Here’s an age-based look at when you should buy stocks

- Instead of buying stocks based on market ups or downs, determine your time horizon for drawing down on funds to cover...

- Savers in their 20s and 30s could keep up to 80 percent of investments in stocks, unless planning to retire early in...

- Forty- and 50-somethings can invest up to 70 percent of funds in stocks, but...

When should I buy more stocks that I already own?

The stock is presently trading at around £17 levels, which is still 500p lower than its pre-pandemic value. I get that there is still some uncertainty around the stock. The pandemic keeps rearing its head, what with the new Omicron variant! And travel is most likely to be impactedif the situation gets out of hand again.

What is the minimum age to trade stocks?

This age is 18 in a handful of states, and 21 in most states. Virtually every individual investor buys and sells stocks through a broker; hence, the minimum age for opening an account acts as a restriction to investing in stocks.

What is the best age to invest in stock markets?

The Best Investments for Your 30s

- Workplace 401 (k) or 403 (b)

- Roth IRA

- A Stock-Heavy Portfolio

- Real Estate

- Yourself

What do you actually own when you buy a stock?

What Happens After You Buy Stock?

- Identification. Investors usually purchase stock through a stockbroker. ...

- Effects. Once the stock is purchased it will show as a holding in the investor's account. ...

- Function. The value of a stock will move up and down as the shares trade on the stock exchanges. ...

- Size. It is possible for the number of shares of stock an investor holds to change. ...

- Considerations. ...

What is a good age to start stock?

If you put off investing in your 20s due to paying off student loans or the fits and starts of establishing your career, your 30s are when you need to start putting money away. You're still young enough to reap the rewards of compound interest, but old enough to be investing 10% to 15% of your income.

Can I get into stocks at 14?

Well, if you want to invest in the stock market by yourself, you have to be an adult, or at least 18 years old to buy stocks. Minors can't invest in the stock market by themselves, teenagers under 18 included in that group.

Can I get into stocks at 17?

Investors under age 18 are not allowed to own stocks, mutual funds, and other financial assets outright. If you are a minor, you can make investments only under the supervision of your parent (or an adult) through a custodial account.

Can you get into the stock market at 16?

At 16, most youngsters have some knowledge of the stock market. To begin investing in the stock market, a custodial account must be opened by a parent or guardian. These types of investment accounts are offered at most brokerage firms including Charles Schwab and Fidelity.

What should a 16 year old invest in?

Open a checking account. Although not extremely exciting or lucrative, this is a simple way to get your teenager familiar with the idea of investing. ... Start a savings account. ... Use a custodial account. ... Work with a robo-advisor. ... Roth IRA. ... Open a 529 plan. ... Start or invest in a business.

Can I use Robinhood at 16?

There are a lot of investing apps that look perfect for teenagers (hello, Robinhood), but you still need to reach 18 to participate. This restriction is a legal requirement specific to the investment industry, and there's no way around it.

Can a 13 year old invest?

If you are a minor, you can make investments only under the supervision of your parent through a custodial account. You parent will have to sign you up for a custodial account offered by an online broker.

What should a 19 year old invest in?

When you're young, you generally want higher returns that stocks, stock-based mutual funds, or ETFs can provide – rather than slower-growing investments like bonds and CDs. Yes, there is inherently more risk in these types of investments, but remember: You're investing with a long-term mindset.

Can a 12 year old invest in stocks?

How old does my child have to be to buy stocks? To start investing in stocks on their own, your kid will need a brokerage account, and they must be at least 18 years old to open one. They can start earlier than this, but they'll need a parent or guardian to open a custodial account for them.

Should I invest in stocks as a teen?

Stocks act as some of the best investments for teenagers because they tend to provide a long-term focus on growth and higher returns. They carry higher risks traditionally than investments like bonds, but young investors can tolerate this volatility due to their long investment horizons.

What should I invest my money in as a teenager?

The bottom line when it comes to investments for teenagers Popular investments for teens include custodial accounts, college savings plans, and retirement accounts. But your teen also might consider some less traditional investment options like starting a business.

Why do you have to be 18 to invest?

18 is the minimum age set by most brokers for opening an account with them. This is because 18 is when a person can legally enter into a contract on his own. Some states have a mandatory minimum age of 21 for letting someone invest in stocks.

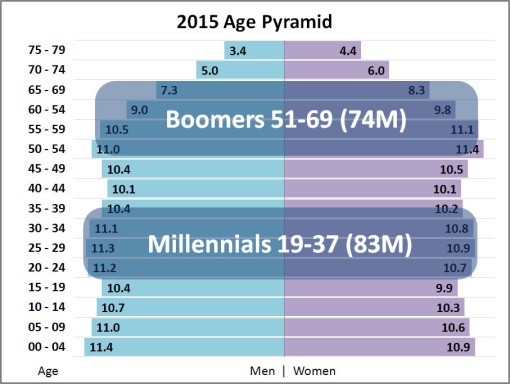

What percentage of stocks should I invest in for a baby boomer?

