How Do Puts & Calls Work in the Stock Market?

- Call Options. A call option is a contract to buy a stock at a set price, and within a limited time. The contract sets a...

- Option Prices. Calls have intrinsic value if the stock is trading above the strike price. A Microsoft 25 call, for...

- Put Options. A put is a contract to sell a stock or "put" it to a buyer. It also...

How to make money with call and put options?

The two most common types of options are calls and puts: 1. Call options Calls give the buyer the right, but not the obligation, to buy the underlying asset Marketable... 2. Put options

What are put and call options?

· You buy a call when you expect the price to go up. When you buy a call contract, you can buy a stock at a guaranteed price up until a certain date. We’ll get to some examples in a bit. Puts are a contract to buy a stock at a certain price. And …

What is a put or CALL TRANSACTION?

· Puts and calls are short names for put options and call options. When you own options, they give you the right to buy or sell an underlying instrument. You buy the underlying …

What is call vs put?

Puts and Calls are often called wasting assets. They are called this because they have expiration dates. Stock option contracts are like most contracts, they are only valid for a set period of …

What is call & put option with example?

Risk vs Reward – Call Option and Put OptionCall BuyerPut SellerMaximum ProfitUnlimitedPremium receivedMaximum LossPremium PaidStrike price – premiumNo Profit – No lossStrike price + premiumStrike price – premiumIdeal ActionExerciseExpireJun 9, 2021

How does call option work?

A call option gives you the right, but not the requirement, to purchase a stock at a specific price (known as the strike price) by a specific date, at the option's expiration. For this right, the call buyer will pay an amount of money called a premium, which the call seller will receive.

Is it better to buy puts or calls?

Neither is particularly better than the other; it simply depends on the investment objective and risk tolerance for the investor. Much of the risk ultimately resides in the fluctuation in market price of the underlying asset.

How do puts and calls work for dummies?

With a call option, the buyer of the contract purchases the right to buy the underlying asset in the future at a predetermined price, called exercise price or strike price. With a put option, the buyer acquires the right to sell the underlying asset in the future at the predetermined price.

Do I have to buy 100 shares on a call?

You could buy shares of the stock, or you could buy a call option. Say a call option that gives you the right, but not the obligation, to buy 100 shares of XYZ anytime in the next 90 days for $26 per share could be purchased for $100.

How much can you lose on a call option?

$500Each contract typically has 100 shares as the underlying asset, so 10 contracts would cost $500 ($0.50 x 100 x 10 contracts). If you buy 10 call option contracts, you pay $500 and that is the maximum loss that you can incur. However, your potential profit is theoretically limitless.

When should you buy puts?

Investors may buy put options when they are concerned that the stock market will fall. That's because a put—which grants the right to sell an underlying asset at a fixed price through a predetermined time frame—will typically increase in value when the price of its underlying asset goes down.

When should I call and put?

A call option gives the holder the right to buy a stock and a put option gives the holder the right to sell a stock. Think of a call option as a down payment on a future purchase.

Do you make more money on calls or puts?

Key Takeaways Puts (options to sell at a set price) generally command higher prices than calls (options to buy at a set price). One driver of the difference in price results from volatility skew, the difference between implied volatility for out-of-the-money, in-the-money, and at-the-money options.

What does a $30 call mean?

The call option allows the investor to buy the stock for $30, and they could immediately sell the stock for $33, giving them a $3 per share difference.

How do I remember calls and puts?

Standard call and put options cover 100 shares of the stock. A straightforward way to remember the difference between calls and puts is that you buy a call option if you think the price will go up and a put option if you think it will go down.

What is a $10 call?

With call options, the strike price represents the predetermined price at which a call buyer can buy the underlying asset. For example, the buyer of a stock call option with a strike price of $10 can use the option to buy that stock at $10 before the option expires.

What is call put option?

Call and put options are derivative investments, meaning their price movements are based on the price movements of another financial product. The financial product a derivative is based on is often called the "underlying.". Here we'll cover what these options mean and how traders and buyers use the terms.

How does a call option work?

For U.S.-style options, a call is an options contract that gives the buyer the right to buy the underlying asset at a set price at any time up to the expiration date. 2 . Buyers of European-style options may exercise the option— to buy the underlying—only on the expiration date.

When is a put option bought?

A put option is bought if the trader expects the price of the underlying to fall within a certain time frame.

How to find the price of a put contract?

To find the price of the contract, multiply the underlying's share price by 100.

Who receives the premium on a put option?

