Full Answer

What is the best stock on the market?

May 23, 2017 · Puts and calls are the two basic types of vehicles used in strategies surrounding options trading. This article provides an overview of why investors buy and sell put options on a stock, and how...

How and when to buy a put option?

Buying "Put options" gives the buyer the right, but not the obligation, to "sell" shares of a stock at a specified price on or before a given date. A Put option "increases in value" when the underlying stock it's attached to "declines in price", and "decreases in value" when the stock goes "up in price". That one is worth reading again!

Are We at the top of the stock market?

Jan 13, 2022 · Investors may buy put options when they are concerned that the stock market will fall. That's because a put—which grants the right to sell an underlying asset at a …

How to trade a put?

Jun 20, 2015 · What a put option is When you buy a put option, you get the right to sell stock at a certain fixed price within a specified time frame. Most put …

How does a stock put work?

A put option is a contract that gives its holder the right to sell a number of equity shares at the strike price, before the option's expiry. If an investor owns shares of a stock and owns a put option, the option is exercised when the stock price falls below the strike price.

What is put option with example?

Example of a put option If the ABC company's stock drops to $80 then you could exercise the option and sell 100 shares at $100 per share resulting in a total profit of $1,500. Broken out, that is the $20 profit minus the $5 premium paid for the option, multiplied by 100 shares.Jul 30, 2021

How do you make money on puts?

Put buyers make a profit by essentially holding a short-selling position. The owner of a put option profits when the stock price declines below the strike price before the expiration period. The put buyer can exercise the option at the strike price within the specified expiration period.

What is buying a put in the stock market?

When a trader buys a put option they are buying the right to sell the underlying asset at a price stated in the option. There is no obligation for the trader to purchase the stock, commodity, or other assets the put secures. 2 The option must be exercised within the timeframe specified by the put contract.

How do puts work for dummies?

By buying the put, you're locking in the value of your stock at $30 per share until the expiration date on the third Friday in August. If the stock price falls to $20 per share, you still can sell it to someone at $30 per share, as long as the option has not expired.Mar 26, 2016

Why would I sell a put?

Selling (also called writing) a put option allows an investor to potentially own the underlying security at both a future date and a more favorable price.

Does Warren Buffett buy options?

In fact, in one annual report, Buffett acknowledged that Berkshire collected $7.6 billion in premiums from 94 derivatives contracts. Put options are just one of the types of derivatives that Buffett deals with, and one that you might want to consider adding to your own investment arsenal.

Can you make a living selling puts?

In general, you can earn anywhere between 1 and 5% (or more) selling weekly put options. It all depends on your trading strategy. How much you earn depends on how volatile the stock market currently is, the strike price, and the expiration date.

Do you need to own stock to buy a put?

Investors don't have to own the underlying stock to buy or sell a put. If you think the market price of the underlying stock will fall, you can consider buying a put option compared to selling a stock short.

Is it better to buy calls or sell puts?

Which to choose? - Buying a call gives an immediate loss with a potential for future gain, with risk being is limited to the option's premium. On the other hand, selling a put gives an immediate profit / inflow with potential for future loss with no cap on the risk.

When should you buy puts?

Investors may buy put options when they are concerned that the stock market will fall. That's because a put—which grants the right to sell an underlying asset at a fixed price through a predetermined time frame—will typically increase in value when the price of its underlying asset goes down.

Is selling puts a good strategy?

Selling Puts: 85.6% Easy Income Starts Here It's called Selling Puts. And it's one of the safest, easiest ways to earn big income. Once folks discover this simple income strategy, they never look back. Because it's just like Covered Calls, but WITHOUT the big capital requirements.Dec 10, 2017

What is put option?

What Is a Put Option? A put option is a contract giving the owner the right, but not the obligation, to sell–or sell short–a specified amount of an underlying security at a pre-determined price within a specified time frame. This pre-determined price that buyer of the put option can sell at is called the strike price .

How do put options affect the price of an asset?

Put option prices are impacted by changes in the price of the underlying asset, the option strike price, time decay, interest rates, and volatility. Put options increase in value as the underlying asset falls in price, as volatility of the underlying asset price increases, and as interest rates decline. They lose value as the underlying asset ...

What happens to an option when it loses its time value?

