If you buy or hold a call option, you have the right to purchase stock shares at the predetermined strike price. For example, suppose you want to purchase at the money call options of stock ABC and the stock price is currently trading at $20. Since you want to purchase at the money call options, you would set a strike price of $20.

...

Problem 11.28.

| Strike | Option Value |

|---|---|

| 165 | 11.86 |

What is a strike price and how to set it?

Generally, if you are buying call options, a higher strike price results in a cheaper option and vice versa for put options. Setting a strike price depends on the amount of risk you want to take and how much you are willing to spend on purchasing the options.

What are the risks of options trading?

Similarly, a put option strike price at or above the stock price is safer than a strike price below the stock price. Picking the wrong strike price may result in losses, and this risk increases when the strike price is set further out of the money. Assume that you have identified the stock on which you want to make an options trade.

Why is it important to pick the optimum strike price?

Picking the strike price is a key decision for an options investor or trader since it has a very significant impact on the profitability of an option position. Doing your homework to select the optimum strike price is a necessary step to improve your chances of success in options trading.

Should you buy or hold a put option?

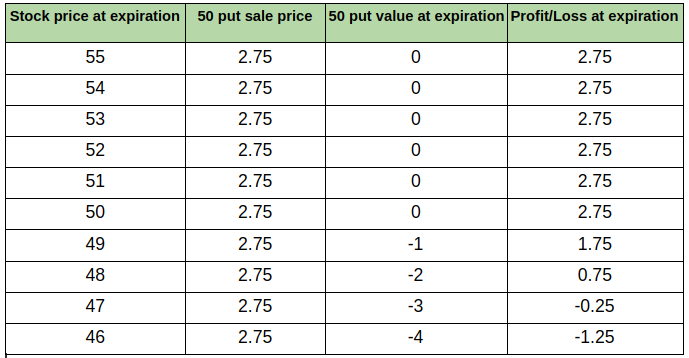

On the other hand, if you buy or hold a put option, you have the right to sell stock shares at a predetermined strike price. For example, suppose you are bearish on company DEF and think that it will trade below $50 in three months.

What happens when an option hits the strike price?

When the stock price equals the strike price, the option contract has zero intrinsic value and is at the money. Therefore, there is really no reason to exercise the contract when it can be bought in the market for the same price. The option contract is not exercised and expires worthless.

What happens when an option hits the strike price before expiration?

When the strike price is reached, your contract is essentially worthless on the expiration date (since you can purchase the shares on the open market for that price). Prior to expiration, the long call will generally have value as the share price rises towards the strike price.

Can you sell an option before it hits the strike price?

Question To Be Answered: Can You Sell A Call Option Before It Hits The Strike Price? The short answer is, yes, you can. Options are tradeable and you can sell them anytime. Even if you don't own them in the first place (see below).

Does strike price matter in options?

The strike price of an option matters because it plays a significant role in determining the value of an option. There are other factors like time and implied volatility that can affect an option's price, however at expiration, an option will only have value if it is “in-the-money.”

What happens when a call option expires above strike price?

When a call option expires in the money, it means the strike price is lower than that of the underlying security, resulting in a profit for the trader who holds the contract. The opposite is true for put options, which means the strike price is higher than the price for the underlying security.

What happens if I don't sell my call option?

If you don't exercise an out-of-the-money stock option before expiration, it has no value. If it's an in-the-money stock option, it's automatically exercised at expiration.

Is it better to exercise an option or sell it?

As it turns out, there are good reasons not to exercise your rights as an option owner. Instead, closing the option (selling it through an offsetting transaction) is often the best choice for an option owner who no longer wants to hold the position.

When should you sell your call options?

Call options should be written when you believe that the price of the underlying asset will decrease. Call options should be bought, or held, when you anticipate a rally in the underlying asset price – and they should be sold when if you no longer expect the rally. Buy your call options when you are bullish.

How can I make money on options without exercise?

Selling the Call Options If your call option is in-the-money with the stock price above the exercise price, you can lock in that equity by just selling the option to someone else. In other words, there really is no need to exercise the option, receive the shares and quickly sell them.

What is the best way to choose strike price in options?

