When preferred stock is cumulative are dividends never paid?

Question:When preferred stock is cumulative, preferred dividends not declared in a period are never paid. called dividends in arrears. considered a liability. distributions of earnings.

What are preferred dividends?

6. Frequently Asked Questions What Are Preferred Dividends? Preferred dividends are the dividends that are accrued paid on a company’s preferred stock.

What happens to undeclared dividends in preferred stock?

The issuer is obligated to pay any accumulated undeclared dividends upon liquidation and, in some cases, upon early redemption of the preferred stock. Some preferred stock requires the issuer to pay a periodic dividend even without a declaration by the board of directors.

What happens to preferred shareholders if a company does not pay dividends?

The company has no such obligation to common shareholders. If the company does not declare and pay a dividend to preferred shareholders, it cannot pay a dividend to common shareholders. What happens to the preferred shareholders’ payments if the company misses a payment depends on whether their dividends are cumulative or non-cumulative.

When preferred stock is cumulative preferred dividends not declared in a period are?

When preferred stock is cumulative, preferred dividends not declared in a given period are called dividends in arrears. Dividends may be declared and paid in cash or stock. A debit balance in the Retained Earnings account is identified as a deficit. 11.

What happens if dividend is not announced on a preferred stock?

If the preferred shareholders do not receive a dividend (the board of directors does not declare a dividend) in a given period, then the undeclared dividend is accumulated.

When preferred stock is cumulative preferred dividends?

Cumulative preferred stock is a type of preferred stock with a provision that stipulates that if any dividend payments have been missed in the past, the dividends owed must be paid out to cumulative preferred shareholders first.

What are preferred dividends declared?

Preferred dividends refer to the cash dividends that a company pays out to its preferred shareholders. One benefit of preferred stock is that it typically pays higher dividend rates than common stock of the same company.

Do cumulative dividends need to be declared?

If a company cannot afford to pay its cumulative dividends on time, it must halt payments to all shareholders while it sources the capital necessary to clear the debt. During that time, unpaid cumulative dividends must also be announced in financial statements.

What is a non-cumulative dividend?

Noncumulative describes a type of preferred stock that does not entitle investors to reap any missed dividends. By contrast, "cumulative" indicates a class of preferred stock that indeed entitles an investor to dividends that were missed.

What does it mean for preferred stock to be cumulative participating?

Cumulative preferred stock is a type of preferred stock that provides a greater guarantee of dividend payments to its holders. The “cumulative” in cumulative preferred stock means that if your company suspends dividend payments, the unpaid dividends (known as dividends in arrears) owed continue to accrue.

How do you record cumulative preferred dividends?

Because you must pay the dividends in arrears first, record the cumulative preferred dividend payment by debiting Dividends Payable-Cumulative Preferred Dividend Arrearage for $10,000 and crediting Cash for $10,000.

When there is cumulative preferred stock How is the amount of dividends distributed to common shareholders calculated?

Annual dividend = par value x dividend rate x position. Quarterly dividend payment = annual dividend / 4. For example, suppose you own 1,000 shares of Company X cumulative preferred stock. Each share has a par value of $100 and a dividend rate of 8 percent.

How do you calculate non cumulative preferred dividends?

2:526:56Preferred share dividends, non-cumulative, fully participatingYouTubeStart of suggested clipEnd of suggested clipThe 20 000 that is payable to the preferred shareholders. And we're going to subtract the 80 000MoreThe 20 000 that is payable to the preferred shareholders. And we're going to subtract the 80 000 that is payable to the common shareholders that means the remaining dividend is 40 000.

When is a preferred stock dividend payable?

Generally, an issuer records a dividend payable when the dividend is declared. However, the terms of the preferred stock require the issuer to pay the original issue price of the preferred stock plus cumulative dividends, whether or not declared, upon redemption.

What happens if preferred shareholders do not receive dividends?

If the preferred shareholders do not receive a dividend (the board of directors does not declare a dividend) in a given period, then the undeclared dividend is accumulated. The issuer is obligated to pay any accumulated undeclared dividends upon liquidation and, in some cases, upon early redemption of the preferred stock.

When the issuer is legally obligated to pay cumulative dividends, should they be accrued as they are

Alternatively, when the issuer is legally obligated to pay cumulative dividends, they should be accrued as they are earned. When preferred shareholders participate in dividends with common shareholders, the two-class method of computing earnings per share may be applicable.

When should noncumulative dividends be recorded?

When noncumulative dividends are discretionary, they should be recorded when they are declared. When the issuer is legally obligated to pay dividends, they should be accrued as they are earned. Noncumulative dividends, generally, do not add to the liquidation or redemption value of preferred stock. Cumulative dividends on preferred stock may accrue ...

How long does it take for a preferred stock to be redeemable?

A reporting entity issues preferred stock that pays cumulative dividends and is redeemable at the holder’s option after four years. The redemption price is equal to the original issue price plus the cumulative dividends, whether or not declared.

What is cumulative preferred stock?

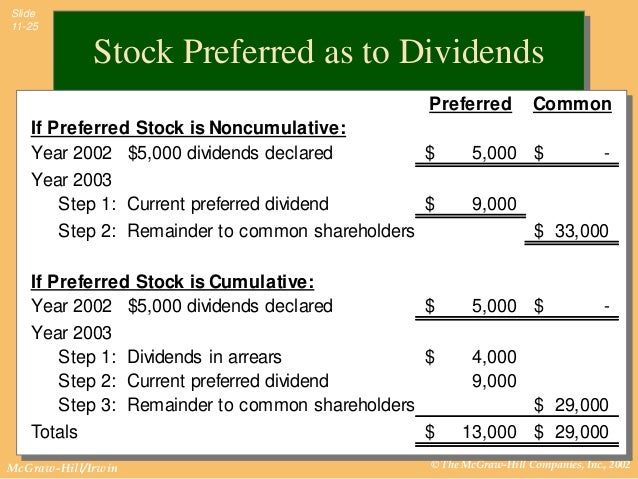

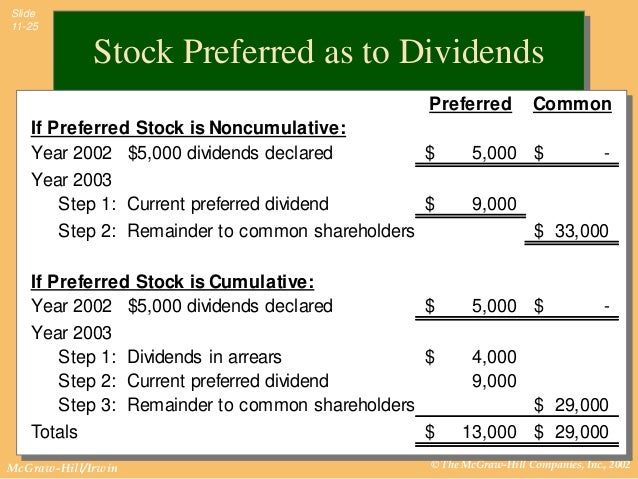

Cumulative preferred stock: In case of cumulative preferred stock, any unpaid dividends on preferred stock are carried forward to the future years and must be paid before any dividend is paid to common stockholders.

What is dividend in arrears?

Any unpaid dividend on preferred stock for an year is known as ‘dividends in arrears’. The disclosure of dividends in arrears is of great importance for the investors and other users of financial statements. Such disclosure is made in the form of a balance sheet note.

Is there a question of dividends in arrears?

If preferred stock is noncumulative and directors do not declare a dividend because of insufficient profit in a particular year, there is no question of dividends in arrears.