Ideally, the trading price of the futures contract should be = 853 * (1 + 8.35% * 30 / 365) – 0 = INR 858.9 So, ideally as per the calculation, the trading price of the Infosys future should be INR 858.9. However, there can be an instance where the current trading price of the future may be in contrast to the one we have just calculated.

Full Answer

Is a stock’s price equal to its theoretical valuation?

Even if a stock price is initially equal to the theoretical valuation, a rising trend will push that price away from the valuation. Some believe that a stock is worth what investors are willing to pay for it at any given moment, so any theoretical valuation is irrelevant – it is simply somebody’s opinion of what a stock is worth.

What is the difference between theoretical price and current price?

The theoretical price is based on historical information of the company while the current price is often based on current information about the company. The second factor is the differences in the composition of the market portfolio used in the calculations.

Is it possible to predict the price of a stock?

And, while this formula calculates the expected future price of the stock based on these variables, there is no way to predict when or if this price will actually occur. However, valuation methods like this can be useful to find dividend stocks trading for less than their intrinsic value.

What influences investors to buy or sell stocks?

Investors are influenced by changing stock prices more than by a theoretical valuation method. A rising stock price attracts more buyers who are willing to pay progressively higher prices for fear of “missing the train.” Even if a stock price is initially equal to the theoretical valuation, a rising trend will push...

How do you find theoretical stock price?

The most popular method used to estimate the intrinsic value of a stock is the price to earnings ratio. It's simple to use, and the data is readily available. The P/E ratio is calculated by dividing the price of the stock by the total of its 12-months trailing earnings.

How do you calculate future stock price?

Determining the Future Value Use a simple formula to determine the present value of the stock price. The formula is D+E/(1+R)^Y where D is any dividends expected to be paid during the period, E is the expected stock price, Y is the number of years down the line, and R is the real rate of return you estimated.

What does theoretical price mean?

The theoretical value of an option is an estimate of what an option should be worth using all known inputs. In other words, option pricing models provide us a fair value of an option.

How do you calculate the future price of a stock without dividends?

The P/E Ratio. The price-to-earnings ratio or P/E ratio is a popular metric for valuing stocks that works even when they have no dividends. Regardless of dividends, a company with high earnings and a low price will have a low P/E ratio. Value investors see such stocks as undervalued.

What is theoretical value and experimental value?

The experimental value is your calculated value, and the theoretical value is your known value. A percentage very close to zero means you are very close to your targeted value, which is good.

What is theoretical option price in thinkorswim?

Fortunately, the thinkorswim® platform can help you determine the theoretical price of an option. The theoretical options price is based on the current implied volatility, the strike price of the option, and how much time is left until expiration. As prices fluctuate, values can change, including the theoretical value.

How do you find theoretical ex right price?

The new share price after the right issue is known as the theoretical ex-rights price (also known as ex-right price or TERP). It is calculated by sum the market value of existing shares and proceeds of right issues divided by the total number of shares after the right issue.

What is the difference between the theoretical price and the current price of XYZ stock?

The first factor is the differences in time period. The theoretical price is based on historical information of the company while the current price is often based on current information about the company.

What is the second factor in the valuation method?

The second factor is the differences in the composition of the market portfolio used in the calculations. The third factor is the difference in the approaches used to calculate the value of beta (Kapil, 2010). Thus, the difference in the valuation methods also contributes to the differences in the two prices. The fourth factor is that buying and selling of stock in the stock market affect the current stock prices (Collier, 2009).