How to pick the right strike priceIdentify the market you want to trade.Decide on your options strategy.Consider your risk profile.Take the time to carry out analysis.Work out the value of your option and pick your strike price.Open an account and place your trade.

When should you buy options?

Whether the volatility is going to increase or decrease Even if the stock price remains at the same place, the value of the option can go up if volatility goes up. It is always advisable to be buying options when the volatility is likely to go up and sell options when the volatility is likely to go down.

How often do options get exercised?

Only about 7% of options positions are typically exercised, but that does not imply that investors can expect to be assigned on only 7% of their short positions. Investors may have some, all or none of their short positions assigned.

What happens if I don't exit option on expiry?

In the case of options contracts, you are not bound to fulfil the contract. As such, if the contract is not acted upon within the expiry date, it simply expires. The premium that you paid to buy the option is forfeited by the seller. You don't have to pay anything else.

What happens if we not square off options on expiry?

You will lose the entire amount paid as premium.

Is it better to exercise an option or sell it?

As it turns out, there are good reasons not to exercise your rights as an option owner. Instead, closing the option (selling it through an offsetting transaction) is often the best choice for an option owner who no longer wants to hold the position.

Can option price be zero before expiry date?

Of course, the time value will come down to zero. However, the intrinsic value will not become zero because it is the difference between closing price of the underlying and the strike price of the option on expiry, which will be positive. It is the premium of OTM (out-of-money) options that becomes zero at expiry.

What is an ITM call?

Your risk tolerance should determine whether you chose an in-the-money (ITM) call option, an at-the-money (ATM) call, or an out-of-the-money ( OTM) call. An ITM option has a higher sensitivity—also known as the option delta —to the price of the underlying stock. If the stock price increases by a given amount, the ITM call would gain more than an ATM or OTM call. But if the stock price declines, the higher delta of the ITM option also means it would decrease more than an ATM or OTM call if the price of the underlying stock falls.

What happens if you choose the wrong strike price?

If you are a call or a put buyer, choosing the wrong strike price may result in the loss of the full premium paid. This risk increases when the strike price is set further out of the money. In the case of a call writer, the wrong strike price for the covered call may result in the underlying stock being called away. Some investors prefer to write slightly OTM calls. That gives them a higher return if the stock is called away, even though it means sacrificing some premium income.

Why is it important to pick the strike price?

Picking the strike price is a key decision for an options investor or trader since it has a very significant impact on the profitability of an option position. Doing your homework to select the optimum strike price is a necessary step to improve your chances of success in options trading.

What is strike price in options?

The strike price of an option is the price at which a put or call option can be exercised. A relatively conservative investor might opt for a call option strike price at or below the stock price, while a trader with a high tolerance for risk may prefer a strike price above the stock price. Similarly, a put option strike price at or above ...

What is strike price?

The strike price of an option is the price at which a put or call option can be exercised. It is also known as the exercise price. Picking the strike price is one of two key decisions (the other being time to expiration) an investor or trader must make when selecting a specific option. The strike price has an enormous bearing on how your option ...

What is implied volatility?

Implied volatility is the level of volatility embedded in the option price. Generally speaking, the bigger the stock gyrations, the higher the level of implied volatility. Most stocks have different levels of implied volatility for different strike prices. That can be seen in Tables 1 and 3.

What happened to GE stock?

GE's stock price collapsed by more than 85% during 17 months that started in October 2007, plunging to a 16-year low of $5.73 in March 2009 as the global credit crisis imperiled its GE Capital subsidiary. The stock recovered steadily, gaining 33.5% in 2013 and closing at $27.20 on January 16, 2014. 1

How much to strike for ABC call options?

Since you want to purchase at the money call options, you would set a strike price of $20. This indicates that if the stock stays above $20 before the expiration date of your call options, you could exercise your options and buy shares of ABC for $20.

What is strike price?

The strike price of an option is the price at which the contract can be exercised. The strike price of a stock and an index option is fixed in the contract. Depending on the amount of premium you want to spend, you may want to set the strike price higher or lower.

Can you buy call options with a higher strike price?

Generally, if you are buying call options, a higher strike price results in a cheaper option and vice versa for put options. Setting a strike price depends on the amount of risk you want to take and how much you are willing to spend on purchasing the options. If you buy or hold a call option, you have the right to purchase stock shares at ...