- Energy.

- Basic Materials.

- Industrials.

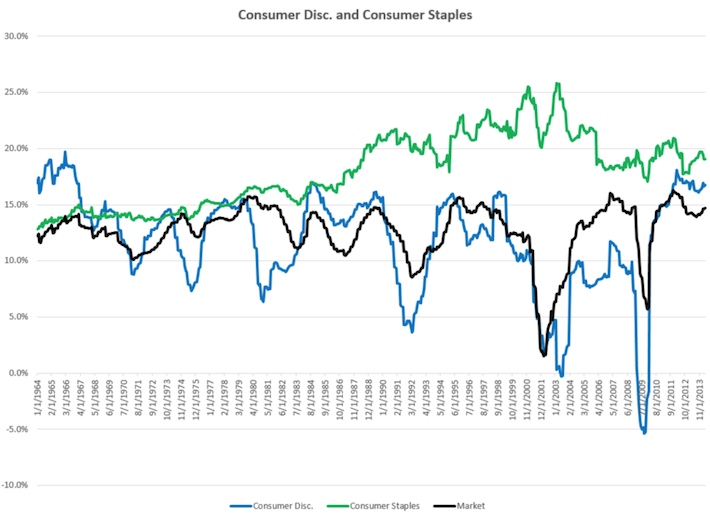

- Consumer Discretionary.

- Consumer Staples.

- Healthcare.

- Financial.

- Information Technology.

- Communications.

- Utilities.

- Energy Sector. The energy sector is made up of companies that work in energy sources, equipment, and services. ...

- Materials Sector. ...

- Industrials Sector. ...

- Consumer Discretionary Sector. ...

- Consumer Staples Sector. ...

- Healthcare Sector. ...

- Financials Sector. ...

- Information Technology Sector.

What you should know about the 11 stock market sectors?

Investing in stock sectors

- Energy

- Materials

- Industrials

- Utilities

- Healthcare

- Financials

- Consumer Discretionary

- Consumer Staples

- Information Technology

- Communication Services

Which is the best stock sector?

Zacks is the leading investment research firm focusing on stock research, analysis and recommendations. In 1978, our founder discovered the power of earnings estimate revisions to enable profitable investment decisions. Today, that discovery is still the heart of the Zacks Rank.

How many sectors are there in the stock market?

The 11 broad GICS sectors commonly used for sector breakdown reporting include the following: 3

- Energy

- Materials

- Industrials

- Consumer Discretionary

- Consumer Staples

- Health Care

- Financials

- Information Technology

- Telecommunication Services

- Utilities

Which sector is more profitable in the stock market?

Which sector is more profitable in the stock market? Overall Market: 70.3%, Energy Sector: 92%. This comparison gives an idea that Energy sector is inherently more profitable than the average stock market.

What are the 11 sectors of the stock market?

11 sectors of the stock marketEnergy. ... Materials. ... Industrials. ... Consumer discretionary. ... Consumer staples. ... Health care. ... Financials. ... Information technology.More items...•

What are the 8 sectors of stock market?

What are sectors in the stock market?Energy.Materials.Industrials.Utilities.Healthcare.Financials.Consumer Discretionary.Consumer Staples.More items...

What are 3 of the 11 major sectors of the stock market?

There are 11 stock market sectors, as classified by GICS, which stands for Global Industry Classification Standard. These sectors include healthcare, materials, real estate, consumer staples, consumer discretionary, utilities, energy, industrials, consumer services, financials, and technology.

What are the 4 types of stocks?

Here are four types of stocks that every savvy investor should own for a balanced hand.Growth stocks. These are the shares you buy for capital growth, rather than dividends. ... Dividend aka yield stocks. ... New issues. ... Defensive stocks. ... Strategy or Stock Picking?

Which sector is best for investment?

Top 5 Sectors to invest in, in 2021- Banking: A number of sectoral mutual funds have increased their allocation in this sector of the economy, resulting in a higher proportion of banking and financial stocks in the market. ... - Infrastructure: ... - Pharmaceuticals: ... - IT/ technology: ... - Chemicals: ... Conclusion.

What stock sector is Tesla in?

Tesla's sector is Consumer Discretionary.

What is the hottest sector of stocks?

Data source: Yahoo! Finance. Even as much of the stock market struggled for direction, there was one sector of the economy that performed extremely well on Tuesday....This Is the Hottest Sector in the Stock Market Right Now.IndexPercentage Change (Decline)Point ChangeDow+0.13%+46S&P 500(0.05%)(2)Nasdaq Composite(0.09%)(12)Jun 1, 2021

What are the best sectors to invest in 2021?