The put seller, or writer, receives the premium. Writing put options is a way to generate income. However, the income from writing a put option is limited to the premium, while a put buyer can continue to maximize profit until the stock goes to zero.

What is the purpose of writing put options?

Writing put options is a way to generate income. However, the income from writing a put option is limited to the premium, while a put buyer can continue to maximize profit until the stock goes to zero. 4 .

What does a put buyer get?

What the Put Buyer Gets. The put buyer has the right to sell a stock at the strike price for a set amount of time. For that right, the put buyer pays a premium. If the price of the underlying moves below the strike price, the option will be worth money (it will have intrinsic value).

What is call in stock?

Calls are a contract to sell a stock at a certain price for a certain period of time. Here, you gotta accurately predict a stock’s movement. That’s the hard part — predicting the market’s direction is near impossible. You buy a call when you expect the price to go up.

What does a call buy?

The buyer of a call purchases the option to buy the stock for a certain price. The time period is limited for these contracts. The buyer must exercise the call option before the contract expires worthless.

Is there a case to buy and sell Elon Musk stock?

There are cases to buy and sell. (There are a lot of Elon Musk super fans and haters out there.) It’s hard to know who to trust and how the stock will actually move.

How do options traders make money?

They may notice a lot of differing opinions on a particular stock. The volume rises as more people buy and sell. The stock gets a lot of coverage, and the implied volatility surges.

What is strike price?

The strike price is the agreed-upon price at which the actual stock will transact. A call buyer wants to see the stock price above the strike price.

What happens if the strike price falls below the strike price?

If the price falls below the strike price, the buyer’s in the money. In short, the whole contract is a function of price. Say you sell a stock at $30 and the current price is $20. You can buy it at the current price and sell it for a profit against your contract.

What happens when you buy a put?

If you buy a put, you’re buying the right to sell a stock at a certain price. You’re betting the price will go down.

What is the difference between a put and call option?

To put it simply, the purchase of put options allow you to sell at a strike price and the purchase call options allow you to buy at a strike price.

What does it mean to buy a call option?

A purchase of a call option gets you the right to buy the underlying at the strike price. Instead of owning a stock, you can buy a call option and participate in a potential upside.

Can you trade put if you own a stock?

You can trade puts like that even if you own the stock, but you won’t get a full compensation for the move of the underlying. In this example, the put gained only $0.60 and the stock lost $2.

Do you have to own Apple stock to trade a put?

You don’t have to own the stock to trade puts. You could buy the July 6, 185 strike put, without owning shares of Apple. If in a week the stock trades to 185, your put would be worth more than $3 and you could sell it with profit. You can use this calculator to get the value of a put with 29 days till expiration and with the underlying market price of $185. The simulation shows that the price of the put would jump to $3.60, which means 20% profit on your trade.

How much is the July 6 strike put in Apple?

The July 6, 187.50 strike put in Apple costs around $4. You have probably noticed that the strike is not the same as the market price. This is because the example uses exchange-traded options. The exchange-traded options are standardized, so they don’t have a strike price for every market price.

How much do you lose if you sell Apple on July 6?

Do the math by adding the premium of $3 to the difference between the market price and the strike of the put. If Apple closes at $180 on July 6, you’ll exercise the option. This means that you are going to use the right to sell Apple at $185 and instead of losing $7, you’ll only lose $4.87.

What is Robinhood trading?

Robinhood is the broker for traders who want a simple, easy-to-understand layout without all the bells and whistles other brokers offer. Though its trading options and account types are limited, even an absolute beginner can quickly master Robinhood’s intuitive and streamlined platform.

What does it mean to buy call options?

Call options "increase in value" when the underlying stock it's attached to goes "up in price", and "decrease in value" when the stock goes "down in price". Call options give you the right ...

When to use a put option?

You use a Put option when you think the price of the underlying stock is going to go "down". Most Puts and Calls are never exercised. Option Traders buy and resell stock option contracts before they ever hit the expiration date. This is because minor fluctuations in the price of the stock can have a major impact on the price of an option.

Why do you sell options for a quick profit?

This is because minor fluctuations in the price of the stock can have a major impact on the price of an option. So if the value of an option increases sufficiently, it often makes sense to sell it for a quick profit.

What does it mean to buy a stock at $140?

A $140 stock price means you get a $45 discount in price etc. etc. And vice versa, if the stock falls in price to $50 a share who wants to purchase a contract that gives them the right to purchase it at $95, when it's selling cheaper on the open market. If you exercised the right and bought the stock at $95 you'd immediately be at a loss ...

What is call option?

Call options give you the right to "buy" a stock at a specified price.

Do put options decrease in value?

