What is the upside for Synchrony Financial's stock?

On average, they anticipate Synchrony Financial's stock price to reach $38.54 in the next year. This suggests a possible upside of 10.6% from the stock's current price. View Analyst Price Targets for Synchrony Financial.

What is the price targets for Synchrony Financial's stock?

Their forecasts range from $34.00 to $43.00. On average, they anticipate Synchrony Financial's stock price to reach $39.08 in the next twelve months. This suggests a possible upside of 4.5% from the stock's current price. View Analyst Price Targets for Synchrony Financial.

Is Synchrony Financial (SYF) a good buy on Wall Street?

Synchrony Financial has received a consensus rating of Buy. The company's average rating score is 2.81, and is based on 13 buy ratings, 3 hold ratings, and no sell ratings. According to analysts' consensus price target of $58.93, Synchrony Financial has a forecasted upside of 27.0% from its current price of $46.39.

What to expect from Synchrony Financial's Q2 results?

On July 18, Synchrony Financial reveals earnings for the most recent quarter. Analysts expect Synchrony Financial will release earnings per share of $1.41. Go here to follow Synchrony Financial stock price in real-time ahead of earnings. Synchrony Financial will present Q2 figures on July 18.

See more

Is Synchrony Financial stock a buy?

Synchrony Financial has received a consensus rating of Buy. The company's average rating score is 2.60, and is based on 10 buy ratings, 4 hold ratings, and 1 sell rating.

Is synchrony bank publicly traded?

It is publicly traded on the New York Stock Exchange. Synchrony is the largest provider of private label credit cards in the U.S. based on purchase volume and receivables.

Who owns Synchrony Financial?

GE CapitalToday GE (NYSE:GE) completed the separation of Synchrony Financial (NYSE: SYF), the largest provider of private label credit cards in the United States[1]. Synchrony Financial has been a part of GE Capital for more than 80 years, helping consumers finance purchases from clothing to jewelry to RVs to furniture.

What is the net worth of synchrony bank?

Synchrony Financial net worth as of July 15, 2022 is $15.03B.

Is Synchrony Bank in financial trouble?

Fitch Affirms Synchrony Financial at 'BBB-'; Outlook Revised to Stable. Fitch Ratings - New York - 03 May 2021: Fitch Ratings has affirmed Synchrony Financial's (SYF) and Synchrony Bank's (SYB) Long-Term Issuer Default Ratings (IDRs) at 'BBB-'. The Rating Outlook has been revised to Stable from Negative.

Does Amazon own Synchrony Bank?

Stamford, Connecticut-based Synchrony Bank, which is a subsidiary of Synchrony Financial, also issues co-branded credit cards with Lowe's, Sam's Club, PayPal, Banana Republic and other companies. The new card application sits directly next to the other Amazon cards.

Is Capital One buying out Synchrony Bank?

Update 7/17/19: Existing cardholders have been sent a letter stating that their existing Synchrony cards will be converted to Capital One and they will receive the new cards by October 11th, 2019. Walmart chooses Capital One as their credit card issuer, in a blow to their current backer Synchrony, WSJ reports.

Is Synchrony Bank owned by Chase?

On June 2, 2014, GE Capital Retail Bank changed its name to Synchrony Bank. Synchrony Financial is the parent company of Synchrony Bank.

Is Synchrony Bank owned by Walmart?

Synchrony Financial, the largest retail store credit card issuer, has partnered with Walmart since 1999. That came to a close this July, when Walmart picked Capital One as its new primary credit card partner.

Is PayPal owned by Synchrony Bank?

With the completion of the transaction, PayPal and Synchrony have extended their existing co-brand consumer credit card program agreement, and Synchrony is now the exclusive issuer of the PayPal Credit online consumer financing program in the U.S., through 2028.

How does Synchrony make money?

Synchrony makes most of its money on the interest it charges on outstanding loan balances. Such income totaled $9.4 billion last year, up 7% from 2014. Many card users pay off their balances every month, but many do not.

Who is Synchrony Bank affiliated with?

Synchrony is the largest provider of private label credit cards in the U.S. Brands partnered with Synchrony include Amazon, Lowe's, Guitar Center, Gap., Cathay Pacific, Rakuten, Verizon, and Sam's Club.

Should I buy or sell Synchrony Financial stock right now?

16 Wall Street research analysts have issued "buy," "hold," and "sell" ratings for Synchrony Financial in the last year. There are currently 1 sell...

What is Synchrony Financial's stock price forecast for 2022?

16 brokers have issued 12 month target prices for Synchrony Financial's stock. Their forecasts range from $22.00 to $65.00. On average, they antici...

