Penny stocks and IPOs tend to be riskier than shares of big companies, for example, because their underlying businesses generally aren’t as stable or profitable. Statistically-based risk measurements, such as standard deviation, seek to assign mathematical value to the risk involved in a particular investment.

Full Answer

How do you measure the risk of a stock?

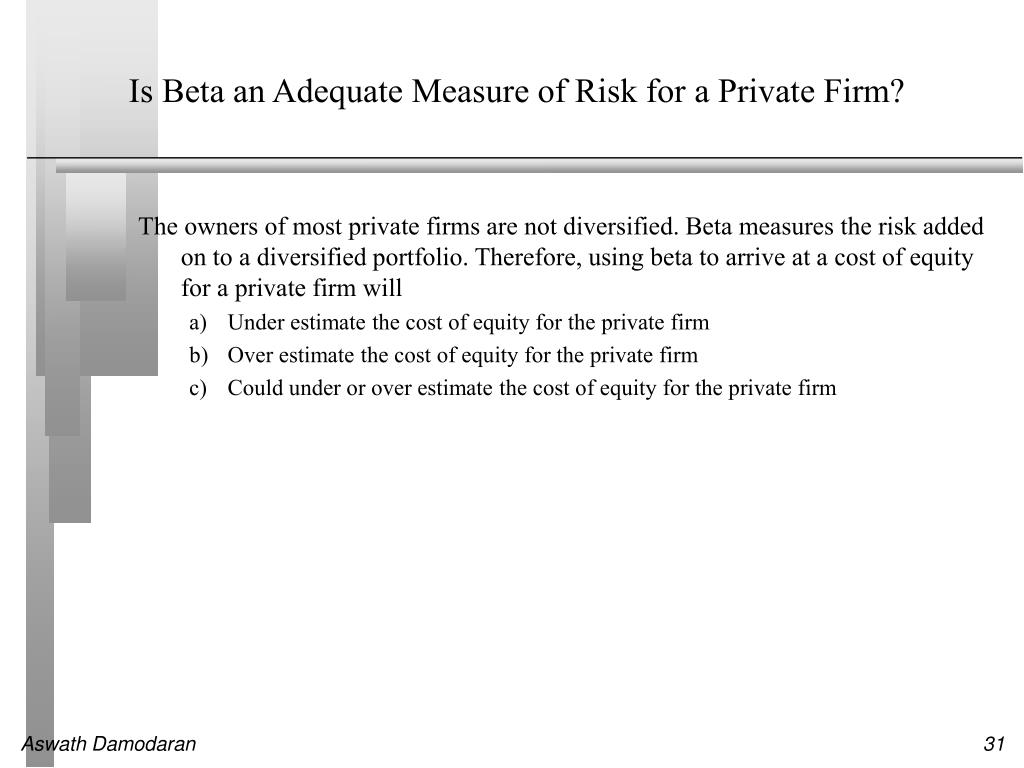

Beta is another common measure of risk. Beta measures the amount of systematic risk an individual security or an industrial sector has relative to the whole stock market. The market has a beta of 1, and it can be used to gauge the risk of a security.

What are the most common measures of risk?

Beta is another common measure of risk. Beta measures the amount of systematic risk an individual security or an industrial sector has relative to the whole stock market. The market has a beta of 1, and it can be used to gauge the risk of a security. If a security's beta is equal to 1, the security's price moves in time step with the market.

Does standard deviation measure risk in the stock market?

When using standard deviation to measure risk in the stock market, the underlying assumption is that the majority of price activity follows the pattern of a normal distribution.

How many stocks should you own to avoid market risk?

No matter how many stocks you own, you can't totally eliminate market risk. However, you can measure a stock's historical response to market movements and select those with a level of volatility you are comfortable with. Beta and standard deviation are two tools commonly used to measure stock risk.

How do you know if a stock is riskier?

A stock that swings more than the market over time has a beta above 1.0. If a stock moves less than the market, the stock's beta is less than 1.0. High-beta stocks are supposed to be riskier but provide higher return potential; low-beta stocks pose less risk but also lower returns.

What is the best measure of total risk of a stock?

BetaBeta and standard deviation are two tools commonly used to measure stock risk. Beta, which can be found in a number of published services, is a statistical measure of the impact stock market movements have historically had on a stock's price.

What measures the total risk of a stock?

betaA quick way to get an idea of a stock's or stock fund's relative risk is by its beta. Beta is a measure of an investment's risk against an index of the overall market such as the Standard & Poor's 500 Index. A beta of one means the stock or fund has the same volatility as the index.

How total risk is measured?

Therefore, the portfolio's total risk is simply a weighted average of the total risk (as measured by the standard deviation) of the individual investments of the portfolio.

What makes a stock high risk?

High-risk stocks are equity investments where investors can experience significant losses, if not all their money. Generally, high-risk stocks tend to be from cyclical, volatile industries or be newer, untested companies.

Which stock is riskier for a diversified investor?

Which stock is riskier for a diversified investor? For diversified investors the relevant risk is measured by beta. Therefore, the stock with the higher beta is more risky.

How do you measure risk risk?

Risk measures are statistical measures that are historical predictors of investment risk and volatility, and they are also major components in modern portfolio theory (MPT). MPT is a standard financial and academic methodology for assessing the performance of a stock or a stock fund as compared to its benchmark index.

What is total risk?

Total risk is an assessment that identifies all of the risk factors associated with pursuing a specific course of action.