When an option loses its time value, the intrinsic value is left over. An option's intrinsic value is equivalent to the difference between the strike price and the underlying stock price. If an option has intrinsic value, it is referred to as in the money (ITM) . Out of the money (OTM) and at the money ...

What to keep in mind when selling put options?

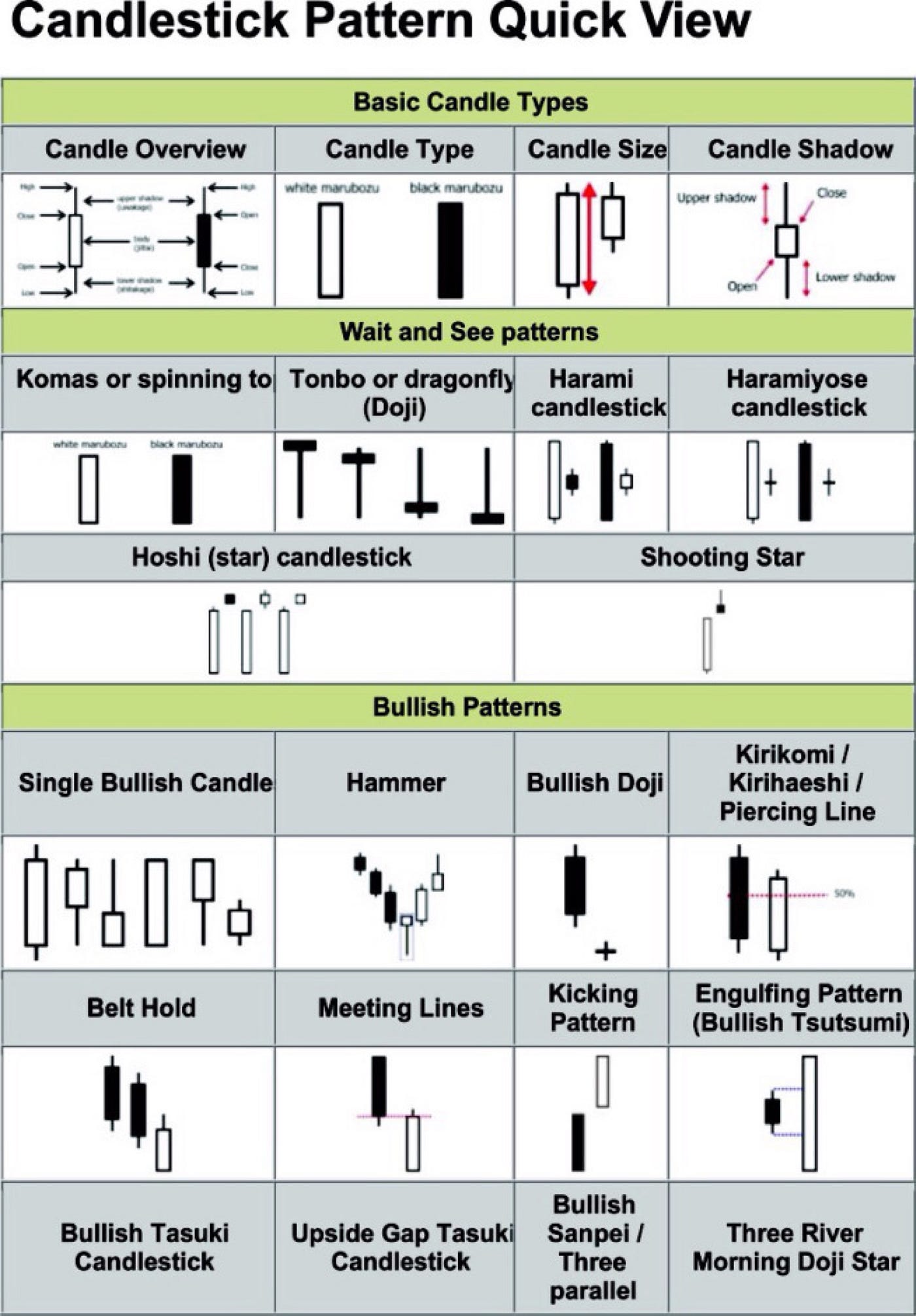

There are several factors to keep in mind when it comes to selling put options. It's important to understand an option contract's value and profitability when considering a trade, or else you risk the stock falling past the point of profitability. The payoff of a put option at expiration is depicted in the image below:

Why does the value of a put option decrease as time to expire?

