How much is a share of nnox worth?

One share of NNOX stock can currently be purchased for approximately $13.97. How much money does Nano-X Imaging make? Nano-X Imaging has a market capitalization of $668.62 million. The company earns $-43.81 million in net income (profit) each year or ($1.29) on an earnings per share basis.

What is Nano-X imaging's (nnox) stock price?

(NNOX) raised $100 million in an initial public offering on Friday, August 21st 2020. The company issued 5,900,000 shares at a price of $16.00-$18.00 per share. Cantor, Oppenheimer, Berenberg and CIBC Capital Markets acted as the underwriters for the IPO and National Securities Corp. was co-manager. What is Nano-X Imaging's stock symbol?

What is the PE (price/earnings) ratio of Nano-X imaging?

The P/E ratio of Nano-X Imaging is -10.83, which means that its earnings are negative and its P/E ratio cannot be compared to companies with positive earnings. Nano-X Imaging has a P/B Ratio of 2.71.

Will Nano-X imaging stock outperform or underperform the S&P 500 over the long term?

Vote “Outperform” if you believe NNOX will outperform the S&P 500 over the long term. Vote “Underperform” if you believe NNOX will underperform the S&P 500 over the long term. You may vote once every thirty days. Nano-X Imaging does not currently pay a dividend. Nano-X Imaging does not have a long track record of dividend growth.

Is NNOX a good stock to buy now?

Out of 3 analysts, 1 (33.33%) are recommending NNOX as a Strong Buy, 0 (0%) are recommending NNOX as a Buy, 2 (66.67%) are recommending NNOX as a Hold, 0 (0%) are recommending NNOX as a Sell, and 0 (0%) are recommending NNOX as a Strong Sell.

Will NNOX get FDA approval?

In April of 2021, Nanox received clearance from the Food and Drug Administration (FDA) of its single-source Nanox Cart X-Ray System. Since then, the company has continued to provide innovative technology for a variety of medical imaging applications.

What is Nanox imaging?

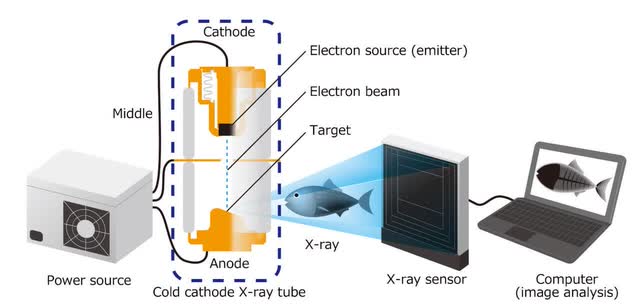

Overview. Nanox has developed a digital X-ray source enabling a cost reduction of imaging systems by orders of magnitude. We are a global company planning mass deployment of imaging systems with the goal to drive early detection preventive healthcare as a new standard of global care.

Is NanoX a good investment?

NanoX Imaging Ltd. may be overvalued. Its Value Score of F indicates it would be a bad pick for value investors. The financial health and growth prospects of NNOX, demonstrate its potential to underperform the market. It currently has a Growth Score of F.

Where is Nanox located?

Strategically located next to the world's largest semiconductor cluster in Yongin, South Korea, the Nanox facility spans 12,000 square meters, including a 1,200-square-meter MEMs clean room.

What is Nanox technology?

Nanox has developed Nanox. ARC, a digital x-ray system based on what the company calls cold-cathode x-ray tube technology. The company believes the technology will enable it to provide systems that deliver high-quality images at a fraction of the cost of existing x-ray systems.

What does zebra Medical do?

Zebra Medical Vision's imaging analytics platform allows healthcare institutions to identify patients at risk of disease and offer improved preventative treatment pathways to advance patient care.

Should I buy or sell Nano-X Imaging stock right now?

1 Wall Street research analysts have issued "buy," "hold," and "sell" ratings for Nano-X Imaging in the last year. There are currently 1 hold ratin...

