| Rank | Stock exchange | MIC | Region | Market place |

| 12 | Deutsche Börse AG | XFRA | Germany | Frankfurt |

| 13 | Saudi Stock Exchange (Tadawul) | XSAU | Saudi Arabia | Riyadh |

| 14 | Nasdaq Nordic and Baltic Exchanges | Europe | Europe | Europe |

| 14 |

- NYSE Stock Exchange. The New York Stock Exchange is the biggest marketplace for investors in the world.

- Nasdaq Stock Exchange. The Nasdaq Stock Exchange is the second-largest exchange in the world.

- OTC Markets. ...

- What Is the Nasdaq Composite Index?

Do different stock exchanges work the same?

In theory, a stock should be the same price on different exchanges. When there is a price difference, it’s usually quickly rectified by investors exploiting the price difference. Price differences are most likely to occur when trading hours are different, such as exchanges in different time zones.

Which exchange is better for stock trading?

- WIG20 index futures and options

- mWIG40 index futures

- USD/PLN, EUR/PLN, GBP/PLN and CHF/PLN FX futures

What are the three major US stock exchanges?

Major commodity exchanges

- Chicago Board of Trade

- Chicago Mercantile Exchange

- United States Mercantile Exchange

- United States International Monetary Financial Futures and Options Exchange

- United States Metal Exchange

- New York Mercantile Exchange

- United States Commodity Exchange

- PEG Commodity Exchange

- HAUFEX Derivatives Financial Exchange

- STER CAUFEX Derivatives Financial Exchange

What companies are listed on the Stock Exchange?

List of companies listed on the Colombo Stock Exchange

- A

- B

- C. City Housing & Real Estate Co.

- D

- E

- F

- G

- H

- I

- J

What are the 3 major stock exchanges?

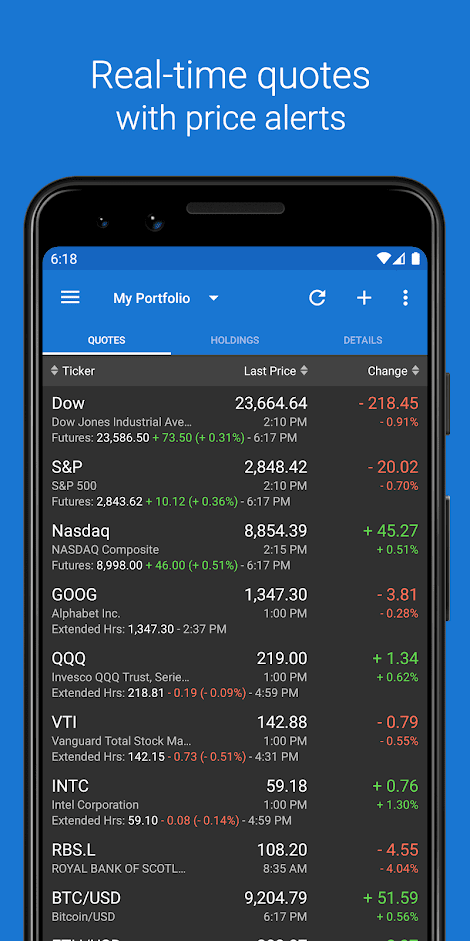

The three most widely followed indexes in the U.S. are the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite.

What are the different types of stock exchange?

The following are the list of stock exchanges operating in India:Bombay stock exchange (BSE) ... National stock exchange (NSE) ... Calcutta Stock Exchange (CSE) ... India International Exchange (India INX) ... Metropolitan Stock Exchange (MSE) ... NSE IFSC Ltd (NSE International Exchange) ... Determining the fair price.More items...•

What are the 4 major stock markets?

Top 10 largest stock exchanges in the worldNew York Stock Exchange.NASDAQ.Tokyo Stock Exchange.Shanghai Stock Exchange.Hong Kong Stock Exchange.London Stock Exchange.Euronext.Shenzhen Stock Exchange.More items...

What are 5 different stock markets?

What Are the Different Types of Exchanges?Auction Markets. ... Electronic Communication Networks (ECNs) ... Electronic Trading. ... Over-the-counter. ... The New York Stock Exchange. ... The Nasdaq. ... The American Stock Exchange.

What are the 7 types of stocks?

