- The "Greeks" refer to the various dimensions of risk that an options position entails.

- Greeks are used by options traders and portfolio managers to hedge risk and understand how their p&l will behave as prices move.

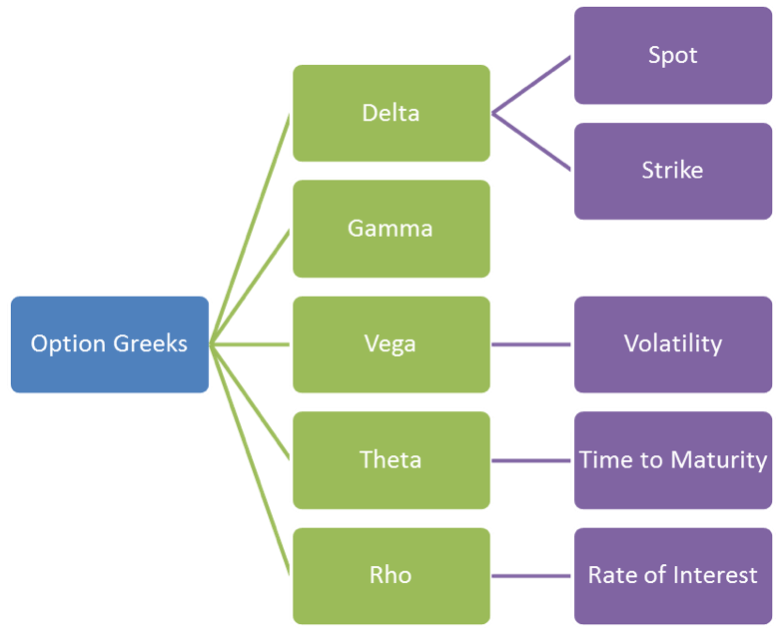

- The most common Greeks include the Delta, Gamma, Theta, and Vega which are the first partial derivatives of the options pricing model.

How to calculate option Greeks?

Worksheet Name

- Open this URL from your browser

- Right-click anywhere on the web page and click on “ Inspect Element ”

- Navigate to Network menu from the Inspect window

- Click on Option Chain from the webpage.

- Select “option-chain-indices?symbol=NIFTY” from the list. Go to Cookies and copy the value of bm_sv

- Paste the copied value in cell A2 of cookie worksheet.

How are option Greeks calculated?

Where to Find the Greeks

- Delta. Delta (cell F4) measures sensitivity of option price to changes in underlying price. ...

- Gamma. Gamma (cell G4) measures sensitivity of delta to changes in underlying price. ...

- Theta. Theta (cell H4) measures sensitivity of option price to passing time. ...

- Vega. Vega (cell I4) measures sensitivity of option price to changes in volatility. ...

- Rho. ...

What are the Greeks options?

- The “Greeks” help traders predict how options will respond to various market changes in the underlying

- Delta and gamma predict option price movement in response to changes in the underlying price

- Theta tells traders how much extrinsic value an option will shed after one day, with all other conditions remaining constant

What is the best stock trading option?

Option Strategies for a Downturn

- Buying in a Downturn. Market history suggests that a contrarian approach works better. ...

- Basics of Put Options. A put option gives the buyer of that option the right to sell a stock at a predetermined price known as the option strike price.

- Put Selling in a Downturn. ...

- An Example. ...

- Drawbacks. ...

- Selling Puts Intelligently. ...

How do the Greeks work in stock options?

In short, the Greeks refer to a set of calculations you can use to measure different factors that might affect the price of an options contract. With that information, you can make more informed decisions about which options to trade, and when to trade them.

What are the best Greeks for options?

Delta, gamma,and theta are the three most important Greeks in the world of stock options, and each tells us something important about an option. If you own 100 shares of a company's stock, your market risk is easy to understand. If the stock rises (or falls) by $1.00, you gain (or lose) $100.

Do options Greeks Matter?

