Let’s say the natural gas price increases by 3%, UGAZ will grow by 9% and DGAZ inversely will drop by 9%. That’s why trading UGAZ and DGAZ stock is for short-term traders only. If you plan to invest in them for the long-term, your chances to make a profit are zero. Think about UGAZ and DGAZ as up-gas and down-gas.

Full Answer

What are Ugaz and dgaz stocks for natural gas?

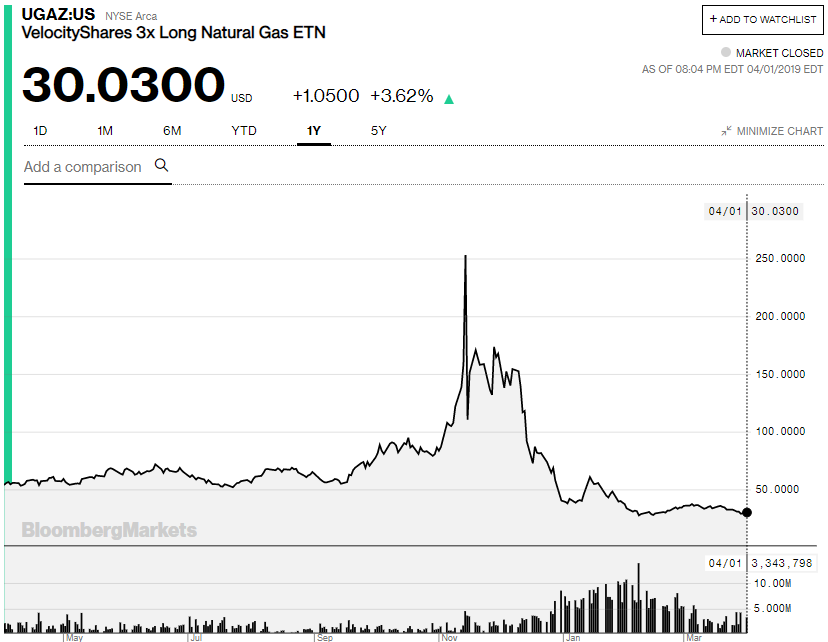

One of the primary commodities that are of great interest to investors is natural gas. In this post, we will discuss how to trade two leveraged ETFs that are indirectly related to natural gas. These are UGAZ (VelocityShares 3x Long Natural Gas) and DGAZ (VelocityShares 3x Inverse Natural Gas). What Are UGAZ Stock and DGAZ Stock?

Why do Ugaz and dgaz follow Ung?

As discussed above, both UGAZ and DGAZ closely watch UNG. The primary objective of UGAZ (VelocityShares 3x Long Natural Gas) is to amplify the daily performance of UNG by three times or 300%. In other words, if UNG price raises 1%, UGAZ will generally show a daily gain of 3%.

Are leveraged ETFs like Ugaz and dgaz worth it?

As you may have noticed, both UGAZ and DGAZ have 3:1 leverage, which can significantly increase your potential profit. We must emphasize that leveraged ETFs are much riskier than regular ETFs. In fact, you can think about these instruments as some of the riskiest ones in the long term.

Should you short or buy dgaz?

Purchasing DGAZ is like shorting the UNG fund, though you can still capture some quick wins in UGAZ. If the weather forecast can directly influence the potential demand, you should also take note of the second factor: the change in natural gas supply.

Is natural gas bullish or bearish?

Natural gas price confirmed moving to the bullish track by forming new bullish wave after testing 6.550 support line, to move towards 50% Fibonacci correction level at 7.600.

Is natural gas a good stock to buy?

Cheniere Energy (LNG): The largest producer of LNG in the U.S. and second largest in the world, Cheniere Energy is easily one of the best natural gas stocks to buy now....7 Best Natural Gas Stocks to Buy Now.LNGCheniere Energy$130.27EQTEQT Corporation$32.5CTRACoterra Energy$25.54ARAntero Resources$29.46SWNSouthwestern Energy$5.842 more rows•Jul 5, 2022

What is the difference between UGAZ and DGAZ?

As we mentioned above, UGAZ amplifies the UNG gains, while DGAZ goes up when UNG drops in price. Understanding the relationship between the UNG fund and its derived leveraged ETFs is the key to opening profitable positions. To make it easier for you, think about UGAZ like up-gaz and DGAZ like down-gaz.

What is the price of natural gas futures?