What Are the Top Industries to Invest in for 2021?1) Artificial Intelligence. Artificial intelligence has been at the top of our 'good investment' list for a long while now. ... 2) Virtual Reality. ... 3) Renewable Energy. ... 4) Cyber Security. ... 5) Transport. ... 6) Cloud Computing.

What are the best sectors to invest in 2022?

Going into 2022, among the key market sectors to watch are oil, gold, autos, services, and housing. Other key areas of concern include tapering, interest rates, inflation, payment for order flow (PFOF), and antitrust.

What are the 7 classifications of stock?

7 Categories of Stocks that Every Investor Should KnowIncome Stocks. An income stock is an equity security that offer high yield that may generate from the majority of security's overall returns. ... Penny Stocks. ... Speculative Stocks. ... Growth Stocks. ... Cyclical Stocks. ... Value Stocks. ... Defensive Stocks.

Which type of share is best?

Best stocks for beginnersReliance Industries Limited. Reliance Industries stock. Reliance Industries Limited (RIL) is India's largest private sector company. ... Tata Consultancy Services. TCS stock. ... HDFC Bank. HDFC Bank stock. ... Hindustan Unilever Limited. HUL stock. ... Maruti Suzuki India Limited. Maruti Suzuki stock.

What is difference between share and stock?

Definition: 'Stock' represents the holder's part-ownership in one or several companies. Meanwhile, 'share' refers to a single unit of ownership in a company. For example, if X has invested in stocks, it could mean that X has a portfolio of shares across different companies.

How many sectors are there in the stock market?

The stock market is often divided into eleven sectors, with each sector having unique dynamics affecting its profitability. Investors looking to build exposure to specific sectors can use any number of ETFs to achieve their asset allocation goals.

What is the financial sector?

The financial sector consists of banks, investment funds, insurance companies and real estate firms, among others. In general, the majority of the revenue generated by the sector comes from mortgages and loans that gain value as interest rates rise.

What is the materials sector?

Materials. The materials sector consists of mining, refining, chemical, forestry and related companies that are focused on discovering and developing raw materials. Since these companies are at the beginning of the supply chain, they are vulnerable to changes in the business cycle.

What is healthcare sector?

The healthcare sector consists of biotechnology companies, hospital management firms, medical device manufacturers and many others. In general, the sector is considered to be both a growth opportunity and defensive play since people will always require medical aid.

What is the energy sector?

The energy sector consists of oil and gas exploration and production companies, as well as integrated power firms, refineries and other operations. In general, these companies generate revenue that’s tied to the price of crude oil, natural gas and other commodities.

What is utilities sector?

The utilities sector consists of electric, gas and water companies as well as integrated providers. In general, the sector generates consistent recurring income by charging consumers and businesses that provide higher-than-average dividend yields.

What Are Stocks?

Stocks (also known as equities) are a type of security that represents the ownership of a business. This ownership entitles the stockholder to a the proportion of the corporation’s assets and profits equal to how much of the stock they own

Stock Market Sectors

Market sectors are groupings of stocks based on the main characteristics or function of the companies they represent

The Financial Sector

The financial sector is a section of the economy made up of firms and institutions that provide financial services to commercial and retail customers.

Investing in the Financial Stock Sector

Some of the positive factors that affect the financial sector include:

The Energy Sector

Since energy is highly linked to supply and demand, it is relatively easy to predict falls and spikes in share price

The Basic Materials Sector

The basic materials sector is comprised of businesses engaged in the discovery, development, and processing of raw materials These companies are involved in the mining and refining of metal, development of chemical products, and production of forestry products.

How many sectors are there in the stock market?

The stock market is often divided into 11 major sectors representing key areas of the economy. Within each sector, there are a number of different publicly traded stocks that operate in the same broad area. If you’re an investor and want to diversify your portfolio expansively, you’ll then need to own companies across the market.

What is the financial sector?

The financial sector is made up of firms and institutions that provide financial services to both corporate and individual customers. This sector consists of banks, investment funds, and insurance companies, among others. By and large, the majority of the revenue generated by the sector comes from mortgages and loans.

What is the consumer staples sector?

The consumer staples sector consists of food and beverage companies as well as companies that create products consumers deemed essential for everyday use. In general, these companies are defensive plays and are able to maintain stable growth regardless of the broader state of the economy.

What is technology sector?

The technology sector consists of businesses revolving around the manufacturing of electronics, software developers, or products and services that are related to information technology. In general, these businesses are driven by upgrade cycles and the general health of the economy, although growth has been robust over the years. ...

What is utility sector?