7 Categories of Stocks that Every Investor Should KnowIncome Stocks. An income stock is an equity security that offer high yield that may generate from the majority of security's overall returns. ... Penny Stocks. ... Speculative Stocks. ... Growth Stocks. ... Cyclical Stocks. ... Value Stocks. ... Defensive Stocks.

How many stock exchanges are there?

60There are 60 major stock exchanges throughout the world, and their range of sizes is quite surprising. At the high end of the spectrum is the mighty NYSE, representing $18.5 trillion in market capitalization, or about 27% of the total market for global equities.

Is Nasdaq or NYSE bigger?

The NASDAQ and NYSE, both located in New York City, are the two largest stock exchanges in the world. The New York Stock Exchange (NYSE) has a larger market cap than the NASDAQ, which is known for its large selection of technology stocks (e.g., Google and Facebook).

Which is the No 1 stock market?

The New York Stock Exchange is the largest stock exchange in the world, with an equity market capitalization of just over 27.2 trillion U.S. dollars as of March 2022. The following three exchanges were the NASDAQ, the Shanghai Stock Exchange, and the Euronext.

What is the difference between Dow Jones and Nasdaq?

NASDAQ is a U.S. stock market index containing around 3,000 companies. In contrast, the DJIA comprises 30 major industry leaders and major contributors to the industry and the stock market. NASDAQ primarily includes technology-based corporations such as Apple, Google, and several other companies in their growth stages.

What is the difference between Nasdaq and NYSE?

The NYSE is an auction market that uses specialists (designated market makers), while the Nasdaq is a dealer market with many market makers in competition with one another. Today, the NYSE is part of Intercontinental Exchange (ICE), and the Nasdaq is part of the publicly traded Nasdaq, Inc.

What NYSE means?

New York Stock ExchangeNew York Stock Exchange (NYSE), one of the world's largest marketplaces for securities and other exchange-traded investments. The exchange evolved from a meeting of 24 stockbrokers under a buttonwood tree in 1792 on what is now Wall Street in New York City.

What is US stock market called?

The New York Stock ExchangeThe New York Stock Exchange | NYSE.

What is a stock exchange?

Stock exchanges are physical or online venues where investors can buy and sell shares of publicly traded stocks. They exist in major markets globally, giving investors access to companies on the global market. In the U.S., there are two major exchanges: The New York Stock Exchange (NYSE) and the Nasdaq. Here’s a look at how these and other stock ...

How does the stock market work?

Stock exchanges function as a part of the wider global stock market. They typically work like auctions, allowing investors to buy and sell shares of stocks. Share price is determined by supply and demand, and the price of the stock typically reflects how well traders think a company will do in the future.

Why are OTC stocks unlisted?

By not paying to be listed on the large stock exchanges , companies can keep stock prices down, helping to draw in investors. OTC stocks are traded through a network of brokers and dealers outside of the major exchanges, such as the NYSE, and as a result, they are what is known as “unlisted.”.

How do I access the NYSE?

Individual investors can access the NYSE and the Nasdaq through a brokerage firm, which typically offers a wide variety of services, including trading securities. Brokerage firms may be full service firms, discount firms or online only.

What is a broker in stock?

Sellers set an “ask” price, the price for which they are willing to part with a stock. Brokers are representatives for the entity buying stocks. A brokerage company acts of behalf of most individual investors. Brokers must be approved by the NYSE and they must be issued a trading license.

How many shareholders are required to be listed on the NYSE?

Companies must meet a number of criteria in order to be listed on the NYSE. For example, companies must have 400 shareholders and 1.1 million publicly held shares. They must also have a minimum share price of $4. The collective value of the shares must be equal to $100 million or more.

Is electronic trading better than traditional trading?

Electronic trading offers significant advantages over traditional trading, including the fact that it can be done remotely, so there is no need for brokers to be physically present at the stock exchange. It’s fast—stocks can be bought and sold almost instantaneously.

Which is the third largest stock exchange in the world?

Japan. Tokyo Stock Exchange. It is the third largest stock exchange in the world by aggregate market capitalization of its listed companies and the largest in Asia. It had 2,292 listed companies with a combined market capitalization of US$3.8 trillion as of Dec 2010.

Where is the Shanghai Stock Exchange located?

