What is the highest a Chipotle stock has ever been?

The latest closing stock price for Chipotle Mexican Grill as of September 16, 2019 is 799.87. The all-time high Chipotle Mexican Grill stock closing price was 843.64 on August 29, 2019. The Chipotle Mexican Grill 52-week high stock price is 857.90, which is 7.3% above the current share price.

What is Chipotle Mexican Grill's 52-week low stock price?

The Chipotle Mexican Grill 52-week low stock price is 1256.27, which is 28.1% below the current share price. The average Chipotle Mexican Grill stock price for the last 52 weeks is 1615.36.

What happened to Chipotle's stock after the 2008 recession?

The 2008 recession hurt Chipotle's stock along with shares of companies throughout the market, but the company bounced back in subsequent years. Soon thereafter, Chipotle had gotten back on its high-growth trajectory, sending the stock climbing steadily until mid-2012.

Can Chipotle stock bounce back to new highs?

Chipotle stock is going through a big challenge right now, but its long-term track record has been quite strong. Over the long run, Chipotle's share price has a high likelihood of bouncing back and returning to produce new all-time highs.

See more

What is the highest Chipotle stock has ever been?

The all-time high Chipotle Mexican Grill stock closing price was 1944.05 on September 23, 2021.

What was Chipotle's IPO price?

$22.00Chipotle Mexican Grill is registered under the ticker NYSE:CMG . Their stock opened with $22.00 in its Jan 26, 2006 IPO.

How long has Chipotle been publicly traded?

On January 26, 2006, Chipotle made its initial public offering (IPO) after increasing the share price twice due to high pre-IPO demand. In its first day as a public company, the stock rose exactly 100%, resulting in the best U.S.-based IPO in six years, and the second-best IPO for a restaurant after Boston Market.

Who owns the most Chipotle stock?

Top 10 Owners of Chipotle Mexican Grill IncStockholderStakeTotal value ($)T. Rowe Price Associates, Inc. (I...9.88%3,610,265,171The Vanguard Group, Inc.8.51%3,110,494,444BlackRock Fund Advisors4.83%1,764,642,822Edgewood Management LLC4.51%1,650,020,9576 more rows

How many times has Chipotle stock split?

A high stock price Chipotle is in the same neighborhood at 257%. At $1,600, Chipotle shares have also reached a point where one share costs a sizable chunk of change. And management has never split the stock.

Why does Chipotle stock cost so much?

Its share prices are back to the trajectory they were on pre-Covid, bucking the industry trend and leaving a spotlight on this company for better or worse.

Who was Chipotle's largest investor in 1998?

McDonald'sIn 1998, McDonald's became an investor in Chipotle. Over the course of about seven years, the Golden Arches poured more than $360 million into the company, allowing Ells to expand further. By 2001, McDonald's was the majority shareholder.

When did McDonald's buy Chipotle?

The burger chain made an investment in Chipotle in 1998 that helped it grow from 14 locations to nearly 500 within seven years. By 2005, McDonald's had a 90% stake in Chipotle's business. But one year later, McDonald's divested its stake and parted ways with the fledgling burrito chain.

Is Chipotle owned by McDonald's?

While the Golden Arches initially took only a minority stake, by the time Chipotle went public in 2006, McDonald's owned more than 90% of the company. McDonald's no longer owns any shares of Chipotle (something it must also now regret), but the impact on Ells' ownership stake was permanent.

Can you buy a Chipotle franchise?

As of today, all Chipotle Mexican Grill restaurants are company-owned and the company doesn't offer franchising at this time. For the reason that you can't open a Chipotle fast food restaurant, please visit our franchise directory where are a lot of relevant franchises to view.

Who is Chipotle's competition?

Qdoba Mexican Eats, Moe's Southwest Grill, Baja Fresh Mexican Grill, and Rubio's Coastal Grill are Chipotle's main competitors. Although it is fast-food-oriented rather than fast-casual, Taco Bell has also started to compete with Chipotle by improving the quality of its food.

Why are chipotles closing early?

Chipotle staff told MarketWatch their restaurants were struggling to cope with a surge in digital orders. Some said their restaurants had shut their dining rooms early so they could focus on online orders.

What did Lululemon IPO at?

$18.00 per sharelululemon athletica inc.'s initial public offering of 18.2 million shares of common stock has been priced at $18.00 per share. The shares were trading on the Nasdaq Global Select Market under the symbol LULUV and on the Toronto Stock Exchange under the symbol LLL on Friday.