For those who are retired, in good health and withdrawing from their investment accounts to cover living expenses, I typically recommend stocks make up 40 percent to 60 percent of their portfolio. Ideally, a retiree has five to 10 years’ worth of their living expenses in more conservative investments, such as cash, bonds and some alternatives.

How much do savers keep in stocks?

Savers in their 20s and 30s could keep up to 80 percent of investments in stocks, unless planning to retire early in their 50s.

How much have stocks declined since 1929?

Looking back to 1929, stocks have declined an average 45 percent during each bear market. If that gives you an upset stomach and there’s a chance you’ll bail out on your stocks when they’ve gone down sharply in price, even if temporarily, your risk tolerance also needs to be a primary factor in your asset allocation.

What do millennials need to retire early?

To achieve this goal, they will need a mix of bonds, real estate, cash or alternative investments to protect their principal in bear markets while they are building their wealth. Young executives in this situation can trim the percentage of stock in their portfolio by 10 percent to 20 percent to make room for these other assets.

How much of your 401(k) should be invested in stocks?

Because this money won’t be needed for such a long time, I typically recommend at least 80 percent of an investment portfolio in stocks.

Why do people work well into their 70s?

Many people will continue to work well into their 70s because they love what they do or want to stay engaged with other professionals. But they still need a game plan when the paycheck ends, especially to cover any large expenses, such as long-term health care.

Should parents invest in college savings accounts?

Parents in this age group should use the same philosophy for investing in their children’s college savings accounts. People who begin investing shortly after the birth of a child can invest this money more heavily in stocks. But as the child gets closer to enrolling in college, you want to invest more conservatively to cushion any drop in the market and ensure the cash is available when the first tuition bill arrives.

How old do you have to be to buy stocks?

You have to be 18-years-old to buy stocks on your own. You can invest as a minor if your parent or another guardian opens a custodial account with you. Investing is risk-fraught and it is not for the faint-hearted.

What is the minimum age to open a brokerage account?

18 is the minimum age set by most brokers for opening an account with them. This is because 18 is when a person can legally enter into a contract on his own. Some states have a mandatory minimum age of 21 for letting someone invest in stocks.

What is Investing?

Investopedia defines investment as an act of committing capital and time to a business, project, real estate, etc. in a bid to make a profit. Simply put, it is ploughing in money in anticipation of future returns. Since investment involves two scarce and costlier inputs, namely time and money, it should be done judiciously, wisely and with utmost care.

What is etrade trading?

E*TRADE is an online discount trading house that offers brokerage and banking services to individuals and businesses. One of the first brokers to embrace online trading, E*TRADE not only survived both the dot-com bubble and Recession — it thrived. You can choose from two different platforms (one basic, one advanced). E*TRADE is a suitable broker for traders of most skill levels, whether you want to buy mutual funds and hold them for decades or dabble in options swing trading. E*TRADE offers a library of research and education materials to help you out.

What is a trade zero?

TradeZero is an online broker and free stock trading platform that provides everything you need to successfully share and trade , including round-the-clock customer support. TradeZero provides four different trading state-of-the-art software programs with its services, a locator for sourcing shares for shorting, commission-free trades, and real-time streaming, to name a few of the features promoted on their website. The software is a unique and (potentially) affordable option for anyone interested in stock trading.

How to start small when buying stock?

Start small when you purchase stock for the 1st time. You can purchase just a single share and add more over time. You may also want to look into fractional shares. This allows you to buy a portion of stock, which can be a good option if you’re looking at more expensive, well-known stock.

Can minors own stocks?

Legally, even minor children can own stocks, either bequeathed to them through a will or as a gift. However, trading in stocks can be done by the setting up of a ‘Uniform Transfers to Minors Act’ or ‘Uniform Gifts to Minors Act account,’ depending on the state of your domicile.

How to invest in 401(k)?

Once you have that money put away, you need to choose where to invest it. Fellow Fool Dan Caplinger has already highlighted the three keys to picking your best 401 (k) investment options: 1 Keep it simple: Check out the target-date funds -- which are based on when you plan to retire -- or asset allocation funds. 2 Be a cheapskate: Choose the funds with the lowest expense ratios. While paying a 1% fee every year might not sound like much, it can eat away at your nest egg over time. 3 Go outside the box: If you're inclined to, some employers allow you to use brokerages to pick individual stocks in your plan.