Shanghai Stock Exchange#N#The Shanghai Stock Exchange (SSE) is based in the city of Shanghai, China. It is the second largest stock exchange in Asia with over 860 listed companies and is the world’s 5th largest stock market by market capitalization at US$2.7 trillion as of 2011.#N#Hong Kong Stock Exchange#N#The Hong Kong Stock Exchange is located in the city of Hong Kong, China. It is Asia’s third largest stock exchange in terms of market capitalization behind the Tokyo Stock Exchange and the Shanghai Stock Exchange, and the fifth largest in the world. As of 2011, the Hong Kong Stock Exchange had 1,477 listed companies with a combined market capitalization of $2.5 trillion.

What is a BATS exchange?

BATS operates two stock exchanges in the U.S., the BZX Exchange and the BYX Exchange (The BATS Exchanges), which currently account for about 10-12% of all U.S. equity trading on a daily basis. This is not really an exchange, but rather it is where companies trade that are not listed on a stock exchange.

What is the difference between OTCQB and OTCQX?

This market is divided into 3 tiers: The OTCQB is for companies registered with the SEC. The OTCQX is for companies who aren’t registered with the SEC but do report their audited financials to the OTC Markets.

What is the OTC market?

There are two different markets for stocks that trade Over-The-Counter: The OTC Bulletin Board (OTCBB) and OTC Markets (formerly Pink Sheets) OTC Markets (formerly Pink Sheets) The OTC Markets is not a stock exchange, but rather the company facilitates the exchange of securities between qualified independent brokers.

What companies are listed on the NASDAQ?

Many tech giants are listed on the NASDAQ such as: Apple, Microsoft, Intel, Dell and many others. AMEX. The American Stock Exchange, now known as NYSE Amex Equities after the NYSE Euronext acquired it in 2008. It is the third-largest stock exchange by trading volume in the United States.

How many companies are listed on the NYSE?

There are over 3,000 listed companies trading on the NYSE. Some of the largest companies in America are listed on the NYSE such as Walmart, Coca-Cola, McDonalds and among others. The NASDAQ is the second-largest stock exchange by market capitalization in the world, after the New York Stock Exchange.

How do stock exchanges work?

How Stock Exchanges Work. A stock exchange is where different financial instruments are traded, including equities, commodities, and bonds. Exchanges bring corporations and governments, together with investors. Exchanges help provide liquidity in the market, meaning there are enough buyers and sellers so that trades can be processed efficiently ...

What is the New York Stock Exchange?

New York Stock Exchange (NYSE) The New York Stock Exchange is the world's largest equities exchange. 6 The parent company of the New York Stock Exchange is Intercontinental Exchange (ICE) as a result of the merger with the European exchange Euronext in 2007. Although some of its functions have been transferred to electronic trading platforms, ...

What is OTC market?

Over-the-Counter (OTC) The term over-the-counter (OTC) refers to markets other than the organized exchanges described above. OTC markets generally list small companies, many of which have fallen off to the OTC market because they were delisted. Two of the major OTC markets include:

Why are some investors wary of OTC stocks?

Some individual investors are wary of OTC stocks because of the extra risks involved. On the other hand, some strong companies trade on the OTC. In fact, several larger companies have deliberately switched to OTC markets to avoid the administrative burden and costly fees that accompany regulatory oversight laws such as the Sarbanes-Oxley Act. 19 You should also be careful when investing in the OTC if you do not have experience with penny stocks, as these primarily trade over-the-counter.

Why are companies listed on the NYSE important?

Companies listed on the NYSE have great credibility because they have to meet initial listing requirements and comply with annual maintenance requirements. To keep trading on the exchange, companies must keep their price above $4 per share. 8 . Investors who trade on the NYSE benefit from a set of minimum protections.

What are the requirements for a stock exchange?

Investors who trade on the NYSE benefit from a set of minimum protections. Among several of the requirements that the NYSE has enacted, the following two are especially significant: 1 Equity incentive plans must receive shareholder approval. 9 2 A majority of the board of directors' members must be independent, the compensation committee must be entirely composed of independent directors, and the audit committee must include at least one person who possesses "accounting or related financial management expertise." 10

What is the second OTC market?

The second OTC market is referred to as the Pink Sheets, a listing service that doesn't require companies to register with the Securities and Exchange Commission (SEC ). Liquidity is often minimal, and these companies are not required to submit quarterly 10Qs. 18

What is the NASDAQ exchange?

