Why do Stocks go up and down?

Stocks go up and down because of the fluctuations in supply and demand. If more investors want to buy a stock, that’s a sign of high demand which eventually drives the prices higher. Similarly, if more investors want to sell, that’s a sign of high supply, which drives prices lower.

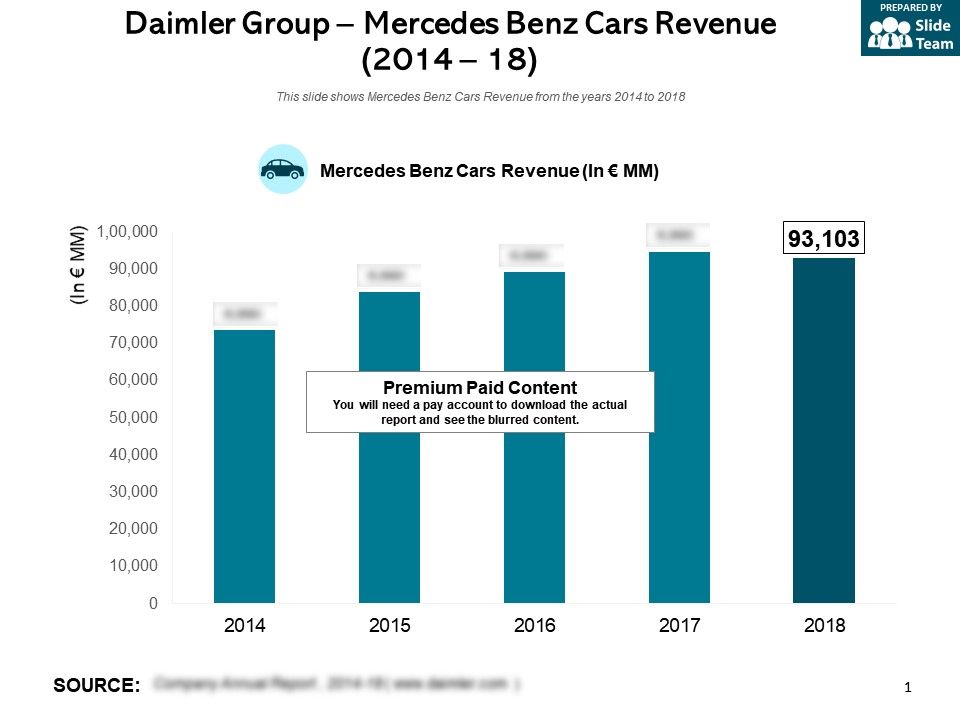

How does Daimler AG stock hold buy signals?

The Daimler AG stock holds buy signals from both short and long-term moving averages giving a positive forecast for the stock, but the stock has a general sell signal from the relation between the two signals where the long-term average is above the short-term average.

What drives stock prices up?

When there is high demand — that is, having more buyers than sellers — is what physically drives up a stock price, buyers must be attracted to the stock for that to happen. One of the factors that drive demand is valuation.

Is the trend in the stock market up or down?

However, in the long run, the trend in the overall stock market is up. Your best bet when looking for stocks that will go up in price is to evaluate factors that tend to drive prices higher, including those described above:

Why do stock prices go up and down?

What affects stock price?

What is demand increase in stocks?

Why is demand for a stock so high?

Why should long term investors be laser focused on a company's potential to increase its profits over many years?

Why is the value of a stock important?

See more

About this website

Why is Daimler stock dropping?

Daimler AG's stock (OTCMKTS: DDAIF) has fallen from $97 at the start of December to $80 currently. The fall is primarily due to the spin-off Daimler's commercial vehicle business and the subsequent listing of Daimler Truck Holding AG 0n December 10 on the Frankfurt Stock Exchange.

Is Daimler a good stock to buy?

Daimler AG - Hold Its Value Score of B indicates it would be a good pick for value investors. The financial health and growth prospects of DDAIF, demonstrate its potential to outperform the market. It currently has a Growth Score of C.

What happened to Daimler AG?

On 28 January 2022, CEO Ola Källenius announced that Daimler will be rebranded as Mercedes-Benz to pursue a higher valuation for the company as it shifts deeper into electric vehicles packed with digital gadgets. On 1 February 2022, Daimler officially changed its registered company name to Mercedes-Benz Group AG.

Did Daimler cut its dividend?