Futures OverviewEnergyLastChg %Brent Crude Oil Continuous Contract$99.07-0.41%Natural Gas Continuous Contract$7.752-0.81%RBOB Gasoline Continuous Contract$3.1324-0.54%Heating Oil Continuous Contract$3.4748-1.38%1 more row

What is the best gas stock to buy?

7 best oil and gas stocks to buy now:Civitas Resources Inc. (CIVI)Ovintiv Inc. (OVV)Chesapeake Energy Corp. (CHK)Occidental Petroleum Corp. (OXY)Chevron Corp. (CVX)ConocoPhillips (COP)Targa Resources Corp. (TRGP)

What is best natural gas stock?

10 Best Natural Gas Stocks to Buy NowCheniere Energy, Inc. (NYSE:LNG) Number of Hedge Fund Holders: 62. ... EQT Corporation (NYSE:EQT) Number of Hedge Fund Holders: 52. ... Kinder Morgan, Inc. (NYSE:KMI) ... Southwestern Energy Company (NYSE:SWN) Number of Hedge Fund Holders: 35. ... Ovintiv Inc. (NYSE:OVV)

How can I invest in natural gas?

Investors can bet on rising natural-gas prices either through exchange-traded funds that invest in gas futures or though shares of companies that produce natural gas.

What is inverse natural gas?

Inverse/Short Natural Gas ETFs seek to provide the opposite daily or monthly return of Henry Hub natural gas prices. The funds use futures contracts to gain exposure and essentially provide a synthetic short position in natural gas.

What affects the price of gas?

Retail gasoline prices are mainly affected by crude oil prices and the level of gasoline supply relative to gasoline demand. Strong and increasing demand for gasoline and other petroleum products in the United States and the rest of the world can place intense pressure on available supplies.

How is gas price determined?

The price of gasoline is made up of four factors: taxes, distribution and marketing, the cost of refining, and crude oil prices. Of these four factors, the price of crude oil accounts for nearly 70% of the price you pay at the pump, so when they fluctuate (as they often do), we see the effects.

Will Natural Gas Prices Go Up in 2023?

Natural gas forecast for July 2023. The forecast for beginning of July 8.06. Maximum price 8.88, while minimum 8.04.

Will natural gas stock go up?

Oil and gas prices are rising wildly in 2022, and they're unlikely to stop anytime soon. These high levels should bode well for these top energy stocks. It's been quite a year for energy stocks.

Does natural gas have a future?

Global gas demand is expected to rise by 3.6% in 2021 before easing to an average growth rate of 1.7% over the following three years, according to the IEA's latest quarterly Gas Market Report, which also provides a new medium-term forecast. By 2024, demand is forecast to be up 7% from 2019's pre-Covid levels.

What is the best stock to buy right now?

Top 10 Stocks To Buy Right NowApple Inc. (NASDAQ: AAPL)Alphabet Inc. (NASDAQ: GOOG) (NASDAQ: GOOGL)Palo Alto Networks, Inc. (NASDAQ: PANW)Shopify Inc. (NYSE: SHOP)Advanced Micro Devices, Inc. (NASDAQ: AMD)Netflix, Inc. (NASDAQ: NFLX)The Walt Disney Company (NYSE: DIS)CrowdStrike Holdings, Inc. (NASDAQ: CRWD)More items...•

What stocks do well when gas prices go up?

While many of the energy have performed well during gasoline price spikes, Schlumberger , Halliburton and ConocoPhillips have seen their stocks dip at least once when futures rose 20%. Signage is displayed outside a Halliburton Co. location in Port Fourchon, Louisiana, U.S., on Thursday, Feb. 8, 2018.

What Are UGAZ Stock and DGAZ Stock?

UGAZ and DGAZ are two 3x leveraged EFTs that track the same underlying asset — the United States Natural Gas Fund. Now, the UNG tracks the price movements in natural gas. So a UNG stock prediction will impact DGAZ and UGAZ directly.

What is the difference between DGAZ and UGAZ?

You can see that UGAZ (yellow) tends to amplify the UNG (blue) percentage gains, while DGAZ (red) shows a mirrored image, by going up when UNG and consequently UGAZ drop and vice versa. If you pay attention to the percentage figures, you can see that the target of 2f00% is relatively maintained.

What is the objective of Ugaz?

The primary objective of UGAZ (VelocityShares 3x Long Natural Gas) is to amplify the daily performance of UNG by three times or 200%. In other words, if UNG price raises 1%, UGAZ will generally show a daily gain of 3%. You should think about trading UGAZ when you have a bullish sentiment on UNG.

What ETFs are linked to natural gas?