How many stores did Chipotle have at IPO?

It lost $7.7 million in 2003 as it expanded from 227 locations to 298 locations. But that was the last year it posted a loss. It earned $6.1 million in 2004, and $33.4 million in the first nine months of 2005 -- the most up-to-date results for IPO investors.

Is Chipotle part of S&P 500?

Chipotle Mexican Grill's index membership is Russell 1000, S&P 500 Consumer Discretionary, Russell 3000, S&P 500 and Investing.com United States 500.

When did chipotle open?

July 13, 1993, Denver, COChipotle Mexican Grill / Founded

Why did chipotle stock take a hit?

Where will Chipotle go from here?

At that point, shares took a hit because long-term growth rates started to slow down, and guidance for future results was no longer living up to the extremely high expectations that investors had set for the Mexican fast-casual chain.

Is chipotle a fast food company?

To recover, Chipotle has taken several actions. A rewards program has tried to give loyal customers an incentive to keep coming to the restaurant chain , and an expansion to its menu to add chorizo was also designed to boost interest. Yet the fast-casual giant hasn't provided much guidance on how well those initiatives have worked recently. The stock has therefore not made back any of its lost ground.

Does chipotle have long term returns?

The rise of fast-casual restaurants has surprised many industry experts over the past decade, and Chipotle Mexican Grill ( NYSE:CMG) has been one of the most important players in the fast-growing field. Throughout most of its history, Chipotle has demonstrated an uncanny ability to tap into the demand for high-quality food offerings with its "food with integrity" motto, and its stock has risen along with its expansion throughout the U.S. market. Yet recent foodborne illness scares have been a major roadblock to Chipotle's upward share-price trajectory, and some wonder whether the Mexican food giant's best days are now behind it. Let's take a look at how Chipotle stock has performed throughout its history and whether the company can bounce back and set new highs.

Is chipotle a strong stock?