Can you use brokerages to pick stocks?

Go outside the box: If you're inclined to, some employers allow you to use brokerages to pick individual stocks in your plan.

Can you take an IRA early?

But pulling out any growth will result in paying both income tax and a 10% penalty. It's important to note that there are some qualified distributions that you are allowed to take early -- to help pay for a first house, or emergency medical expenses, for instance. Opening up an IRA is actually quite simple.

How long do you have to invest in stocks in your 30s?

If you’re in your 30s, you have 30 years or more to profit from the investment markets before you are likely to retire. Temporary declines in stock prices won’t hurt you as much, because you have years to recoup any losses. So, if your stomach can handle the volatility of stock prices, now’s the time to invest aggressively.

What Should Your Portfolio Look Like in Your 30s, 40s, and 50s?

Barbara Friedberg is a former portfolio manager and owner of two investment resource websites. She is a financial technology consultant and author of several investing and personal finance books.

What is the best asset allocation for a 40 year old?

Asset allocation in your 40s may lean slightly more toward lower-risk bonds and fixed investments than in your 30s, although the ratio of stock investments to bond investments varies, depending on your risk comfort level. The conservative, risk-averse investor might be comfortable with a 60% stock and 40% bond allocation. A more aggressive investor in their 40s might be comfortable with an 80% stock allocation. Just remember, the more stock holdings you have, the more volatile your investment portfolio, and the greater your exposure to risk.

How to catch up if you're late to the saving party?

If you’re late to the saving and investing party, you can catch up by putting the pedal to the metal and making some lifestyle trade-offs .

Is it a good idea to invest in retirement?

There are investments you can make during each decade of your adult life to take advantage of the power of time. Saving for retirement—especially starting at an early age—is a good idea and almost always beneficial. However, investing does come with risks that are important to understand.

Can bonds beat stocks?

While bonds are more stable, their returns likely won’t beat stocks. So if you’re relatively risk-tolerant, you can invest a large portion of your portfolio in stock funds and the remainder in bond and cash investments. Or, if you want to go the easy route, simply choose a target-date mutual fund. These funds are automatically rebalanced as you age, starting out more aggressive when you’re younger and becoming more conservative as you move closer to retirement.

Why do people retire after they don't have enough cash?

"Some retirees are put back into the workforce after retiring because they didn't accumulate enough to sustain an expected lifestyle, " says Xavier Epps, owner of XNE Financial Advising, LLC, in the District of Columbia.

Should a 60 year old retiree invest in conservative stocks?

The idea that a 60-year-old retiree should be investing primarily in conservative investments is an antiquated way of approaching personal finance, Loescher says. "Historically, the rule of thumb stated that an individual should take the number 100, subtract their age, which will define the amount of stocks someone should have in their portfolio.

How much of your portfolio should be invested in stocks?

The authors suggested retiring with 20% to 40% of your portfolio invested in stocks, then gradually upping those levels to between 40% and 80%.

How long did the stock market downturn last?

While stocks lost about 40% of their value on average each time, the duration of the downturn—measured from the month the market hit its last high until the month it bottomed out—was relatively short: about 1.4 years, on average.

How much of your savings should you spend on bonds?

In general, the bigger share of your savings you hope to spend each year, the more you need to count on the market to boost your portfolio. If you aimed to spend just 3% of your savings a year, your chances of success with an all-bond portfolio jump to more than 70%. If you need to spend down 5% each year, they drop below 10%. “When you are behind on saving, you need to be more aggressive” in terms of stocks, says Dennis Nolte, a financial planner in Winter Park, Fla.

How often should I do a gut check on my 401(k)?

If you plan to handle your portfolio yourself, Foster recommends sitting down at least once a year to do a “gut check” on your portfolio: “Ask yourself, How would I feel if the market went down 10% tomorrow?” Would you be okay?

How much has the Standard and Poor's 500 returned in the past decade?

Chances are you’ve felt pretty good about stocks these days. Over the past decade the Standard & Poor’s 500 has returned over 14% a year on average.

How much money did the stock market lose in 2008?

History suggests that’s often exactly what happens. In the five years from the 2008 financial crisis, investors yanked more than $500 billion from U.S. stock funds, according to the trade group Investment Company Institute, while pouring roughly $1 trillion into bond funds. In fact, the stock market hit bottom in March 2009, before embarking on what would ultimately become a nearly decade-long bull market.

What happens when the market plunges?

There’s a real risk that when the market plunges, you’ll panic and decide to sell your investments at a low price. “When the market recovers, it recovers quickly,” Schmehil says. “You can miss out on a lot of appreciation.”. History suggests that’s often exactly what happens.