Daimler announced Tuesday the dividend was cut to 0.9 euros a share from 3.25 euros in 2018, while 2019 net profit fell to 2.7 billion euros ($3 billion) from 7.6 billion euros ($8.3 billion) the previous year. This despite Mercedes retaining its title as the world's top selling upmarket automaker.

Will Mercedes stock go up?

The 21 analysts offering 12-month price forecasts for Mercedes Benz Group AG have a median target of 94.95, with a high estimate of 120.23 and a low estimate of 64.09. The median estimate represents a +75.77% increase from the last price of 54.02.

What is the difference between DDAIF and Dmlry?

Company overview. Daimler AG (OTCPK:DDAIF) (OTCPK:DMLRY) is a major German producer of passenger cars, trucks, vans and buses. Mercedes-Benz, a subsidiary of Daimler, offers premium and luxury vehicles under a number of Mercedes brands.

What happens Daimler?

Daimler AG will remain in the DAX but will be renamed to Mercedes-Benz Group AG in February, bringing the company more closely into line with its best-recognized global brand. The company's shareholders will receive one Daimler Truck share for every two Daimler shares held.

What went wrong with DaimlerChrysler merger?

Due to the numerous differences in the organizational cultures, the integration process at DaimlerChrysler failed. Management did not succeed in bringing in line the two cultures and it failed in laying the foundation for a shared corporate culture that reflected aspects of both cultures.

Does Daimler still own Mercedes?

The Mercedes-Benz Corporation is part of Daimler AG, also known as the Daimler Group. Although Mercedes-Benz is their most well-known subsidiary, Daimler currently manufactures a wide range of high-quality cars, buses, motorcycles. From 1926 to 1998, they were known as “Daimler-Benz AG”.

How much dividend does Daimler pay?

In its 2020 fiscal year, Daimler AG paid out dividends between 1.3 and 1.4 euros per share. In December 2021, Daimler AG split in the Mercedes-Benz Group and Daimler Truck. Daimler Truck's earnings per share reached 2.85 euros in 2021.

Is Dmlry a good buy?

Our Ai stock analyst implies that there will be a negative trend in the future and the DMLRY shares are not a good investment for making money. Since this share has a negative outlook we recommend looking for other projects instead to build a portfolio.

Who owns Mercedes-Benz stock?

Mercedes-Benz, which is best known for its luxury vehicles, is a subsidiary of Daimler AG. Freightliner, Thomas Built Buses, Detroit Diesel, and Smart Automobile are also part of Daimler. In 2020, Daimler was forced to pay $2.2 billion for cheating on the emissions requirements of the Clean Air Act.

Can you buy shares in Mercedes-Benz?

You can buy or sell Mercedes-Benz Group AG shares through a Stocks and Shares ISA, Lifetime ISA, SIPP or Fund and Share Account.

Is Mercedes Listed on NYSE?

On October 5, 1993, Daimler-Benz AG became the first German company to list on the New York Stock Exchange (NYSE).

Factors That Cause the Market to Go Up and Down

War, inflation, government policy changes, technological change, corporate performance, and interest rates all can cause a market to go up and down.

What Makes a Stock Go Up or Down? | Nasdaq

When it comes to the stock market, one thing is for certain: stocks go up and stocks go down. The question is, what makes a stock go up or down? What.

Why do stock prices go up and down?

Stock prices go up and down when someone agrees to buy shares at a higher or lower price than the previous transaction.

What affects stock price?

High demand for a stock drives the stock price higher, but what causes that high demand in the first place? It's all about how investors feel:

What is demand increase in stocks?

Sometimes demand for stocks in general increases, or demand for stocks in a particular stock market sector increases. A broad-based demand increase can drive individual stocks higher without any company-specific news. One example: The COVID-19 pandemic led to consumers increasing spending online at the expense of brick-and-mortar stores. Some investors believe this change is here to stay, which led to an increase in demand and higher prices for e-commerce stocks across the board.

Why is demand for a stock so high?

Ultimately, demand for a stock is driven by how confident investors are about that stock's prospects. In the short term, things like quarterly earnings reports that beat expectations, analyst upgrades, and other positive business developments can lead investors to be willing to pay a higher price to acquire shares. On the flip side, disappointing earnings reports, analyst downgrades, and negative business developments can cause investors to lose interest, thus reducing demand and forcing sellers to accept lower prices.

