How many shares of stock does GameStop have?

Jan 19, 2021 · Gaming the System: How GameStop Stock Surged 1,500% In Nine Months (arstechnica.com) 39. An anonymous reader quotes a report from Ars Technica: Nine months ago, GameStop stock bottomed out at $2.80 a share, a reflection of the myriad problems facing the retailer specifically and brick-and-mortar game retail as a whole. As of Tuesday morning, …

Is GameStop the most valuable stock in the SmallCap 600?

Jan 19, 2021 · GameStop's stock has surged 1,500% in nine months after activist investors take board seats along with a massive short squeeze. Posted January 19, 2021 by Deimos. Tags: ... Gaming the system: How GameStop stock surged 1,500% in nine months Authors Kyle Orland Published Jan 19 2021 Word count 1607 words.

What did GameStop’s Q4 earnings report say about the company?

Jan 19, 2021 · Gaming the system: How GameStop stock surged 1,500% in nine months

Is GameStop's long-term health better than last year's stock doldrums suggest?

Feb 01, 2021 · Here's a game many people would like to play: How to make a billion bucks in a month. And nine investors just pulled it off with GameStop stock.. X. Nine investors, including large fund-running ...

Why GameStop stock is high?

How owns the most GameStop stock?

| Stockholder | Stake | Shares owned |

|---|---|---|

| The Vanguard Group, Inc. | 7.65% | 5,837,633 |

| BlackRock Fund Advisors | 6.28% | 4,794,611 |

| SSgA Funds Management, Inc. | 2.17% | 1,653,929 |

| Geode Capital Management LLC | 1.01% | 773,880 |

Can you buy a fraction of GameStop stock?

Stash allows you to purchase smaller pieces of investments, called fractional shares, rather than having to pay the full price for a whole share. , you can buy GameStop Corp stock in any dollar amount, or any other fund or stock you know on Stash.

Is GameStop bullish?

So it's clear an insider wanted to buy, even at a higher price than the current share price (being US$98.79). It's very possible they regret the purchase, but it's more likely they are bullish about the company.3 days ago

How many shares exist for GameStop?

| Avg Vol (3 month) 3 | 4.18M |

|---|---|

| Avg Vol (10 day) 3 | 1.7M |

| Shares Outstanding 5 | 76.34M |

| Implied Shares Outstanding 6 | N/A |

| Float 8 | 63.01M |

Who owns the most Exxon stock?

| Stockholder | Stake | Shares owned |

|---|---|---|

| The Vanguard Group, Inc. | 8.00% | 338,672,876 |

| SSgA Funds Management, Inc. | 5.98% | 253,211,345 |

| BlackRock Fund Advisors | 4.63% | 195,981,349 |

| Fidelity Management & Research Co... | 1.68% | 71,245,644 |

How do I buy shares in GameStop?

How do you buy stock in GameStop?

- Compare share trading platforms. Use our comparison table to help you find a platform that fits you.

- Open your brokerage account. Complete an application with your details.

- Confirm your payment details. ...

- Research the stock. ...

- Purchase now or later. ...

- Check in on your investment.

How do I purchase stock in GameStop?

Is it good to buy GameStop stock?

Is GME worth buying?

Is GameStop a good investment?

What is happening to GameStop stock?

To understand what's happening to GameStop stock, first you have to understand short selling, where investors make a bet that a stock will go down instead of up. To do this, they borrow a share of the stock (for a fee), immediately sell it to pocket the current value, and agree to buy another share later to "cover" their short position.

What happens if you short a stock?

But shorting stocks comes with huge risks if the stock price goes up. When your short position eventually comes due, you're forced to buy the stock at whatever price the market currently sets, and there's theoretically no limit to how high it could go. If you invest $1,000 in buying a stock, all you can lose is $1,000.

What happens if you borrow $1,000 worth of stock to short it?

If you borrow $1,000 worth of stock to short it, you could lose a lot more than that when you're forced to buy much more expensive stock. Investors as a whole were so sure that GameStop stock was going to go down that they wanted to borrow every single available share (and then some) to make money on the coming collapse.

Is GameStop a short stock?

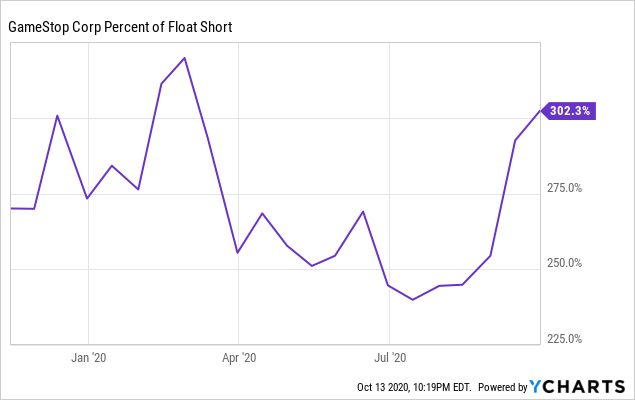

GameStop has been one of the most heavily shorted stocks on the market for a while now. Since the middle of 2019, the "short interest" (i.e., the number of shares investors have expressed interest in borrowing for a short position) has heavily surpassed the stock's "free float" (i.e., the number of actively traded shares available).

Is GameStop a brick and mortar company?

GameStop faces plenty of headwinds to its core business of selling disc -based games in brick-and-mortar stores (as we've written about extensively ). But that extreme level of short interest in an already heavily depressed stock was probably overly pessimistic about the company's near-term prospects.

Who owns GameStop stock?

Fidelity FMR is the top holder of GameStop shares. It owns 9.5 million shares, through September, or nearly 14% of shares outstanding. Adding that up and Fidelity hauled in a nearly $3 billion gain just this year for its investors.

How much is GameStop worth?

That means they grabbed roughly three-quarters of the $20.4 billion gain in the company's market value this year. GameStop is now worth $22.7 billion, up from just $1.3 billion a month ago. The rally in GameStop is breathtaking.