Should I buy Wells Fargo?

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here. Clearly, recent earnings estimate revisions suggest that good things are ahead for Wells Fargo and that a beat might be in the cards for the upcoming report. Each was hand ...

Should value investors choose Wells Fargo (WFC) stock now?

Wells Fargo & Co. posted its highest revenue since before the pandemic began as its fortunes revived along with the U.S. economy. The San Francisco-based bank said Wednesday that its revenue rose 11% from a year ago to $20.27 billion, topping the $17.76 ...

Is it time to buy Wells Fargo?

head of global market strategy at Wells Fargo Investment Institute. “Now is not a time to be buying the dip if you have cash,” said Christopher, in a phone interview Thursday. “And don’t sell.” he said. “It’s just a time to be patient” as ...

Is Wells Fargo undervalued?

Wells Fargo Looks Undervalued. The industry is going through a challenging phase, the market for financial services is highly competitive and saturated, and banks are being hurt by declining net ...

See more

What is the target price for Wells Fargo stock?

Stock Price Target WFCHigh$65.00Median$51.50Low$42.00Average$52.77Current Price$43.93

Is Wells Fargo Bank a good buy?

WFC stock is at best fairly valued now, if not slightly overvalued. Based on the stock's last traded share price of $49.33 as of April 11, 2022, Wells Fargo is now valued by the market at 12.4 times consensus forward FY 2022 P/E as per financial data sourced from S&P Capital IQ.

What is the highest Wells Fargo stock price?

Historical daily share price chart and data for Wells Fargo since 1972 adjusted for splits. The latest closing stock price for Wells Fargo as of July 27, 2022 is 43.71. The all-time high Wells Fargo stock closing price was 65.93 on January 26, 2018.

Is Wells Fargo good for investing in stocks?

The current dividend yield of Wells Fargo is 1.24%. The credit risk and commercial loan activity are improving in 2021, combating the negative impact of COVID-19 on stocks. Investing in Wells Fargo seems like a beneficial investment because it has excellent credit quality and net charge-offs.

Will Wells Fargo stock ever come back?

Takeaway. The key investor takeaway is that Wells Fargo is nearly full speed ahead in 2022. The large bank has full clearance to improve the efficiency ratio and repurchase shares with billions in annual income while higher interest rates will boost revenues.

Why did Buffett sell Wells Fargo?

It's pretty clear that Buffett and Berkshire exited Wells Fargo because of the years of dealing with the fallout of the bank's phony accounts scandal, in which employees at Wells Fargo opened credit card and bank accounts on behalf of thousands of customers without their consent.

Is Wells Fargo or Bank of America better?

Both banks cover a majority of states, though Wells Fargo has the edge over Bank of America when it comes to branch count. Both have multiple ways to contact customer service. Unless you need 24/7 access to customer service like Wells Fargo offers, the two banks are roughly on par with each other.

Does China own Wells Fargo Bank?

The top ranked bank brand is Industrial and Commercial Bank of China (ICBC), a state-owned Chinese bank with a brand value of $47.83 billion in 2016, a 32% improvement compared with 2015's brand value. Wells Fargo & Co....Powered by.PluginsBlock | ActiveFirst ImpressionFirst ImpressionView Policy90 more rows•Feb 2, 2017

When did Wells Fargo stock split?

The first split for WFC took place on July 01, 1988. This was a 3 for 2 split, meaning for each 2 shares of WFC owned pre-split, the shareholder now owned 3 shares. For example, a 1000 share position pre-split, became a 1500 share position following the split. WFC's second split took place on July 24, 1989.

How often does Wells Fargo pay dividends?

There are typically 4 dividends per year (excluding specials), and the dividend cover is approximately 2.5.

Who owns the most Wells Fargo stock?

The Vanguard Group, Inc.Top 10 Owners of Wells Fargo & CoStockholderStakeShares ownedThe Vanguard Group, Inc.8.12%307,851,072SSgA Funds Management, Inc.4.66%176,634,569BlackRock Fund Advisors4.50%170,376,516Fidelity Management & Research Co...3.71%140,757,3226 more rows

What stocks does Warren Buffett buy?

Top Warren Buffett Stocks By SizeBank of America (BAC), 1.01 billion shares.Apple (AAPL), 890.9 million shares.Coca-Cola (KO), 400 million shares.Kraft Heinz (KHC), 325.6 million shares.Occidental Petroleum (OXY), 226.1 million shares.Chevron (CVX), 159.2 million shares.American Express (AXP), 151.6 million shares.More items...

Is Wells Fargo stock a Buy, Sell or Hold?

Wells Fargo stock has received a consensus rating of buy. The average rating score is and is based on 28 buy ratings, 13 hold ratings, and 0 sell r...

What was the 52-week low for Wells Fargo stock?

The low in the last 52 weeks of Wells Fargo stock was 40.07. According to the current price, Wells Fargo is 100.02% away from the 52-week low.

What was the 52-week high for Wells Fargo stock?

The high in the last 52 weeks of Wells Fargo stock was 60.30. According to the current price, Wells Fargo is 66.47% away from the 52-week high.

What are analysts forecasts for Wells Fargo stock?

The 41 analysts offering price forecasts for Wells Fargo have a median target of 44.49, with a high estimate of 66.00 and a low estimate of 23.00....

Want To Bet Against Tesla? There Could Be A New Inverse ETF For Traders

Housing Market Seesaw: Mortgage Rates Soar While Housing Starts Drop

An ETF filed Thursday would bet against one of the most loved stocks and companies and could create a battle with the world’s richest person.

What is the ticker symbol for Wells Fargo?

