What's the Subros share price today?

As on 08 Jun, 2022, 03:41 PM IST Subros share price was up by 1.11% basis the previous closing price of Rs 300.1. Subros share price was Rs 300.15....

How can I quickly analyze Subros stock?

Subros share can be quickly analyzed on following metrics: Stock's PE is 60.25 Price to Book Ratio of 2.35 Dividend Yield of 0.23 EPS (trailing 12...

Who's the owner of Subros?

Promoter,DII and FII owns 36.79, 12.23 and 0.6 shares of Subros as on 31 Mar 2022There is no change in promoter holding from 31 Dec 2021 to 31 Mar...

What has been highest price of Subros share in last 52 weeks?

In last 52 weeks Subros share had a high price of Rs 430.00 and low price of Rs 275.30

What is the market cap of Subros?

Market Capitalization of Subros stock is Rs 1,958.05 Cr.

Who are the peers for Subros in Auto Ancillaries sector?

Within Auto Ancillaries sectorSubros and Suprajit Engineering Ltd. are usually compared together by investors for analysis.

What is the face value of a stock?

What is Subros Ltd?

(%) 0.22. Face Value. Face Value. Face value of a stock is the value ascribed to the stock as per the balance sheet of the company. The dividend declared by a company is usually declared as a percentage of face value.

SUBROS Stock Chart

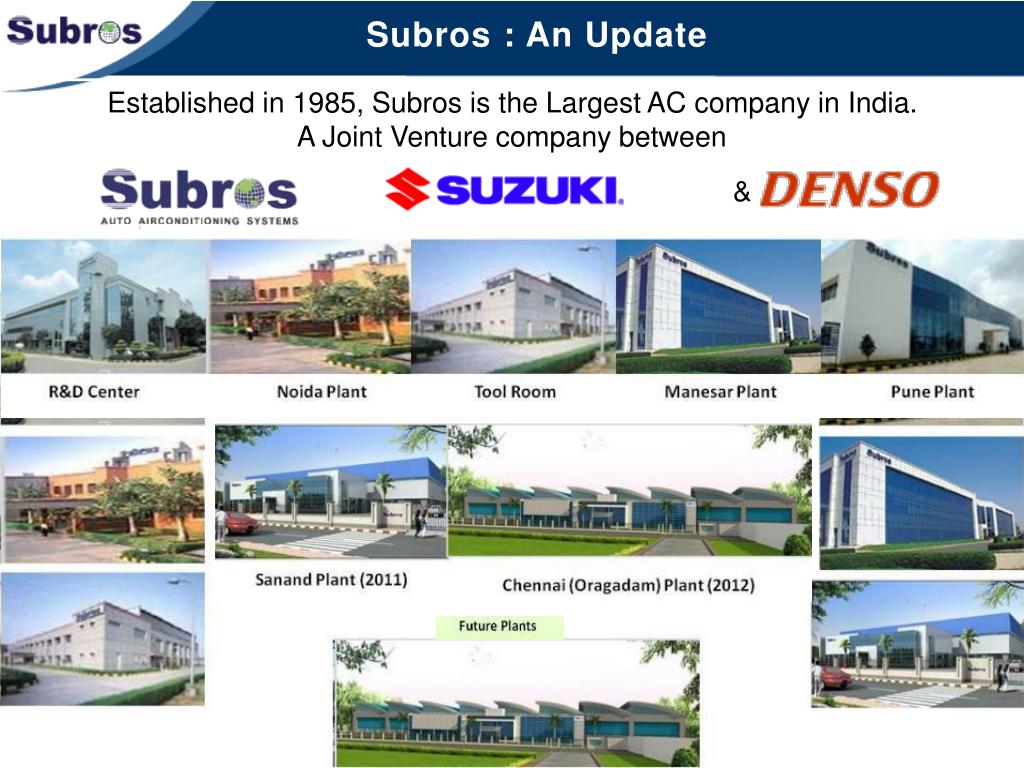

Subros Ltd., incorporated in the year 1985, is a Small Cap company (having a market cap of Rs 2,044.49 Crore) operating in Auto Ancillaries sector. Subros Ltd. key Products/Revenue Segments include Air Conditioning Equipment And Accessories, Sale of services and Scrap for the year ending 31-Mar-2020.

Ideas

Get $150 worth of Bitcoin from TradeStation Crypto with a new account. Start trading

Profile

Subros was established in 1985 as a joint venture between the Suri Brothers, Denso Corporation, Japan and Suzuki Motor Corporation, Japan. The company has grown from a capacity of 15,000 AC units in 1985 comprising of largely an assembly operation, into the largest and only integrated manufacturing unit in India for Auto Air Conditioning systems.

Transparency is our policy. Learn how it impacts everything we do

Subros Ltd. engages in the manufacture of thermal products for automotive applications. Its products include compressors, condensers, heating, ventilation, and air conditioning systems, tubes and hoses, bus air conditioners, rail air conditioning, transport refrigeration system, truck cabin air conditioning system, and off-roader air conditioning.

How we make money

Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data.

How we use your personal data

We sell different types of products and services to both investment professionals and individual investors. These products and services are usually sold through license agreements or subscriptions. Our investment management business generates asset-based fees, which are calculated as a percentage of assets under management.

How we approach editorial content

How we use your information depends on the product and service that you use and your relationship with us. We may use it to:

Signals & Forecast

Maintaining independence and editorial freedom is essential to our mission of empowering investor success. We provide a platform for our authors to report on investments fairly, accurately, and from the investor’s point of view.

Support, Risk & Stop-loss

There are mixed signals in the stock today. The Subros Limited stock holds a buy signal from the short-term moving average; at the same time, however, the long-term average holds a general sell signal.

Is Subros Limited stock A Buy?

Subros Limited finds support from accumulated volume at ₹340.25 and this level may hold a buying opportunity as an upwards reaction can be expected when the support is being tested.

Golden Star Signal

Subros Limited holds several positive signals, but we still don't find these to be enough for a buy candidate. At the current level, it should be considered as a hold candidate (hold or accumulate) in this position whilst awaiting further development.

Top Fintech Company

This unique signal uses moving averages and adds special requirements that convert the very good Golden Cross into a Golden Star. This signal is rare and, in most cases, gives substantial returns. From 10 000+ stocks usually only a few will trigger a Golden Star Signal per day!