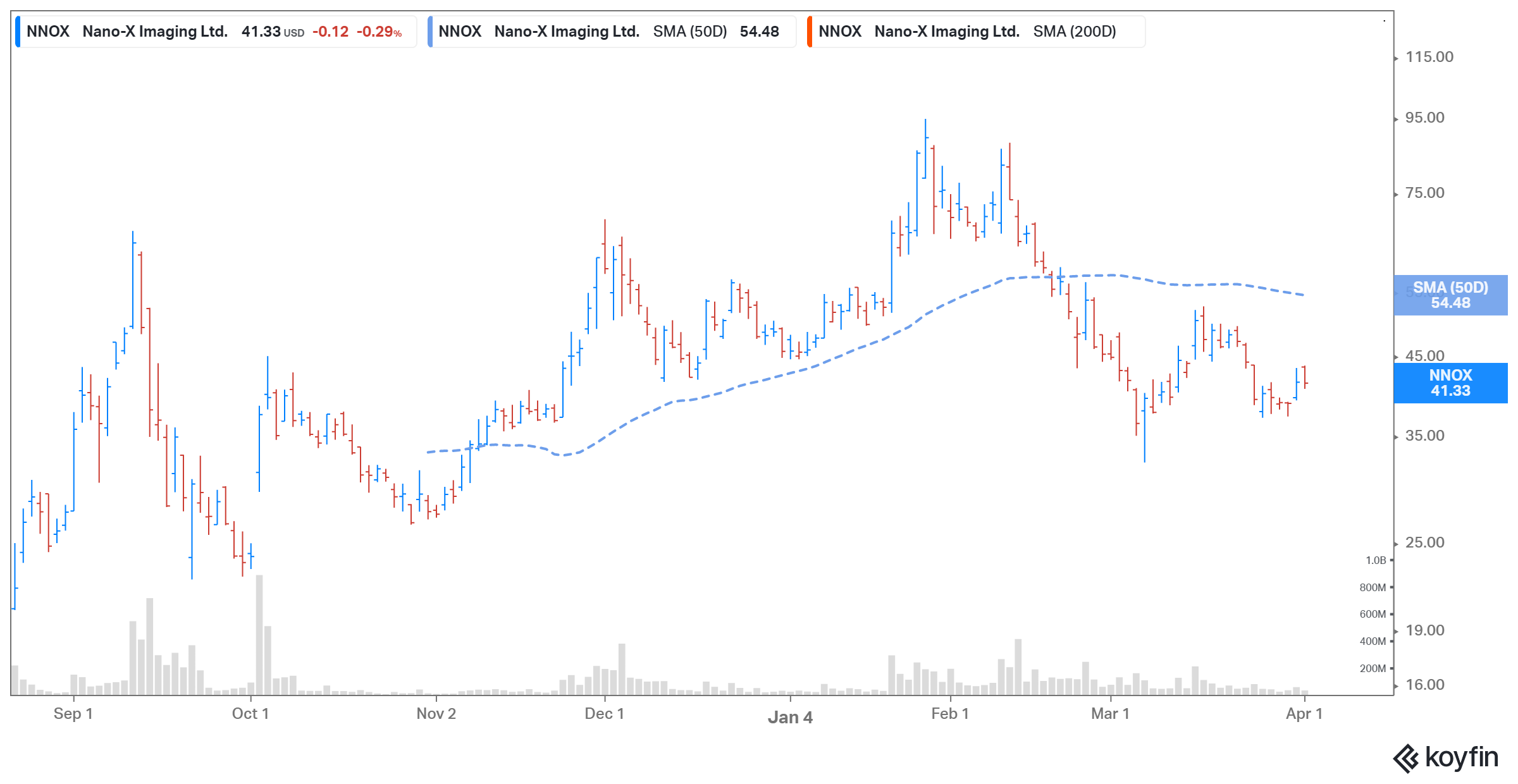

How has Nano-X Imaging's stock price performed in 2022?