In general, the value of a put option decreases as its time to expiration approaches because of the impact of time decay. Time decay accelerates as an option's time to expiration draws closer since there's less time to realize a profit from the trade. When an option loses its time value, the intrinsic value is left over.

What happens when you exercise put options?

Conversely, a put option loses its value as the underlying stock increases. When they are exercised, put options provide a short position in the underlying asset. Because of this, they are typically used for hedging purposes or to speculate on downside price action.

Can an option buyer sell an option?

The option buyer can sell their option and, either minimize loss or realize a profit, depending on how the price of the option has changed since they bought it. Similarly, the option writer can do the same thing. If the underlying's price is above the strike price, they may do nothing.

What does it mean to buy a put option?

Essentially, when you're buying a put option, you are "putting" the obligation to buy the shares of a security you're selling with your put on the other party at the strike price - not the market price of the security.

Why do you need options in stock market?

While buying or holding long stock positions in the market can potentially lead to long-term profits, options are a great way to control a large chunk of shares without having to put up the capital necessary to own shares of bigger stocks - and, can actually help hedge or protect your stock investments.

What is the best strategy to capitalize on a bearish stock?

1. Long Put. A long put is one of the most basic put option strategies.

How many shares are in an option contract?

You can also trade options over-the-counter (OTC), which eliminates brokerages and is party-to-party. Options contracts are typically comprised of 100 shares and can be set with a weekly, monthly or quarterly expiration date (although the time frame of the option can vary).

What is put option?

A put option is a contract that allows an investor the right but not the obligation to sell shares of an underlying security at a certain price at a certain time. When the market is volatile, as it has been recently, investors may need to re-evaluate their strategies when picking investments. While buying or holding long stock positions in ...

What are the factors that affect the total capital investment for a put option?

Apart from the market price of the underlying security itself, there are several other factors that affect the total capital investment for a put option - including time value, volatility and whether or not the contract is "in the money."

How does a short put work?

Much like a short call, the main objective of the short put is to earn the money of the premium on that stock. The short put works by selling a put option - especially one that is further "out of the money" if you are conservative on the stock. The risk of this strategy is that your losses can be potentially extensive.

Why do you put a put on a stock?

A stockholder can purchase a "protective" put on an underlying stock to help hedge or offset the risk of the stock price falling because the put gains from a decline in stock prices. But investors don't have to own the underlying stock to buy a put.

What is put option?

A put option is a contract that gives the owner the option, but not the requirement, to sell a specific underlying stock at a predetermined price (known as the “strike price”) within a certain time period (or “expiration”). For this option to sell the stock, the put buyer pays a "premium" per share to the put seller.

What does a put seller do?

Put sellers make a bullish bet on the underlying stock and/or want to generate income. If the stock declines below the strike price before expiration, the option is in the money.

Why is an in the money put option considered intrinsic value?

An in-the-money put option has "intrinsic value" because the market price of the stock is lower than the strike price. The buyer has two choices: First, if the buyer owns the stock, the put option contract can be exercised, putting the stock to the put seller at the strike price.

What happens if a stock stays at the strike price?

The seller will be put the stock and must buy it at the strike price. If the stock stays at the strike price or above it, the put is out of the money, so the put seller pockets the premium. The seller can write another put on the stock, if the seller wants to try to earn more income. Here’s an example.

Why are put options so popular?

Put options remain popular because they offer more choices in how to invest and make money. One lure for put buyers is to hedge or offset the risk of an underlying stock's price falling. Other reasons to use put options include:

Can you exercise a put option at the strike price?

For a put buyer, if the market price of the underlying stock moves in your favor, you can elect to "exercise" the put option or sell the underlying stock at the strike price. American-style options allow the put holder to exercise the option at any point up to the expiration date. European-style options can be exercised only on the date ...

Why do option traders buy and sell?

This is because minor fluctuations in the price of the stock can have a major impact on the price of an option. So if the value of an option increases sufficient ly, it often makes sense to sell it for a quick profit.

What does it mean to buy a stock at $140?

A $140 stock price means you get a $45 discount in price etc. etc. And vice versa, if the stock falls in price to $50 a share who wants to purchase a contract that gives them the right to purchase it at $95, when it's selling cheaper on the open market. If you exercised the right and bought the stock at $95 you'd immediately be at a loss ...

