How to Use Implied Volatility to Forecast Stock Price

- Implied Volatility Caveat. Implied volatility is used as a tool to evaluate options, not stocks. Options are vehicles...

- Implied Volatility Annual Percentage Forecast. Determine the future date for which you want to use implied volatility to...

- Other Factors Influencing Implied Volatility. Find the stock's implied...

How to calculate implied volatility?

How to Calculate Implied Volatility. As mentioned, implied volatility is calculated using an option pricing model. One option is the Black-Scholes model, which factors in current market price of a stock, options strike price, time to expiration and risk-free interest rates.

How to interpret implied volatility?

- Time until expiration — $2

- Distance between the strike price and current stock price — $2

- Implied volatility — $1

What is considered a high implied volatility?

Pros and Cons of Using Implied Volatility

- Quantifies market sentiment, uncertainty

- Helps set options prices

- Determines trading strategy

What does implied volatility really mean?

- Quantifies market sentiment, uncertainty

- Helps set options prices

- Determines trading strategy

Can you use implied volatility to forecast stock price?

For example, investors can use implied volatility to estimate the future volatility of asset prices based on certain predictive factors, such as option supply and demand and the date to maturity (ibid.). Additionally, investors can value and hedge options with implied volatility information.

How does implied volatility affect stock price?

Options that have high levels of implied volatility will result in high-priced option premiums. Conversely, as the market's expectations decrease, or demand for an option diminishes, implied volatility will decrease. Options containing lower levels of implied volatility will result in cheaper option prices.

How do you use volatility to predict price?

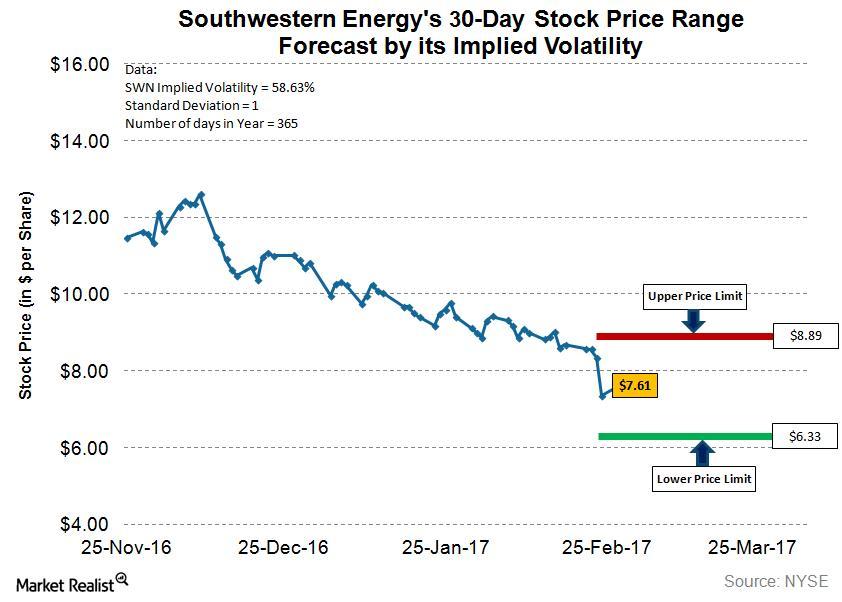

First, divide the number of days until the stock price forecast by 365, and then find the square root of that number. Then, multiply the square root with the implied volatility percentage and the current stock price. The result is the change in price.

How do you use implied volatility to trade stocks?

3:456:13Implied Volatility and Options | Options for Volatility Course - YouTubeYouTubeStart of suggested clipEnd of suggested clipA diagonal involves selling and out of the money option and then buying and in the money option ofMoreA diagonal involves selling and out of the money option and then buying and in the money option of the same kind with a further out expiration. It's a debit strategy. The long option drives the trade.

What does the implied volatility tell you?

Implied volatility shows the market's opinion of the stock's potential moves, but it doesn't forecast direction. If the implied volatility is high, the market thinks the stock has potential for large price swings in either direction, just as low IV implies the stock will not move as much by option expiration.

What happens when IV goes up?

As an earnings announcement approaches, options reflect potential or anticipated moves in the underlying stock. Options IV levels typically rise going into an announcement and reflect what traders are willing to pay for calls and puts at that time. Think of this as the big inhale.

How do you determine a stock price increase?

The supply and demand determine a share price. If the demand is high, it will increase, and if the demand is low, it decreases. Stock prices depend on the bid and ask of the stock. A bid is an offer to buy a certain number of shares for a specific price.

Which indicator is used for volatility?

Some of the most commonly used tools to gauge relative levels of volatility are the Cboe Volatility Index (VIX), the average true range (ATR), and Bollinger Bands®.

Can volatility predict returns?

The authors investigated whether implied volatility can predict stock returns on the U.S. stock market using an OLS-regression model on a period of 9 years, from 1996 to 2005. They discovered evidence that implied volatility can be used as a predictor of returns.

How do you read an implied volatility chart?

0:556:44How to use an implied volatility chart - YouTubeYouTubeStart of suggested clipEnd of suggested clipItself I'm going to take off the option volume here and we could see that you know the impliedMoreItself I'm going to take off the option volume here and we could see that you know the implied volatility. It can move down and up and right.

What is a good implied volatility number?

Around 20-30% IV is typically what you can expect from an ETF like SPY. While these numbers are on the lower end of possible implied volatility, there is still a 16% chance that the stock price moves further than the implied volatility range over the course of a year.

Is high implied volatility good or bad?

Usually, when implied volatility increases, the price of options will increase as well, assuming all other things remain constant. So when implied volatility increases after a trade has been placed, it's good for the option owner and bad for the option seller.

Is high implied volatility good or bad?

Usually, when implied volatility increases, the price of options will increase as well, assuming all other things remain constant. So when implied volatility increases after a trade has been placed, it's good for the option owner and bad for the option seller.

What is a good implied volatility number?

Around 20-30% IV is typically what you can expect from an ETF like SPY. While these numbers are on the lower end of possible implied volatility, there is still a 16% chance that the stock price moves further than the implied volatility range over the course of a year.

Is high IV good for options?

High IV (or Implied Volatility) affects the prices of options and can cause them to swing more than even the underlying stock.

How does IV affect calls?

Volatility's Effect on Options Prices As volatility increases, the prices of all options on that underlying - both calls and puts and at all strike prices - tend to rise. This is because the chances of all options finishing in the money likewise increase.