What is the best way to measure risk?

Risk—or the probability of a loss—can be measured using statistical methods that are historical predictors of investment risk and volatility. Commonly used risk management techniques include standard deviation, Sharpe ratio, and beta.

Does beta measure total risk?

Beta (β) is a measure of the volatility—or systematic risk—of a security or portfolio compared to the market as a whole (usually the S&P 500).

What two types of risk make up total risk?

Types of Risk Broadly speaking, there are two main categories of risk: systematic and unsystematic. Systematic risk is the market uncertainty of an investment, meaning that it represents external factors that impact all (or many) companies in an industry or group.

What are the 3 different levels of risk?

We have decided to use three distinct levels for risk: Low, Medium, and High. Our risk level definitions are presented in table 3. The risk value for each threat is calculated as the product of consequence and likelihood values, illustrated in a two-dimensional matrix (table 4).

What are the two types of risk in stocks?

Basically, stocks are subject to two types of risk - market risk and nonmarket risk . Nonmarket risk, also called specific risk, is the risk that events specific to a company or its industry will adversely affect the stock's price.

What is market risk?

Market risk, on the other hand, is the risk that a particular stock's price will be affected by overall stock market movements. Nonmarket risk can be reduced through diversification.

What is the beta of a stock?

Beta, which can be found in a number of published services, is a statistical measure of the impact stock market movements have historically had on a stock's price.

What is standard deviation in stock market?

Standard Deviation. Standard deviation, which can also be found in a number of published services, measures a stock's volatility, regardless of the cause . It basically tells you how much a stock's short-term returns have moved around its long-term average return. The most common way to calculate standard deviation is to figure ...

Does beta measure market risk?

Since beta measures movements on average, you cannot expect an exact correlation with each market movement. Calculating your portfolio's beta will give you a measure of its overall market risk. To do so, find the betas for all your stocks.

Can you eliminate market risk?

No matter how many stocks you own, you can't totally eliminate market risk. However, you can measure a stock's historical response to market movements and select those with a level of volatility you are comfortable with. Beta and standard deviation are two tools commonly used to measure stock risk. Beta, which can be found in a number ...

What is market cap?

Market cap describes the size of a company in terms of its total market value based on outstanding shares. Compared with blue-chip giants like Apple (NYSE: AAPL), companies with very small market caps tend to have little recorded operational history, with unproven track records and unknown management. By the nature of their size, these stocks often have poor liquidity, making it difficult for investors to actually sell their shares when they want to. This can force an investor to have to wait longer than they’d like to sell their shares, potentially losing money and taking on more risk than expected.

What is leveraged ETF?

A leveraged ETF is an exchange-traded fund that also uses derivatives and debt to amplify the returns of an index, essentially magnifying any returns or losses.

What is an ETF?

As a refresher, an ETF is a collection of stocks that can be bought at once. ETFs are categorized by investment objectives or themes. Outside of the traditional ETFs, which carry varying degrees of risk, there are specialized ETFs that the SEC deems somewhat riskier.

How long are short term investments?

Short-term investments (trading): Are typically held anywhere from a few minutes to a few weeks, at most for anytime less than a year. Seek to profit off volatility and near-term gains rather than long-term underlying factors having to do with a company’s financials or management.

Do risky investments have higher upside?

These risky investments might have a higher upside, but they come with greater risk. Taking on this degree of risk isn’t for everyone, so before you begin picking stocks or building a portfolio of many stocks, it’s crucial to understand how much risk you are willing to take on.

Is short term trading riskier than long term trading?

Shorter-term trading tends to be riskier than longer-term trading . Over time, the U.S. stock market has produced returns of about 10% annually, on average. Yet within this trend, it’s true that some stocks go up and some stocks fizzle.

Do inverse ETFs have risk?

It holds a similar effect to shorting something. However, by the usage of derivatives, inverse ETFs can carry a lot of risk and cause large losses if an investor bets wrong on the market’s direction. Additionally, inverse ETFs are short-term only, carrying more risk.

What happens if you buy XYZ stock?

If you buy XYZ stock, you may get lucky, and the stock will go up faster than the market, or you may not get lucky, and the stock could continue to go down in value; even all the way down to zero. If you keep your index fund, you know the market will recover. Your potential for rapid gain is not as great.

Is it riskier to own individual stocks or mutual funds?

This is what makes owning individual stocks riskier than owning mutual funds. With a stock, in a very short period of time, your money could double quickly, or it could be worth almost nothing. Contrast that with an index mutual fund, which owns many ...

Who is the Motley Fool?

Founded in 1993 in Alexandria, VA., by brothers David and Tom Gardner, The Motley Fool is a multimedia financial-services company dedicated to building the world's greatest investment community .

What does beta mean in stock market?

Of course, the problem with using beta as a measure of a stock's risk is this: Beta measures how much a given stock's price deviates from "normal" stock price movements. A high-beta stock could be one that falls steeply when the stock market merely stumbles, a stock that soars when the market just plods along, or both. It doesn't tell you much about whether the business behind the stock ticker is a good business, or a risky business.

Do you need to rely on the internet to determine a stock's risk rating?

Simply put, there's no need to rely on internet "experts" to spoon-feed you ratings on an investment, when you can determine a risk rating all on your own.

Does Rich Smith have a position in Motley Fool?

The author (s) may have a position in any stocks mentioned. Rich Smith has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy .