense industry produces modern weaponry, including combat vehicles, ships, bombers, and fighter jets. Companies in the industry also offer cybersecurity, information technology (IT), analytics, robotics, and intelligence systems. Its primary customer is the U.S. government, but it also sells its products and services to foreign governments ...

Defense goes electric

For most of its history, the defense industry’s primary expertise was in metal-bending. These were the few companies on Earth capable of building massive battleships, bombers, and tanks.

New administration, new priorities

Defense stocks performed weakly in 2020 as investors grew increasingly convinced that the White House would change hands. But, so far, those concerns appear to be overblown.

Will conflict move defense stocks?

While there could be some incremental added sales of munitions and spare parts should the U.S. and its allies get drawn into a new Middle East or Afghanistan conflict, investors should avoid buying in based on that thesis.

How to find the best defense stocks

The defense sector tends to be a stable group of companies with a few failures but also a few standouts. Here are some tips to consider when evaluating individual defense companies.

Should you invest in defense stocks?

Defense companies manufacture lethal products and can be involved in supporting clandestine operations or intelligence gathering that some find unsettling. If you don’t want to support those activities, then investing in defense stocks is not a great choice for you.

Invesco Aerospace & Defense ETF (NYSEArca: PPA)

The fund seeks to replicate the yield and price of the SPADE Defense Index. The fund invests 90% of its assets in the underlying index, and its top three holding are Boeing Co, Lockheed Martin Corp and United Technologies Corp.

SPDR S&P Aerospace & Defense ETF (NYSEArca: XAR)

Replicating the S&P Aerospace & Defense Index, the fund’s top holdings are B/E Aerospace Inc, Boeing Co and Spirit AeroSystem Holdings Inc.

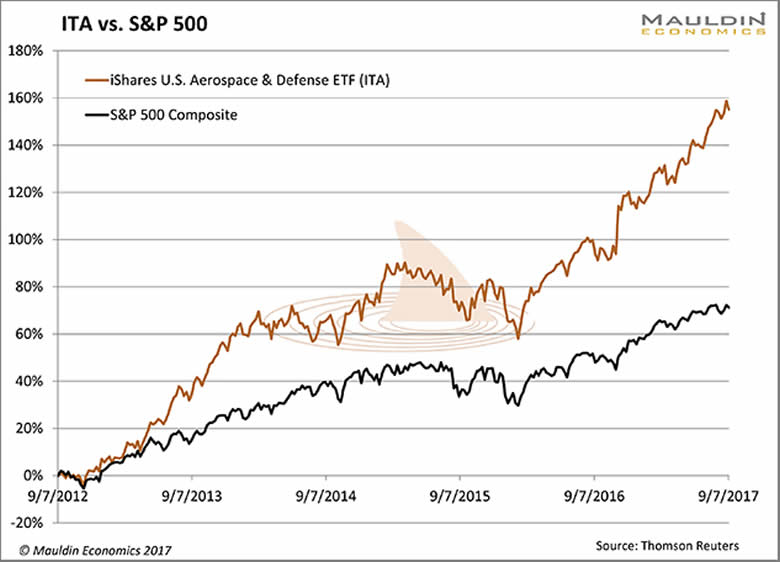

iShares US Aerospace & Defense (NYSEArca: ITA)

The fund seeks to replicate the performance of the Dow Jones US Select Aerospace & Defense Index which is composed of US aerospace and defense equities. The fund invests at least 90% of its assets in the index, and its top holdings are Boeing Co, Lockheed Martin Corp and United Technologies Corp—identical to PPA’s top holdings.

How much debt does Raytheon have?

The combined company will have net debt of $26 billion, with the legacy United Technologies business contributing approximately $24 billion. Following the merger, Raytheon Technologies Corporation will be the third largest commercial company and the second largest provider of defense products in the world.

When did Lockheed Martin merge with the Department of Defense?

Created when Lockheed Corporation and Martin Marietta merged in 1995, Lockheed Martin is the world’s largest defense contractor. The company had nearly $54 billion in sales in 2018, with the U.S. Department of Defense contributing 60% of this total.

What is the average moat rating for Morningstar?

To receive an average moat rating, funds must have at least 50% of their assets in stocks that earn moat ratings from Morningstar. Those funds with a rating of 4 or higher can be considered wide-moat funds; from 3.5 to 4.0, moderately wide; 2.5 to 3.5, narrow moat; 1.5 to 2.5, minimal; and 0 to 1.5, no moat. Average moat ratings are available ...

Does the WeWork fund own SpaceX?

The fund also owns some privately held companies, notably WeWork and SpaceX. These remain a small portion of the fund's overall assets, but investing in them early could prove beneficial down the line if they have successful IPOs. Plus, they are another way the fund differentiates itself from popular passive funds.".