Why are put and call options called wasting assets?

Puts and Calls are often called wasting assets. They are called this because they have expiration dates. Stock option contracts are like most contracts, they are only valid for a set period of time. So if it's January and you buy a May Call option, that option is only good for five months.

What does it mean to buy call options?

Call options "increase in value" when the underlying stock it's attached to goes "up in price", and "decrease in value" when the stock goes "down in price". Call options give you the right ...

Why do you buy put options?

Investors may buy put options when they are concerned that the stock market will fall. That's because a put—which grants the right to sell an underlying asset at a fixed price through a predetermined time frame—will typically increase in value when the price of its underlying asset goes down.

What does closing a short put mean?

Opening a position is self-explanatory, and closing a position simply means buying back puts that you had sold to open earlier. Long Put. Image by Julie Bang © Investopedia 2019.

What is the breakeven point of a $95 strike put?

The breakeven point of a $95-strike long put (bought for $3) at expiration is $92 per share ($95 strike price minus the $3 premium). At that price, the stock can be bought in the market at $92 and sold through the exercise of the put at $95, for a profit of $3. The $3 covers the cost of the put and the trade is a wash.

What is a protective put?

A protective put is used to hedge an existing position while a long put is used to speculate on a move lower in prices. The price of a long put will vary depending on the price of the stock, the volatility of the stock, and the time left to expiration. Long puts can be closed out by selling or by exercising the contract, ...

Can you buy a put option if you own a stock?

So, whether you own a portfolio of stocks, or you simply want to bet that the market will go down, you can benefit from buying a put option.

Can you buy puts on short sales?

The profit equals the sale price minus the purchase price. In some cases, an investor can buy puts on stocks that cannot be found for short sales.

Why do you put options on stocks?

Put options are a useful tool either to help manage risk in your portfolio or to make bets on a stock you don't own falling. In many cases, using a put option can give you more flexibility and a more attractive potential return than other strategies. Dan Caplinger has no position in any stocks mentioned.

Why do you buy put options?

As you can see, put options are nice because they offer a way to profit from a stock dropping. If you own that stock, then buying a put option protects you from losses below the strike price, as you can always just exercise the option and guarantee that you'll get the fixed amount specified in the option.

What happens if you sell a stock at $120?

If the share price rises to $120 per share, then having sold the stock will mean that you've missed out on an extra $1,700 in stock gains. But with the put option, you can never lose more than the $150 you paid upfront -- potentially saving you from missing out on big gains in an unexpected advance.

How many shares can you sell with a put option?

When you buy a put option, you get the right to sell stock at a certain fixed price within a specified time frame. Most put options allow you to sell 100 shares of stock to the investor who sells you the put option, and you have to make a decision about what to do before the option expires. If the price of the stock on the open market falls below ...

Do put options expire?

Conversely, if the market price of the stock is still above the strike price of the put option, then you'll simply let it expire, and if you want to sell the stock, you'll do it on the open market where you'll get a higher price. Image source: Getty Images. As you can see, put options are nice because they offer a way to profit from ...

Can you buy a put option without owning the stock?

By contrast, simply buying a put option without owning the underlying stock works out best when the stock falls. That's because you don't have the losses from your position in the stock offsetting the gains in the value of the put option, and so you're able to reap the full benefits of the put option's profits.

What does a put seller get?

What the Put Seller Gets. The put seller, or writer, receives the premium. Writing put options is a way to generate income. However, the income from writing a put option is limited to the premium, while a put buyer can continue to maximize profit until the stock goes to zero. 4 .

What is call put option?

Call and put options are derivative investments, meaning their price movements are based on the price movements of another financial product. The financial product a derivative is based on is often called the "underlying.". Here we'll cover what these options mean and how traders and buyers use the terms.

What happens if the price of the underlying moves below the strike price?

For that right, the put buyer pays a premium. If the price of the underlying moves below the strike price, the option will be worth money ( it will have intrinsic value). The buyer can sell the option for a profit (this is what many put buyers do) or exercise the option (sell the shares). 3 .

What is strike price?

Here, the strike price is the predetermined price at which a put buyer can sell the underlying asset. 1 For example, the buyer of a stock put option with a strike price of $10 can use the option to sell that stock at $10 before the option expires. It is only worthwhile for the put buyer to exercise their option ...