Utilities. The utility sector consists of electric, gas, and water companies as well as integrated providers. In general, many investors treat utilities as long-term holdings and invest in the sector to generate a steady income for their portfolios.

What is the materials sector?

The materials sector consists of mining, refining, chemical, forestry, and related companies that are focused on discovering and developing raw materials. Since these companies are at the beginning of the supply chain, it’s natural that their activities tend to move along with the economic cycles.

What is the main source of revenue for real estate companies?

Accordingly, the main source of revenue for these companies comes from rent income and real estate capital appreciation.

Sorting the Stocks

So much information, but so little time. Investors face a challenging task before allocating money to a specific stock.

What are the different sectors in the stock market?

The key sectors in the Indian stock market are, but are not limited to:

What are some of the major sectors in Indian stock markets?

Some companies are household names, while some are less well-known. Sectors come in handy by bringing hidden gems to the attention of investors. Amongst the various sectors in stock markets, here are four key sectors that you need to know about:

Sectors Sliced and Diced

To sum up, sectors group several stocks based on similar business models, allowing investors to zoom in on a particular industry and identify a particular stock. The overload of information at the hands of investors eats up a lot of useful time.

What is a sector in the stock market?

Stock Sectors are a means of breaking down and simplifying an enormous and complex stock market. Analysts and portfolio managers use the GICS sector classification to enable better portfolio structuring, risk management, and reporting. Stock Market Sectors enable more granular performance reporting, analysis, and comparison ...

What is the financial sector?

Many people think of the Financial Sector as banking . The Financial Sector includes banks, but it also encompasses investment firms, stock brokerages, money managers, and some insurance and real estate firms.

How many sectors are there in GICS?

The GICS divides the market into 11 sectors. Using the GICS makes it easy for investors to find information about stocks and sectors. investors can analyze the sectors’ past performance to understand which industries are growing/declining and which are the best performing stock in each sector and industry.

What is the basic materials sector?

The Basic Materials Sector is confusing because it includes everything from gold mining to cement to lumber to paint manufacturing.

What is the new name for the telecommunications sector?

The Communications Stock Sector is the new name for the Telecommunications Stock Sector . The best way to think of Communications Stocks is as companies that transmit data in any electronic form.

How many sectors are there in the stock market?

In total, there are 11 sectors in the stock market, each with its own characteristics and features. Under each sector umbrella is a grouping of industries, which are represented by all the companies in that industry that trade on the stock market.

What is sector in investing?

A sector is a slice of the stock market that represents a certain part of the economy or industry. Knowing how these sectors work can guide the selection of stocks, mutual funds, exchange-traded fundsand other investments.

What is market capitalization?

With stock market sectors, market capitalization is measured as the total value of all of the companies across each industry included in a particular sector. This is a fluid number, meaning it can change daily based on how stock prices of individual companies move.

The Financial Sector

- The financial sector is a section of the economy made up of firms and institutions that provide financial services to commercial and retail customers. 1. These include banks, investment companies, insurance companies, and real estate firms. 2. The financial sector generates a good portion of its revenue from loans and mortgages and thrives in a low-interest-rate environment. …

Investing in The Financial Stock Sector

- Some of the positive factors that affect the financial sector include: 1. Moderately rising interest rates 2. Reduced regulation 3. Low consumer debt levels Conversely, investors should consider some of the negative factors that affect this sector as well: 1. Rapid interest rate increases 2. Yield curve flattening 3. Stricter and increased legislation Key Leaders in the Financial Sector : J…

The Energy Sector

- The energy sector is comprised of companies whose primary business activities relate to Producing or supplying energy through

- Many investors believe renewable and alternative energy sources will play an important role in the future

- The energy sector does well during times of high oil and gas prices, which are normally durin…

- The energy sector is comprised of companies whose primary business activities relate to Producing or supplying energy through

- Many investors believe renewable and alternative energy sources will play an important role in the future

- The energy sector does well during times of high oil and gas prices, which are normally during times of economic expansion

The Basic Materials Sector

- The basic materials sector is comprised of businesses engaged in the discovery, development, and processing of raw materials

- The most common materials within the sector are mined products, such as ores and metals, and forestry products, such as lumber, natural gas, crude oil, and coal

- Many of these companies provide the necessities for construction and development

- The basic materials sector is comprised of businesses engaged in the discovery, development, and processing of raw materials

- The most common materials within the sector are mined products, such as ores and metals, and forestry products, such as lumber, natural gas, crude oil, and coal

- Many of these companies provide the necessities for construction and development

- These companies and their stocks are sensitive to changes in the business cycle