Why should long term investors be laser focused on a company's potential to increase its profits over many years?

While a lot of ink is spilled about daily fluctuations in stock prices, and while many people try to profit from those short-term moves , long-term investors should be laser-focused on a company's potential to increase its profits over many years. Ultimately, it's rising profits that push stock prices higher.

Why is the value of a stock important?

In the long term, the value of a stock is ultimately tied to the profits generated by the underlying company. Investors who believe a company will be able to grow its earnings in the long run, or who believe a stock is undervalued, may be willing to pay a higher price for the stock today regardless of short-term developments. This creates a pool of demand undeterred by day-to-day news, which can push the stock price higher or prevent big declines.

Mercedes-Benz beats profit forecast, sees supply chain headwinds in 2022

Mercedes-Benz Cars & Vans expects an adjusted earnings before interest and taxes (EBIT) of 14 billion euros ($15.9 billion) in 2021 and sees supply chain headwinds persisting into 2022, it said on Friday.

GOP Congresswoman Nancy Mace talks 5G and airplanes, autonomous vehicles, weed decriminalization

Congresswoman Nancy Mace (R-SC) joins Yahoo Finance Live to discuss 5G and airlines, regulation for autonomous vehicles, and the proposed States Reform Act to reform federal cannabis laws.

Is Daimler AG (DDAIF) A Smart Long-Term Buy?

Oakmark Funds, an investment management firm, published its “Oakmark Global Fund” fourth quarter 2021 investor letter – a copy of which can be seen here. A return of 3.94% was reported by the fund in the fourth quarter of 2021, extending its 12-month return to 18.80%. Since inception, the fund had an average total return […]

UPDATE 1-Daimler AG to rebrand as Mercedes-Benz on Feb. 1

Daimler AG will be formally renamed Mercedes-Benz Group AG on Tuesday - nearly a year after the spin-off of its truck and bus division was announced - in a move its boss hopes will unlock shareholder value for the premium carmaker.

Daimler AG to rebrand as Mercedes-Benz on Feb. 1

Daimler AG will be formally renamed Mercedes-Benz Group AG on Tuesday - nearly a year after the spin-off of its truck and bus division was announced - in a move its boss hopes will unlock shareholder value for the premium carmaker.

What is Stock Price?

Stock price refers to the current price that a share of stock is trading at.

Why do stock prices go up and down?

The price of any product being sold in the market is set by the demand and supply of the particular product.

Why do stock prices go up and down – Key factors that affect

The earnings of a company are calculated from a company’s profits. Almost all the investors are unable to invest in a profitable company. The Stock prices show the actual value of the future earnings expectations of the company.

Reasons that cause an increase in demand

When Such a Thing Happens, Retailers can Buy the Share with more ease, This Automatically Increases the Volume, i.e., Demand Increases.

What drives stock prices?

Stock prices are driven by a variety of factors, but ultimately the price at any given moment is due to the supply and demand at that point in time in the market. Fundamental factors drive stock prices based on a company's earnings and profitability from producing and selling goods and services. Technical factors relate to a stock's price history ...

Why do older investors pull out of the market?

Older investors, who tend to pull out of the market in order to meet the demands of retirement

Why is low inflation bad for stocks?

2 Deflation, on the other hand, is generally bad for stocks because it signifies a loss in pricing power for companies.

How does news affect stock market?

The political situation, negotiations between countries or companies, product breakthroughs , mergers and acquisitions , and other unforeseen events can impact stocks and the stock market. Since securities trading happens across the world and markets and economies are interconnected, news in one country can impact investors in another, almost instantly.

Why do you buy stock with a valuation multiple?

That's the reason for the valuation multiple: It is the price you are willing to pay for the future stream of earnings. 1:26.

Why do small cap stocks have a liquidity discount?

Many small-cap stocks suffer from an almost permanent "liquidity discount" because they simply are not on investors' radar screens.

How are stock prices determined?

Stock prices are determined in the marketplace, where seller supply meets buyer demand. But have you ever wondered about what drives the stock market—that is, what factors affect a stock's price? Unfortunately, there is no clean equation that tells us exactly how the price of a stock will behave. That said, we do know a few things about the forces that move a stock up or down. These forces fall into three categories: fundamental factors, technical factors, and market sentiment .

How much did Daimler stock fall in 2021?

