Should you buy CVS stock?

CVS Health’s dividend payout ratio (DPR) is 36.91%. CVS Health Corp. engages in the provision of healthcare services. It operates through the following segments: Pharmacy Services, Retail or ...

Should I Sell my CVS stock?

- A bearish trading pattern since 2014

- An ugly bottom in March

- The top holding of the XLE and VDE

- An attractive dividend- Earnings were humming along until Q2

- Bargains in the oil patch, CVX is positioned to take advantage

Is CVS stock too cheap to ignore?

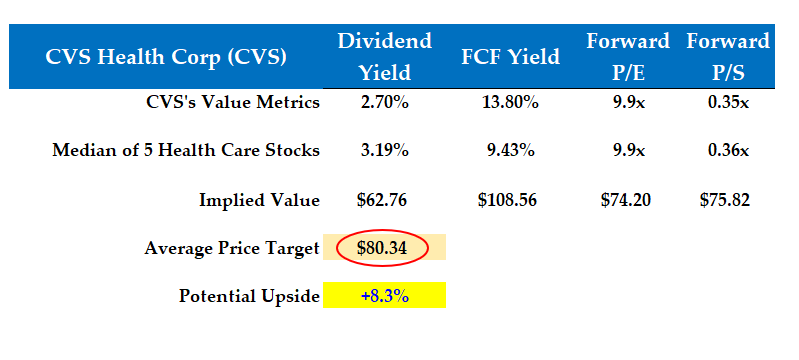

The bull thesis on CVS stock is that despite the negative story, the stock is simply too cheap to ignore. That is, it’s already priced for the bad story and then some, and any upside surprise could...

Does CVS stock pay dividends?

What is CVS dividend? Two dollars a share is paid out as CVS’s dividend each year. 2.22 percent is the annual dividend yield of CVS’s stock. CVS HEALTH Corp’s dividend is greater than the industry average of 1.34 percent, but lower than the US market average of 4.43 percent.

See more

Is stock in CVS a good buy?

Valuation metrics show that CVS Health Corporation may be undervalued. Its Value Score of A indicates it would be a good pick for value investors. The financial health and growth prospects of CVS, demonstrate its potential to outperform the market. It currently has a Growth Score of A.

Is CVS stock overvalued?

Investors may also note in 2020 and 2021, Walgreens' EV-to-EBITDA ratio was about one or two turns higher than CVS Health. When compared to Walgreens, CVS does not appears overvalued. If the stock gets more inexpensive, it looks better.

What was the highest CVS stock price?

The latest closing stock price for CVS Health as of July 19, 2022 is 96.79. The all-time high CVS Health stock closing price was 113.45 on July 29, 2015.

Did CVS have a stock split?

The first split for CVS took place on March 15, 1989. This was a 2 for 1 split, meaning for each share of CVS owned pre-split, the shareholder now owned 2 shares. For example, a 1000 share position pre-split, became a 2000 share position following the split. CVS's second split took place on June 16, 1998.

Is CVS a good stock to buy 2021?

CVS Stock Key Metrics Based on the mid-point of CVS' management guidance, the company is expecting a modest +5% growth in top line (as compared to +9% revenue increase for FY 2021) and a -2% contraction in non-GAAP earnings per share for FY 2022.

Is CVS a buy hold or sell?

CVS Health has received a consensus rating of Buy. The company's average rating score is 2.79, and is based on 15 buy ratings, 4 hold ratings, and no sell ratings.

Why is CVS stock going up?

The revenue growth was driven by increased prescription volume and from Covid-19 vaccination and testing administration. CVS' bottom line of $1.97 on a per share and adjusted basis was up 19% y-o-y, and well above our estimate of $1.81.

What is CVS PE ratio?

The Verdict On CVS Health's P/E Ratio CVS Health's P/E is 21.2 which is above average (18.5) in its market.

What is Aetna stock price today?

AET Price/Volume StatsCurrent price$212.7052-week highDay low$211.79VolumeDay high$213.36Avg. volume50-day MA$203.39Dividend yield200-day MA$188.39Market Cap1 more row

How long has CVS paid a dividend?