The Greeks are essential tools in risk management that can help options-traders make informed decisions about what and when to trade. They help to look at how different factors such as price changes, interest rate changes, volatility, and time affect the price of an option contract.

Which Greek is important for option selling?

Theta is one of the most important concepts for a beginning options trader to understand because it explains the effect of time on the premium of the options purchased or sold. The further out in time you go, the smaller the time decay will be for an option.

How do you read Greek?

0:445:18Learn to Read and Write Greek - Greek Alphabet Made Easy #1YouTubeStart of suggested clipEnd of suggested clipAs you may know the greek writing system is written from left to right like all western languages.MoreAs you may know the greek writing system is written from left to right like all western languages. This means there is one less difficulty in learning how to write greek.

How do Greek options help?

The Greeks give you a way to measure the theoretical exposure of an option or option strategy to the various risks it is exposed to. Not only do Greeks help you understand these risks but they can help you to tailor a trade to your outlook. Example: You want to minimize your exposure to directional movement.

Do you need to know the Greeks to trade options?

The Greeks are utilized in the analysis of an options portfolio and in sensitivity analysis of an option or portfolio of options. The measures are considered essential by many investors for making informed decisions in options trading.

(At Least The Four Most Important Ones)

Before you read the strategies, it’s a good idea to get to know these characters because they’ll affect the price of every option you trade. Keep i...

A Different Way to Think About Delta

So far we’ve given you the textbook definition of delta. But here’s another useful way to think about delta: the probability an option will wind up...

How Stock Price Movement Affects Delta

As an option gets further in-the-money, the probability it will be in-the-money at expiration increases as well. So the option’s delta will increas...

How Delta Changes as Expiration Approaches

Like stock price, time until expiration will affect the probability that options will finish in- or out-of-the-money. That’s because as expiration...

Remember The Textbook Definition of Delta, Along With The Alamo

Don’t forget: the “textbook definition” of delta has nothing to do with the probability of options finishing in- or out-of-the-money. Again, delta...

What is an option contract?

Options contracts are used for hedging a portfolio. That is, the goal is to offset potential unfavorable moves in other investments. Options contracts are also used for speculating on whether an asset's price might rise or fall.

What is an in the money option?

An in-the-money option means that a profit exists due to the option's strike price being more favorable to the underlying's price. Conversely, an out-of-the-money (OTM) option means that no profit exists when comparing the option's strike price to the underlying's price.

What is the difference between a call option and a put option?

In short, a call option gives the holder of the option the right to buy the underlying asset while a put option allows the holder to sell the underlying asset. Options can be exercised, meaning they can be converted to shares of the underlying asset at a specified price called the strike price.

What is gamma in trading?

Gamma measures the rate of changes in delta over time. Since delta values are constantly changing with the underlying asset's price, gamma is used to measure the rate of change and provide traders with an idea of what to expect in the future. Gamma values are highest for at-the-money options and lowest for those deep in- or out-of-the-money. 5

What is delta in options?

Delta is a measure of the change in an option's price (that is, the premium of an option) resulting from a change in the underlying security. The value of delta ranges from -100 to 0 for puts and 0 to 100 for calls (-1.00 and 1.00 without the decimal shift, respectively). 3 Puts generate negative delta because they have a negative relationship with the underlying security—that is, put premiums fall when the underlying security rises, and vice versa.

Why do call options have a small delta?

When call options are deep out-of-the-money, they generally have a small delta because changes in the underlying generate tiny changes in pricing. However, the delta becomes larger as the call option gets closer to the money. Table 5: Example of Delta after a one-point move in the price of the underlying. Strike Price.

What is the term for how much an option's premium fluctuates leading up to its expiration?

How much an option's premium, or market value, fluctuates leading up to its expiration is called volatility. Price fluctuations can be caused by any number of factors, including the financial conditions of the company, economic conditions, geopolitical risks, and moves in the overall markets.

What are the key options Greeks?

Delta, Gamma, Vega, Theta, and Rho are the key option Greeks. However, there are many other option Greeks that can be derived from those mentioned above. Name. Dependent Variable. Independent Variable. Delta. Option price. Value of underlying asset.