In this post, we will discuss how to trade two leveraged ETFs that are indirectly related to natural gas. These are UGAZ (VelocityShares 3x Long Natural Gas) and DGAZ (VelocityShares 3x Inverse Natural Gas).

Why does UNG use future contracts?

The main reason for this is because UNG doesn’t keep stocks representing a sector but uses future contracts and OTC swaps to catch and mimic the natural gas price.

What is the United States Natural Gas Fund?

The United States Natural Gas Fund provides speculators exposure to natural gas. This is why you should initially analyze everything related to natural gas, like the EIA Natural Gas Report, the weather in the U.S., and so on.

How much leverage does DGAZ have?

As you may have noticed, both UGAZ and DGAZ have 3:1 leverage, which can significantly increase your potential profit.

Component Grades

We have 5 different ratings for every ETF to help you appreciate its future potential. You can unlock it all now.

VelocityShares 3X Long Natural Gas ETN linked to the S&P GSCI Natural Gas Index Excess Return (UGAZ) ETF Bio

The investment objective of the VelocityShares 3x Long Natural Gas ETN seeks to replicate, three times the performance of the S&P GSCI Natural Gas Index ER.

About VelocityShares 3x Long Natural Gas ETN

The investment seeks to replicate, net of expenses, three times the performance of the S&P GSCI Natural Gas Index ER. The index comprises futures contracts on a single commodity and is calculated according to the methodology of the S&P GSCI Index.... Read more

Golden Star Signal

This unique signal uses moving averages and adds special requirements that convert the very good Golden Cross into a Golden Star. This signal is rare and, in most cases, gives substantial returns. From 10 000+ stocks usually only a few will trigger a Golden Star Signal per day!

Top Fintech Company

featured in The Global Fintech Index 2020 as the top Fintech company of the country.

Is UGAZ an ETF?

There is a lot to misunderstand energy ETFs and ETNs (exchange-traded notes).

What is the target of Ugaz?

The principal target of UGAZ is to increase the daily performance of UNG by 300% or 3 times. For example, if UNG price raises 1%, UGAZ will manifest a daily gain of 3%. It is better to trade UGAZ when there is bullish sentiment on UNG.

What is the main objective of UGAZ?

The principal objective of UGAZ is to increase the daily performance of UNG by 3 times. The main objective of DGAZ is to produce profits from the losses in the UNG fund.

Why does natural gas price go up?

We mentioned the weather. The crude oil and natural gas prices will go higher when temperatures could cause a spike in price. But also, when the over the warm periods, when we have an increasing demand for cooling, the price of natural gas can rise.

How much leverage does DGAZ have?

It is obvious that UGAZ and DGAZ have 3:1 leverage. Great, because that might boost your profit. But, keep in mind, that profit is in direct proportion with the risk.

How does supply and demand affect natural gas prices?

Supply and demand have a great influence on crude and natural gas prices. Their prices tend to fall when the supply is bigger than demand. When we have more supply than demand in the market, the prices will rise.

Is shorting both sides of an ETF safe?

Shorting both sides isn’t an easy money way. Shorting makes sense only if you do it with a small part of your portfolio and you have a lot of cash. In any other case, it can be extremely dangerous when shorting both sides of a leveraged ETF.

How much did Ugaz bottom on March 3?

On March 3, UGAZ bottomed at $1,675/share, increased to $2,644/share on March 17 (a gain of 57.9% over 14 days), and increased to $3,075/share on April 22 (a gain of 83.6% over 50 days). In 2020, the short-term price movement of UGAZ seems to be nearly matching that of natural gas.

How much natural gas will be produced in 2020?

If production falls to the black line, about 2.6 trillion cubic feet of natural gas would be produced in May 2020.

What percentage of natural gas is used for electricity?

As shown below, 35% of natural gas demand in the United States is used for electric power. And out of the five categories of use (electric power, industrial, residential, commercial, and transportation), electric power is the only category that is growing significantly.

Is Henry Hub natural gas different from futures?

The Henry Hub natural gas price is slightly different than the futures price. Below is the long-term graph of the Henry Hub natural gas price not adjusted for inflation, and there is a slight difference. In 2012 and 2016, the bottom for the actual Henry Hub price was one month before the bottom in the futures.

Is natural gas going to bottom?

Natural gas seems to have bottomed. Natural gas demand is expected to increase, and supply seems to be decreasing. UGAZ is a highly risky but potentially highly profitable way to play natural gas. It seems that natural gas prices have hit a bottom.