How has Synchrony Financial's stock price performed in 2022?

Synchrony Financial's stock was trading at $46.39 at the beginning of the year. Since then, SYF stock has decreased by 32.1% and is now trading at...

Are investors shorting Synchrony Financial?

Synchrony Financial saw a decline in short interest in May. As of May 15th, there was short interest totaling 12,440,000 shares, a decline of 17.8%...

When is Synchrony Financial's next earnings date?

Synchrony Financial is scheduled to release its next quarterly earnings announcement on Tuesday, July 19th 2022. View our earnings forecast for Sy...

How were Synchrony Financial's earnings last quarter?

Synchrony Financial (NYSE:SYF) issued its quarterly earnings results on Monday, April, 18th. The financial services provider reported $1.77 earning...

How often does Synchrony Financial pay dividends? What is the dividend yield for Synchrony Financial?

Synchrony Financial declared a quarterly dividend on Thursday, April 21st. Shareholders of record on Monday, May 2nd will be paid a dividend of $0....

Is Synchrony Financial a good dividend stock?

Synchrony Financial(NYSE:SYF) pays an annual dividend of $0.88 per share and currently has a dividend yield of 2.79%. The dividend payout ratio of...

How will Synchrony Financial's stock buyback program work?

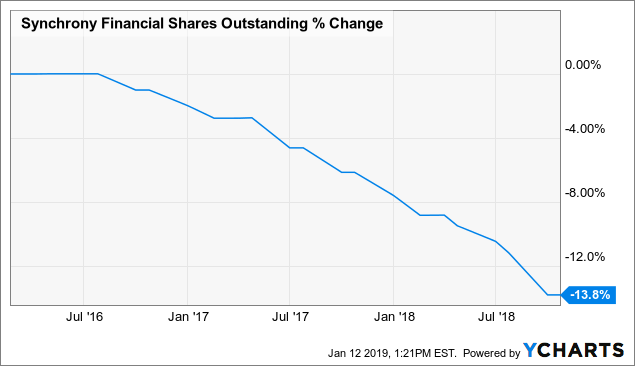

Synchrony Financial announced that its board has approved a stock buyback plan on Monday, April 18th 2022, which authorizes the company to buyback...

Recently Viewed Tickers

Synchrony Financial

Visit a quote page and your recently viewed tickers will be displayed here.

How much does Synchrony Financial make?

Synchrony Financial engages in the provision of consumer financial services. It operates through three sales platforms: Retail Card, Payment Solutions, and CareCredit. The Retail Card platform is a provider of private label credit cards, and also provides Dual Cards and small-and medium-sized business credit products.

When will Synchrony stock repurchase?

Synchrony Financial has a market capitalization of $27.42 billion and generates $16.07 billion in revenue each year. The financial services provider earns $1.39 billion in net income (profit) each year or $2.60 on an earnings per share basis.

Does Synchrony Financial have a dividend?

Synchrony Financial declared that its board has approved a stock buyback program on Tuesday, May 25th 2021, which authorizes the company to repurchase $2,900,000,000.00 in shares, according to EventVestor. This repurchase authorization authorizes the company to repurchase up to 10.7% of its stock through open market purchases.

New York Stock Exchange

Synchrony Financial does not yet have a strong track record of dividend growth. The dividend payout ratio of Synchrony Financial is 33.85%. This payout ratio is at a healthy, sustainable level, below 75%. Based on earnings estimates, Synchrony Financial will have a dividend payout ratio of 16.45% next year.

Environmental, Social, and Governance Rating

Synchrony Financial operates as a consumer financial services company in the United States. The company offers private label credit cards, dual cards, and small and medium-sized business credit products; and promotional financing for consumer purchases, such as private label credit cards and installment loans.

Business Summary

"B" score indicates good relative ESG performance and an above-average degree of transparency in reporting material ESG data publicly and privately. Scores range from AAA to D.

5 Undervalued Stocks to Buy Before March

Synchrony Financial operates as a consumer financial services company in the United States. The company offers private label credit cards, dual cards, and small and medium-sized business credit products; and promotional financing for consumer purchases, such as private label credit cards and installment loans.

Does Capital One's Discount to Peers Make the Stock a Value Play?

2022 has started on a weak note for the U.S. stock market. All three major stock indexes have losses year-to-date, and Nasdaq has underperformed by 10%. Seeking undervalued stocks in a broader stock market that is still near all-time highs seems like a challenging task. The world is waiting for news about whether or not Russia will invade Ukraine.

10 Cheap Value Stocks to Buy Amid Market Uncertainty

Capital One's stock is performing well, but there are indications it may not be as much of a value play as the market thinks.