What is theta in options?

Theta (θ) is a measure of the sensitivity of the option price relative to the option’s time to maturity. If the option’s time to maturity decreases by one day, the option’s price will change by the theta amount. The Theta option Greek is also referred to as time decay. In most cases, theta is negative for options.

Why is the RHO the least significant option?

The rho is considered the least significant among other option Greeks because option prices are generally less sensitive to interest rate changes than to changes in other parameters. Where: ∂ – the first derivative. V – the option’s price (theoretical value) r – interest rate.

What is beta in stock?

Beta The beta (β) of an investment security (i.e. a stock) is a measurement of its volatility of returns relative to the entire market. It is used as a measure of risk and is an integral part of the Capital Asset Pricing Model (CAPM). A company with a higher beta has greater risk and also greater expected returns.

What is call option?

Call Option A call option, commonly referred to as a "call," is a form of a derivatives contract that gives the call option buyer the right, but not the obligation, to buy a stock or other financial instrument at a specific price - the strike price of the option - within a specified time frame.

Do long options have gamma?

Long options have a positive gamma. An option has a maximum gamma when it is at-the-money (option strike price equals the price of the underlying asset). However, gamma decreases when an option is deep-in-the-money or out-the-money.

What are the Greeks used for?

Greeks are used by options traders and portfolio managers to hedge risk and understand how their p&l will behave as prices move. The most common Greeks include the Delta, Gamma, Theta, and Vega - which are first partial derivatives of the options pricing model.

What are the primary Greeks?

The primary Greeks (Delta, Vega, Theta, Gamma, and Rho) are calculated each as a first partial derivative of the options pricing model (for instance, the Black-Scholes model ). The number or value associated with a Greek changes over time.

What is the difference between a delta and a put option?

Delta of a call option has a range between zero and one, while the delta of a put option has a range between zero and negative one. For example, assume an investor is long a call option with a delta of 0.50. Therefore, if the underlying stock increases by $1, the option's price would theoretically increase by 50 cents.

What does theta mean in options?

Theta. Theta (Θ) represents the rate of change between the option price and time, or time sensitivity - sometimes known as an option's time decay. Theta indicates the amount an option's price would decrease as the time to expiration decreases, all else equal.

What is delta in options?

Delta (Δ) represents the rate of change between the option's price and a $1 change in the underlying asset's price. In other words, the price sensitivity of the option is relative to the underlying asset. Delta of a call option has a range between zero and one, while the delta of a put option has a range between zero and negative one. For example, assume an investor is long a call option with a delta of 0.50. Therefore, if the underlying stock increases by $1, the option's price would theoretically increase by 50 cents.

What is Greek variable?

Each "Greek" variable is a result of an imperfect assumption or relationship of the option with another underlying variable. Traders use different Greek values, such as delta, theta, and others, to assess options risk and manage option portfolios.

What are the variables in Greeks?

Understanding Greeks. Greeks encompass many variables. These include delta, theta, gamma, vega, and rho , among others. Each one of these variables/Greeks has a number associated with it, and that number tells traders something about how the option moves or the risk associated with that option.

What happens to the delta of an option when it gets further out of the money?

As an option gets further in-the-money, the probability it will be in-the-money at expiration increases as well. So the option’s delta will increase. As an option gets further out-of-the-money, the probability it will be in-the-money at expiration decreases. So the option’s delta will decrease.

What is gamma in stock?

Gamma. Gamma is the rate that delta will change based on a $1 change in the stock price. So if delta is the “speed” at which option prices change, you can think of gamma as the “acceleration.”. Options with the highest gamma are the most responsive to changes in the price of the underlying stock. As we’ve mentioned, delta is a dynamic number ...

What is the delta of an at the money call?

Usually, an at-the-money call option will have a delta of about .50, or “50 delta.”. That’s because there should be a 50/50 chance the option winds up in- or out-of-the-money at expiration. Now let’s look at how delta begins to change as an option gets further in- or out-of-the-money.