Mortgage rates have spiked as a result of rising inflation and stronger than expected consumer spending, according to new data released by Freddie Mac (OTCQB: FMCC). While mortgage rates were on the rise, housing starts were in decline, based on the latest federal data.

What is Wells Fargo?

Wells Fargo & Company trades on the New York Stock Exchange (NYSE) under the ticker symbol "WFC."

What is the peg ratio of Wells Fargo?

Wells Fargo & Co. is a diversified, community-based financial services company. It is engaged in the provision of banking, insurance, investments, mortgage, and consumer and commercial finance. It firm operates through the following segments: Community Banking, Wholesale Banking, Wealth & Investment Management, and Other. The Community Banking segment offers complete line of diversified financial products and services for consumers and small businesses including checking and savings accounts, credit and debit cards, and automobile, student, and small business lending. The Wholesale Banking segment provides financial solutions to businesses across the United States and globally. The Wealth and Investment Management segment includes personalized wealth management, investment and retirement products and services to clients across U.S. based businesses. The Other segment refers to the products of WIM customers served through community banking distribution channels. The company was founded by Henry Wells and William G. Fargo on March 18, 1852 and is headquartered in San Francisco, CA.

Does Wells Fargo have a dividend?

Wells Fargo & Company has a PEG Ratio of 1.08. PEG Ratios above 1 indicate that a company could be overvalued.

What is Wells Fargo?

Wells Fargo & Company does not yet have a strong track record of dividend growth. The dividend payout ratio of Wells Fargo & Company is 72.73%. This payout ratio is at a healthy, sustainable level, below 75%. Based on earnings estimates, Wells Fargo & Company will have a dividend payout ratio of 11.14% next year.

What is a large cap stock?

Wells Fargo is one of the largest banks in the United States, with approximately $1.9 trillion in balance sheet assets. The company is split into three segments for reporting purposes: community banking; wholesale banking; and wealth and investment management. The community banking segment serves consumers and small businesses with products including deposit accounts, credit and debit cards, and student, mortgage, and home equity loans. Wholesale banking includes corporate and commercial real estate lending, asset-based lending and trade financing, merchant services, and capital markets businesses. Wealth and investment management includes advisory, brokerage, retirement, and trust services. The bulk of Wells' lending takes place in the U.S.

Is growth stock outperforming value?

Stocks of large-cap companies where neither growth nor value characteristics predominate. Stocks in the top 70% of the capitalization of the U.S. equity market are defined as large cap.

When will Wells Fargo report 2021 earnings?

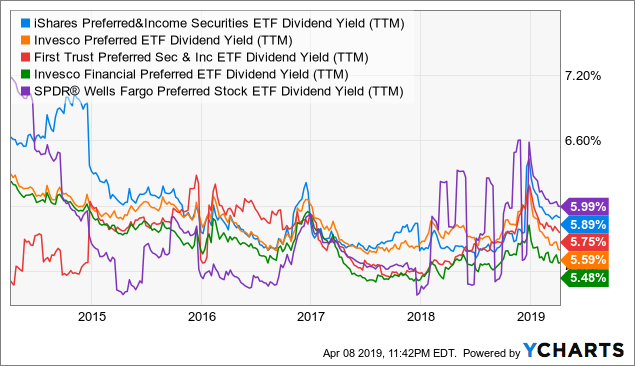

Growth stocks may be outperforming value, again, in 2020. But in an environment of historically low interest rates (and with the coronavirus and economic shutdown seemingly poised to keep them low for a long time), many investors are still searching for high levels of income, which can often be found in value stocks. Over the years, the performance record has favored growth. Since 2003, the Russell 1000 Growth Index has climbed 450%, compared to an advance of 240% for the Russell 1000 Value Index. In 12 of the 17 years of this period, growth stocks have topped value stocks. Still, value is the place to achieve income. The current yield on the iShares Russell 1000 Value Index ETF is 3.5%, compared to the 1.2% current yield on the iShares Russell 1000 Growth Index ETF. This is not unimportant, as the current yield on the 10-year Treasury Bond is 0.75%.

Who is the head of human resources at Wells Fargo?

SAN FRANCISCO, July 07, 2021--Wells Fargo & Company (NYSE: WFC), as previously announced, will report its second quarter 2021 earnings results on Wednesday, July 14, 2021, at approximately 8 a.m. Eastern Time. The results will be available online at https://www.wellsfargo.com/about/investor-relations/quarterly-earnings/. In addition to being available on the Company’s Investor Relations website, the earnings results also will be available on the Securities and Exchange Commission website at http

Why is it important to own bank stocks?

SAN FRANCISCO, July 08, 2021--Wells Fargo & Company (NYSE: WFC) announced today that Bei Ling will join the company on Oct. 1 as head of Human Resources. She will report to CEO Charlie Scharf and serve on the company’s Operating Committee.

Does Wells Fargo offer personal lines of credit?

Owning bank stocks is a great way to hedge against inflation, as this industry tends to thrive during inflationary periods. Matt Frankel: It's really tough to find an industry that is more equipped to invest in during an inflationary environment than banks.

Is it Still Safe to Invest in Wells Fargo (WFC)?

Wells Fargo said it would stop offering personal lines of credit and shutter those current accounts. The bank will no longer offer the product, which enabled users to borrow between $3,000 and $100,000 and was pitched as tool to consolidate higher-interest credit-card debt, pay for home renovations and avoid overdraft fees on linked accounts. "Wells Fargo recently reviewed its product offerings and decided to discontinue offering new Personal and Portfolio line of credit accounts and close all existing accounts," the bank said in a six-page letter that was reviewed by CNBC.