The NASDAQ Exchange. The NASDAQ is the world’s first all-electronic stock market exchange founded by the National Association of Securities Dealers (NASD) in 1971. NASDAQ is the acronym for the National Association of Securities Dealers Automated Quotations.

What is the stock market?

Understanding the Different Stock Exchanges. A stock exchange is the market in which securities are bought and sold. The U.S. equities markets is represented by three major exchanges. Here is some information on each of the exchanges.

What time does the OTC exchange open?

The OTC exchange is open from 9:30 AM EST to 4 PM EST, Monday through Friday. Small and micro-cap stocks and foreign companies through American depository receipts (ADR) can also be traded. Many of the companies trade extremely thin volume if any. There is no pre and post market trading available on these stocks.

How many stocks does the NASDAQ have?

The NASDAQ has over 3,100 stocks and averages two billion shares of total trading volume on a daily basis. NASDAQ was the first exchange to provide level 2 quotes, which displays all public market maker quotes by depth, price and size.

What was the daytrader's exchange?

The Daytrader’s Exchange. During the 1987 stock market crash, the NYSE and NASDAQ received tons of criticism about brokers, market makers and specialists not answering phone calls. This prompted the creation of the Small Order Execution System (SOES), which required market makers on the NASDAQ to absolutely honor these trades.

Why did the NASDAQ become a preferred exchange?

The NASDAQ attracted technology giants like Microsoft (NASDAQ: MSFT) and Oracle (NASDAQ: ORCL) early on to solidify its niche for riskier companies. Due to the cheaper listing costs and less stringent listing requirements, the NASDAQ grew a reputation as the preferred exchange for technology companies and start-ups.

What is OTC trading?

The Over-The-Counter (OTC) Market . This exchange was originally called the Pink Sheets, due to the original quotes being printed on pink sheets of paper in 2000. The name change to OTC was implemented in 2010. There is no physical exchange location like the NYSE.

What are the major exchanges?

Nearly every major country in the world has at least one stock exchange which performs the same function as the NYSE and NASDAQ do in the US. Some of the better known foreign exchanges include the following: 1 London Stock Exchange 2 Tokyo Stock Exchange 3 Toronto Stock Exchange 4 Paris Bourse 5 Frankfurt Stock Exchange 6 Shanghai Stock Exchange 7 Singapore Exchange 8 Hong Kong Stock Exchange

What time does the stock exchange open?

The exchange is open Monday through Friday (except legal holidays), from 9:30 a.m. to 4:00 p.m., New York time.

What is the NASDAQ market?

The NASDAQ Market. The National Association of Securities Dealers Automated Quotations, or NASDAQ, was the world’s first electronic stock market. For this reason, it was also referred to for much of its early existence as the over the counter market, or OTC. Today it’s the second largest stock exchange in the US by market capitalization.

What is required to list a stock on the NASDAQ?

Though requirements for a company to list its stock on the NASDAQ are less stringent than on the NYSE, NASDAQ still requires that a company is registered with the Securities and Exchange Commission (SEC), have at least three broker/dealers (market makers) and meet certain minimum financial asset requirements.

How many hours a day does Hong Kong stock market open?

Hong Kong Stock Exchange. Because stock exchanges are all around the world, stocks trade 24 hours a day, seven days a week. One or more stock exchanges are open at any given time.

What is the CME in the stock market?

Sometimes referred to simply as “the Merc”, the CME is a derivative exchange for financial securities, currencies and commodities as well as a host of lesser known derivative types. The “Bond Market”.

Is there a literal seat on the NYSE?

Though there are no literal seats on the exchange as there were in the 19th Century (which is where the term comes from), the licenses the NYSE sells to direct traders continue to be referred to in the same way. The NYSE tends to include the stock of generally better known and more established companies.

What is stock exchange?

Stock exchanges, meanwhile, are secondary markets where people who already own shares can make deals with potential buyers and not directly with the company themselves. In the United States there exist several registered exchanges that operate freely, with three of them standing out as major commerce hubs.

What is the second largest stock exchange?

The NASDAQ is the second-largest stock exchange by market capitalization. As has been famously said, money makes the world go round. Cold hard cash is still an incredible predictor of power, influence, and success.

What does NYSE stand for?