Is gamma a friend of the option seller?

Theta. Time decay, or theta, is enemy number one for the option buyer. On the other hand, it’s usually the option seller’s best friend.

Does Vega affect the value of options?

Vega does not have any effect on the intrinsic value of options; it only affects the “time value” of an option’s price. Typically, as implied volatility increases, the value of options will increase. That’s because an increase in implied volatility suggests an increased range of potential movement for the stock.

What are Greeks in Option s?

Option Greeks are financial measures and used to measure the risk and reward of an option. Greeks determining parameters, such as volatility or the price of the underlying asset.

What is Delta in Options?

Delta (Δ) is a measure of the sensitivity of an option’s price changes relative to the changes in the underlying asset’s price. In other words, if the price of the underlying asset increases by $1, the price of the option will change by Δ amount.

What is Gamma in Options?

Gamma (Γ) is a measure of the delta’s change relative to the changes in the price of the underlying asset. If the price of the underlying asset increases by $1, the option’s delta will change by the gamma amount. The main application of gamma is the assessment of the option’s delta.

What is Vega in Options?

Vega (ν) is an option Greek that measures the sensitivity of an option price relative to the volatility of the underlying asset. If the volatility of the underlying asses increases by 1%, the option price will change by the vega amount.

What is Theta in Options?

Theta (θ) is a measure of the sensitivity of the option price relative to the option’s time to maturity. If the option’s time to maturity decreases by one day, the option’s price will change by the theta amount. The Theta option Greek is also referred to as time decay.

What is Rho in Options?

Rho (ρ) measures the sensitivity of the option price relative to interest rates. If a benchmark interest rate increases by 1%, the option price will change by the rho amount.

What are option Greeks?

The option price depends on several variables. This includes the price of the underlying, interest rates, volatility, and the time to expiry. Option Greeks measure the sensitivity of the option price to these variables and are a measure of the risk.

There are five types of option Greeks

The name option Greek comes from the Greek letters that represent the sensitivity of an option to different variables. There are five different types of option Greeks.

Theta is a measure of time

Theta measures the decay in the time value of an option. Options prices are made up of two constituents. The first is the intrinsic value, which depends on the strike price and the underlying’s current price. The second component is the time value, which decays gradually as the option nears expiry.

Finding Values For The Greeks

as The Underlying Stock Price Changes—Delta and Gamma

- At its simplest interpretation, deltais the total amount the option price is expected to move based on a $1 change in the underlying security. Delta thus measures the sensitivity of an option's theoretical value to a change in the price of the underlying asset. It is normally represented as a number between minus one and one, and it indicates how much the value of an option should ch…

Changes in Volatility and The Passage of Time—Theta and Vega

- Theta is a measure of the time decay of an option, the dollar amount an option will lose each day due to the passage of time. For at-the-money options, theta increases as an option approaches the expiration date. For in- and out-of-the-money options, theta decreases as an option approaches expiration. Thetais one of the most important concepts for a beginning options trad…

Minor Greeks

- In addition to the risk factors listed above, options traders may also look to second- and third-order derivatives that indicate changes in those risk factors given changes in other variables. While less commonly used, they are nonetheless useful for getting a full grasp of an options position's complete risk profile. Some of these minor Greeks include the lambda, epsilon, vomm…

The Bottom Line

- The Greeks help to provide important measurements of an option position's risks and potential rewards. Once you have a clear understanding of the basics, you can begin to apply this to your current strategies. It is not enough to just know the total capital at risk in an options position. To understand the probability of a trade making money, it is essential to be able to determine a vari…

Understanding Options Contracts

Influences on An Option's Price

The Greeks

Delta

Gamma

Theta

Vega

Minor Greeks

The Bottom Line

- The Greeks help to provide important measurements of an option position's risks and potential rewards. Once you have a clear understanding of the basics, you can begin to apply this to your current strategies. It is not enough to just know the total capital at risk in an options position. To understand the probability of a trade making money, it is...