No one, which is why Put options "decrease in value" as the stock price "goes up".

What does put option mean?

Buying "Put options" gives the buyer the right, but not the obligation, to "sell" shares of a stock at a specified price on or before a given date.

What are calls and puts?

In addition to individual stocks, you can trade puts and calls on market indexes such as the Dow Jones industrials or the Standard & Poor's 500. You can also trade options on futures contracts for commodities such as oil, gold or copper. When you deal in options, you can trade them to close your position, you can exercise them to buy or sell the underlying stock, or you can hold them until expiration. At that point your position in a worthless option disappears, or your broker settles the contract for you if it still has value.

What is a put in stock?

A put is a contract to sell a stock or "put" it to a buyer. It also represents 100 shares, and it has the same intrinsic value as a call -- in reverse. The lower a stock moves, the higher its put options rise. You can buy one or 100 calls or puts at a time.

Do options have intrinsic value?

Options also have time value. The longer until expiration, the more time value they have. At expiration, the time value is zero and the option either has intrinsic value or is worthless. The volatility of the underlying stock also adds value, as does an active market in which traders are busily buying and selling a high volume of options.

What is the intrinsic value of a call?

Calls have intrinsic value if the stock is trading above the strike price. A Microsoft 25 call, for example, has $5 of intrinsic value if the stock itself is at $30. If the stock goes to $35, the option doubles its intrinsic value to $10. Options also have time value.

What is call option?

Call Options. A call option is a contract to buy a stock at a set price, and within a limited time. The contract sets a strike price at which you can buy the stock. The contract ends when its expiration date passes. A stock option represents 100 shares of the underlying stock, and the expiration date is the third Friday of the expiration month.

What is options market?

The options market allows traders to speculate on the direction of stock prices or to hedge investments they already own. Before having a go at the volatile options market, educate yourself on how it works and about the two basic flavors of option contracts: puts and calls.

Can you trade options on futures?

You can also trade options on futures contracts for commodities such as oil, gold or copper. When you deal in options, you can trade them to close your position, you can exercise them to buy or sell the underlying stock, or you can hold them until expiration.

What does it mean when an investor buys a call?

An investor who buys a call seeks to make a profit when the price of a stock increases. The investor hopes the security price will rise so they can purchase the stock at a discounted rate. The writer, on the other hand, hopes the stock price will drop or at least stay the same so they won’t have to exercise the option.

What is call option?

Call Option Defined. A call gives investors the option, but not the obligation, to purchase a stock at a designated price (the strike price) by a specific time frame (the expiration date). Essentially, the buyer of the call has the option to purchase the security up until the expiration date. The seller of the call is also known as the writer.

What happens if the stock price drops to $90?

If the price drops to $90 per share you can exercise this option. This means instead of losing $1,000 in the market you may only lose your premium amount. Keep in mind, the examples above are high-level. Options trading can become a lot more complex depending on the specific options an investor chooses to purchase.

How much would a stock option be worth if it went up to $65?

If the stock price only goes up to $65 a share and you executed your option, it would be worth $6,500. This would only result in a $25 gain because you must subtract the premium amount from your total gain ($6,500-$6,300-$175=$25). But if you purchased the shares outright you would have gained $500.

What is the biggest risk of a call option?

The biggest risk of a call option is that the stock price may only increase a little bit. This would mean you could lose money on your investment. This is because you must pay a premium per share. If the stock doesn’t make up the cost of the premium amount, you may receive minimal returns on this investment.

Why are call options limited?

Conversely, put options are limited in their potential gains because the price of a stock cannot drop below zero.

Can you hedge against a stock price drop with a put option?

However, the investor is not obligated to do so. Purchasing a put option is a way to hedge against the drop in the share price. So, even if the stock price declines on a put option, they can avoid further loss. The investor could also profit from a bear market or dips in the prices of the stocks.

How does a put option work?

How a Put Option Works. A put option becomes more valuable as the price of the underlying stock decreases. Conversely, a put option loses its value as the underlying stock increases. When they are exercised, put options provide a short position in the underlying asset.

What is put option?

What Is a Put Option? A put option is a contract giving the owner the right, but not the obligation, to sell–or sell short–a specified amount of an underlying security at a pre-determined price within a specified time frame. This pre-determined price that buyer of the put option can sell at is called the strike price .

What if the investor did not own the SPY units?

What if the investor did not own the SPY units, and the put option was purchased purely as a speculative trade? In this case, excercising the put option would result in a short sale of 100 SPY units at the $425 strike price. The investor could then buy back the 100 SPY units at the current market price of $415 to close out the short position.