The NYSE, which stands for the New York Stock Exchange, is the single largest stock exchange in the world, at least by market capitalization, a figure derived by multiplying the price of a share of companies listed on the exchange by the number of shares of that company in circulation. The parent company of the New York Stock Exchange now goes by the moniker of NYSE Euronext, due to it combining with the European exchange group in 2007.

What is the NASDAQ?

NASDAQ. The NASDAQ, which originally stood for the National Association of Securities Dealer Automated Quotation system, was founded in 1971 and was one of the world's very first electronic stock markets.

What is OTC stock?

The OTC Bulletin Board is a quotation service that shows real-time quotes, sale prices, and trading volume data for over-the-counter equity securities, meaning those that generally aren't listed on NASDAQ or a national securities exchange. People who use the system can use it to look up prices and enter quotes for securities. Many penny stocks and small companies can be found on the board.

Is the stock market the third largest?

It is the third-largest stock exchange, at least by measures of trading volume. Unlike the other stock exchanges, it mostly features smaller companies, making it an ideal spot to find up and coming companies. Stock traders negotiating. Image credit: Rawpixel.com/Shutterstock.

Is the NASDAQ a digital stock exchange?

Unlike the New York Stock Exchange, all NASDAQ trades are done digitally, giving the exchange a trading volume higher than any other electronic stock exchange in the entire world.

What is the most important financial document in American history?

The Buttonwood Agreement is recognized as the founding document of the New York Stock Exchange (NYSE).

Where is the NYSE located?

Known as the Big Board, the NYSE is the largest stock exchange in the world and the heart of Wall Street in Lower Manhattan’s Financial District but it’s not the only stock exchange by far.

When did electronic trading become popular?

Electronic trading: Electronic trading became popular in the 1990s and has now replaced most in-person floor trading. Over-the-counter (OTC) trading: Small companies that can’t get listed on the big exchanges often trade on OTC exchanges. Helpful: How To Calculate Your Debt-to-Income Ratio.

Do stock exchanges sell anything?

Stock exchanges themselves don’t sell anything. Think of them instead as being like farmers markets — places where lots and lots of different sellers gather so interested buyers can shop them all in one place. See: How the SEC Affects You and the Economy.

Who is Andrew Lisa?

An award-winning writer, Andrew was formerly one of the youngest nationally distributed columnists for the largest newspaper syndicate in the country, the Gannett News Service. He worked as the business section editor for amNewYork, the most widely distributed newspaper in Manhattan, and worked as a copy editor for TheStreet.com, a financial publication in the heart of Wall Street's investment community in New York City.

What is stock exchange?

A Stock Exchange is an organization that anchor formulated market for dealing in securities, derivatives, commodities, and other financial equipment. It is one of the powerful ingredients of the financial market. Here, buyers and sellers club together to carry out transactions.

How many stocks are in the NASDAQ?

It consists of more than 3,000 stocks listed under it and comprises of the world’s humongous tech giants such as Apple, Microsoft, Google, Facebook, Amazon, Tesla, and Intel. ALSO READ.

What is the market capitalization of Shanghai SSE?

Currently, Shanghai SSE is the world’s 3rd largest stock exchange with a combined market capitalization of US$ 6.5 trillion as of Jan 2021.

What is the oldest stock exchange in the world?

The London Stock Exchange (LSE) is based in London and is the sixth-largest stock exchange in the world. It was established in 1801 and is the oldest stock exchange in the world. It has more than 3,000 listed companies with a combined market capitalization of $3.67 trillion as of Jan 2021.

What is the most engaging aspect of the stock market?

The most engaging aspect is that the Stock exchanges are also deemed as the financial measures of an economy where industrial development and firmness are mirrored in the index. Here is the list of the largest Stock Exchange in the world –.

What does EURONEXT stand for?

The Word EURONEXT is an acronym for European New Exchange Technology and has its corporate address at La Défense in Greater Paris. EURONEXT was established in 2000 by the consolidation of the exchanges in Amsterdam, Paris, and Brussels.

What is the JPX?

The Japan Stock Exchange (JPX) is a Japanese financial services corporation that operates multiple securities exchanges including Tokyo Stock Exchange and Osaka Securities Exchange. It was formed by the merger of the two companies on January 1, 2013.

What is stock exchange?

Stock exchanges are marketplaces in which U.S. financial securities, commodities, derivatives and other financial instruments are traded. While in the past, traders and brokers used to meet physically in a stock exchange building to trade stocks, now most of the financial trading happens electronically and automatically.