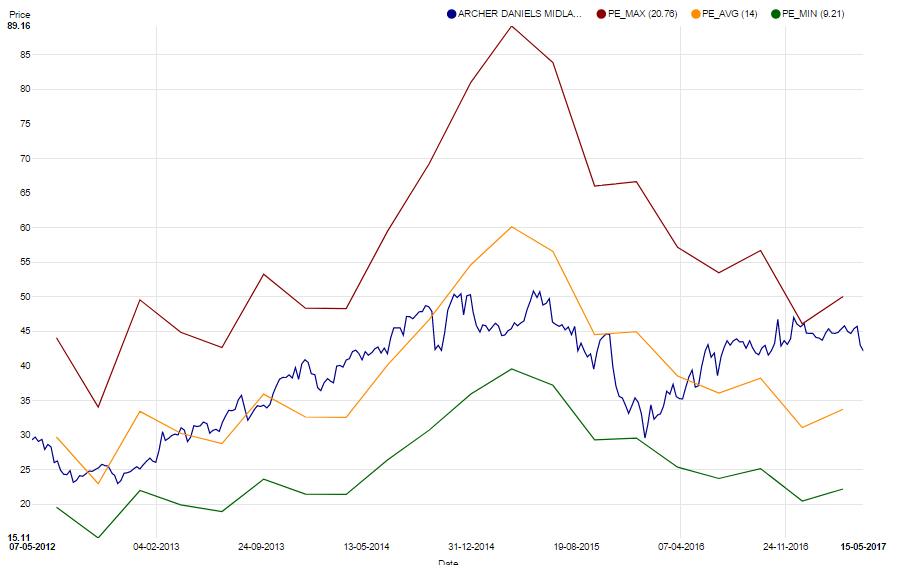

What is the beta of an asset?

The beta of an asset measures the volatility of a company’s stock relative to the changes in the market. Computation of asset beta is founded on historical returns and thus may not give an estimate of the firm’s future share prices due to the dynamism of the prevailing market conditions (Vance, 2003).

What is risk premium?

Risk premium can be defined as the incentives for investing in a risky asset. The risk premium is the amount over and above the risk free rate of return.

How is required rate of return calculated?

The required rate of return will be computed using the capital asset pricing model (CAPM). The model is an identity that calculates the required rate of rate by adding a risk premium to the risk free rate of return. The model takes into account risks arising from the market in which the asset trades.

What is systematic risk?

The systematic risk is represented by the beta factor. It gives the amount of risk. The risk premium is the product of price of risk and the amount of risk (Atrill, 2009). The formula for the capital asset pricing model is illustrated by the equation shown below.

What is risk free rate?

Risk free rate is the rate of interest that does not have risks such as interest risk fluctuations, default risk, re-investment risk, and currency fluctuations. For the analysis, the interest rate for a 10 year US treasury bond will be the risk free rate of return (Bloomberg L.P., 2013).

Why are futures prices trending downward?

More fundamentally, why indeed are the upcoming futures prices trending downward rather than trending upward? Or even just staying neutral? The usual suspects are to blame – economic uncertainty, unimpressive growth, a base level of political agitation. Throw in other negatives, no matter how incidental they are to the stock market (e.g. ISIS, Ebola) and here we are.

What is the stock market index?

A stock market index is, at its essence, just a number that represents a collection of stock prices manipulated arithmetically. The index is a quantity, but not really “of” anything you can taste or touch. Yet we can add another level of abstraction and create a futures contract for a stock index, the result of which is speculators taking positions on what direction the market at large will move in. In other words, buying and/or selling a number. A number of great cultural and perceived significance, but still, ultimately a number.

What is the difference between index futures and index funds?

But one huge difference between stock index futures and such index funds is that the former don’t take dividends into account. An index fund, by virtue of actually holding positions in the various stocks that comprise the index, is eligible for whatever dividends those stocks’ companies’ managers decide to pay out to shareholders.

Who does the Motley Fool recommend?

The Motley Fool owns shares of and recommends Amazon.com and Twitter. The Motley Fool recommends Johnson & Johnson. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Is it hard to value long established stocks?

On the other hand, long-established stocks, especially those that have a consistent record of dividend payments and increases, aren't too difficult to value -- at least in theory.

Can we predict the price of a stock in the future?

None of us has a crystal ball that allows us to accurately project the price of a stock in the future. However, if we make a few basic assumptions, it is possible to determine the price a stock should be trading for in the future, also known as its intrinsic value.

Why do investors compare stock prices?

Some investors like to compare a current stock price with how much they think a stock is worth to determine whether a stock is a good investment at current levels. This approach is based on the assumption that a stock represents a specific business that has intrinsic value, and that the market price may deviate from that value, but eventually comes back to reflect it.