How does a call option work?

For U.S.-style options, a call is an options contract that gives the buyer the right to buy the underlying asset at a set price at any time up to the expiration date. 2 . Buyers of European-style options may exercise the option— to buy the underlying—only on the expiration date.

What does "out of the money" mean?

Out of the money means the underlying price is below the strike price. At the money means the underlying price and the strike price are the same. You can buy a call in any of those three phases. However, you will pay a larger premium for an option that is in the money because it already has intrinsic value.

What is strike price in options?

The strike price is the set price that a put or call option can be bought or sold. Both call and put option contracts represent 100 shares of the underlying stock.

What is put option?

A put option gives the option buyer the right to sell the underlying stock at a specific price. Puts are purchased to profit from a falling share price. Option contracts are defined by the underlying stock, the stock price at which the option can be exercised -- called the strike price -- and an expiration date.

Why are put options more expensive?

Puts for more distant expiration dates are more expensive because there is more time for the stock to move and make the put purchase profitable. One put option is for 100 shares, so the cost of one contract is 100 times the quoted price.

What happens when a put option expires?

A put option has value at expiration if the stock price is below the strike price. If not, the option expires without any value. A purchase put option can be later sold to realize a profit. It isn't necessary to exercise the contract.

What is an option in stock market?

Essentially, a stock option allows an investor to bet on the rise or fall of a given stock by a specific date in the future. Often, large corporations will purchase stock options to hedge risk exposure to a given security. On the other hand, options also allow investors to speculate on the price of a stock, typically elevating their risk.

What happens if you trade a stock above $150?

Should the stock trade above $150, the option would expire worthless allowing the seller of the put to keep all of the premium . However, should the stock close below the strike price, the seller would have to buy the underlying stock at the strike price of $150. If that happens, it would create a loss of the premium and additional capital, ...

What happens if IBM stock is worth less than $150?

If the stock is worth less than $150, the options will expire worthless, and the trader would lose the entire amount spent to buy the options, also known as the premium.

What is a contract in trading?

Contracts represent the number of options a trader may be looking to buy. One contract is equal to 100 shares of the underlying stock. Using the previous example, a trader decides to buy five call contracts. Now the trader would own 5 January $150 calls. If the stock rises above $150 by the expiration date, the trader would have the option to exercise or buy 500 shares of IBM’s stock at $150, regardless of the current stock price. If the stock is worth less than $150, the options will expire worthless, and the trader would lose the entire amount spent to buy the options, also known as the premium.

What is strike price?

The strike price determines whether an option should be exercised. It is the price that a trader expects the stock to be above or below by the expiration date. If a trader is betting that International Business Machine Corp. ( IBM) will rise in the future, they might buy a call for a specific month and a particular strike price. For example, a trader is betting that IBM's stock will rise above $150 by the middle of January. They may then buy a January $150 call.

Why are options important?

This is known as the expiration date . The expiration date is important because it helps traders to price the value of the put and the call, which is known as the time value, and is used in various option pricing models such as the Black Scholes Model .

How many shares are in an option contract?

Options are purchased as contracts, which are equal to 100 shares of the underlying stock. When a contract is written, it determines the price that the underlying stock must reach in order to be in-the-money, known as the strike price.

What Is A Put Option?

- Puts are traded on various underlying assets, which can include stocks, currencies, commodities, and indexes. The buyer of a put option may sell, or exercise, the underlying asset at a specified strike price. Put options are traded on various underlying assets, including stocks, currencies, bo…

Put vs. Call Option

How to Buy A Put Option

Time Value, Volatility and "In The Money"

Put Option Strategies

- While a put option is a contract that gives investors the right to sell shares at a later time at a specified price (the strike price), a call option is a contract that gives the investor the right to buyshares later on. Unlike put options, call options are generally a bullish bet on the particular stock, and tend to make a profit when the underlying security of the option goes up in price. Put …

Put Option Examples

- Just like with call options, put options can be bought through brokerages like Fidelity or TD Ameritrade(AMTD) - Get TD Ameritrade Holding Corporation Report. Because options are financial instruments similar to stocks or bonds, they are tradable in a similar fashion. However, the process of buying put options is slightly different given that they are essentially a contract on un…