Yes, CVS's dividend has been stable for the last 10 years. Does Cvs Health have sufficient earnings to cover their dividend? Yes, CVS's past year earnings per share was $6.07, and their annual dividend per share is $2.10. CVS's dividend payout ratio is 34.6%, which is sustainable.

How many CVS shares exist?

1.313BHistorical Shares Outstanding DataDateValueMarch 14, 20221.313BFebruary 02, 20221.313BDecember 31, 20211.322BOctober 27, 20211.320B21 more rows

When did Walgreens stock split?

WBA SplitsSplit dateSplit RatioFeb 14, 19831/2 Stock SplitMay 09, 19851/2 Stock SplitFeb 04, 19911/2 Stock SplitAug 09, 19951/2 Stock Split3 more rows

What is CVS Health?

How much of CVS is held by institutions?

CVS Health Corp. engages in the provision of health care services. It operates through the following segments: Pharmacy Services, Retail or Long Term Care, Health Care Benefits, and Corporate/Other. The Pharmacy Services segment offers pharmacy benefit management solutions. The Retail or Long Term Care segment includes selling of prescription drugs and assortment of general merchandise. The Health Care Benefits segment offers traditional, voluntary and consumer-directed health insurance products and related services, including medical, pharmacy, dental, behavioral health, medical management capabilities. The Corporate/Other segment involves in providing management and administrative services. The company was founded by Stanley P. Goldstein and Ralph Hoagland in 1963 and is headquartered in Woonsocket, RI.

What is the P/E ratio of CVS Health?

75.99% of the stock of CVS Health is held by institutions. High institutional ownership can be a signal of strong market trust in this company.

Where is CVS Health located?

The P/E ratio of CVS Health is 16.00, which means that it is trading at a less expensive P/E ratio than the Retail/Wholesale sector average P/E ratio of about 27.70.

Is CVS Health a buy?

CVS Health's mailing address is ONE CVS DR., WOONSOCKET RI, 02895. The pharmacy operator can be reached via phone at (401) 765-1500, via email at [email protected], or via fax at 401-762-2137.

Does CVS Health have a dividend?

CVS Health has received a consensus rating of Buy. The company's average rating score is 2.83, and is based on 13 buy ratings, 4 hold ratings, and no sell ratings.

How much does CVS invest in California?

CVS Health does not yet have a strong track record of dividend growth. The dividend payout ratio of CVS Health is 26.67%. This payout ratio is at a healthy, sustainable level, below 75%. Based on earnings estimates, CVS Health will have a dividend payout ratio of 24.21% next year.

What is CVS's CSR report?

CVS Health (NYSE: CVS) has surpassed $200 million in affordable housing investments in California as part of an ongoing commitment to address housing insecurity throughout the country. Over the past years, the company and its subsidiaries have invested in over 130 affordable housing communities across California, facilitating the construction or rehabilitation of more than 12,500 affordable homes.

What is CVS 2030?

CVS Health Corp. released its latest corporate social responsibility (CSR) report, Transform Health 2030, that includes goals for engagement with customers and patients, new environmental goals and the company's first standalone diversity report. CVS is launching a "go green" portal on its website to help customers find sustainable products and learn how to reduce waste and recycle. The pharmacy retailer also aims to reduce emissions by 2030 and is a founding partner of a consortium to improve the single-use bag. CVS will also invest $85 billion by 2030 on programs to improve inclusivity in wellness and business, including a five-year, $5 million scholarship program for Black and Latinx colleagues created in collaboration with the United Negro College Fund. And for customers, the plan includes the launch of digital health services and administering COVID-19 tests in order to reach 65 billion health care interactions by 2030. CVS stock has gained 28.2% over the last year while the S&P 500 index is up 53.2% for the period.

Is CVS closing 900 drugstores?

The Transform Health 2030 strategy is guided by four priority areas, Healthy People, Healthy Business, Healthy Community and Healthy Planet, through which the company uses its strengths as a health care leader to amplify positive impact.