Can option writers buy back?

Similarly, the option writer can do the same thing. If the underlying's price is above the strike price, they may do nothing. This is because the option may expire at no value, and this allows them to keep the whole premium. But if the underlying's price is approaching or dropping below the strike price–to avoid a big loss–the option writer may simply buy the option back (which gets them out of the position). The profit or loss is the difference between the premium collected and the premium that is paid in order to get out of the position.

Can an option buyer sell an option?

The option buyer can sell their option and, either minimize loss or realize a profit, depending on how the price of the option has changed since they bought it. Similarly, the option writer can do the same thing. If the underlying's price is above the strike price, they may do nothing.

Do you have to hold a put option until expiration?

Alternatives to Exercising a Put Option. The put option seller, known as the option writer, does not need to hold an option until expiration (and neither does the option buyer). As the underlying stock price moves, the premium of the option will change to reflect the recent underlying price movements.

What to keep in mind when selling put options?

There are several factors to keep in mind when it comes to selling put options. It's important to understand an option contract's value and profitability when considering a trade, or else you risk the stock falling past the point of profitability. The payoff of a put option at expiration is depicted in the image below:

What is the benefit of buying call options?

But they can also result in a 100% loss of the premium if the call option expires worthless due to the underlying stock price failing to move above the strike price. The benefit of buying call options is that risk is always capped at the premium paid for the option.

What is the premium on a call option?

You pay a fee to purchase a call option, called the premium. It is the price paid for the rights that the call option provides . If at expiry the underlying asset is below the strike price, the call buyer loses the premium paid. This is the maximum loss.

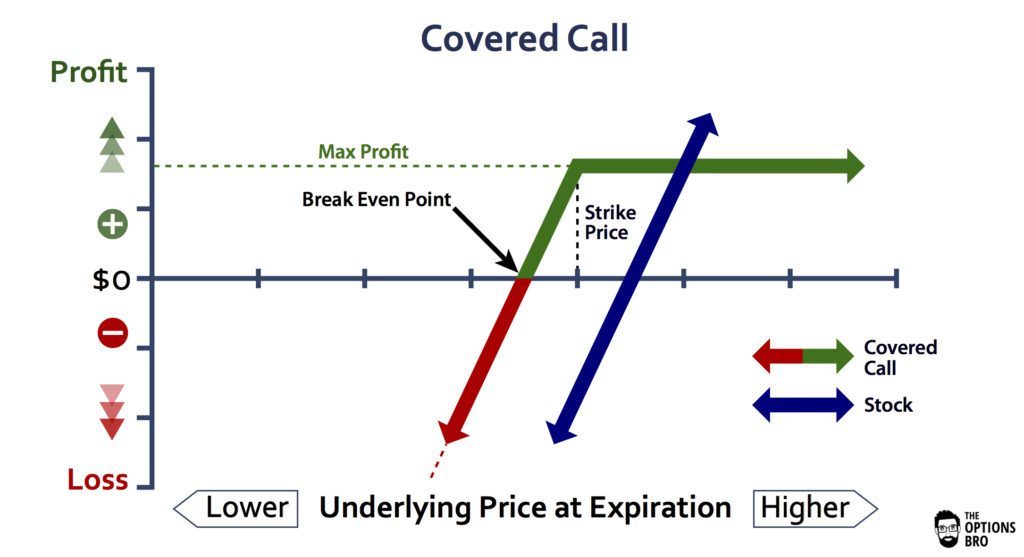

How do you use a covered call option?

Some investors use call options to generate income through a covered call strategy. This strategy involves owning an underlying stock while at the same time writing a call option, or giving someone else the right to buy your stock. The investor collects the option premium and hopes the option expires worthless (below strike price). This strategy generates additional income for the investor but can also limit profit potential if the underlying stock price rises sharply.

How does covered call work?

Covered calls work because if the stock rises above the strike price, the option buyer will exercise their right to buy the stock at the lower strike price. This means the option writer doesn't profit on the stock's movement above the strike price. The options writer's maximum profit on the option is the premium received.

What is the profit of an option?

If the underlying asset's current market price is above the strike price at expiry, the profit is the difference in prices, minus the premium. This sum is then multiplied by how many shares the option buyer controls.

How long can a call option be held?

The call option buyer may hold the contract until the expiration date, at which point they can take delivery of the 100 shares of stock or sell the options contract at any point before the expiration date at the market price of the contract at that time. The market price of the call option is called the premium.

Can you buy call options for speculation?

Call options may be purchased for speculation or sold for income purposes or for tax management.