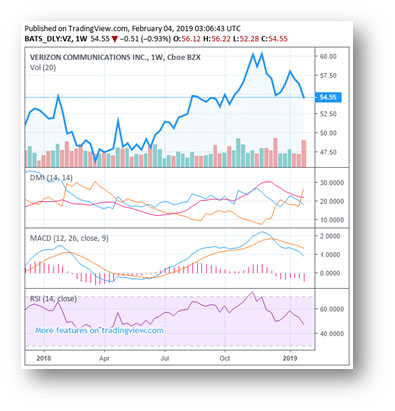

What is the average Verizon stock price for the last 52 weeks?

The average Verizon stock price for the last 52 weeks is 54.77. For more information on how our historical price data is adjusted see the Stock Price Adjustment Guide. Verizon Communications Inc. is one of the largest communication technology companies.

When did Verizon start trading with a dividend?

Dividend History. Verizon stock began trading on July 3, 2000. Prior to this date, the stock was trading as Bell Atlantic.

What is the all-time high Verizon stock price?

The all-time high Verizon stock closing price was 69.50 on October 04, 1999. The Verizon 52-week high stock price is 59.85, which is 12.8% above the current share price. The Verizon 52-week low stock price is 49.69, which is 6.4% below the current share price.

Is Verizon now a wireless business?

Analyst Report: Verizon Communications Inc. Verizon is now primarily a wireless business (more than 70% of revenue and nearly all operating income).

See more

Is VZ stock a good buy now?

VZ Stock Analysis: Is It A Buy Right Now? VZ stock holds a Relative Strength Rating of 60 out of a best possible 99, according to the IBD Stock Checkup. The best stocks tend to have an RS rating of 80 or better.

What is a good price for Verizon stock?

Stock Price Forecast The 22 analysts offering 12-month price forecasts for Verizon Communications Inc have a median target of 56.00, with a high estimate of 71.00 and a low estimate of 49.30.

Is Verizon a Buy Sell or Hold?

For example, a company with a P/E ratio of 25 and a growth rate of 20% would have a PEG ratio of 1.25 (25 / 20 = 1.25)....Momentum Scorecard. More Info.Zacks RankDefinitionAnnualized Return1Strong Buy24.75%2Buy18.15%3Hold9.70%4Sell5.35%2 more rows

What is Verizon's PE ratio?

The PE ratio is a simple way to assess whether a stock is over or under valued and is the most widely used valuation measure. Verizon PE ratio as of July 15, 2022 is 9.38.

When did Verizon stock split?

Stock splitsDateSplit Ratio2006-11-201.0381998-06-3021990-05-0221986-04-1822 more rows

Is Verizon a good company?

Verizon is recognized as one of the Top-Rated Workplaces.

Is Verizon a good stock to buy 2022?

Verizon Stock: 2022 Outlook Lowered Verizon cut its outlook for wireless service revenue growth to a range of 8.5% to 9.5%, down from 9% to 10%. Verizon stock holds a Relative Strength Rating of 60 out of a possible 99, according to IBD Stock Checkup.

Is Verizon stock volatile?

Verizon Communications Stock Return Volatility The company accepts 1.3482% volatility on return distribution over the 90 days horizon.

Does Verizon have a lot of debt?

Verizon has a massive net debt load, which likely represents the company's biggest weakness. At the end of December 2021, Verizon had $7.4 billion in short-term debt and $143.4 billion in long-term debt that was marginally offset by $2.9 billion in cash and cash equivalents on hand at the end of this period.

What is Tesla's PE ratio?

The PE ratio is a simple way to assess whether a stock is over or under valued and is the most widely used valuation measure. Tesla PE ratio as of July 20, 2022 is 89.46.

What is VZ PEG ratio?

About PEG Ratio (TTM) Currently, Verizon Communications Inc. has a PEG ratio of 2.32 compared to the Wireless National industry's PEG ratio of 1.96.

What is the PEG ratio for AT&T?

Valuation Measures 4As of Date: 7/16/2022 Current6/30/2021Forward P/E7.879.04PEG Ratio (5 yr expected)N/A3.24Price/Sales (ttm)0.911.19Price/Book (mrq)0.871.245 more rows

How to calculate restricted stock?

How long are futures trading delayed?

To calculate, start with total shares outstanding and subtract the number of restricted shares. Restricted stock typically is that issued to company insiders with limits on when it may be traded. A company's dividend expressed as a percentage of its current stock price.