How do margin rates work?

Margin interest is accrued daily and charged monthly. The interest accrued each day is computed by multiplying the settled margin debit balance by the annual interest rate and dividing the result by 360. The amount of the debit balance determines the annual interest rate on that particular day.

What does 5% margin mean?

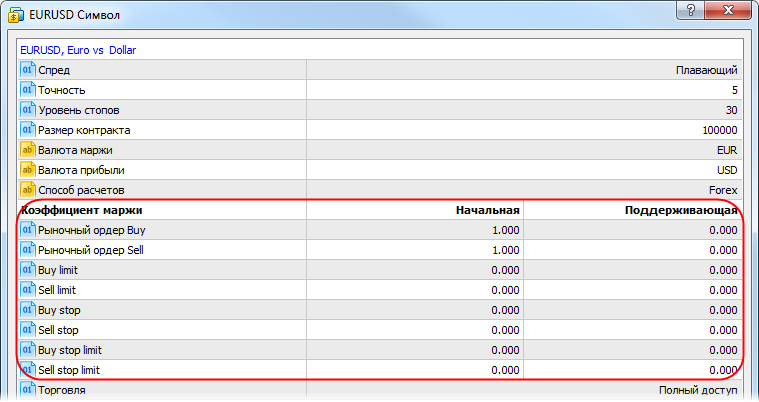

Markets with higher volatility or larger positions may require a bigger deposit. Margin requirements reflect your leverage. For example, if the margin requirement is 5%, the leverage is 20:1, and if the margin requirement is 10%, the leverage is 10:1.

How do margins work in stocks?

To buy stocks on margin, a margin account must be opened and approval obtained for the loan. If the stock's price rises, the investor can sell the stock, repay the loan, and keep the profit. If the stock's price falls, the broker may issue a margin call, requiring more cash or selling the stock.

What are margin rates Robinhood?

If you fail to meet your minimums, Robinhood Financial may be forced to sell some or all of your securities, with or without your prior approval. The margin interest rate charged by Robinhood Financial is 3.5% as of May 4, 2022. The rate might change at any time without notice and at Robinhood Financial's discretion.

How much margin should I use?

When possible, try not to use more than 10% of your asset value as a margin and draw a line at 30%. It is also a great idea to use brokers like TD Ameritrade that have cheap margin interest rates. Remember, the margin interest compounds as long as you keep the margin open.

What happens if free margin is negative?

It is worth paying attention that if a free margin becomes negative, and then any pending orders will not be executed.

How do you pay back margin?

You can repay the loan by depositing cash or selling securities. Buying on a margin allows you to pay back the loan by either adding more money into your account or selling some of your marginable investments.

What happens if you lose money on margin?

Failure to Meet a Margin Call The margin call requires you to add new funds to your margin account. If you do not meet the margin call, your brokerage firm can close out any open positions in order to bring the account back up to the minimum value. This is known as a forced sale or liquidation.

How do you avoid margin interest?

How do I avoid paying Margin Interest? If you don't want to pay margin interest on your trades, you must completely pay for the trades prior to settlement. If you need to withdraw funds, make sure the cash is available for withdrawal without a margin loan to avoid interest.

Can I withdraw margin from Robinhood?

You can get even more out of Robinhood Gold with Cash Management. If you've enabled Margin Investing, you can turn on Margin Spending to use margin for day-to-day spending and withdrawals.

Does Robinhood affect credit score?

If you have good credit, Robinhood will not affect your score in any way. However, if you do have poor credit or no credit at all, Robinhood could be detrimental to your score. When you apply for a financial service – more specifically an account with fluctuating debt – it is added as a “hard inquiry” on your report.

Does Robinhood have hidden fees?

Investing with a Robinhood brokerage account is commission-free. We don't charge you fees to open your account, to maintain your account, or to transfer funds to your account. However, self-regulatory organizations (SROs) such as the Financial Industry Regulatory Authority (FINRA) charge us a small fee for sell orders.