Nano-X Imaging's stock was trading at $14.54 at the beginning of 2022. Since then, NNOX shares have decreased by 31.0% and is now trading at $10.03...

When is Nano-X Imaging's next earnings date?

Nano-X Imaging is scheduled to release its next quarterly earnings announcement on Tuesday, August 9th 2022. View our earnings forecast for Nano-X...

How were Nano-X Imaging's earnings last quarter?

Nano-X Imaging Ltd. (NASDAQ:NNOX) posted its quarterly earnings data on Thursday, March, 31st. The company reported ($0.44) earnings per share (EPS...

Who are Nano-X Imaging's key executives?

Nano-X Imaging's management team includes the following people: Mr. Ran Poliakine , Founder & Chairman (Age 53) Mr. Erez I. Meltzer , Chief Exe...

Who are some of Nano-X Imaging's key competitors?

Some companies that are related to Nano-X Imaging include CBIZ (CBZ) , Dada Nexus (DADA) , NV5 Global (NVEE) , EVO Payments (EVOP) , N-able (N...

What other stocks do shareholders of Nano-X Imaging own?

Based on aggregate information from My MarketBeat watchlists, some companies that other Nano-X Imaging investors own include NVIDIA (NVDA) , Adva...

When did Nano-X Imaging IPO?

(NNOX) raised $100 million in an IPO on Friday, August 21st 2020. The company issued 5,900,000 shares at a price of $16.00-$18.00 per share. Cantor...

What is Nano-X Imaging's stock symbol?

Nano-X Imaging trades on the NASDAQ under the ticker symbol "NNOX."

What is the NNOX symbol?

When will Nano X Imaging release its next earnings?

Nano-X Imaging trades on the NASDAQ under the ticker symbol "NNOX."

What is nano x?

Nano-X Imaging is scheduled to release its next quarterly earnings announcement on Tuesday, August 10th 2021. View our earnings forecast for Nano-X Imaging.

What is the P/E ratio of Nano X?

Nano-X Imaging Ltd., a development-stage company, develops, produces, and commercializes digital X-ray source technology for the medical imaging industry worldwide. Its X-ray source is based on a novel digital MEMs semiconductor cathode. The company also develops a prototype of the Nanox.ARC, a medical imaging system incorporating its novel digital X-ray source; and Nanox.CLOUD, a companion cloud-based software that will allow for the delivery of medical screening as a service. Nano-X Imaging Ltd. was founded in 2011 and is headquartered in Neve Ilan, Israel.

Does Nano X pay dividends?

The P/E ratio of Nano-X Imaging is -14.58, which means that its earnings are negative and its P/E ratio cannot be compared to companies with positive earnings.

Is Nano X Imaging a buy?

Nano-X Imaging does not currently pay a dividend.

Recently Viewed Tickers

Nano-X Imaging has received a consensus rating of Buy. The company's average rating score is 2.67, and is based on 2 buy ratings, 1 hold rating, and no sell ratings.

Nano-X Imaging Ltd

Visit a quote page and your recently viewed tickers will be displayed here.

Transparency is our policy. Learn how it impacts everything we do

Nano-X Imaging Ltd. engages in the development of medical imaging systems.

How we make money

Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data.

How we use your personal data

We sell different types of products and services to both investment professionals and individual investors. These products and services are usually sold through license agreements or subscriptions. Our investment management business generates asset-based fees, which are calculated as a percentage of assets under management.

How we approach editorial content

How we use your information depends on the product and service that you use and your relationship with us. We may use it to:

What are the different grades for stocks?

Maintaining independence and editorial freedom is essential to our mission of empowering investor success. We provide a platform for our authors to report on investments fairly, accurately, and from the investor’s point of view.

How many sectors are there in Zacks?

Within each Score, stocks are graded into five groups: A, B, C, D and F. As you might remember from your school days, an A, is better than a B; a B is better than a C; a C is better than a D; and a D is better than an F.