What is the NYSE?

The NYSE is a stock exchange based in New York, founded in 1790. 1 In April 2007, the New York Stock Exchange merged with a European stock exchange known as Euronext to form what is currently NYSE Euronext. 2 NYSE Euronext also owns NYSE Arca (formerly the Pacific Exchange ). 3 In order to be listed on the New York Stock Exchange, a company must have upwards of $4 million in shareholder's equity. 4 Locals and visitors can also see the exchange's building on Wall Street in New York City--although more than 80% of trading is now done electronically.

What is the Nasdaq?

Unlike AMEX, the Nasdaq is the largest electronic screen-based market. Created by the National Association of Securities Dealers (NASD) in 1971, it is popular because of its computerized system and relatively modern, as compared to the New York Stock Exchange.

When was the AMEX acquired?

The American Stock Exchange ( AMEX) was also a popular New York-based stock exchange, which was acquired in 2008. Unlike the Nasdaq and NYSE, AMEX focused on exchange-traded funds (ETFs). 1 .

Do stock exchanges require capital?

As a baseline, stock exchanges require regular financial reports, audited earnings, and minimal capital requirements. Companies that operate publicly through shareholders, or successful startups wishing to put up an initial public offering (IPO) must go through a stock exchange.

A Look at How The Stock Exchange Works

What Are The Different Types of Exchanges?

- Auction Markets

In an auction market, buyers and sellers are paired based on the lowest price the seller will accept for the shares of their stocks and the highest price the buyer is willing to pay. When those two figures match up, a trade can take place between the buyer and seller. The matching pairs are p… - Electronic Communication Networks

ECNs allow investors to trade listed stocks and other exchange-traded products. They are required to register with the SEC and are classified as an alternative trading system (ATS). To place a trade with an ECN, investors must be subscribers, and for the most part, only broker deal…

What Are The Different Stock Exchanges?

- There are two main stock exchanges in the United States: the New York Stock Exchange and the Nasdaq. Investors may also encounter the American Stock Exchange (ASE).

Accessing The Stock Exchanges

- Individual investors can access the NYSE and the Nasdaq through a brokerage firm, which typically offers a wide variety of services, including trading securities. Brokerage firms may be full service firms, discount firms or online only. Which type of firm you choose will depend on your needs and the type of investor you are. If you plan on being a hands-on investor who is willing to …

What Are Stock Exchanges?

How Stock Exchanges Work

- A stock exchange is where different financial instruments are traded, including equities, commodities, and bonds. Exchanges bring corporations and governments, together with investors. Exchanges help provide liquidityin the market, meaning there are enough buyers and sellers so that trades can be processed efficiently without delays. Exchanges also ensure that tr…

Auction Exchanges

- Auction exchanges—or the auction market—is a place where buyers and sellers put in competitive bids and offers simultaneously. In an auction exchange, the current stock price is the highest price a buyer is willing to spend on a security, while the lowest price is what the seller will accept. Trades are then matched, and when paired together, the order is executed. The auction market i…

Electronic Exchanges

- Many exchanges now allow trading electronically. There are no traders and no physical trading activity. Instead, trading takes place on an electronic platform and doesn't require a centralized location where buyers and sellers can meet. These exchanges are considered more efficient and much faster than traditional exchanges and carry out billions of dollars in trades each day. The …

Electronic Communication Networks

- Electronic communication networks (ECNs) are part of an exchange class called alternative trading systems (ATSs). ECNs connect buyers and sellers directly because they allow a direct connection between the two; ECNs bypass market makers.11Think of them as an alternative means to trade stocks listed on the Nasdaq and, increasingly, other exchanges such as the NYS…

Over-The-Counter

- The term over-the-counter(OTC) refers to markets other than the organized exchanges described above. OTC markets generally list small companies, many of which have fallen off to the OTC market because they were delisted. Two of the major OTC markets include:

Other Exchanges

- There are many other exchanges located throughout the world, including exchanges that trade stocks and bonds as well as those that exchange digital currencies.

The Bottom Line

- Every stock must list on an exchange where buyers and sellers meet. The two big U.S. exchangesare the NYSE and the Nasdaq. Companies listed on either of these exchanges must meet various minimum requirements and baseline rules concerning the "independence" of their boards. But these are by no means the only legitimate exchanges. Electronic communication net…