The Daimler AG stock price fell by -1.90% on the last day (Thursday, 8th Jul 2021) from $85.50 to $83.88. and has now fallen 4 days in a row. During the day the stock fluctuated 1.64% from a day low at $82.84 to a day high of $84.20. The price has fallen in 7 of the last 10 days and is down by -10.31% for this period. Volume has increased on the last day by 12 thousand shares but on falling prices. This may be an early warning and the risk will be increased slightly over the next couple of days. In total, 26 thousand shares were bought and sold for approximately $2.16 million.

Is Daimler stock a buy or sell signal?

The Daimler AG stock holds a buy signal from the short-term moving average; at the same time, however, the long-term average holds a general sell signal.

Is Daimler AG stock A Buy?

Daimler AG holds several positive signals, but we still don't find these to be enough for a buy candidate. At the current level, it should be considered as a hold candidate (hold or accumulate) in this position whilst awaiting further development.

Why do stock prices go up and down?

Stock prices go up and down based on supply and demand. When people want to buy a stock versus selling it, the price goes up. If people want to sell a stock versus buying it, the price goes down. Forecasting whether there will be more buyers or sellers in a stock requires additional research, however. Buyers are attracted to stocks ...

Why do stocks go up?

Sometimes, stocks go up simply because they have been going up. In a strategy known as momentum investing, investors buy shares in rising stocks and sell shares in those that are following. This momentum builds on itself and continues to drive rising share prices higher.

What Makes a Stock Price Go Up?

A stock is simply an ownership share in a physical company. Stock shares allow investors to buy or sell an interest in a company on an exchange through a bidding process. Sellers indicate prices at which they are asking to give up their shares, and buyers similarly post prices at which they’re bidding to buy shares. This is known as the bid-ask spread.

What Makes a Stock Go Up and Down?

Although factors such as earnings per share and P/E ratio are standard metrics of valuation, many other factors can impact whether a stock goes up or down. Some of these include:

Why are buyers attracted to stocks?

Buyers are attracted to stocks for any number of reasons, from low valuation to new product lines to market hype. Learning how the stock exchange works is the first step in understanding the factors that make a stock go up and down; knowing what makes stocks valuable can help you predict which ones are more likely to rise.

What attracts buyers to a stock?

One of the factors that attracts buyers to a stock is valuation . Companies can be valued in a number of different ways, but earnings per share and P/E ratio are two common factors in the equation.

What happens after a trade at $10.10?

After the first trade at $10.10, there are no more sellers willing to accept such a low price. The next trade occurs at $10.20, as the demand to pay a higher price exceeds the willingness of sellers to accept a lower price.

Why do stock prices go up and down?

Stock prices go up and down when someone agrees to buy shares at a higher or lower price than the previous transaction.

What affects stock price?

High demand for a stock drives the stock price higher, but what causes that high demand in the first place? It's all about how investors feel:

What is demand increase in stocks?

Sometimes demand for stocks in general increases, or demand for stocks in a particular stock market sector increases. A broad-based demand increase can drive individual stocks higher without any company-specific news. One example: The COVID-19 pandemic led to consumers increasing spending online at the expense of brick-and-mortar stores. Some investors believe this change is here to stay, which led to an increase in demand and higher prices for e-commerce stocks across the board.

Why is demand for a stock so high?

Ultimately, demand for a stock is driven by how confident investors are about that stock's prospects. In the short term, things like quarterly earnings reports that beat expectations, analyst upgrades, and other positive business developments can lead investors to be willing to pay a higher price to acquire shares. On the flip side, disappointing earnings reports, analyst downgrades, and negative business developments can cause investors to lose interest, thus reducing demand and forcing sellers to accept lower prices.

Why should long term investors be laser focused on a company's potential to increase its profits over many years?

While a lot of ink is spilled about daily fluctuations in stock prices, and while many people try to profit from those short-term moves , long-term investors should be laser-focused on a company's potential to increase its profits over many years. Ultimately, it's rising profits that push stock prices higher.

Why is the value of a stock important?

In the long term, the value of a stock is ultimately tied to the profits generated by the underlying company. Investors who believe a company will be able to grow its earnings in the long run, or who believe a stock is undervalued, may be willing to pay a higher price for the stock today regardless of short-term developments. This creates a pool of demand undeterred by day-to-day news, which can push the stock price higher or prevent big declines.