How do stock prices move?

Stock prices move in trends. Once a major trend develops, it may last several months or quarters. Investors are influenced by changing stock prices more than by a theoretical valuation method. A rising stock price attracts more buyers who are willing to pay progressively higher prices for fear of “missing the train.” Even if a stock price is initially equal to the theoretical valuation, a rising trend will push that price away from the valuation.

What happens when you sell a stock?

Buying and selling impacts the current stock price. When selling is stronger than buying, the stock price declines , and when buying is stronger than selling, the stock prices increases. Investors buy and sell for a variety of reasons, which may have little to do with stock valuation – manipulation, short-term speculation or the need to raise cash.

How do stock analysts determine how much a stock is worth?

Some stock analysts develop sophisticated formulas to determine how much a stock should be worth based on multiple factors, such as sales and earnings growth, cash flows or price-to-earnings ratios. Different valuation methods and methodologies can produce different results.

Is a stock price a theoretical valuation?

Some believe that a stock is worth what investors are willing to pay for it at any given moment, so any theoretical valuation is irrelevant – it is simply somebody’s opinion of what a stock is worth. A stock price reflects what investors do, not what they think, and represents the opinions of all market participants, not just one.

Why is fair value different from futures price?

The futures price may be different from the fair value due to the short-term influences of supply and demand for the futures contract. The fair value always refers to the front-month futures contract as opposed to a further out month contract.

What is fair value in futures?

Fair value can show the difference between the futures price and what it would cost to own all stocks in that index. For example, the formula for the fair value on the S&P futures contract is:

What does fair value mean in stocks?

Fair value can show the difference between the futures price and what it would cost to own all stocks in that index.

What is fair value in stock market?

Fair value is the sale price agreed upon by a willing buyer and seller. The fair value of a stock is determined by the market where the stock is traded. Fair value also represents the value of a company’s assets and liabilities when a subsidiary company’s financial statements are consolidated with a parent company.

Where do futures trade?

Futures contracts trade on the Chicago Mercantile Exchange while individual stocks as components of the S&P 500 are trading at dispersed stock exchanges around the country. 1 Therefore, there are often discrepancies between the two.

Does Investopedia include all offers?

This compensation may impact how and where listings appear. Investopedia does not include all offers available in the marketplace.

What is program trading?

Program trading enables a computer to send out all the required trades to an exchange as the futures contract is being traded.

How to find the weight of a stock in a portfolio?

The weight of a stock in a portfolio is obtained by getting the percentage of the stock invested in a portfolio.

Why are forward and futures contracts different?

Another disparity between futures and forwards contracts comes about due to differences in delivery dates. Futures contracts have a range of delivery dates. A trader with a short position will deliver the asset as soon as possible to avoid financing costs if the interest rates charged are higher than the returns from the underlying asset. If the interests are lower, the trader will hold on to the asset as much as possible in order to maximize the income earned on the asset. Forward contracts lack a range of delivery dates.

How can investors make arbitrage profits?

If F < (S − I) (1 + R) T , investors can make arbitrage profits by selling the assets and buying the forward contract.

What is investment asset?

An investment asset is an asset held for the purposes of investing. The holder takes a position in the asset in the hope of earning an income or capital gain. Examples include stocks and bonds issued by various financial institutions.

What is forward vs future?

Forwards vs. Futures. Unlike future contracts, which are settled on a daily basis, forward contracts are settled at maturity. It can be shown that if interest rates are constant (or if they change in a perfectly predictable way), the theoretical no-arbitrage forward and futures prices are the same.

What is short selling?

Short selling involves the sale of a security not owned by an investor. The investor sells the security but purposes to buy it later. The investor will then realize profits if the price of the security goes down and losses if the price of the security goes up.

What is investment asset?

Investment assets are assets held by a significant number of people purely for investment purposes( Examples: stocks, bonds, gold, silver –although a few people might also hold them for industrial purposes for example).

Why is foreign currency analogous to a security?

A foreign currency is analogous to a security providing a yield because the holder of the currency can earn interest at the risk-free interest rate prevailing in the foreign country.