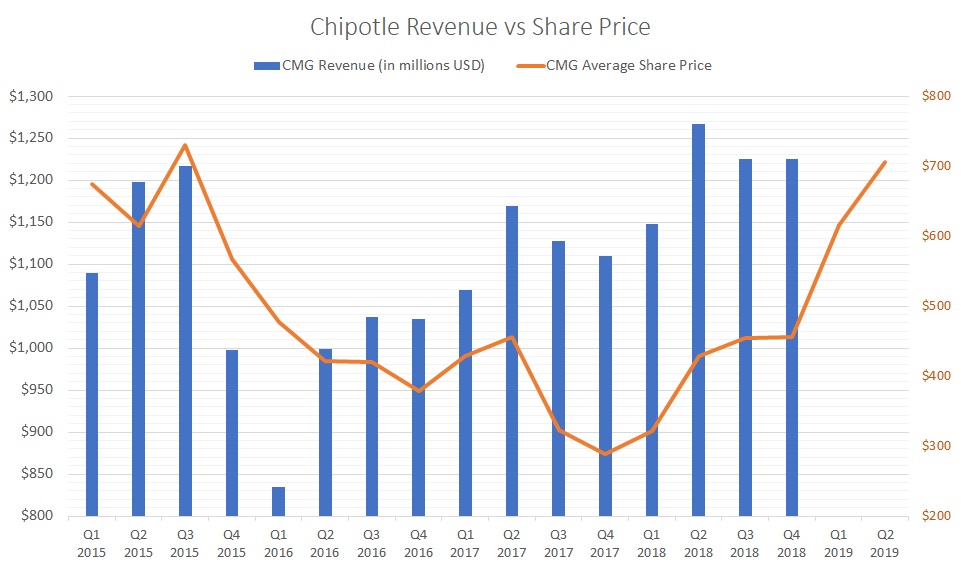

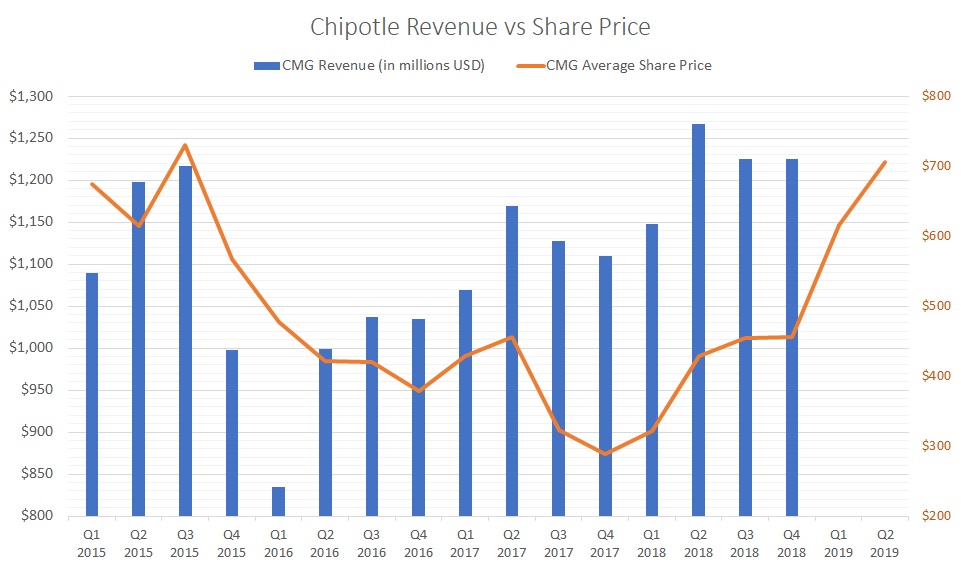

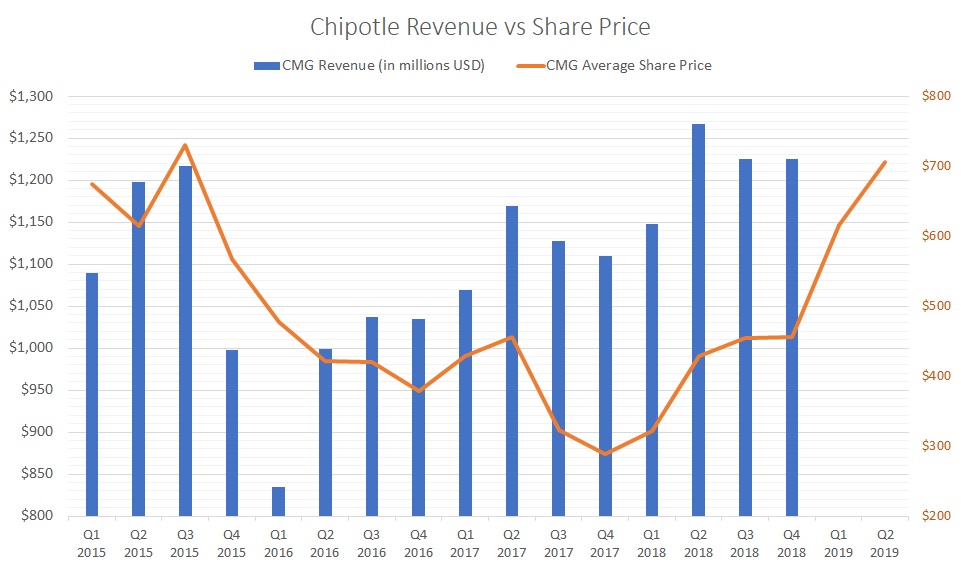

As you can see in the chart above, Chipotle has posted strong returns for long-term shareholders, even if the stock has given back much of its overall gains over the past year. Its rise since its 2006 spinoff from McDonald's amounts to more than 800%, giving investors who put $1,000 into the stock a position worth more than $9,000 today.

How much is a $1,000 investment in 2009 worth?

Chipotle has had three main periods of strong performance for its stock. In the first couple of years as an independent company, Chipotle demonstrated its ability to capitalize on the huge opportunity it had to dominate the new-restaurant space. With growth rates that hurdled it past other concepts like Moe's Southwest Grill and Qdoba, Chipotle was able to build its store base into an empire very quickly. Consistently delivering financial results that exceeded expectations by huge margins also helped to send the stock soaring.

Does chipotle stock predict future returns?

If you invested in the company 10 years ago, that decision would have paid off big time: According to CNBC calculations, a $1,000 investment in 2009 would be worth more than $10,000 as of March 29, 2019, a total return of over 900 percent. In the same time frame, by comparison, the S&P 500 was up 240 percent.

Is chipotle gaining momentum?

While Chipotle’s stock has done well over the years, any individual stock can over- or under-perform and past returns do not predict future results. In this case specifically, some investors remain cautious.